In September 2025, TRON and NEAR announced one-click cross-chain stablecoin swaps, a development that could reshape the way decentralized finance operates. As the TRON ecosystem integrates NEAR intents for stablecoin swaps, users no longer need to juggle wallets or trust risky bridges to move stablecoins across chains. Instead, they just declare something like “Swap USDT from TRON to another chain,” and the system executes it instantly. Users see their command followed while the backend handles all the blockchain interactions. This unleashes a new era of DeFi development that is safer, simpler, and more scalable for users and businesses.

Understanding Near Intents and Why They’re Relevant In Stablecoin Swaps

What are Near Intents?

NEAR Intents are part of NEAR’s chain abstraction framework. Instead of forcing users to manually interact with blockchains (choose networks, bridge assets, pay gas, etc.), Intents let users simply declare what they want done, not how to do it.

What do users see when they transact using NEAR Intents-based swaps?

A simple request like “Swap 100 USDT on TRON for USDT on Ethereum) or “Stake 50 USDC”.

What happens under the hood:

- The request (Intent) is broadcast into NEAR’s intent system.

- A decentralized network of solvers picks it up.

- Solvers compete to execute it in the fastest and most cost-efficient way possible.

- The user gets the result without managing wallets, bridges, or gas fees on multiple chains.

What are the essential components of NEAR intent swaps that users don’t see?

Users might not see much, but there’s a lot to be done during DeFi development that makes the backend processes possible.

- Abstraction Making User Journeys Simpler

Responsible for: Removing friction in onboarding and retention.

Users don’t need to pick chains, manage multiple wallets, or calculate gas fees. They just state their intent, and the system handles the rest.

- Competition Facilitating Faster and Cheaper Execution

Responsible for: Driving efficiency in transaction fulfillment.

A decentralized network of solvers competes to execute each swap, ensuring the best possible price and speed. They are incentivized to find the best routes and prices, ensuring optimal execution for the user.

- Execution Security, Ensuring Reduced System Risk

Responsible for: Protecting funds by eliminating reliance on risky cross-chain bridges.

Bridge exploits have drained billions. Intents cut that risk out entirely.

- Composability, Broadening Liquidity Access

Responsible for: Making liquidity from multiple chains instantly available.

Instead of building isolated liquidity pools, platforms gain one-click access to TRON’s stablecoin reserves and beyond.

Why are Near Intent-Based One-Click Swaps Essential For Stablecoin Swaps?

1. Stablecoins Are A Key To Future-Proof DeFi Development

- Over 70% of DeFi activity runs on stablecoins like USDT and USDC.

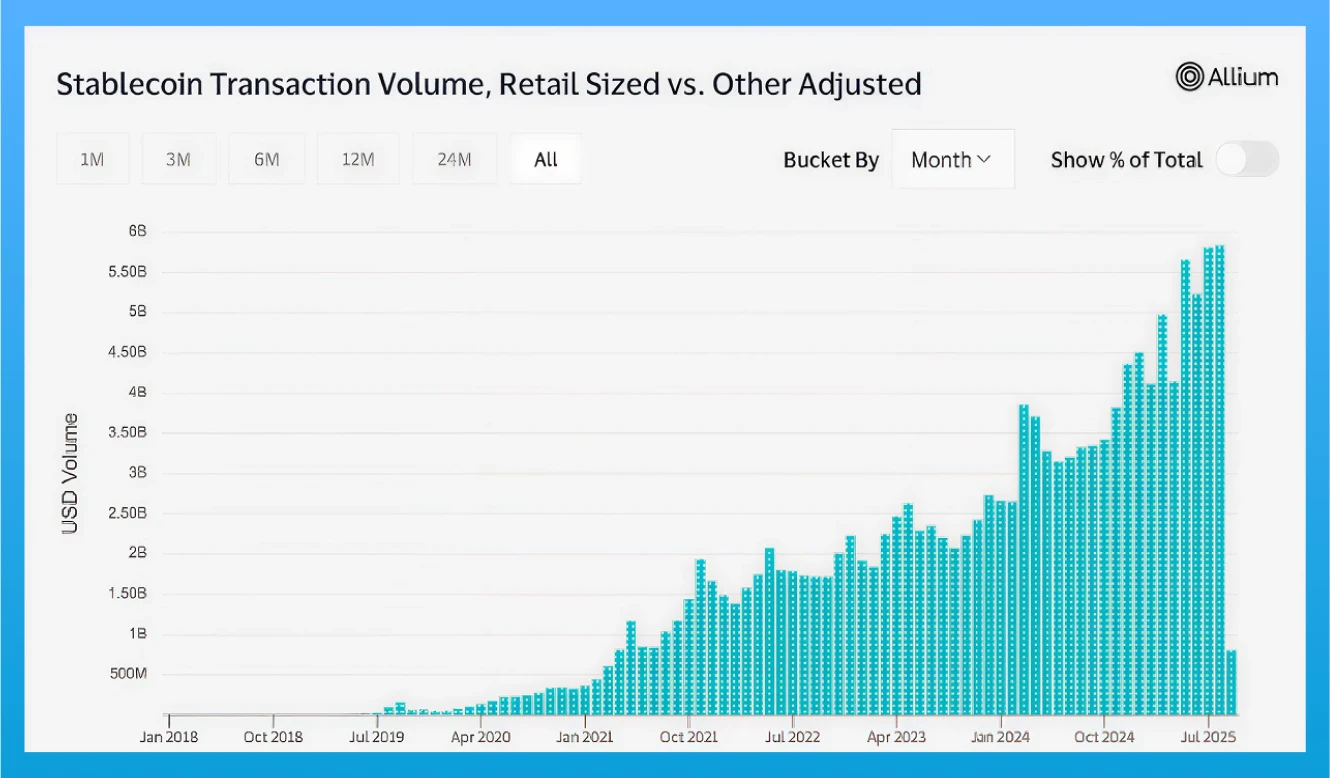

- Stablecoins are soaring. As demonstrated in the graph above, stablecoin transactions in the retail segment reached record levels, hitting $5.84Bn in 2025, with volumes already crossing past the year’s total by August.

