Why aPriori’s $20M Raise Matters

In August 2025, aPriori, a Web3 startup founded by former quant engineers from Coinbase, Jump Trading, and Citadel, secured $20 million in a Series A round led by Pantera Capital, HashKey, IMC Trading, and other investors. This massive funding brings its total raise to $30 million, all directed toward building institutional-grade on-chain trading infrastructure.

But why such a squander for institutional-grade decentralized exchange development? It seems that aPriori aims to solve DeFi’s biggest headaches, which are:

- Wide spreads often scare away professional traders.

- MEV (Miner/Maximal Extractable Value) leakage, which costs users billions of dollars annually.

- Bad quality trades that erode liquidity instead of contributing to it, making DEX liquidity weaker and less reliable.

aPriori is tackling these challenges with an AI-powered DEX aggregator named Swapr and a liquid staking platform that redistributes MEV back to stakers.

This funding round isn’t only about one startup. It’s a signal that the market is hungry for a new class of high-frequency, institutional-grade decentralized crypto exchange software solutions. For future-focussed businesses, the real question now is “How to build an on-chain, institutional-grade exchange that offers transparency while surpassing the CEX’s efficiency?”

What Are Core Features Required For Institutional-Grade DEX Development?

Institutional-grade DEXs are on-chain trading platforms designed to meet the performance, compliance, and security needs of financial institutions, asset managers, hedge funds, and other professional trading entities who indulge in large-scale, high-frequency activity. These decentralized crypto exchange software solutions offer CEX-level efficiency without compromising on DeFi strengths.

Core traits of an institutional-grade DEX:

- High Throughput & Low Latency

- 10,000+ transactions per second (TPS), sub-second finality.

- Critical for high-frequency and arbitrage trading.

- MEV Resistance

- Fair sequencing services, encrypted mempools, and batch auctions.

- Reduces front-running and sandwich attacks.

- AI-Driven Smart Order Routing

- Aggregates liquidity across AMMs and order books.

- Predictive routing powered by AI for best execution.

- Liquidity Depth

- Partnerships with market makers, HFT firms, and staking pools.

- Cross-chain collateral support for leverage trading (USDC, ETH, RWAs).

- API & FIX Connectivity

- High-performance APIs for algo/HFT firms.

- FIX protocol support for TradFi integration.

- Compliance Readiness

- AML/KYC modules.

- Jurisdiction-specific licensing frameworks (SEC, SFC, MiCA).

- Customizable Order Types

- Beyond basic limit/market: stop-loss, iceberg, TWAP/VWAP.

- Mirrors institutional, centralized OTC trading desks.

- Advanced Risk Management

- On-chain liquidation engines with circuit breakers.

- Insurance funds for trader protection.

- Institutional-grade margin systems (isolated + cross).

- Security & Auditability

- Smart contract audits, formal verification.

- Real-time proof-of-reserves and on-chain transparency.

- User Experience at Scale

- Non-custodial wallet integration.

- Gasless trading on decentralized crypto exchange software via meta-transactions.

- Session signing for institutional traders managing multiple accounts.

How to Build a High-Frequency, Institutional-Grade DEX

aPriori’s approach offers lessons for every entrepreneur considering DEX development. However, the good news is that you don’t need millions of dollars to start your institutional-grade DEX. You can start small with a white label decentralized exchange and scale up as your DeFi exchange picks up momentum.

