Digital Asset Tokenization and gradually becoming a part of the core financial infrastructure.

With a well-designed digital asset tokenization platform, businesses can divide their assets into smaller, tradable units, settled in seconds, and managed through automated compliance mechanisms. Assets that once required months to sell can now be fractionalized and offered to investors across jurisdictions, dramatically improving liquidity and market reach. This guide explores everything about digital asset tokenization, its working, and the benefits shared.

Understanding The Digital Asset Tokenization Platform and Its Working

Digital asset tokenization platform development connects traditional markets with blockchain networks through a structured process that combines asset design, technical deployment, compliance, and ongoing market operations. Here is how it works:

1. Asset Representation

Every tokenization project begins with a legal and technical definition of the asset to be represented on-chain. A smart contract is deployed to issue tokens tied to the rights, income streams, and obligations of the underlying asset.

2. Blockchain Integration

Blockchain infrastructure for a tokenization platform defines its liquidity, cost, and compliance options.

Public networks offer deep liquidity pools, broad interoperability, and connectivity to DeFi markets, whereas Permissioned blockchains deliver controlled access, governance features, and privacy. Most leveraged networks are Hybrid models, an amalgamation of both.

3. Smart Contract Automation

Smart contracts are the operational layer of blockchain-based tokenization. They manage dividend payouts, transfer permissions, and automated settlements. This atomic settlement compresses transaction cycles from T+2 or T+5 down to under a minute, significantly reducing counterparty risk and improving capital efficiency.

4. Oracles for Off-Chain Data

Tokenized ecosystems often require external data for valuations, regulatory updates, or market pricing. Secure oracle services such as Chainlink deliver verified, real-time feeds to the blockchain, ensuring that smart contracts execute based on accurate inputs and mitigating the “oracle problem.”

When correctly implemented, this infrastructure supports not only cryptocurrency tokenization and utility token creation, but also complex portfolios that integrate multiple real-world asset classes.

How Digital Asset Tokenization Can Benefit Businesses?

For banks, asset managers, and large corporations, tokenization is changing how assets are raised, managed, and traded.

Higher Liquidity: Breaking an asset into fractional units has opened the door to markets that were traditionally locked away. Real estate, private equity, and infrastructure projects that once demanded millions upfront can now be bought in smaller pieces.

Operational Cost Efficiencies: Smart contract automation streamlines repetitive processes, reduces reconciliation times, and lowers administrative overhead. Established digital asset tokenization platforms report cost savings approaching 40%, driven largely by reduced manual intervention.

Faster Settlement Cycles: Replacing multi-day settlement windows with T+0 execution increases capital turnover and minimizes counterparty exposure.

Global Distribution Potential: Tokenized assets can be issued and traded across multiple jurisdictions, providing issuers with direct access to a broader investor base. In 2025, more than 60% of institutional investors are exploring tokenized private equity, signaling sustained interest in cross-border participation.

How to Build a Digital Asset Tokenization Platform

The digital asset tokenization platform development requires a structured approach to address the regulatory obligations and market performance.

1. Asset & Legal Structuring – Define the asset class and establish a legal framework that links tokens to enforceable ownership rights. This is the foundation of investor confidence.

2. Blockchain Architecture – Select the network based on liquidity needs, transaction costs, and compliance requirements.

3. Compliance Integration – Embed KYC/AML processes, transfer restrictions, and jurisdictional controls directly into the platform’s core.

4. Smart Contract Development – Deploy and audit contracts that manage issuance, transfers, distributions, and lifecycle events.

5. Liquidity Enablement – Connect to secondary markets, integrate APIs for cross-chain trading, and, if needed, onboard market makers.

6. Custody & Investor Reporting – Partner with licensed custodians and provide transparent reporting tools that meet institutional standards.

Key Market Trends Driving Tokenization in 2025

Several macro developments are accelerating the expansion of tokenized digital assets:

- Institutional Adoption – Over 75% of institutional investors plan to increase allocations this year. Tokenized bonds, funds, and U.S. Treasuries are leading, with $1 billion in tokenized T-bills already in circulation.

- Regulatory Convergence – The U.S. is advancing coordinated digital asset frameworks alongside AI regulation. Europe’s MiCA rules and parallel Asian frameworks are set to expand tokenized real estate markets toward $3 trillion by 2030.

- RWA Tokenization Growth – Real estate, private equity, and infrastructure remain top priorities for tokenization companies, with RWAs projected to represent 15% of global real estate under management by 2030.

- Stablecoins as Settlement Rails – USDC and USDT are now essential payment infrastructure, with a combined market cap exceeding $150 billion in 2025.

