Earning without constant effort is no longer limited to dividends or rental checks. Today, income can flow directly from tokenized assets, such as treasuries that accrue interest daily, receivables that pay on settlement, or properties that distribute rent on-chain. What was once slow, fragmented, and reserved for large institutions is becoming programmable and accessible.

Real-World Asset Tokenization makes passive income transparent, compliant, and scalable, transforming how capital works for both investors and providers. This guide talks about how the RWA Tokenization Platform can unlock yield around the finance, supply Chain, and real estate for investors as well as infrastructure providers.

What Does “Passive Income” Mean On-Chain?

On an RWA tokenization platform, passive income is a process coded into the asset itself. Instead of relying on intermediaries to calculate, approve, and release payments, the platform automates every step.

This income reaches investors automatically, on time, and with full transparency., resulting in reduced reconciliation costs and strengthening trust.

Here’s how it works:

- Defined entitlements: Each token carries rules about who can receive income, how returns are calculated, and when distributions occur. This ensures payments are accurate and consistent.

- Built-in compliance: Whenever tokens are transferred, the system automatically checks whether the new holder is eligible under KYC, AML, or jurisdictional rules. This keeps the investor base compliant at all times.

- Verified reserves and valuations: Because many tokenized products are backed by off-chain assets (like Treasuries or receivables), the RWA Tokenization platform connects to oracles that verify reserves or net asset values in real time. This replaces manual reports with automated proof.

- Reliable payouts: Distributions can flow through fiat rails, stablecoins, or tokenized cash. Whichever method is used, the system reconciles entitlements with payments, so investors receive what they are owed without delays.

Launch a Tokenization Platform that Delivers Real Income!

How Tokenized Assets Create Passive Income, and How Platforms Maximize ROI

For investors, the appeal of tokenized real-world assets lies in access to predictable income streams that were once restricted to institutions. For the RWA Tokenization Platform owners, the same flows open new opportunities to grow assets under management and generate sustainable fees.

Tokenized Cash Equivalents

Short-term Treasuries and money market funds are now available as tokenized products. Investors earn a daily yield, distributed automatically through smart contracts. Corporate treasurers benefit by sweeping idle balances into these instruments with near-instant settlement, turning liquidity management into a source of return.

Supply-Chain and Receivable Pools

Tokenized invoices allow investors to purchase portions of trade receivables. Income comes from the discount applied to early payment, while the platform manages waterfall rules and eligibility checks. Businesses gain faster access to capital, and investors receive consistent returns tied to real transactions.

Real Estate and Infrastructure Income

Rental income or operating revenues from tokenized properties are distributed proportionally to token holders. By binding disclosures and payout schedules directly to the token, the platform ensures transparency and minimizes reconciliation disputes.

Collateral-Backed Lending

Investors can pledge tokenized assets as collateral to secure loans without selling them. This allows income to continue flowing while unlocking additional liquidity. Providers earn fees by integrating with lending desks and exchanges that accept tokenized assets.

Dividend Reinvestment Options

Platforms can offer automatic reinvestment of distributions into new tokens. This compounds investor returns and steadily increases AUM for the provider, creating a mutually reinforcing growth cycle.

Portfolio Guardrails and Yield Strategies

Advanced RWA tokenization infrastructure can create pre-set strategies, such as laddered Treasuries, diversified receivable pools, or conservative real estate bundles, so investors align returns with their risk profile. Providers monetize these structured offerings while reducing churn.