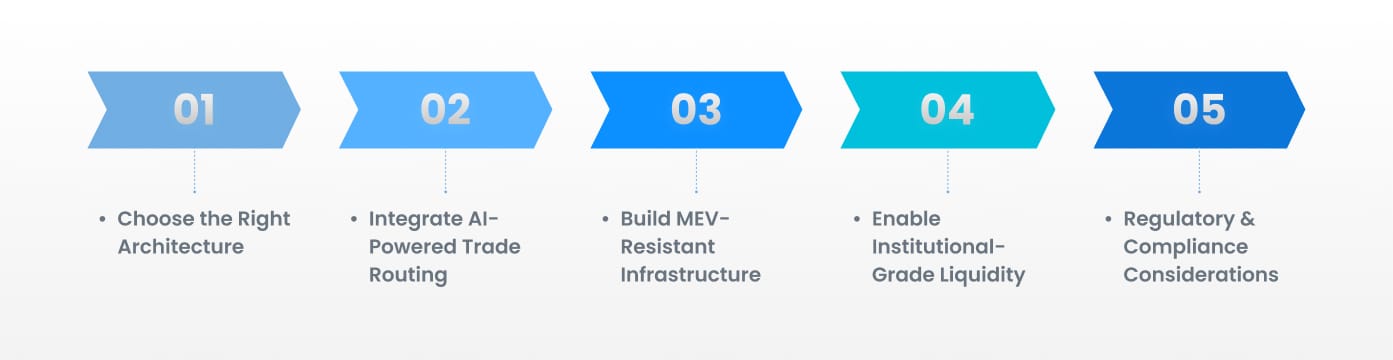

All you need is a reliable DeFi Exchange Development Company, and you’re all set to build an institutional-class on-chain trading platform with high-frequency trading capabilities. These are the 4 steps to consider during

1. Choose the Right Architecture

- Custom Layer-1 Blockchain (Tendermint BFT / Cosmos SDK): Building a custom layer-1 like Hyperliquid for your DEX development offers full control over block production, execution logic, and throughput. With sub-second finality and 10,000+ TPS possible, it’s the foundation for high-frequency trading strategies.

- Optimized Layer-2 Rollup (zkRollups, OP-Stack): This is a quicker path to market that reduces costs and inherits security from Ethereum while offering throughput in the thousands of TPS.

What is the best architecture for building an institutional-grade DEX?

Custom L1 gives more design freedom and MEV protection, while L2s are faster to deploy but dependent on the base chain’s congestion and governance.

2. Integrate AI-Powered Trade Routing

- Aggregator Engine (like Swapr): Like Swapr, acts as a DeFi execution engine, routing orders across liquidity venues to minimize spreads. You can also integrate a custom aggregator platform to ensure best execution.

- Machine Learning Algorithms: Implementing AI/ML algorithms strategically enhances the aggregator function. They continuously analyze order book depth, liquidity shifts, and fee structures to minimize slippage, making decentralized crypto exchange software suitable for institutional use.

What is the Expected Impact associated with AI aggregator engine integration?

- Deploying these AI-enhanced DEX aggregators brings up to 30% improvement in price execution as compared to basic AMM swaps, making the DEX attractive for arbitrageurs and institutional desks.

- Predictive routing prevents large trades from moving the market too aggressively, protecting both liquidity providers and traders.

Also Read>>> Antier Rolls Out AI Modules for Crypto Exchanges

3. Build MEV-Resistant Infrastructure

MEV resistance in DEXs is essential to ensure transparent and fair transaction execution. These are some of the measures to be considered for MEV-proof decentralized exchange development.

- Fair Sequencing Services (FSS): DEXs can enforce neutral transaction ordering to block front-running.

- Encrypted Mempools: These pools hide pending trades until confirmation, removing the window for bots to exploit them.

- Batch Auctions: Many DEXs also bundle trades and execute them simultaneously, neutralizing sandwich attacks.

- Liquid Staking: Instead of MEV draining users, aPriori channels it back to stakers, creating an aligned incentive model. Future-proof DEXs can implement such models to discourage MEV attacks.

Why it Matters:

MEV drained more than $1.3 billion from users between Sep 2022 and June 2024. DEX development that actively mitigates this has a clear institutional advantage.

4. Offer Institutional-Grade Liquidity in a HFT-Grade Infrastructure:

aPriori is designed to handle high-frequency trading strategies on-chain. This becomes a major draw for hedge funds. Those following its footsteps or building on it can consider the following:

- Partnerships with Market Makers and HFT Firms: They deepen order books, reducing spreads and improving execution speed.

