Multisig wallets are now a core control for any enterprise holding institutional-size crypto assets. As DAOs, foundations, and corporate treasuries move large balances on-chain, buyers expect multi-approver custody, auditability, and recovery workflows. Leading smart-account platforms have secured tens of billions in assets and show that the market favors multisig approaches for treasury governance. That adoption is being matched by a rising focus on operational controls, signer hygiene, and UX hardening because many losses stem from human or configuration errors rather than raw cryptography. The result is rising demand for enterprise multisig mobile crypto wallet solutions that combine smart contracts, hardware keys, and programmatic guards.

Market Hype of Multisig Crypto Wallets

Institutional appetite for robust custody is driving multisig into the mainstream. Organizations no longer accept a single private key as adequate protection for sizable on-chain balances. Multisig crypto wallet development solutions provide a governance-friendly model where approvals mirror corporate sign-off processes and create audit trails that internal and external stakeholders can inspect.

Did You Know?

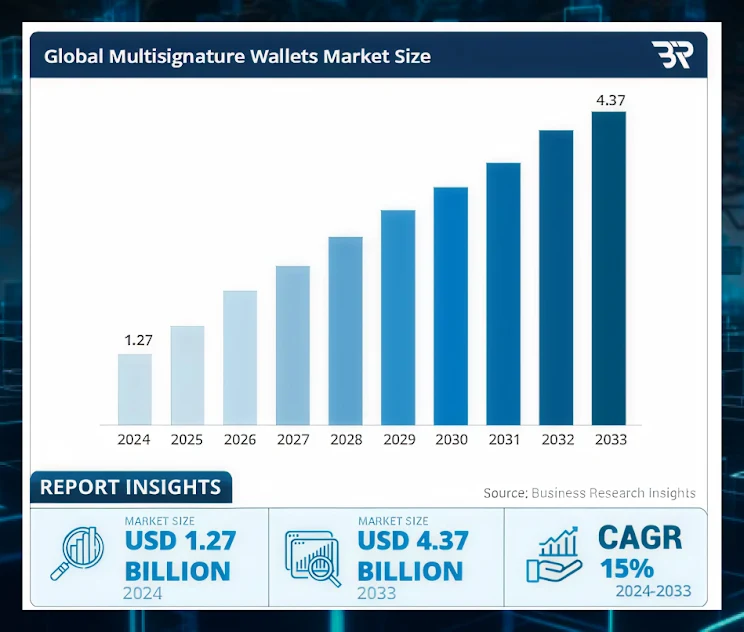

The market for multisignature wallets was estimated to be worth USD 1.27 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of roughly 15% from 2025 to 2033, reaching USD 4.37 billion.

Source: https://www.businessresearchinsights.com/market-reports/multisignature-wallets-market-113519

The market has responded with mature offerings that integrate hardware key storage, threshold signing, and programmatic policy checks. But the story is nuanced: several high-profile incidents showed multisig does not eliminate risk if contracts are overly complex or operational practices are weak. That has shifted buyer priorities from merely deploying multisig to implementing hardened signer infrastructure, clear recovery playbooks, and anti-phishing UX. As a result, demand now favors vetted, SLA-backed multisig cryptocurrency wallet solutions that combine minimal on-chain attack surface with enterprise-grade key custody and monitoring.

How Do Multisig Crypto Wallets Cut Hacks by 90%?

Understanding how multisig cryptocurrency wallets drastically reduce hack incidents starts with looking at how attackers actually operate in today’s Web3 landscape. Breaches often stem from single-point exposures, operational lapses, and coordinated social engineering patterns seen across real cases. When we analyze these incidents, a clear pattern emerges in how approval flows and key structures influence attack success rates. This gives us a concrete foundation to explore why multisig setups show such a significant drop in compromised events.

- Eliminates single-key compromise- Requiring M-of-N approvals removes the single point of failure. An attacker must compromise multiple, independently secured keys to drain funds, which is dramatically more difficult and expensive.

- Reduces automated exfiltration risk- Server-side key exfiltration or single-host breaches rarely yield multiple keys. Multisig prevents automated scripts or single compromised machines from immediately moving funds.

- Enforces separation of duties and policies- Multisig enables role-based approval flows and time delays that mirror enterprise controls, preventing an insider from unilaterally executing risky transfers.

- Lowers impact of phishing and social engineering- Attackers must deceive several signers or compromise multiple signer environments; this multiplies operational friction and raises detection chances. Combined with better signer UX, phishing losses fall sharply.

- Enables programmatic guards and on-chain checks- Smart-account multisig allows adding guard contracts, spend limits, and time locks that stop or flag anomalous flows before execution. This layered defense prevents many classes of attack even after approvals begin.

To truly leverage the security uplift that multisig frameworks offer, adopting a white-label approach ensures faster deployment, refined signing workflows, and a smarter path to market readiness. White-label solutions help you accelerate launch timelines, strengthen operational structures, and avoid the inefficiencies of building from scratch. If you want to secure these advantages and step into the ecosystem with confidence, choosing a white label crypto wallet development company is the most strategic move.

