Introduction

Hyperliquid has become the biggest place for perpetual futures trading, eating into the market share of the top centralized platforms effortlessly. Even after the $6M exploit, people are drawn by its CEX-like speed that comes without giving up on transparency and decentralization. This makes building a perpetual futures DEX a lot more than a walk in the park. It requires blending top-notch UX with smart on-chain trading mechanics. But before we discuss the decentralized perpetual exchange development process to replicate Hyperliquid’s success, let’s talk about why it’s even worth building in the first place.

Why Build a Perpetual Futures DEX like Hyperliquid?

- $22B+ Daily Volume: Hyperliquid handles over $22 billion in 24-hour trading, proving serious demand for on-chain perps.

- 70% Market Share (On-Chain Perps): Hyperliquid perpetual exchange dominates the decentralized perpetual futures segment, capturing 70% of the on-chain market.

- $548.5 Million in TVL: This reflects strong capital commitment and ecosystem trust.

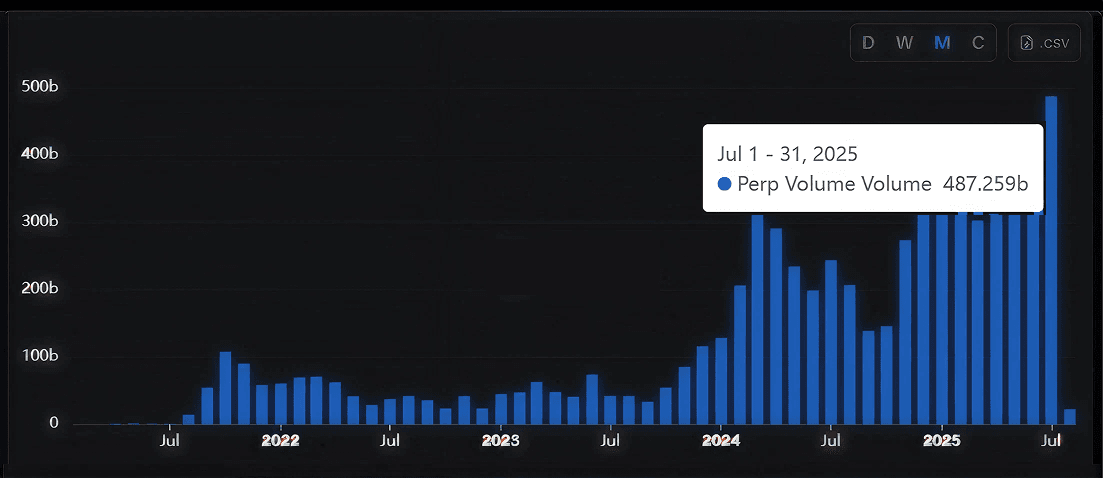

- Perps Dominate Crypto Derivatives Volume by 90%: Perpetual contracts are the go-to derivatives nowadays, dwarfing dated futures. Average perpetual trading volumes in July 2025 reached 487.26 billion, unlocking a new all-time high.

Source: https://defillama.com/perps

- No Expiry, Just Strategy: Unlike traditional futures, perpetuals let traders hold positions indefinitely. No rollovers or expiry headaches that exchanges or traders have to worry about.

- $2.1 Trillion+ Cumulative Volume: The decentralized perpetual exchange is built keeping in mind long-term trader engagement and liquidity depth.

- Funding Rates Keep It Real: Smart mechanisms align perpetual prices with spot, ensuring fair market dynamics.

- CEX Performance, DEX Principles: Hyperliquid proves that decentralized platforms can match centralized exchange performance, while giving users self-custody and transparency.

Building your Hyperliquid-inspired perpetual futures DEX means owning a slice of the next-gen financial stack where users, not middlemen, call the shots.

Also, as the COO and co-founder at Coingecko states that CEXs seem jealous of DEXs, it is clear that the decentralization wave is already here. Timing your entry in the on-chain spot and perpetual trading is the real edge.

