A practical, regulation-aligned roadmap for traditional exchanges entering digital assets with institutional-grade white label exchange infrastructure. No multi-year build required.

Traditional exchanges have moved past the “should we enter digital assets?” question. It’s no longer an exploratory phase but a shift that no traditional brokers, forex, or stock exchanges can ignore.

Every market operator is making a structural move toward:

- Compliant digital asset trading venues

- Tokenized securities

- 24/7 settlement infrastructures

- Custody frameworks built for institutions

- Direct integration with banks and asset managers

For a pioneer like NASDAQ, this is a strategic expansion into parallel market structures that will soon merge with traditional capital markets. A leading white label cryptocurrency exchange development company can enable them to extend their core strengths: surveillance, compliance, and unmatched trading efficiency.

Global Exchanges are Not Missing $4 Trillion Crypto Market

Traditional exchanges around the world are deploying their digital asset strategy. They’re not just testing the waters but running fully regulated digital asset divisions. Here are a few that recently launched their crypto arms, either by building or acquiring cryptocurrency exchange software tech.

| Traditional Exchange | Strategy | What They Launched | Regulatory Scope | Strategic Signal |

|---|---|---|---|---|

| SIX Swiss Exchange (SDX) 🇨🇭 | Build | Fully regulated digital asset exchange with custody + settlement | FINMA (Switzerland) | Digital securities + crypto ETPs are already mainstream |

| Deutsche Börse 🇩🇪 | Acquire | Crypto Finance Group (24/7 trading + custody + staking) | FINMA + BaFin | Big crypto exchanges prefer acquisition/integration over building |

| Börse Stuttgart 🇩🇪 | Build | BSDEX (regulated crypto MTF under KWG) | BaFin (Germany) | Demand for regulated crypto MTFs is established |

| CMC Markets 🇬🇧 | Integrate | Crypto CFDs into FX/CFD platforms | FCA-aligned | Multi-asset brokers are entering crypto to retain users |

1. Börse Stuttgart, BSDEX

Action:

Launched BSDEX, regulated under the German Banking Act (KWG).

Focus:

Transparent order books, regulated custody, supervised digital asset trading.

Takeaway for NASDAQ:

- There is a clear, regulated blueprint for digital asset MTFs.

- Highlights the need for transparent matching, low fees, and reliable custody, all core strengths of Antier’s institutional white label cryptocurrency exchange development stack.

2. SIX Swiss Exchange- SDX

Action:

SIX launched SDX, a fully regulated trading, settlement, and custody infrastructure for digital assets.

Recent Activity:

Expanding listings of crypto-linked ETPs, leveraged BTC/ETH, structured products, and even memecoin ETPs like BONK.

Takeaway for NASDAQ:

- Proves that a stock exchange can run a digital asset venue under strict regulatory oversight.

- Strengthens the case for exchange engines that can handle tokenized securities and ETPs, exactly what Antier’s stack supports.

3. Deutsche Börse Group

Action:

Acquired Crypto Finance Group, securing regulated 24/7 crypto trading, custody, and staking.

Recent Activity:

Integrating with Commerzbank and other institutions in preparation for EU-wide MiCAR regulation.

Takeaway for NASDAQ:

- Major exchanges are buying digital asset infra rather than building it internally.

- Validates Antier’s white label crypto exchange software development approach: pre-built, MiCAR-ready, institution-grade infrastructure.

4. CMC Markets

Action:

CMC added crypto CFDs to its multi-asset infrastructure.

Takeaway for NASDAQ:

- Multi-asset brokers are expanding into digital assets to capture new flows.

- Reinforces demand for platforms that support FX, commodities, equities, and crypto under one framework.

If NASDAQ launches its crypto exchange software in 2026, it’s not too early, but it’s going to be big. Building an institutional crypto exchange, however, demands:

- Multi-year engineering across custody, compliance, wallets, and liquidity

- Constant regulatory alignment across the SEC, FINRA, FATF, and MiCA

- New security architectures that TradFi systems were never designed to handle

This is exactly where Antier’s institutional-grade white label crypto exchange development solution changes the equation. It closes the competitive gap without burning years on internal custom cryptocurrency exchange development.