- Cross-Chain Compatibility (Stablecoins, Crypto, RWAs): Implementing this allows institutions to trade with assets they already use, bridging traditional and decentralized finance. DEXs can also allow collateralization of these assets for margin and leverage trading.

Why is this important?

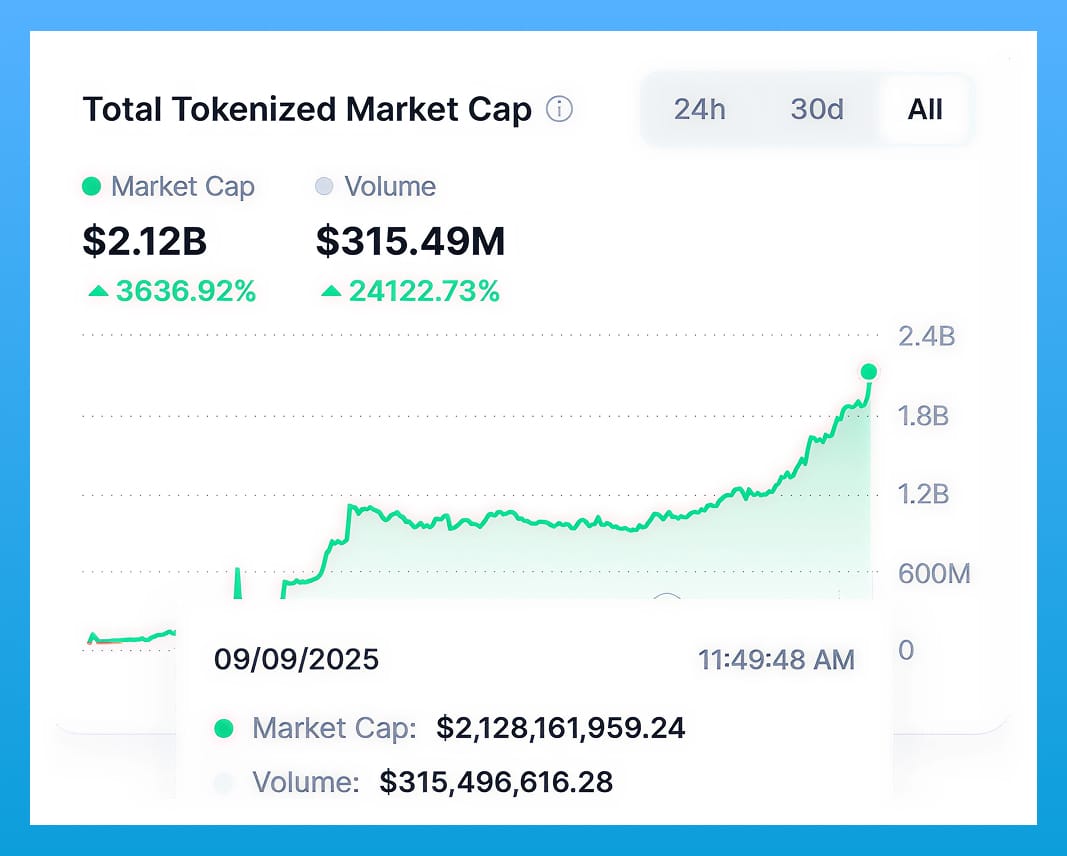

- At the time of writing this, the RWA tokenization market is valued at $2.12 billion. The market is yet to unlock more peaks and reach $18.9 trillion by 2033, making multi-asset onboarding a must-have for all future-ready decentralized crypto exchange software.

- Also, institutions won’t join a DEX with thin liquidity. So, deep pools are essential to deepen traders’ confidence in your trading platforms.

5. Regulatory & Compliance Considerations

At last, regulatory compliance is non-negotiable to gain investor confidence. Depending on the target market, trading platforms must obtain required licenses and accreditations. These are some recent laws governing digital asset trading in various crypto-friendly countries.

- Hong Kong SFC (2023): Virtual Asset Trading Platforms must obtain licenses, enforce AML/KYC, and maintain cybersecurity standards.