Also Read>>> Essential Components of a Perpetual Futures DEX

Step-by-Step Perpetual Futures DEX Development Process

1. Concept & Research :

- Define your vision, decide on the target markets (which tokens or trading pairs), desired leverage (10×?, 50×?), and unique value proposition (speed, assets, UI features).

- Analyze existing perpetual futures DEXs to identify best practices and pitfalls (for example, Hyperliquid’s design versus GMX’s AMM approach). After you decode your on-chain perps exchange strategy, you must prepare a formal specification of features and requirements in coordination with your perpetual futures DEX development company.

2. Choose Blockchain Infrastructure:

- Decide whether to build on an existing chain or launch a new one. Options include: an established Layer-1 (like Solana for speed, EVM-based chains for tooling), a dedicated Layer-2 solution (Arbitrum, Optimism), or creating a new L1 like Hyperliquid did (resource-intensive but gives full control).

- Your choice affects cost, development time, and capabilities. For a Hyperliquid-like approach, a dedicated, new high-throughput HyperBFT-based L1 was chosen, but starting on an L2 might also be faster to market. So, consider your decentralized perpetual exchange development options carefully.

3. Design Architecture:

- Coordinate with your perpetual futures trading platform development company to draft the system architecture. This includes planning the on-chain components, including order book smart contracts, margin engine, oracle oracles, liquidity vaults, and off-chain services, including order matching logic, data indexers.

- If you’re going for a custom chain, you’ll need to decide on a smart-contract language (Solidity/EVM, Rust/C++). Define data schemas for orders, trades, and user accounts. Meticulously plan how the on-chain order book will function and what data the chain will store. Any loopholes here will lead to costly losses after launch.

Also Read>>> Order Book Perpetual DEXs and AMM-Based Perpetual DEXs: An Overview

4. Develop Core Smart Contracts: Watch over while your decentralized perpetual exchange development company implements the on-chain logic that controls major functions of your trading platform.

- Order Book Contract: Manage order placement, matching, and cancellation. If fully on-chain, this contract pairs orders.

- Perpetual Engine: Handle margin accounts, position tracking, funding rate calculations, and auto-liquidations.

- Liquidity Vaults: If using a vault, program its deposit/withdrawal and automated trading logic.

- Oracles: Integrate or write oracle contracts to fetch external prices.

- Token Contracts: If you have a governance/reward token, develop and audit that.

Each of the DEX perpetual contracts should be thoroughly tested with unit tests.

5. Build the Matching Engine :

- If you chose on-chain matching, much of this logic is in smart contracts. But if you opted for hybrid or off-chain matching for speed, you’ll need a backend matching service that monitors systems for requests, processes, and matches orders and executes the transactions.

- While you’re replicating the Hyperliquid perpetual futures exchange, ensure latency is minimal. For on-chain CLOB, follow Hyperliquid’s 200k orders/sec as it sets a high bar in the decentralized perpetual trading space. You may not need that much initially, but ensure your engine can scale efficiently whenever needed.

6. Integrate Oracle and Risk Management Systems:

- Plug in price oracles (e.g., Chainlink, Pyth, or a custom aggregator) during perpetual futures DEX development so your exchange always gives competitive prices.

- You’ll also need to set up risk parameters such as max leverage, minimum collateral, maintenance margin, etc.

- Also, develop the funding-rate algorithm to incentivize a balance between longs and shorts.

Test all these systems comprehensively under simulated price shocks to verify that auto-liquidations and price updates work as expected, under pressure and normal situations.

7. Front-End and UI :

- Collaborate with your decentralized perpetual futures exchange development company to develop the trading interface as per your target audience. You can use common frameworks (React, Vue) and charting libraries (TradingView, Highcharts). No matter what you and your tech partner finalize, the UI must display the on-chain order book, charts, and positions in real time, without any fuss or confusion.

