Most crypto founders in 2025 won’t fail due to poor ideas or a lack of funding; they’ll fail silently because of one overlooked decision: choosing the wrong cryptocurrency development company. The difference isn’t always visible upfront. The right partner can help you shape tokenomics that resonate with your audience, deliver compliant and audit-ready code, and build future-proof infrastructure that scales post-launch. A wrong choice might leave you with hidden vulnerabilities, poor community traction, or even reputational risk.

But here’s what many founders still overlook: there are blind spots that only a seasoned coin development expert can identify. If you think a basic dev shop can deliver your vision, you might already be missing something crucial. There’s more to uncover, from red flags you might miss to the critical questions no one tells you to ask. Keep reading to make sure you don’t overlook a detail that could shape your entire token journey.

- Why Choosing a Coin Development Company Is More Crucial Than Ever in 2025

- Key Factors to Consider Before Choosing a Cryptocurrency Development Company

- Red Flags to Avoid

- 6 Questions to Ask Before Hiring a Coin Development Company

- Top 5 Cryptocurrency Development Companies to Watch in 2025

- You’re One Decision Away From a Game-Changing Launch

Why Choosing a Coin Development Company Is More Crucial Than Ever in 2025

In 2025, crypto startups face more complexity than ever before. The rise of AI-driven token utilities, tighter regulations, and sharper investor scrutiny have turned coin development into a strategic process. Choosing the right cryptocurrency development company now plays a crucial role in the success of your project. The right partner can craft secure smart contracts, deliver future-ready tokenomics, and support smooth post-launch scaling. A poor choice, on the other hand, can slow you down or even kill your momentum before launch.

What many founders overlook are the silent deal-breakers, technical gaps, hidden compliance risks, or missed optimization layers that only come to light later. That’s why it’s not just about picking a developer. It’s about choosing one with proven depth, regulatory know-how, and a track record of real impact. If you’re unsure whether you’ve asked the right questions or compared the best-fit firms, you’re probably missing something big.

Key Factors to Consider Before Choosing a Cryptocurrency Development Company

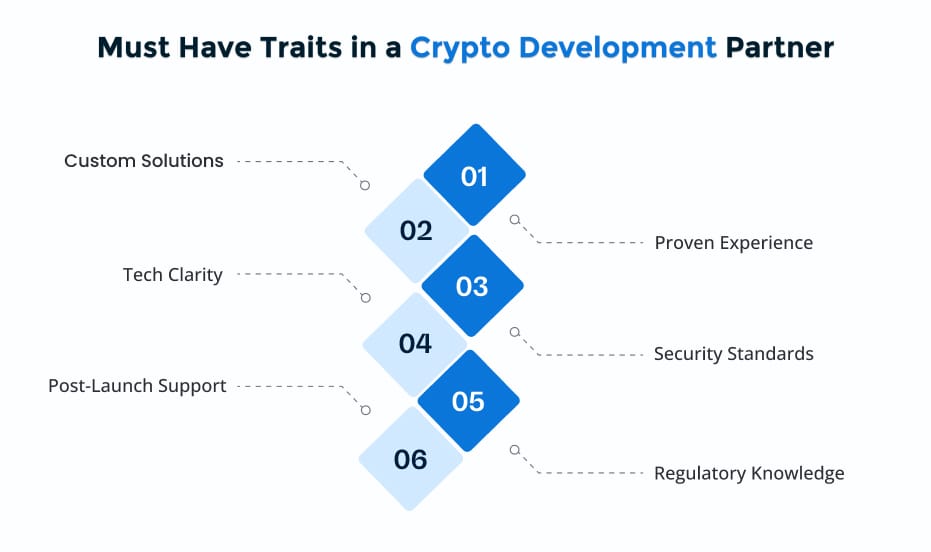

Selecting the right cryptocurrency development company can significantly impact the future of your project. It’s not just about coding but choosing a team that understands blockchain, business, and user trust. Here’s what you should check before you make a decision.

