Have you ever felt frustrated by how fragmented digital finance has become? One app for trading, another for NFTs, a separate platform for staking, and each with its own risks, logins, and compliance headaches. This scattered approach doesn’t just waste time; it erodes trust and slows adoption for enterprises that need agility at scale.

That’s why the conversation is shifting toward all-in-one super crypto apps : unified ecosystems designed for today’s Web3 economy. Investors and businesses alike are realizing that efficiency, security, and interoperability can no longer be optional—they are survival essentials. The real question smart leaders now ask isn’t if they should move toward a unified crypto solution, but how quickly they can get there. Let’s unpack these questions and help you make an informed investment decision.

Why Smart Investors Are Going for All-in-One Super Crypto Apps?

In the evolving digital finance landscape, investors and enterprises no longer want fragmented solutions. Instead of juggling separate wallets, exchanges, NFT platforms, and staking dashboards, they prefer all-in-one super crypto app development that consolidates every feature under one roof.

This trend is not just about convenience; it’s about efficiency, scalability, and compliance. A unified app reduces the friction of moving assets across multiple platforms, enables seamless onboarding of new users, and strengthens enterprise adoption by ensuring KYC/AML compliance in a single ecosystem.

Recent market reports show that multi-utility crypto applications are gaining traction among both retail and institutional investors, as they reduce operational costs, improve liquidity flows, and open revenue streams across staking, swaps, NFTs, and fiat rails. For enterprises, adopting or building such an app is a competitive edge in customer retention and digital finance leadership.

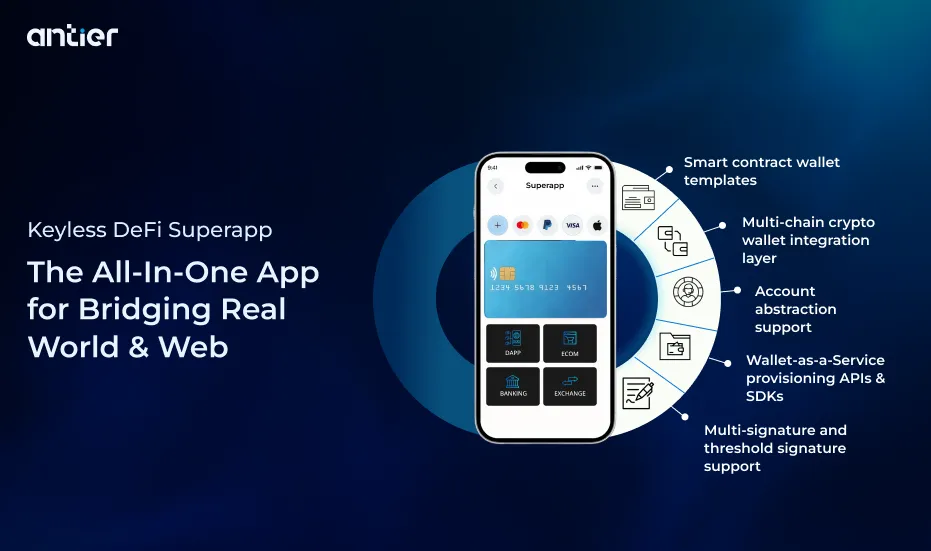

Features of a Successful Super Crypto App Development

Not all super crypto apps are created equal. The most successful ones integrate a broad yet secure set of functionalities:

1. Multi-chain wallet support – seamless asset storage and transfers across Ethereum, BNB Chain, Polygon, TON, Solana, and more.

2. Built-in exchange & swap engine – enabling instant trades without forcing users onto external platforms.

3. Staking & yield services – offering users access to passive income streams while boosting platform liquidity.

4. NFT marketplace integration – a one-stop hub for NFT minting, trading, and custody.

5. Fiat on/off ramps – smooth transitions between digital assets and fiat currencies (USD, EUR, GBP).

6. Advanced security measures – multi-sig wallets, HSM custody, biometric login, and third-party smart contract audits.

7. Compliance-ready modules – integrated KYC/AML, regulatory reporting, and tax-ready transaction logs.

8. Scalable architecture – modular design that supports continuous upgrades and cross-chain interoperability.

An enterprise-grade super crypto app strikes a balance between breadth of features and depth of security. Cutting corners on any of the above usually translates into higher risks of hacks, compliance issues, or poor user adoption.

How to Choose the Best Super Crypto App Development Company?

Building such a sophisticated product in-house is often impractical for enterprises without specialized expertise in Web3. Choosing the right Super crypto app development company is, therefore, critical. When evaluating potential partners, enterprises should focus on the below mentioned factors:

- Technical expertise & portfolio : Look for super app development companies with proven experience in multi-chain wallet development, DEX/DeFi integrations, and enterprise-grade blockchain products.