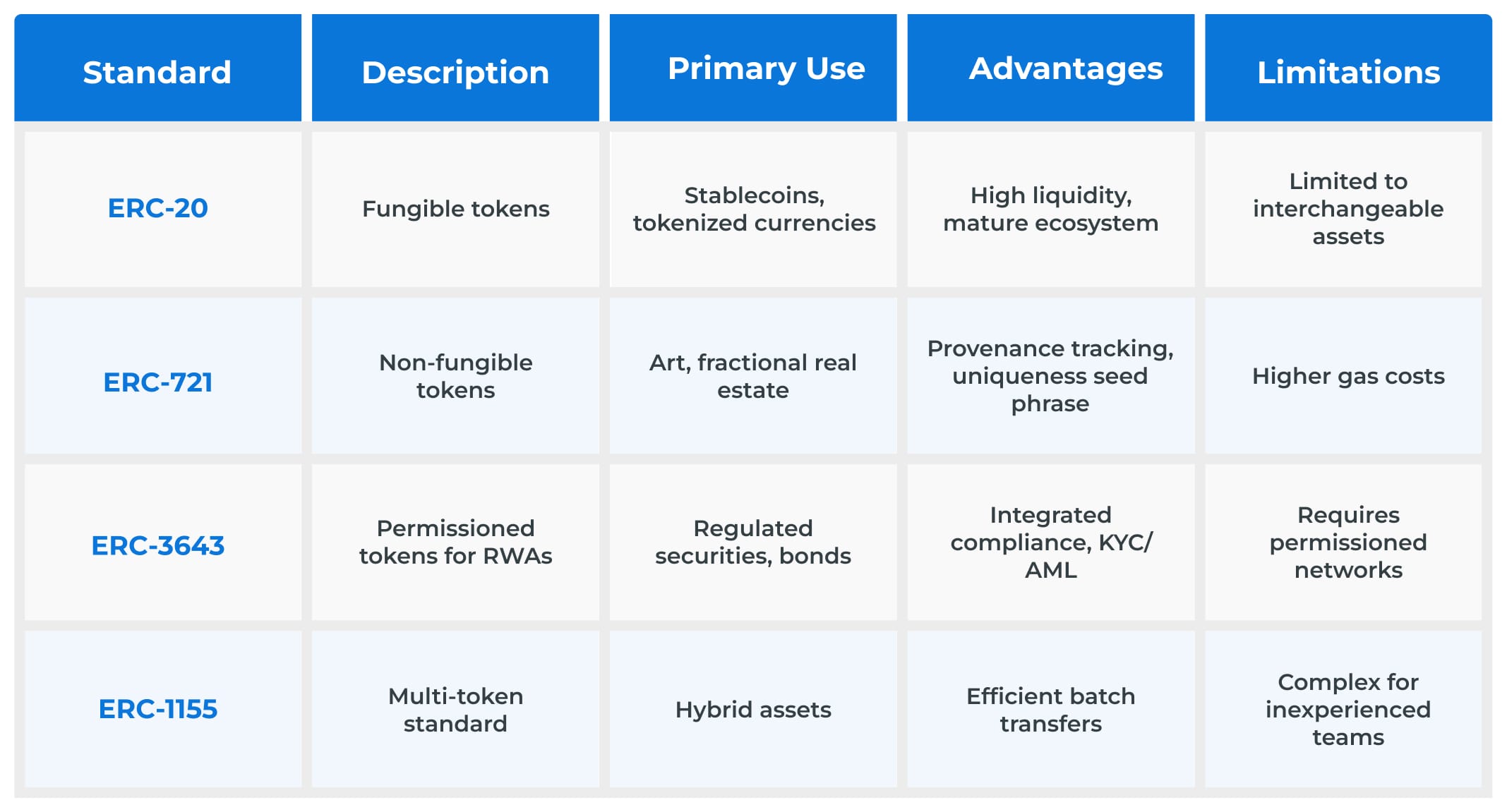

Choose the Right Token Standards for Secure Tokenization

The choice of token standard determines interoperability, compliance readiness, and operational flexibility:

For regulated markets, ERC-3643 is emerging as the preferred option due to its embedded compliance features, making it highly relevant for enterprise-grade tokenization projects.

Digital Asset Tokenization Case Studies from Leading Institutions

- Goldman Sachs Digital Assets Platform – Operates on Canton Network, processing $1.5 trillion monthly with integrated compliance and settlement capabilities.

- HSBC Orion – Facilitates tokenized bonds with T+1 settlement and full regulatory oversight.

- Siemens Digital Bonds – Issued on Polygon, enabling fractional ownership and reducing issuance costs.

- World Bank & EIB – Launched tokenized green bonds on Ethereum, raising $10 billion for sustainable finance.

Strategic Recommendations for 2025 and Beyond

- Start with High-Value RWAs – Focus on real estate, private credit, or fixed income, where investor demand is proven.

- Enable Multi-Chain Interoperability – Avoid liquidity fragmentation by designing cross-network compatibility.

- Integrate Compliance from the Start – Use ERC-3643 or equivalent standards with jurisdiction-specific governance.

- Deploy Advanced Analytics – Use data insights for customized investor offerings and digital asset monetization strategies.

Takeaway

For enterprises and financial institutions, digital asset tokenization is a strategic driver of growth. It enables new revenue channels, widens access to investors, and strengthens long-term engagement. A future-ready tokenization company must provide platforms that are secure, regulatory-compliant, and built to scale, connecting traditional assets with blockchain-based markets. Those delivering institutional-grade solutions in 2025 will secure early market share and define the performance standards in a sector expected to reach multi-trillion-dollar value within the decade.