- Proven Experience: Choose a company with real-world blockchain project delivery. Look for use cases across token development, DeFi, wallets, or NFT platforms.

- Custom Solutions: Ensure they can build tailored products, not just reuse templates. Your idea should reflect in the features and flow.

- Security Standards: Ask about their approach to code audits, wallet security, and bug prevention throughout the development cycle.

- Tech Clarity: A good crypto coin development company will walk you through their tech stack and explain how it fits your goals.

- Regulatory Knowledge: Your platform should comply with crypto regulations and KYC/AML norms relevant to your target market.

- Post-Launch Support: Strong companies offer upgrades, monitoring, and optimization even after your platform goes live.

Pro Tip: Always ask the team to share client testimonials or working demos. It helps verify their real capabilities.

Red Flags to Avoid

- Promises of guaranteed returns or unrealistic launch timelines

- Lack of transparency in pricing, scope, or the coin development process

- No portfolio or client references to back their claims.

- Poor communication or delayed responses during early discussions

- One-size-fits-all solutions with no room for customization

Finding the right cryptocurrency development company means knowing which factors matter and which warning signs to watch. A team with real expertise, transparent pricing, and solid support gives your project the best chance. But ignoring red flags like unclear terms or poor communication can cost you time and trust. Ask smart questions, stay alert, and choose a partner that matches your long-term vision.

6 Questions to Ask Before Hiring a Coin Development Company

Before hiring a coin development company, ask the right questions can protect your budget, timeline, and long-term success. These 6 questions will help you assess both technical expertise and overall credibility:

1. What is your experience in coin development?

Look for successful projects across public and private blockchains.

2. Which blockchain platforms and tech stacks do you specialize in?

Make sure the team is proficient in EVM chains, smart contracts, and the latest consensus mechanisms.

3. Can you provide live project links or case studies?

Proof of work matters more than presentations.

4. Do you offer white-label or custom coin development?

Choose what fits your go-to-market strategy best.

5. How do you handle smart contract development and audits?

Security, gas optimization, and code quality are non-negotiables.

6. What level of post-launch support do you provide?

A good team will offer version updates, token burns, and upgrade paths.

These questions help uncover the technical depth, reliability, and transparency of any cryptocurrency development company. If you have other specific concerns, like tokenomics design, cross-chain compatibility, or DeFi integration, don’t hesitate to ask. Partnering with a renowned and experienced coin development company ensures that every query is answered clearly and your project gets the expert attention it deserves.

Top 5 Cryptocurrency Development Companies to Watch in 2025

- Antier Solutions: Antier leads with audit-ready tokens, U.S. compliance, DAO modules, and tokenomics expertise. From MVP to mainnet, it’s the top choice for serious crypto founders.

- OpenXcell: OpenXcell suits fast-moving teams with prebuilt modules for staking, vesting, and liquidity, perfect for DEX-ready tokens.

- Peiko: Peiko builds smart contracts with clean front-end flows, ideal for apps needing both tech depth and user simplicity.

- Prolitus: With Layer-2 readiness and oracle support, Prolitus creates efficient, secure tokens for multi-chain growth.

- HashCash: HashCash offers AML/KYC compliance and dashboards, perfect for asset-backed and institutional token projects.

Ready to build your token the right way?

Explore the comprehensive blog on cryptocurrency development companies for a complete comparison and expert insights.

You’re One Decision Away From a Game-Changing Launch

Every successful crypto project begins with a single, smart decision: choosing the right coin development partner. In 2025, that choice can define whether your token fades into noise or leads the next wave of blockchain innovation. You’ve seen how the best companies deliver speed, security, compliance, and strategic support. But now it’s your move. You’re one decision away from a game-changing launch.

The crypto space is crowded, but great ideas still rise, with the right partner. Antier, a renowned crypto development company, brings clarity, compliance, and cutting-edge tools to every project. Whether you’re a startup or scaling fast, we help you launch smart, stay secure, and grow stronger. Thousands trusted us. Now it’s your turn.

Get in touch and let’s shape your token journey together.