Why a NASDAQ-Level Exchange Can’t Use Retail-Grade Crypto Tech?

| Requirement | Institutional Standard | Typical Retail Crypto Platform | Antier’s Institutional White Label Crypto Exchange Software | Why This Matters for NASDAQ |

|---|---|---|---|---|

| Compliance & Reporting | FATF, SEC, FINRA, MiCA alignment; Travel Rule; trade surveillance | Basic KYC; shallow AML; no real audit trails | Automated KYC/AML, Travel Rule, jurisdiction controls, full audit logging | Regulated exchanges cannot rely on patchwork compliance |

| Custody & Asset Security | MPC + HSM, segregated accounts, withdrawal governance | Hot wallets; basic multisig | MPC wallet infra, HSM support, segregated/omnibus accounts, multi-approval policies | Institutional asset security must be provable, not promised |

| Trading Engine Performance | Sub-millisecond latency; deterministic throughput | High latency, outages during volatility | 100K+ TPS, event-driven engine, complex order types (TWAP, Iceberg, OCO) | NASDAQ-grade uptime and execution integrity |

| Tokenization Standards | ERC-1400, ERC-3643, permissioned transfers | Only ERC-20; no securities logic | Full security token support + compliance-enforced transfers | For tokenized equities, bonds, funds — securities rules must be programmable |

| Settlement Model | T+0 atomic settlement | Off-chain settlement; delays | Smart contract–driven instant settlement (T+0) | Reduces counterparty and operational risk |

| Investor Controls | Role-based permissions, KYC-linked wallets, and jurisdiction mapping | None | Permissioned investor tiers, whitelist/blacklist logic | Mandatory for MiCA, SEC exemptions, and institutional onboarding |

| Market Surveillance | Market abuse detection, order flow analytics | Basic logs, no supervision | Integrated surveillance + alerting | Required for exchange approval |

| Integration & Multi-Asset Support | FIX gateways, MM APIs, multi-asset trading | Websocket only | FIX, low-latency MM APIs, FX/CFD/crypto multi-asset support | Essential for NASDAQ-scale interoperability |

| Liquidity Infrastructure | Tier-1 MM support; aggregated books | Isolated liquidity pools | Tier-1 aggregation + MM onboarding modules | Day-one deep liquidity and tight spreads |

Most white label crypto exchange platforms weren’t built for retail speculation, not institutional governance. If you’re a NASDAQ-level exchange, you can’t leverage a retail-focused turnkey exchange for the following reasons:

- Fragmented Compliance:

Regulators expect built-in surveillance, AML/KYC automation, Travel Rule compatibility, and auditability. Most platforms retrofit these poorly.

- Lack of Institutional-Grade Custody

Traditional exchanges require MPC (multi-party computation) wallets, HSM (hardware security module) compatibility, segregated accounts, disaster recovery-grade key control, and several other major cryptocurrency exchange security mechanisms.

- Equities-like Trading Experience:

Crypto engines that choke during volatility aren’t acceptable for a market operator that clears billions in trades daily. So, pick the best white label crypto exchange with trading engines that enable an equities-like trading experience.

- Tokenization of TradFi Products:

The main prize for NASDAQ isn’t just BTC/ETH or the 730 million+ owners, it’s actually digitized equities, bonds, structured products, repos, and private markets. That’s where NASDAQ-like exchanges need to lead.