- They’re the entry and exit ramp for most users, so any friction in moving them directly affects adoption.

2. Bridges Break Trust, Intents Restore It

- Stablecoin users expect safety and stability, and bridge exploits undermine that trust.

- Intents remove bridges from the DeFi development equation, making stablecoin transfers not just more convenient but also secure and predictable.

3. Speed is Non-Negotiable in Payments

- Cross-border remittances, trading, and merchant transaction settlements rely on instant transfers.

- One-click intent swaps enable near-instant movement of stablecoins across TRON, Ethereum, and other chains, exactly what business use cases demand.

4. Liquidity Without Fragmentation

- If a user on Ethereum wants to use TRON’s USDT liquidity, they normally have to bridge it across, which is slow, risky, and expensive.

- With NEAR intents, a user doesn’t need to care where that USDT sits. They just say that they want to swap “USDT for ETH” maybe and the intent system finds the best route, pulling from the deepest available liquidity. For users, it is just one click and one big liquidity pool.

5. Compliance & Institutional Readiness

- Institutions exploring stablecoin rails need a risk-minimized and efficient system.

- Intent-based swaps align with this expectation, giving entrepreneurs a stronger case when pitching to partners or investors.

How Near Intents Will Shape the Next Wave of DeFi Development?

- UX Becomes the Differentiator

Most dApps today lose users at the first hurdle that is complicated onboarding. Switching chains, setting up wallets, and handling bridge fees drives everyday users away.

- With NEAR Intents on TRON, the entire interaction shrinks to a single action.

- Entrepreneurs can now design “one-tap” DeFi products leveraging Near Intent technology on TRON or SUI, lowering the barrier for mainstream adoption.

- The less friction your users face, the faster your platform achieves traction and retention.

- Stablecoin Liquidity Without the Hassle

TRON isn’t just another chain. It holds the majority of global USDT circulation. That’s billions in liquidity sitting in one place.

- NEAR Intents lets builders access this liquidity without relying on risky bridges.

- TRON-based dApps can offer deep liquidity pools across chains while keeping the UX unified.

- For an entrepreneur planning DeFi development on TRON, this means that their users trade with confidence, because liquidity is never an issue.

- Infrastructure That Scales Without Extra Engineering

Traditionally, cross-chain integrations consume massive DeFi development hours and complex smart contract maintenance. Every bridge or chain added multiplies the risk and cost.

NEAR Intents flips this model:

- DeFi developers building on TRON will focus on business logic and features, while solvers handle execution.

- The system abstracts away cross-chain complexity, letting platforms scale quickly.

- They facilitate faster launches. Entrepreneurs can test, iterate, and capture markets ahead of slower competitors who are trying to implement cross-chain convenience.

- Investor Confidence Through Reduced Risk

Investors have long seen bridges as the weakest link in DeFi. 2.8 Billion of total funds have been lost to bridge exploits over the past few years, accounting to 44% of DeFi hacks. NEAR Intents eliminates this risk factor by cutting bridges out of the equation.

Also Read>>> Biggest 2025 Hacks & Tips for Secure Cryptocurrency Exchange Development

For entrepreneurs pitching to investors, it translates into:

- Lower attack surface, as explained above, forming a stronger security narrative.

- Easier fundraising, as the infrastructure itself signals maturity and risk management.

- Ready-Made Toolkit for Builders

The best part for those planning DeFi development on TRON is that entrepreneurs don’t have to reinvent the wheel. The TRON-NEAR integration comes with practical development resources, acting as an “infrastructure as a service” for next gen DeFi entrepreneurs.

- APIs and SDKs like SwapKit let builders plug into this system quickly.

- You don’t need a 50-person team from a DeFi development company to support cross-chain stablecoin swaps.

- Lower cross-chain DeFi development costs mean higher ROI and more efficient product roadmaps.

The Roadmap for Next-Gen DeFi

TRON has solidified its position as a dominant force in the stablecoin market, particularly with USD Tether and now NEAR-powered one-click swaps. As of September 2025, TRON hosts the largest circulating supply of USDT, exceeding $79 billion, and has recorded over 329 million total user accounts and 11 billion total transactions. This makes TRON a critical global settlement layer for stablecoin transactions. The collaboration of TRON’s established stablecoin dominance and NEAR’s innovative Intents technology creates a powerful synergy, setting standards for cross-chain DeFi development in terms of simplicity, safety and liquidity.

And it’s not just about TRON. SUI implemented this in July 2025 and many other blockchains are going to do it.

Launch your intent-powered DeFi platform with Antier.

NEAR Intents unlock the opportunity and Antier helps you turn it into a business.

At Antier, we don’t just track innovations like NEAR Intents but we help entrepreneurs put them to work. By integrating intent-based swaps into your DeFi platform, you can:

- Offer frictionless user journeys with one-click stablecoin swaps.

- Access TRON’s deep USDT liquidity without bridge risks.

- Build investor confidence through secure, compliance-aligned infrastructure.

- Accelerate time-to-market with our ready-to-deploy DeFi modules and cross-chain expertise.

Whether you’re building a new DeFi platform or upgrading an existing one, Antier provides the white-label solutions, technical expertise, and compliance-first strategy to help you capture this next wave of growth.

Talk to SMEs at Antier today to launch your intent-powered DeFi exchange, wallet, or social dApp and stay ahead in the next era of stablecoin innovation.