As of August 2025, the global crypto market cap nears $4 trillion, major trackers list thousands of cryptocurrencies, and roughly 800+ spot exchanges.

Not just exchanges, but the industry abounds in wallets, staking and lending platforms as well. Many of these crypto apps pay KOLs (Key Opinion Leaders) for nothing but likes and an inactive or irrelevant community. KOL ROI platforms help those crypto apps measure how many funded wallets, first trades and repeat usage do they campaigns drive, enabling them to optimize their influencer spend.

Centralized influencer tools show impressions but they don’t prove on-chain activity or connect to CEX/DEX trading volume in a transparent way. A decentralized KOL ROI platform fixes this with verifiable attribution and programmable payouts on an L2, so everyone (crypto apps, KOLs, finance, even partners) can see how money moves, without trusting a black box.

Why Build Your KOL ROI dApp in 2026?

KOL ROI dApp development enables crypto applications to measure the impact of influencer marketing by ranking KOLs by money made, not noise. Influencer budgets are under a microscope, fake engagement is rampant and that’s why all crypto apps need a clean KOL ROI dashboard.

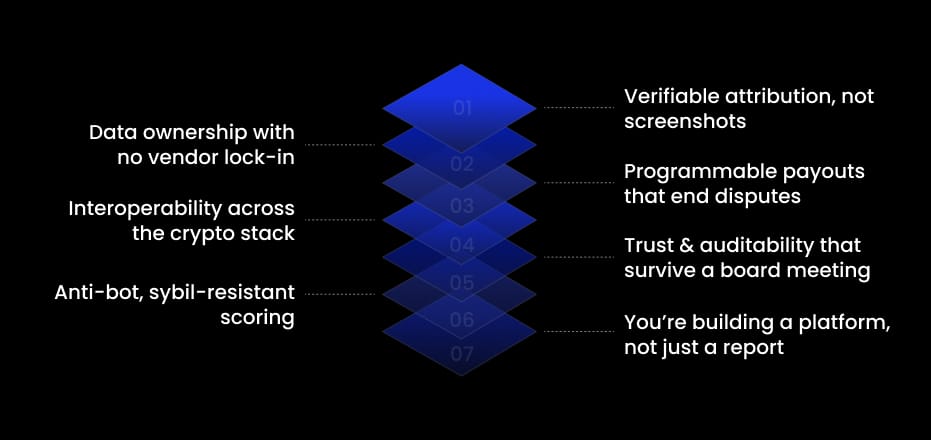

Here’s what you get in decentralized KOL ROI platforms that a normal analytics tool can’t:

- Verifiable attribution, not screenshots

Register every campaign in an on-chain campaign registry (Base/Polygon/Arbitrum). Results are anchored to smart-contract receipts, so no silent edits and no “trust us” PDFs. Crypto exchange and platform owners, partners and even KOLs, can verify outcomes.

- Data ownership with no vendor lock-in

Coordinate with your dApp development company to build a platform in a way that it keeps raw events in your warehouse and publish hashes/proofs on-chain. If a connector or vendor changes, your audit trail and KPIs stay intact. That’s a real verifiable attribution.

- Programmable payouts that end disputes

Use L2 payout escrow to pay by rules you set: per conversion, trading volume, or retention cohort (W4/W8/W12). When a KPI threshold is hit, funds release automatically. Finance gets a clean on-chain trail and KOLs get transparent smart-contract payouts.

- Interoperability across the crypto stack

Plug into exchanges, wallets, and DeFi protocols via open APIs and subgraphs. A KOL ROI dashboard compares apples-to-apples performance across CEX/DEX, so budget flows to what actually drives trades.

- Trust & auditability that survive a board meeting

Join forces with your dApp development services provider to build a KOL ROI platform that reports the only numbers that matter: Trading Volume, Conversion, Trust/Accuracy, Retention. Each metric links back to evidence. So, those vanity metrics no matter after you check these real numbers out.

- Anti-bot, sybil-resistant scoring

Combine wallet-level behavior, graph analysis (cluster detection), and optional DID/attestations to filter out bot farms. This ensures that crypto apps entrusting your KOL ROI dApp pay humans and not farms.

- You’re building a platform, not just a report

Once the core works, expose a public subgraph/API. Agencies, wallets, and exchanges can integrate, and you become the neutral attribution layer, charging for access or services from apps that want access to authentic influencer impact data.

In 2026, a decentralized approach turns KOL spend into auditable, on-chain evidence with automatic L2 payouts and cross-ecosystem coverage. This results in less arguments over impressions, more funding the KOLs who drive deposits, first trades, and users who stay.

What are KPIs that matter in KOL ROI dApps?

- Trading Volume Generated:Total dollars users traded after coming from a KOL.

