Webull has made a powerful comeback in the crypto market, relaunching services in the United States with 50+ coins and in Australia with 240+ digital assets. Instead of building the pipes themselves, Webull Australia plugged into Coinbase’s white label rails, and you can do it too under your own name with white label crypto exchange development.

For traditional stock, forex, and commodity exchanges or trading apps, still debating whether to enter crypto, this move is a loud signal. Their customers are already into crypto, the market is ready, and competition is already scaling fast.

So the real question is: how can traditional exchanges catch up without burning years and millions on in-house builds?

Why Webull’s Relaunch Matters For Traditional Exchanges

If you’re a traditional exchange (stock, derivatives, or commodities), you can’t ignore these:

- Crypto is No Longer Optional: It’s not a side bet or something less important than equities and ETFs. Investors expect crypto as a part of a full trading suite. If your exchange doesn’t offer it, they’ll move to a platform that does.

- White label model in action: Coinbase Prime provides custody, liquidity, and execution while Webull doubled down on branding and customer experience. This promotes the use of white label cryptocurrency exchange models.

- Speed Beats Perfection: Custom cryptocurrency exchange development takes 18-24 months, and in a market this competitive, your platform can’t wait for another two years to perfect a crypto trading arm.

- User-first integration: Crypto is now part of Webull’s core app. This means that users no more need to juggle separate platforms for accessing crypto markets.

- Competitive fees: With spreads as low as 30 bps, legacy exchanges charging high fees look outdated overnight. However, 30 bps is still unsuitable for short-term and high-frequency trading opportunities. Traditional exchanges seeking to enter crypto markets must collaborate with top white label cryptocurrency exchange development companies to build institutional-grade, high-frequency trading platforms.

Global rollout strategy: Launching in two major markets within 48 hours shows execution speed and creates urgency for traditional exchanges sitting on the sidelines. Traditional exchanges can adopt white label crypto exchange software models or partnerships, depending on the regulatory and market requirements, and launch before competitors own their customers.

How Can Traditional Exchanges Compete After Webull’s Crypto Relaunch?

Being a traditional exchange, you already have licenses, user bases, and credibility. Adding a crypto trading arm with a white-label cryptocurrency exchange development solution is the lowest-risk, fastest path to capturing market share.

- Assess Market Demand & Regulatory Scope

- Identify which jurisdictions allow crypto trading under your existing licenses or where you can readily launch with minimum licensing requirements.

- Decide whether to start with spot trading or offer advanced products like derivatives.

- Your white label crypto exchange development company can also help you navigate the regulatory landscape of your target jurisdictions.

Also Read>>> Super Crypto Trading Platform: Stocks, Forex & More in One Place

- Choose Your Infrastructure Model

- White label crypto exchange software offers the fastest route to launch, allowing you to operate under your own branding.

- Traditional exchanges can also explore partnerships with custody/liquidity providers, like Webull did with Coinbase Prime.

- Integrate Custody & Liquidity Providers

- If you’re building your crypto exchange from scratch, you’ll need to secure user assets with institutional-grade custody. However, if you’re leveraging a prebuilt clone script or a white label cryptocurrency exchange from a reliable provider, you may find a ready-to-deploy solutions with all these integrations baked in.

- Ensure liquidity depth from global providers to compete with platforms like Webull. Your white label crypto exchange development company can help you partner with reliable market-making companies and also build custom market-making bots to enhance order-book depth.

- Focus on Compliance Alignment

- Map your crypto operations with SEC, FinCEN (US), or ASIC (Australia) requirements. White label cryptocurrency exchange development companies like Antier also offer legal services for launch in global markets.

- Also, ensure to use vendor solutions that already embed KYC/AML modules to stay audit-ready.

- Design the User Experience

- You may offer crypto within your existing platform, so users don’t need to switch between stocks, forex, and crypto seamlessly. For that integration, you’ll need to plan the UX strategically so an average stockbroker doesn’t feel overwhelmed with your complex crypto jargon. You can also mirror dashboards and workflows so crypto feels natural to your existing users. Don’t force them to learn an entirely new system.

- Keep fees competitive (sub-50 bps) and emphasize transparency, as it can be your edge. Your white label crypto exchange development company can help you create hybrid models where you enable transparent and traceable trading while centralizing several aspects of your trading app.

- Plan a Phased Rollout

- Start with BTC, ETH, and the top stablecoins, and slowly allow trading for others.

- You can gradually expand to 50+ coins, then 200+ assets as user adoption grows.

Also Read>>> Top 8 White Label Crypto Exchanges Price List

Integrate a full-stack white label exchange with spot, margin, staking, cards, and more.

Key Takeaway

Webull’s expansion paves the way for traditional exchanges. You can partner with the right white label crypto exchange development company to launch quickly, keep fees competitive, and focus on user experience. Traditional exchanges don’t need to reinvent the wheel, but they need to catch the wave before it passes by them.