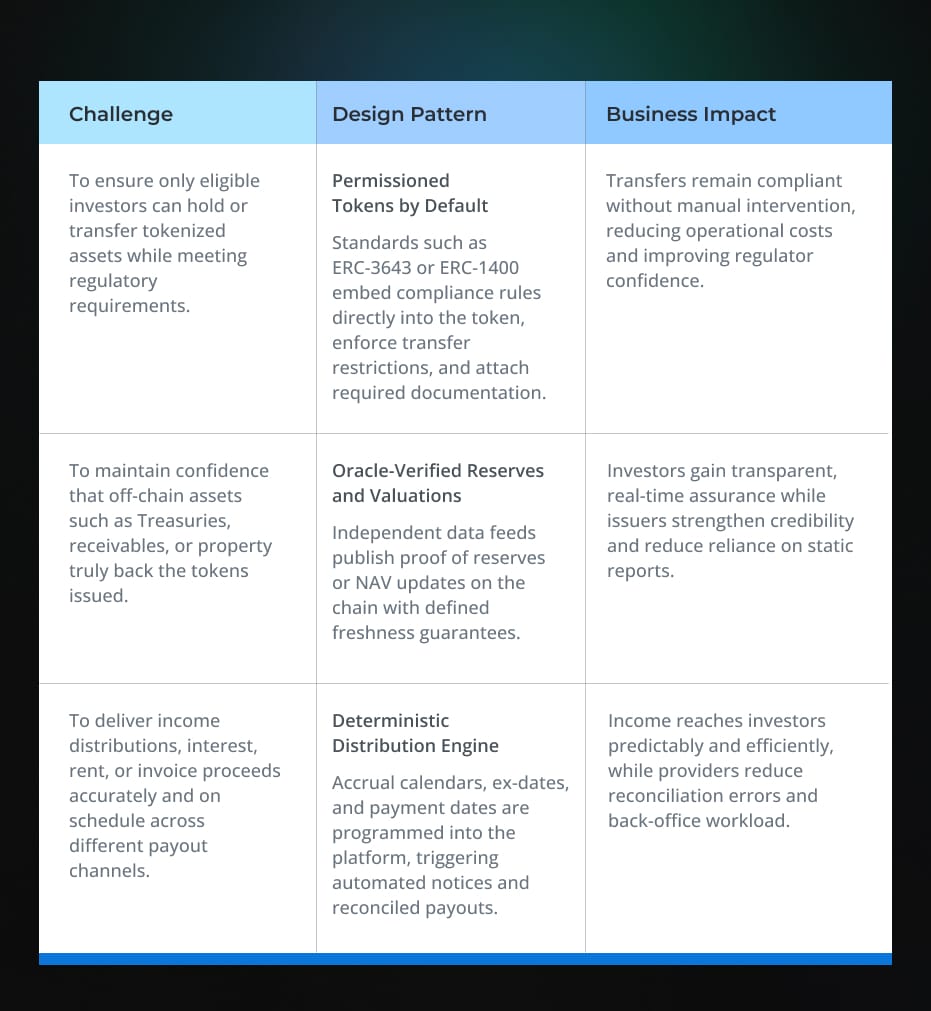

Proven Design Patterns for Tokenization Infrastructure

Passive income from tokenized assets is only meaningful if platforms can deliver it reliably, transparently, and in full compliance. Investors want confidence that returns are backed by real assets and distributed on time. Enterprises building platforms want a model that scales without constant remediation or manual reconciliation.

The following design patterns address these priorities. They show how infrastructure choices directly shape the investor experience and create sustainable value for providers.

These patterns ensure that tokenized assets move beyond being digital records. They become reliable income-generating instruments that investors can trust, and providers can scale profitably.