- Follower Conversion Rate: Out of people who clicked after a key opinion leader advocated for a platform, how many made their first trade there?

- Accuracy & Trust Score (0–100): Are these real people or bots? Normal engagement patterns, unique devices and those who fund a wallet, and place a trade usually signal real users.

- Retention: Of the new traders who came in KOL’s influence, how many are still active after 4, 8, and 12 weeks?

Steps to Build Your KOL ROI DApp in 2026

You don’t need to code it yourself. Hire a reputable dApp development company for the heavy lift. Your role is to make the key calls below, fast and clear.

1. Lock the MVP scope & KPIs

Decide 1 social (X or YouTube) + 1 trading source (a CEX partner feed or a DEX family). Freeze definitions for Trading Volume, Conversion (click → first trade), Trust/Accuracy (anti-bot), Retention (W4/W8/W12).

Outcome: A focused, testable KOL ROI dApp development.

2. Approve data access (no scraping, ever)

Green-light official APIs for the chosen social channel and your CEX affiliate/partner program and pick your DEX coverage (e.g., via The Graph/Covalent).

Outcome: Clean data contracts and verifiable attribution later.

3. Choose chain, payout currency and rules

Pick an L2 (Base/Polygon/Arbitrum) and stablecoin. Set L2 payout escrow rules: pay per conversion, by trade-volume tiers, or by retention cohorts.

Outcome: Dispute-free, programmable payouts in your KOL ROI dApp development contract.

4. Approve the on-chain backbone

Your key opinion leader ROI metrics platform delivers two tiny, auditable contracts:

- On-chain campaign registry (stores campaign IDs + proof hashes)

- Payout escrow (releases funds when KPIs are met)

You approve admin roles and a public subgraph for read access.

Outcome: Tamper-evident receipts; anyone can verify results.

5. Finalize tracking & attribution windows

Approve redirect domain + UTM/ref format and the attribution window (e.g., 7/30 days). Decide first-touch / last-touch / blended.

Outcome: Click → funded wallet → first trade ties back cleanly.

6. Prioritize connectors

Hand your dApp development services provider a short backlog: Social (X → YouTube → Instagram/TikTok Business), then Trading (your primary CEX, then DEX family).

Outcome: A clear plan for CEX/DEX connectors without scope creep.

7. Set anti-bot policy (simple and strict)

Approve the initial Trust/Accuracy threshold (e.g., “no payouts < 70/100”). Allow an appeal path.

Under the hood you’ll run anti-bot sybil detection using wallet behavior, graph clustering, and optional DID/attestations, you just set the bar.

Outcome: Crypto apps pay humans, not farms.

8. Shape the KOL ROI dashboard

Sign off fields and roles:

- Leaderboard: KOL • Volume • Conversion % • Trust/Accuracy • Retention (W4/W8/W12)

- Filters: campaign, KOL, niche, chain/exchange

- Proof links: each KPI can open the on-chain receipt

- Exports/alerts: CSV/JSON, Slack/email on thresholds

Outcome: A daily-use KOL ROI dashboard that moves budget.

9. Approve security, privacy, and compliance

Minimal PII (hashed IDs), signed webhooks, KMS-managed secrets, RBAC + audit logs, clear consent copy, and region-friendly retention (GDPR/CCPA).

Outcome: Web3 influencer analytics you can defend.

10. Run a tight pilot, then flip the switch

Pick 3-5 KOLs and one campaign. Review live results, tune thresholds, freeze payout rules, and go live.

Outcome: Real traffic, real learnings, real ROI.