Partner With Antier

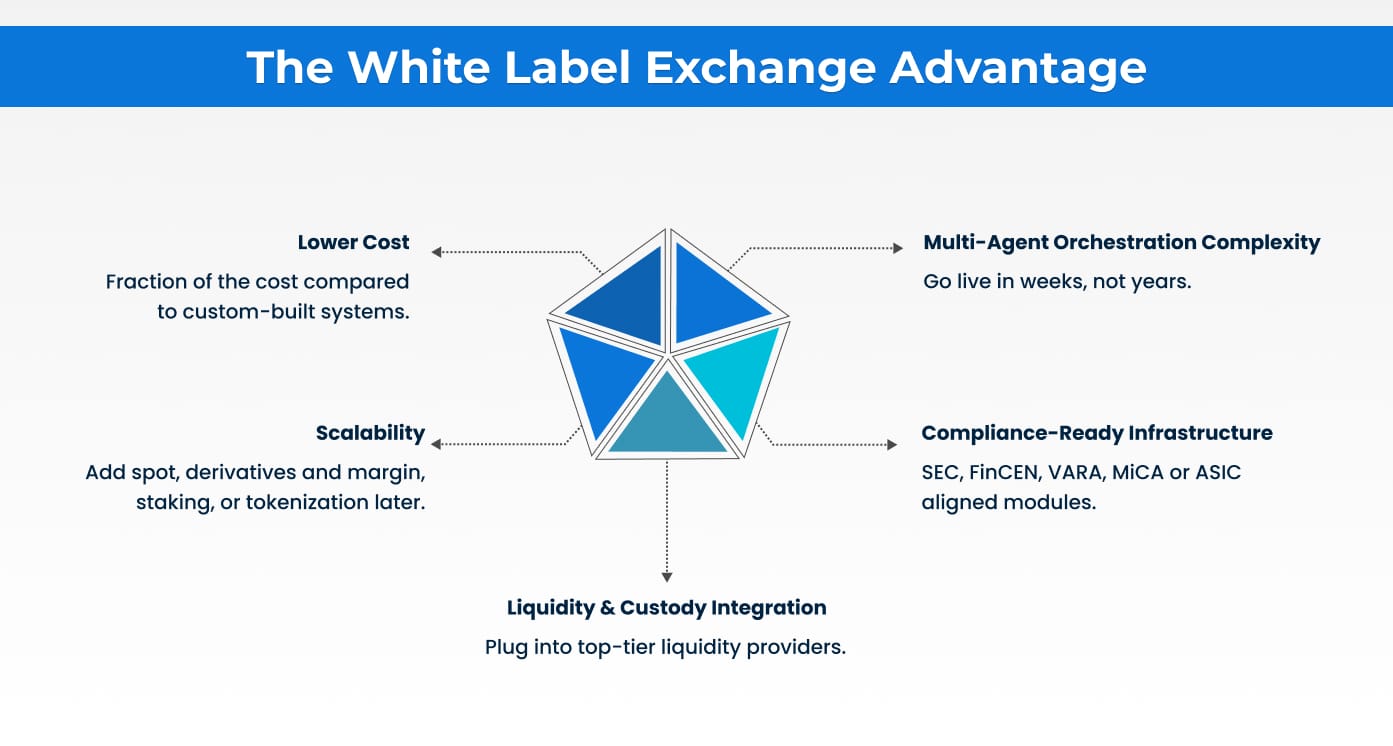

At Antier, we’ve helped launch 250+ regulated exchanges worldwide. We specialize in integrating crypto trading modules into traditional financial institutions, enabling them to expand seamlessly into digital assets. Our white label crypto exchange software solutions are:

- VARA/MiCA/SEC/FinCEN-compliant

- Integrated with leading liquidity providers and modules

- Feature-rich and scalable: spot, derivatives, staking, perpetuals, tokenization, and advanced AI-based modules.

- Mobile-ready with CEX-grade security

Ready to launch your crypto exchange the Webull way? Schedule your demo call today!

FAQs

Why did Webull relaunch crypto in the US and Australia?

Webull re-integrated crypto into its main app in the US with 50+ assets and launched in Australia with 240+ coins via Coinbase Prime. The aim was to deliver a smoother user experience and capture global demand.

How can traditional exchanges enter the crypto market quickly?

The fastest route is a white label cryptocurrency exchange, which provides ready-made infrastructure (custody, liquidity, compliance) so exchanges can launch in weeks instead of years.

Is building a crypto exchange from scratch better than white label?

Building from scratch offers control, but it’s slow (18–24 months) and costly. White label crypto exchange software solutions are faster, cost-effective, and proven in regulated markets.

How much does it cost to integrate crypto trading into traditional exchanges?

White label crypto exchange prices vary by features and jurisdiction. You may be charged anywhere from $100K–$500K for integrating it, whereas building and integrating a custom exchange may cost you several millions.