- Security-first development : Ensure they implement security audits, bug bounty programs, and HSM integrations as part of their core process, not as an afterthought.

- Regulatory know-how : Your vendor must understand compliance frameworks like FATF, GDPR, and MiCA, and have experience integrating enterprise KYC/AML providers.

- Modular & scalable architecture : A good partner builds with modularity in mind so you can add staking, NFT, or fiat services without overhauling the core app.

- Transparent communication & milestone-based delivery : The company should provide detailed project roadmaps, with security gates and clear acceptance criteria at every stage.

- Post-launch support : Continuous monitoring, upgrades, and incident response capabilities are essential for long-term platform stability.

Smart enterprises prefer super crypto app service providers who combine blockchain development expertise with compliance advisory, ensuring that the solution is technically advanced and regulatorily sustainable.

Build an All-In-One Shop Super Crypto App With The Best Team!

Why Security Matters Now More Than Ever for Super Crypto Apps?

The urgency around security in super crypto apps has never been higher. With global digital asset adoption surging and transaction volumes crossing billions daily, these platforms have become prime targets for advanced cyberattacks, phishing schemes, and smart contract exploits. High-profile breaches in the past two years alone have cost enterprises and users billions of dollars, exposing the gaps in inadequate security frameworks.

Unlike traditional fintech apps, a super crypto app development solution integrates multi-chain wallets, exchanges, staking, NFTs, and fiat ramps, exponentially increasing its attack surface. Any compromise can cascade across multiple services, amplifying financial and reputational damage.

This is why enterprises building or adopting such apps must treat security as a first principle, embedding MPC custody, zero-trust frameworks, and continuous threat intelligence into the core architecture and not as afterthoughts. This is where hiring comprehensive super app development services from the right firm plays a vital role.

How Much Does It Cost to Build an All-in-One Super Crypto App?

Cost is the most frequently asked question when enterprises explore super crypto app development. However, the answer depends entirely on the scope of the project, the depth of features, and the security standards implemented. Several key factors directly influence the overall pricing:

- Architecture design – modular vs. monolithic structures impact scalability and future flexibility.

- Blockchain support – single-chain vs. multi-chain integration alters complexity and development effort.

- Custody model – non-custodial vs. custodial solutions (HSMs, MPC wallets) drive technical overhead.

- Security layers – audits, bug bounty programs, and penetration testing strengthen resilience.

- Compliance integrations – KYC/AML, regulatory reporting, and data privacy adherence shape requirements.

- Advanced services – staking, NFT marketplace, and fiat on/off ramps increase build depth.

- Third-party integrations – liquidity providers, fiat gateways, and APIs influence system design.

- User experience design – enterprise-grade UX, multilingual support, and accessibility raise design workload.

- Post-launch operations – monitoring, upgrades, and incident response frameworks ensure continuity.

Enterprises must consider the total cost of ownership (TCO), which includes not just development but also ongoing expenses like node infrastructure, audit renewals, compliance updates, and operational monitoring. Thus, it is very important to connect with an experienced and renowned super crypto app development company that shall help you with an estimated cost for the super app you wish to build for your business.

📌 Pro tip for enterprises: Start with a discovery workshop with your vendor to define scope, validate compliance requirements, and estimate realistic cost and timeline. This upfront clarity accelerates decision-making and ensures security isn’t compromised for speed.

How Much Time Does It Take to Create a Web3 Super Crypto App?

Timelines depend on scope and delivery model (custom build vs white-label customization).

Below are realistic enterprise estimates:

- MVP (basic wallet + swaps): 3–6 months

- Feature-rich app (multi-chain, NFT, staking, compliance): 6–12 months

- Enterprise super app (custody, exchange engine, fiat ramps, audits, monitoring): 9–18+ months

A phased development approach is ideal:

- Launch a secure MVP quickly to capture market presence.

- Expand to multi-chain and DeFi features after real-world testing.

- Integrate compliance-heavy and custodial modules once user traction justifies the additional investment.

The key is to avoid rushing security-critical features. Enterprises should only move to production after independent audits and penetration testing confirm readiness.

Wrapping Up The Thoughts!

All-in-one super crypto apps are the next phase of Web3 adoption, offering enterprises a competitive advantage through consolidation, compliance, and customer-centric innovation. However, analyzing costs, timelines, and security measures upfront is crucial to avoid delays, overruns, and vulnerabilities.

For enterprises, the right strategy is to partner with a trusted Web3 super app development company like Antier that can combine deep technical expertise, regulatory compliance, and secure architecture into a scalable roadmap. With proper planning, a phased build, and enterprise-grade security, our super crypto apps deliver long-term value and sustainable growth in the evolving digital asset economy. Connect with our experts today!