Ever scanned your palm at a café, tapped your phone, and wondered if your next cup of coffee might one day be paid with crypto? Spoiler: that future is already here. With over 50 million crypto cards in circulation and various designs, traditional plastic is becoming outdated. Major brands aren’t just toying with decentralized wallets—they are racing to partner with fintech innovators hungry to bridge blockchain and daily spend. Meanwhile, savvy consumers juggle portfolios while swiping stablecoins at the grocery.

So if you have ever thought, “There’s got to be a smoother path from wallet to checkout,” you’re not alone. Card wallet-as-a-service (C-WAAS) solution provides the quickest route to launching virtual and physical crypto cards for your crypto wallets with complete compliance and multi-chain reach. Let us examine how this breakthrough model is changing payments and why this is the right time to make your claim.

What Is C-WAAS?

Card Wallet as a Service encapsulates a fully managed, white-label crypto card wallet infrastructure that enables businesses to issue physical and virtual debit/credit cards backed by digital assets. Leveraging APIs and SDKs, C-WAAS platforms handle end-to-end processes—KYC/AML onboarding, fiat settlement, custodial or non-custodial custody, transaction monitoring, and compliance reporting—eliminating the need for in-house blockchain engineering. Modern C-WAAS offerings typically support multi-chain tokenization (ERC-20, BEP-2, SPL), real-time exchange routing, and seamless integration with existing core banking or payment networks (Visa, Mastercard). Ultimately, C-WAAS empowers organizations from fintech startups to legacy banks to deliver branded crypto cards without building complex backend systems from scratch.

Key Drivers & Market Trends Of Crypto Card Wallet

While the cryptocurrency wallet development market with crypto card integration accelerates toward maturity, several macro and micro trends are pushing the demand. Let us understand the trends in detail:

1. Stablecoin-Linked Card Programs- Leading payment networks (e.g., Mastercard) are launching stablecoin-linked cards, such as FIUSD integration, to bridge crypto with mainstream commerce, targeting over 150 million merchant endpoints.

2. Super-App Web3 Wallets- Platforms are evolving into “super apps,” converging wallet management, DeFi dashboards, NFT marketplaces, staking, and social features into one UI, reducing friction and boosting retention.

3. Regulatory Clarity & Compliance – Recent guidance around digital-asset frameworks and AML/KYC protocols is lowering barriers for C-WAAS adopters. fostering wider enterprise engagement.

4. AI-Driven User Experiences- Predictive analytics and behavioral biometrics personalize notifications, detect fraud in real time, and streamline authentication through voice/face recognition, elevating security and engagement.

5. Merchant Crypto Acceptance- Rising e-commerce demand for crypto payments is pushing merchants to integrate crypto payment gateways directly into their POS systems, fueling B2B C-WAAS uptake.

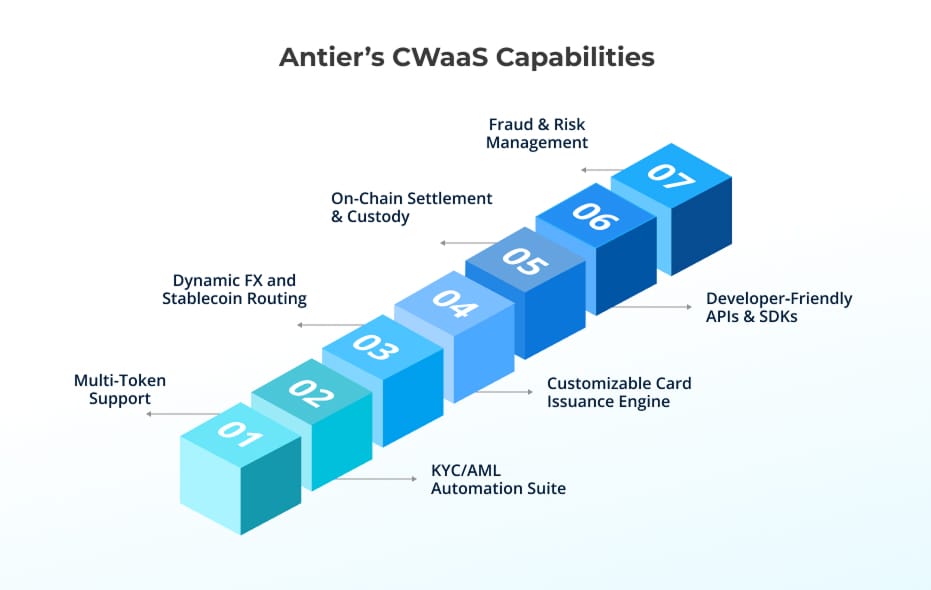

Antier’s Card Wallet-as-a-Service (C-WAAS) Capabilities

Have you ever wondered what it takes to deliver a truly seamless, secure, and scalable crypto card experience that your users will love—and your competitors will envy? At Antier, we built our Card Wallet-as-a-Service (CWaaS) on a modular, API-first backbone precisely for that reason. Imagine plugging in advanced tokenization, real-time FX routing, and enterprise-grade compliance with just a few calls—no months-long integrations, no hidden surprises. Ready to see why enterprises trust Antier to power their white-label crypto card wallet ambitions? Explore our in-demand features below.