8 Easy Steps: How to Create a Multisig Crypto Wallet That is Secure & Scalable?

Step 1: Define threat model and governance rules

Document exactly who can sign, approval thresholds, emergency escalation, and acceptable transaction types. This blueprint guides architecture, UX, and audit scope.

Step 2: Choose the right architecture: on-chain multisig, MPC, or hybrid

Select smart-contract multisig for transparent, auditable control; MPC for low on-chain footprint and flexible signer UX; or a hybrid that balances cost, latency, and trust assumptions.

Step 3: Design signer custody and identity controls

Require hardware-backed keys or HSMs for signers, define onboarding/offboarding, and enforce multi-device segregation to limit correlated compromise risk.

Step 4: Implement minimal, audited smart accounts and signature flows

Reuse battle-tested libraries and keep contract logic small; avoid unnecessary delegatecall or upgrade complexity that expands attack surface.

Step 5: Build a hardened signer UX with intent signing and metadata

Make every signer see clear transaction intent, origin, and human-readable details to prevent blind signing and phishing-driven approvals.

Step 6: Run layered security testing and formal review cycles

Execute unit tests, fuzzing, third-party audits, and red-team operational simulations that include phishing and social-engineering scenarios.

Step 7: Deploy monitoring, on-chain guards, and incident controls

Add dashboards for pending approvals, anomaly detection, timelocks, and emergency pause mechanisms that allow rapid containment of suspicious activity.

Step 8: Operate with runbooks, drills, and continuous review

Maintain incident runbooks, rotate keys on schedule, run signing drills, and review signer lists when personnel change to avoid stale privileges.

Now that you have explored the comprehensive multisig Web3 crypto wallet development process, you must also consider the costs related to the solution. Let’s scroll to read more.

Start Building a Hack-Resistant Web3 Crypto Wallet With The Best Team

How Much Does Multisig-Crypto Wallet Development Cost?

The overall multi-signature crypto wallet development cost varies with feature depth, integrations, and assurance level. Here are practical enterprise ranges and cost drivers.

- Basic multisig integration: This covers integrating an open-source smart account like Safe, a lightweight front-end, basic signer onboarding, and minimal testing, suitable for small teams.

- Mid-tier enterprise solution: Includes custom UX, hardware signer integrations, multi-chain support, professional security audit, and monitoring dashboards for treasury use.

- High-assurance treasury platform: Adds formal verification, MPC hybrid signing, HSM/PKI integration, enterprise compliance features, 24/7 SLAs, and extensive red-team validation. This is the range for regulated firms or large treasuries.

*Cost drivers to note- Audit cycles and rework, number of supported chains and assets, hardware and HSM provisioning, compliance or KYC features, and 24/7 operational SLAs. Often a single extra audit or an HSM integration can move a project from mid-tier to high-assurance pricing.*

Get in touch with an experienced blockchain wallet development company to build the most successful and affordable solution.

Enterprise Real Failure Modes & Prevention Checklist

- Contract complexity backdoors- Avoid large, generic delegatecall surfaces. Keep contracts minimal and encodable in human review.

- Blind signing and phishing- Prioritize intent signing UX and signer training rather than assuming cryptography alone will stop attackers.

- Stale or too many signers- Enforce periodic reviews of signer lists and automatic deprovisioning when personnel change.

- Insufficient monitoring- Implement real-time dashboards and anomaly alerts that detect unusual approval patterns or high-value transfers.

Modern Trends Every Crypto Wallet Investor Should Adopt

a) Smart accounts with modular guardrails that encode policies on-chain.

b) MPC hybrids that reduce gas costs and centralization while keeping multi-approval semantics.

c) Enterprise signer services using HSMs and SLAs for auditors and CFOs.

d) UX-first anti-phishing design so signers see plain-language intent and origin.

e) Continuous security programs: audits, red-team ops, runbooks and forensic pipelines.

Take the Next Step Toward Enterprise-Grade Wallet Development

Multisig wallet solutions are not a checkbox. When engineered correctly, it meaningfully reduces the probability and impact of single-key compromise and operational theft. The headline “90 percent” reduction describes the practical, measured security delta in many implementations when multisig is combined with hardware-backed keys, clear governance, UX that prevents blind signing, and continuous operational controls. To deliver that outcome, you must marry secure contract design, professional auditing, hardened signer custody, monitoring, and well-rehearsed response playbooks. For enterprise buyers, the biggest returns come from investing early in audits, signer HSMs, and operational maturity rather than marginal feature additions. And this can be achieved by partnering with a reliable and reputable digital wallet development company like Antier that promises to offer the best solution designed by highly talented and certified blockchain experts.

Connect with our experts today!

Frequently Asked Questions

01. What are multisig wallets and why are they important for enterprises holding crypto assets?

Multisig wallets require multiple approvals for transactions, providing enhanced security and governance for enterprises managing large crypto balances, thus preventing single points of failure.

02. How does the market for multisig wallets project to grow in the coming years?

The multisignature wallet market was estimated at USD 1.27 billion in 2024 and is expected to grow at a CAGR of approximately 15%, reaching USD 4.37 billion by 2033.

03. What factors are driving the demand for multisig cryptocurrency wallet solutions?

Demand is driven by the need for robust custody solutions that include operational controls, signer hygiene, and user experience improvements to mitigate risks from human errors and complex contracts.