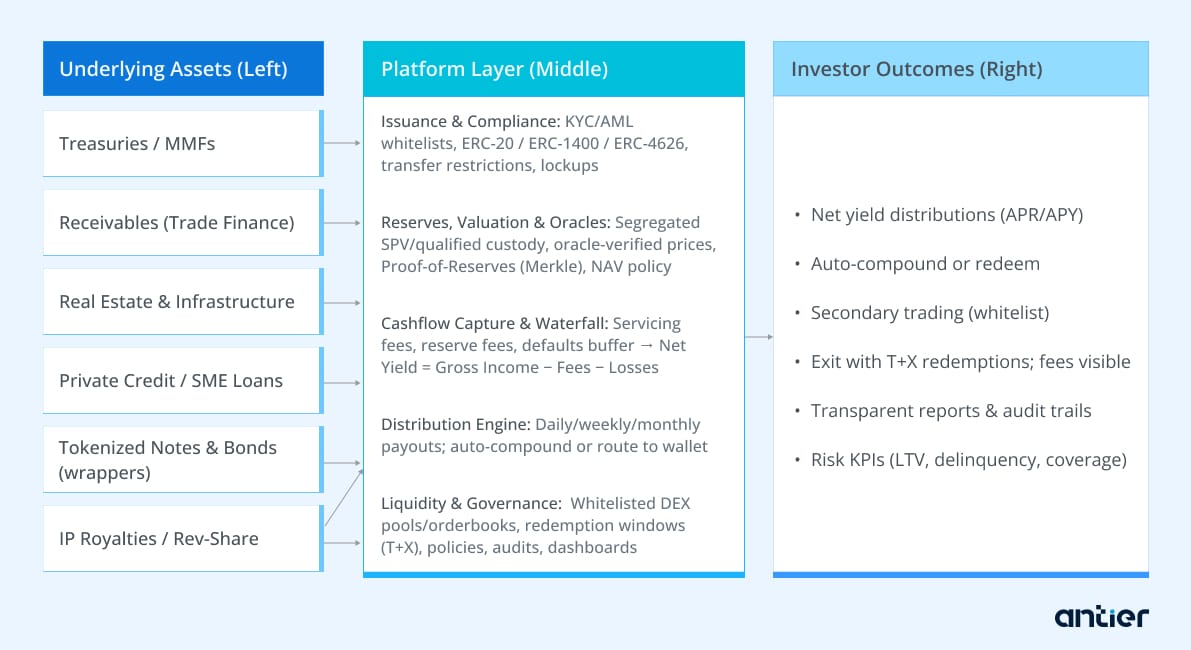

Product Configurations That Deliver Income with Minimal Friction

Different asset classes lend themselves to tokenization in unique ways, but the common goal is to deliver predictable income while minimizing operational complexity. The following configurations demonstrate how platforms can achieve this balance.

Tokenized Money Market Funds and Treasuries

Short-term government securities and money market instruments are natural candidates for tokenization because they already operate on precise calendars and established valuation methods. On-chain platforms can expose daily accruals, enable eligibility-controlled transfers, and, in some cases, provide near-instant liquidity (T+0 or T+1). The success of large-scale initiatives such as BlackRock’s BUIDL and Franklin Templeton’s Benji programs has confirmed both investor appetite and operational feasibility in this segment.

Receivable Pools for Supply-Chain Finance

Trade receivables and payables can also be tokenized, with programmatic rules defining obligor limits, invoice aging, and geographic scope. Platforms enforce these rules automatically and distribute returns through structured waterfalls. For investors, this translates into steady discount yields backed by real economic activity. For originators, it provides continuous financing as soon as receivable data meets eligibility policies.

Income-Producing Real Estate

Real estate projects generate recurring rental or lease income, which can be fractionalized through tokenization. Platforms can partition tokens into different classes to manage expense waterfalls and allocate distributions fairly among stakeholders. By binding disclosures and automating periodic reporting, the platform reduces disputes and strengthens investor trust throughout the life of the asset.

Tokenized Notes and Bonds

Debt instruments such as notes and corporate bonds can be issued and managed in tokenized form. Regulatory guidance, such as frameworks from the Hong Kong Monetary Authority, already outlines the process for listing, registrar functions, and multi-currency issuance. Once tokenized, coupon payments follow the same deterministic flow as other income products, ensuring investors receive returns on schedule with fewer intermediaries involved.

Passive Income Flow of Tokenized Assets – v2

How to Assure Distribution without Compliance Debt

Institutions want yield access; supervisors want orderly markets; operations want less reconciliation work. The platform can meet all three by applying eligibility at the point of transfer and policy-driven routing:

- Maintain investor status on the chain (e.g., ONCHAINID).

- Enforce region and category rules at mint, subscription, and every transfer.

- Route settlement through fiat or tokenized cash according to local permissions.

- Expose regulator views: cap table snapshots, transfer denials, distribution proofs, and oracle feeds, without custom exports.

Real-World Asset Case: BT Asset Hub

BT Asset Hub, developed with Antier Solutions, is a tokenization platform designed to digitize multiple asset classes, with real estate being one of the key underlying categories. The platform converts assets into fractional tokens, automates rent and yield distributions through smart contracts, and embeds compliance checks. For investors, this creates transparent income flows and improved access to traditionally illiquid markets; for providers, it simplifies operations and ensures trustworthy reporting.