- Multi‑Chain Token Support – Tokenize assets on Ethereum, BNB Chain, Polygon, Solana, and more—ensuring interoperability and broad market reach while adhering to white-label crypto card standards

- Dynamic FX and Stablecoin Routing – Real-time conversion between cryptocurrencies and stablecoins like USDC/EURC, minimizing volatility risk in day-to-day transactions for cardholders.

- KYC/AML Automation Suite – Integrated identity verification, document scanning, and sanction-screening workflows, critical for any cryptocurrency wallet development services offering.

- Customizable Card Issuance Engine – Design and issue physical and virtual debit cards with bespoke branding, card art, and tiered issuer BIN management through a white-label card wallet portal.

- On-Chain Settlement & Custody – Choose between custodial, hybrid, or self-custodial models with smart contract–driven escrow, token locks, and programmable spending rules.

- Fraud & Risk Management – AI-powered transaction monitoring, behavioral biometrics (typing patterns, touch pressure), and anomaly alerts to safeguard user assets.

- Developer‑Friendly APIs & SDKs – Comprehensive documentation and sandbox environments accelerate integration with mobile apps, web portals, and existing payment systems.

When you partner with us, you are not just buying a product; you are gaining a future-proof platform that adapts as your business does. Thus, it is always recommended to partner with an experienced and certified crypto wallet development company like Antier, boasting a vast team of skilled experts who can help you launch a business-catered wallet solution.

How to Choose the Best C-WAAS Solution Provider?

“Choosing the right partner isn’t just a checkbox in your roadmap; it’s the foundation upon which every subsequent investment stands.”

When you are weighing options for a card wallet as a service (CWaaS) solution provider, it’s crucial to team up with a partner whose vision aligns with yours, whose APIs are as robust as their roadmap, and whose track record speaks volumes. Before you commit budget or resources, ask yourself: Does this provider move as fast as the market? Can they flex to support new chains and emerging use cases?

Once you feel assured on the above questions by a well-known cryptocurrency wallet development company, just know that this is your ideal partner. Apart from the above questions, there are more checklists that you need to consider while choosing the best card wallet-as-a-service solution provider. Let us explore

- Assess the provider’s track record in crypto wallet development company projects and white-label deployments.

- Verify compliance capabilities: KYC/AML automation, regulatory reporting, and audit readiness.

- Evaluate multi-chain support and token compatibility aligned with your user base.

- Examine customization options for branding, UX/UI workflows, and spend controls.

- Confirm integration ease via RESTful APIs, webhooks, and SDK availability.

- Review post-launch support: SLAs for uptime, security patches, and feature upgrades.

- Analyze fee structures: transaction fees, issuance costs, crypto card wallet development costs, and platform licensing.

How Much Does C-WAAS Cost?

Determining the investment for a crypto card wallet as a service solution depends on several variables. Rather than quoting a flat range, consider these influencing factors:

- Platform Licensing & Setup- One-time fees for white-label customization, API onboarding, and compliance framework integration.

- Per-Issuance and Fulfillment Costs- Physical card manufacturing, virtual card provisioning, and BIN sponsorship fees.

- Transaction & FX Fees- Variable costs per transaction, dynamic FX markups, and stablecoin swap fees.

- Custody & Settlement Models- Custodial versus non-custodial crypto wallet development impacts escrow fees and smart contract maintenance.

- Compliance & Security Services- Charges for identity verification, transaction monitoring, risk analytics, and insurance premiums.

- Volume‑Based Discounts- Lower unit economics with higher transaction volumes or larger card portfolios.

A thorough cost analysis should weigh platform capabilities, expected transaction throughput, and desired feature set against long-term TCO objectives, ensuring alignment with strategic growth and ROI targets. Tying up with the best blockchain wallet development company can help you get an idea of the price of the development cost as per what customizations or features you need.

Launch Your C‑WAAS Solution with Top Crypto Wallet Development Experts

Looking ahead to launching a card wallet solution in the market? Invest in white-label crypto card wallets; they have become indispensable for forward-thinking businesses. They bridge the gap between digital assets and everyday spending, helping you gain market position faster and smarter in the market, drive new revenue streams through seamless crypto-to-fiat conversions, and deepen customer loyalty with branded, integrated experiences. As markets mature and competition intensifies, a robust C‑WAAS platform isn’t just a nice‑to‑have—it’s your ticket to sustainable growth and industry leadership.

When you choose Antier, you are not just hiring a vendor; you are gaining a trusted ally with deep cryptocurrency wallet development know-how, bulletproof security measures, and a proactive support team that’s as invested in your success as you are. In today’s environment of escalating cyber threats and rapid blockchain evolution, that peace of mind is priceless. So connect with our experts today!