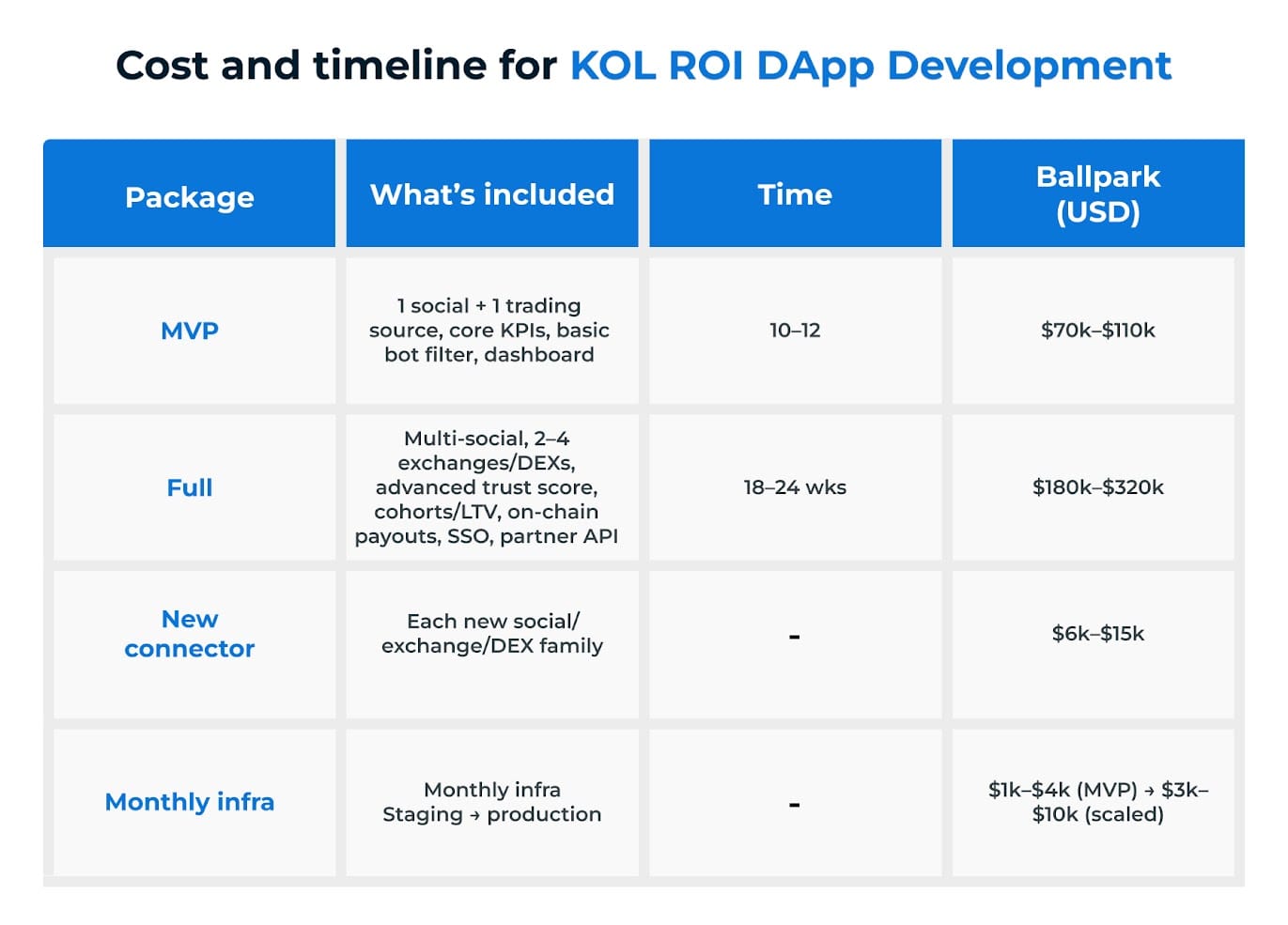

What changes cost/time: number of connectors, how fast platforms approve access, and how deep you want the anti-bot logic.

Build Your KOL ROI dApp With Antier

The market already has enough crypto apps that a reliable, decentralized KOL ROI platform is need of the hour. Whether you are a crypto app paying for influencers and getting nothing or a launchpad or agency seeking to build a truthful dashboard for clients, now is your time to build the best web3 influencer ROI platform. You don’t need to reinvent pipes. Antier delivers the heavy build and your team makes a few high-leverage calls.

What we deliver

- On-chain campaign registry + L2 payout escrow (Base/Polygon/Arbitrum)

- Attribution engine joining click → fund → first trade → retention (with confidence)

- KOL ROI dashboard (leaderboard, filters, exports, alerts, proof links)

- CEX/DEX connectors via official APIs and subgraphs (no scraping)

- Anti-bot sybil detection with transparent scoring

- Security & ops: consent + hashed IDs, signed webhooks, RBAC, audit logs, monitoring, handover

Share your KOL ROI dApp development requirements today!

Quick FAQs

1) Do we need to build everything in-house?

No. Partner with a reputable dApp development company; you decide MVP scope, data access, payout rules, and anti-bot thresholds. They deliver the on-chain campaign registry, L2 payout escrow, connectors, and the KOL ROI dashboard.

2) What’s the fastest viable MVP?

Start with 1 social + 1 trading source, track Trading Volume, Conversion, Trust/Accuracy, Retention (W4/W8/W12), and ship in about 10–12 weeks.

3) Why decentralized vs a normal analytics tool?

You get verifiable attribution (on-chain receipts), data ownership (no vendor lock-in), programmable payouts (L2 escrow), and clean interoperability across CEX/DEX. No black boxes are involved.

4) How do automated payouts work?

Funds sit in L2 payout escrow; when your KPI rules are met (per conversion, trade-volume tiers, or retention cohorts), the smart contract releases payment. There are no spreadsheets and hence no disputes.