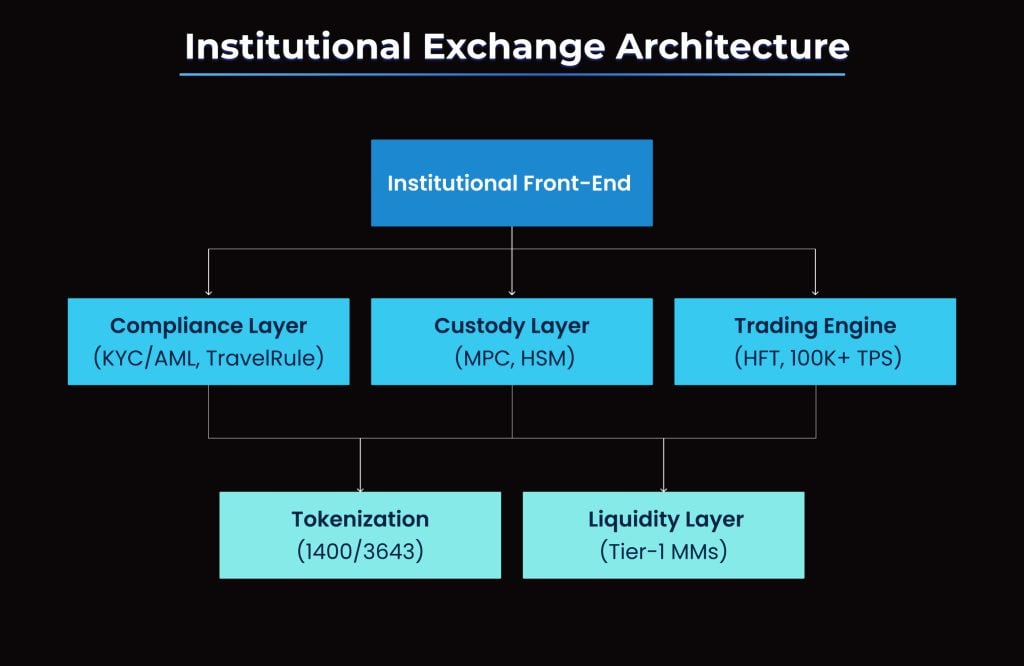

Antier’s Institutional Crypto Exchange White Label: Built For Traditional Exchanges

Antier delivers a fully engineered platform that strips away the multi-year development burden and replaces it with a modular, compliant, and bank-grade exchange environment.

Here’s what makes it fit for a market operator of NASDAQ’s scale:

1. Compliance-First Architecture That Holds Up Under Global Regulation

- Automated KYC/AML screening

- Transaction monitoring and anomaly detection

- FATF Travel Rule compatibility

- Rule-based workflows for suspicious activity

- Integrated reporting for regulators and auditors

- Geofencing, blacklisting, and whitelisting controls

2. Institutional Custody and Wallet Security

- MPC-based key management

- Optional HSM integration

- Segregated and omnibus account structures

- Operational controls for withdrawals, approvals, and multi-person governance

- Cold, warm, and policy-defined vault layers

- SOC2-aligned security practices

3. High-Frequency Trading Engine Designed for Stress Conditions

- 100K+ TPS matching throughput

- Sub-millisecond order placement and cancel cycles

- Complex order types: Iceberg, TWAP, FOK, Stop-Limit, OCO

- Event-driven architecture for predictable performance under spikes

4. Liquidity From Day 1

A cryptocurrency exchange software must avoid thin books. Antier ensures liquidity from day 1 with the following integrations in its white label crypto exchange platform development:

- Tier-1 liquidity aggregation

- Market-making APIs

- Options to mirror liquidity from major venues

5. Tokenization-Ready Infrastructure

- ERC-1400, ERC-3643, ERC-20

- Permissioned transfer rules

- Role-based investor categories

- On-chain compliance enforcement

- Capital table integration

- T+0 settlement logic

These integrations form the foundation required for crypto exchange software to tokenize and launch:

- Tokenized equities

- Tokenized bonds

- Tokenized private credit

- Tokenized funds

- Tokenized real estate and alternatives

Access the Step-By-Step Rollout Plan for NASDAQ-Level Crypto & Tokenized Securities Exchanges

Institutions Don’t Need Another Experiment, They Need White Label Exchange Infrastructure That Works

Are you ready for the modernization of capital markets? An era where the global markets facilitate:

- Real-time settlement

- Constant market access

- Fractionalization of assets for global investors

- Programmable compliance

- Reduced reconciliations and counterparty risk

- Automated corporate actions

The exchanges that own the tokenized securities rails will own the next wave of global markets. To deploy these, NASDAQ-level exchanges require audit-grade compliance, bank-level custody, stable high-frequency performance, tokenization-ready architecture, global liquidity, and operational transparency, among other requirements. Building all of this in-house would take years. Antier’s white label crypto exchange development solutions enable them to implement these today, not five years from now.

If you’re building a regulated digital asset exchange or planning a tokenization division, request a confidential briefing with Antier’s institutional team today.

Frequently Asked Questions

01. What is the current trend for traditional exchanges regarding digital assets?

Traditional exchanges are moving towards compliant digital asset trading venues, tokenized securities, and 24/7 settlement infrastructures, indicating a strategic shift into the digital asset market.

02. How are exchanges like NASDAQ adapting to the digital asset landscape?

NASDAQ is expanding into parallel market structures by leveraging institutional-grade white label exchange infrastructure, focusing on surveillance, compliance, and trading efficiency.

03. What are some examples of traditional exchanges that have launched digital asset divisions?

Examples include SIX Swiss Exchange with its fully regulated digital asset exchange, Deutsche Börse acquiring Crypto Finance Group, and Börse Stuttgart launching BSDEX, all of which are now operating regulated digital asset platforms.