- EU MiCA (2024): The law imposes strict custody, reporting, and disclosure rules for exchanges operating in Europe.

- US SEC & FinCEN: Platforms dealing with US users need AML, KYC, and securities law alignment to avoid enforcement risks.

What should entrepreneurs do to ensure compliance with regulations?

- Entrepreneurs planning to launch their DEXs in top crypto-friendly nations legally must learn about the basic regulatory requirements.

- One can collaborate with DeFi Exchange Development Company to bake compliance modules (KYC checks, risk monitoring, reporting dashboards) into the exchange from day one, as retro-fitting them later is costly and delays growth.

Why Investors Are Backing Institutional-Grade DEX Development?

According to Chainalysis’s global crypto adoption report, institutional investment in cryptocurrency has reached new levels. It’s not just aPriori representing the market’s readiness, but various blockchain protocols like Polkadot are tapping into the institutional hype.

Investors are backing DEXs that address structural flaws. From execution fairness and liquidity fragmentation to trust gaps, future-ready DEX development must consider the following to attract traders and investors:

- Execution fairness: Platforms that eliminate front-running and deliver fair trading are more likely to attract institutional users, scale revenues, and make platforms more investable.

- Liquidity fragmentation: Solutions that aggregate liquidity across pools and chains reduce inefficiency, creating stickier volume and stronger growth metrics, ensuring returns for investors.

- Trust gaps: Transparent, auditable execution lowers reputational and regulatory risks, which reassures both users and investors.

- Faster settlement: Seconds-level settlement beats TradFi’s T+2 delays, unlocking faster capital turnover, a major competitive edge for growth.

- Transparency: Visible smart contracts and order flows build regulatory credibility, improving long-term sustainability.

- Aligned incentives: MEV redistribution keeps users engaged and rewards liquidity providers, signaling healthier economics and higher retention.

Antier’s Role in Institutional-Grade DEX Development

As institutional investors are drawn towards DEXs, we expect more market players to build trading platforms for hedge funds, asset managers, and institutions that demand execution speed, liquidity depth, and compliance readiness. aPriori’s $20M raise confirms that the appetite is real.

Building a DEX that matches aPriori’s ideologies isn’t a cakewalk. It requires subject matter experts from top DEX development companies who have proven experience.

Antier’s decentralized exchange development services can help you bring Wall Street execution to Web3. They provide:

- Custom L1 & L2 Development: Tailored for sub-second execution.

- MEV-Resistant Infrastructure: Fair sequencing, batch auction logic, public auditability.

- AI-Powered Routing Modules: Similar to aPriori’s Swapr aggregator.

- Compliance-Ready Frameworks: SFC, MiCA, SEC, and FinCEN aligned.

- Track Record: 250+ regulated exchanges launched worldwide, spanning spot, derivatives, staking, and perpetual DEXs.

For entrepreneurs, working with a decentralized exchange development company like Antier means cutting years off development timelines.

Frequently Asked Questions

01. What Is an Institutional-Grade DEX?

An institutional-grade DEX is not just another AMM or order-book exchange. It is a decentralized crypto exchange software designed with high throughput, MEV resistance, deep liquidity, regulatory readiness, and advanced order types. These features allow it to match Wall Street execution standards while keeping DeFi transparency.

02. How does MEV redistribution benefit a DEX?

Instead of validators capturing hidden profits, MEV redistribution sends value back to stakers and users. This creates aligned incentives, improves retention, and makes the platform more attractive for both traders and investors.

03. Why is faster settlement important for institutional investors?

Faster settlement (seconds on-chain vs. T+2 in TradFi) frees up capital quickly, enabling higher trading volumes, faster turnover, and better capital efficiency. These are all critical for institutional strategies.

04. How can entrepreneurs build a DEX like aPriori?

Entrepreneurs can work with reputable DEX development companies to design MEV-resistant infrastructure, integrate AI-powered routing, secure institutional liquidity partnerships, and ensure compliance with SFC, SEC, or MiCA frameworks.