- You’ll also have to integrate with wallets (Metamask, Coinbase Wallet, etc.) for deposits/withdrawals.

- At last, don’t forget to build a dashboard (customizable if you’re targeting institutions) for user balances, margin positions, and trade history.

During your Hyperliquid Perpetual Exchange development, you’ll need to conduct UX reviews as the smoother this is, the quicker traders will adopt it.

8. Security Audit and Testing :

- Your security layer should be strong, including the best security features. Here are a few crypto exchange security suggestions for 2025 and beyond.

- Before launch, engage reputable auditors for smart contracts (e.g., CertiK, Trail of Bits). Your perpetual futures DEX development company can help you conduct thorough audits or partner with reputable auditors.

- Perform penetration testing on any backend servers and test on a testnet or staging environment with large simulated volumes before you finally launch. You’ll also need to fix all critical issues that arise during testing or after. A bug bounty program post-launch is also recommended for ongoing safety.

9. Liquidity Bootstrapping :

- To attract users at launch, consider token airdrops or liquidity mining rewards. Hyperliquid airdropped ~31% of its token supply to early users, which created viral growth. It’s a great hype strategy that your perpetual futures DEX can leverage. Even without a token, you can offer fee discounts

- Also, partner with market makers to ensure initial liquidity. You might need to seed the liquidity pool with capital initially, or your perpetual futures trading platform development company can suggest you best liquidity mechanisms as per your goals.

10. Launch & Monitoring :

- Deploy on mainnet and constantly monitor key metrics (TVL, volume, open interest), as you’ll have to watch the health of the system even if it is decentralized.

- Implement real-time alerts for abnormal events (e.g., oracle price spikes, failed transactions). Now that you know about the Jelly episode, you can join forces with your decentralized perpetual exchange development company and have a foolproof plan for such hacks. When you have it, flaunt it well with some good marketing measures.

11. Iterate and Scale :

- After launch, your work doesn’t end, as you’ll need to continue improving the platform. Listen to community feedback and upgrade consistently.

- Possible expansions include more trading pairs, gas-less trading mechanics, cross-chain bridges to source liquidity, spot trading support, or new financial products (options, futures, on new assets or tokenized RWA, maybe).

Throughout the process, strong project management and clear documentation are essential, and a reliable perpetual futures DEX development company like Antier will ensure that.

Final Takeaway

Building your decentralized perpetual exchange like Hyperliquid is a challenging but attainable project. In the big picture, it means combining high-speed blockchain infrastructure, a solid order-matching engine, reliable price feeds, deep liquidity mechanisms, and rock-solid security. You’ll be essentially constructing a regulated-grade trading platform on open finance rails.

Build With Antier

Antier has built high-performance centralized, decentralized, and hybrid perpetual futures trading platforms for clients who don’t settle for second best. Their services include:

- Custom Orderbook/AMM-Based Perp DEX

- On-Chain Matching Engine

- Funding Rate Mechanism

- Cross & Isolated Margin Modes

- Oracle Integration (Pyth, Chainlink, etc.)

- Gasless Trading UX

- Copy Trading & Leaderboards

- White-Label Perpetual DEX Kit

Share your requirements today!

Frequently Asked Questions

01. What is Hyperliquid known for in the trading market?

Hyperliquid is recognized as the largest platform for perpetual futures trading, capturing 70% of the on-chain market share and handling over $22 billion in daily trading volume.

02. Why are perpetual futures contracts becoming more popular than traditional futures?

Perpetual futures contracts allow traders to hold positions indefinitely without expiry, making them more appealing. They dominate crypto derivatives volume by 90%, reflecting a significant shift in trading preferences.

03. What advantages does a decentralized perpetual futures exchange offer compared to centralized exchanges?

A decentralized perpetual futures exchange provides CEX-like performance with the benefits of self-custody, transparency, and fair market dynamics through smart mechanisms that align prices with the spot market.