Ways To Address Risk Expectations Up-Front in RWA Tokenization

Supervisors are increasingly focused on the structural risks surrounding tokenization. Weak collateral practices and unstable settlement assets remain high on their agendas. The Bank for International Settlements has cautioned against excessive reliance on privately issued stablecoins, instead advocating tokenized platforms anchored by central bank and commercial bank money. Platforms that anticipate this regulatory direction now will avoid costly retrofits later.

Regional shifts add another layer of complexity. In Hong Kong, for instance, some brokers have reportedly been asked to pause RWA tokenization initiatives. These developments highlight the importance of designing with flexibility, incorporating jurisdiction toggles, eligibility controls, and structured shutdown procedures at both the product and venue levels.

A practical control stack, therefore, includes:

- On-chain eligibility and controller rights to remediate sanctions hits or court orders without forks (e.g., forced transfers in security-token standards).

- Independent reserve/NAV verification with alert thresholds and incident playbooks.

- Dual-book reconciliation that ties fiat payouts and on-chain entitlements with daily checks.

- Key-management policies (MPC/HSM) with quorum, geography, and time-lock controls.

Procurement Questions That Separate Durable Platforms from Demos

- Can the token block ineligible transfers at the contract level without pausing the entire asset?

- Is reserve/NAV data published on chain with an independent oracle and a declared freshness SLA?

- Do distributions emit machine-readable events that back-office systems can subscribe to, and do they reconcile to the banking ledger?

- Are venue integrations available for compliant secondary transfers and, where applicable, for collateral use?

- Does the platform support document binding and versioned disclosures at the token level to reduce audit friction?

- Is multi-chain deployment treated as a policy abstraction, not a set of code forks?

Tips for Businesses to Prioritize Assets and Chains- Without Another “Roadmap” Slide

- If the primary buyer base is corporate treasuries, prioritize tokenized money market and Treasury exposures. They align with existing mandates, settle quickly, and use familiar valuation rules.

- If the network includes suppliers and distributors, start with receivable pools where the discount yield is clear and payout schedules map to invoice data.

- If the base includes property developers and income-fund managers, select income-producing real estate with conservative leverage and transparent rent rolls.

- Choose chains by custody readiness and venue reach for the target holders, using a portable compliance model so expansion is a configuration step, not a rewrite.

This keeps effort anchored to current buyers and current controls, not to a predefined phase plan.

Turn Real Assets into Income-Generating Products with Our Tokenization Platform!

Checklist to Ensure That RWA Tokenization Platform Is Delivering Expected Outcomes

- Distribution accuracy: Percentage of payouts matching computed entitlements on first pass.

Data Accuracy: Oracle updates at the time of distribution.

Eligibility efficacy: transfers auto approved versus blocked by policy; remediation time for false positives. - Liquidity velocity: Secondary turnover, spread, and settlement cycle for permissioned transfers.

- Collateral utilization: Percentage of AUM recognized by venues or lenders for margin and financing.

- Audit lead time: Days from request to regulator or auditor package delivery.

Tracking these numbers keeps conversations concrete and delivers the expected outcome.

Takeaway

Enterprises no longer need to speculate about tokenized passive income. The combination of institutional issuance at scale, clear supervisory direction, and working collateral integrations provides a concrete basis for action. Teams that implement permissioned tokens, on-chain identity and eligibility, independent reserve/NAV verification, and a deterministic distribution engine will deliver income that holders can rely on, and auditors can verify. The result is not only new revenue, but also a cleaner, faster operating model for yield-bearing assets, designed for production.

Partner with Antier to transform treasuries, receivables, or real estate into tokenized income streams with compliant RWA Infrastructure.

Frequently Asked Questions

01. What is passive income on an RWA tokenization platform?

Passive income on an RWA tokenization platform is a process coded into the asset itself, allowing payments to be automated without intermediaries, ensuring timely and transparent distributions to investors.

02. How does the RWA Tokenization Platform ensure compliance for investors?

The RWA Tokenization Platform ensures compliance by automatically checking the eligibility of new token holders under KYC, AML, and jurisdictional rules whenever tokens are transferred.

03. What benefits do tokenized assets offer to investors?

Tokenized assets offer investors access to predictable income streams, reduced reconciliation costs, and reliable payouts, transforming income generation that was previously limited to large institutions.