Asset tokenization development has gained significant momentum in recent years, and the biggest developments have been witnessed by Treasury companies. Treasury Tokenization enables users to integrate their traditional financial assets into a decentralized ecosystem. It automates the critical operations of treasury departments, enhancing speed, transparency, and operational feasibility. This guide explores how the treasury department can future-proof its operations with Tokenized Treasury Platform development services.

Understanding Tokenization and Its Relevance in the Treasury Companies

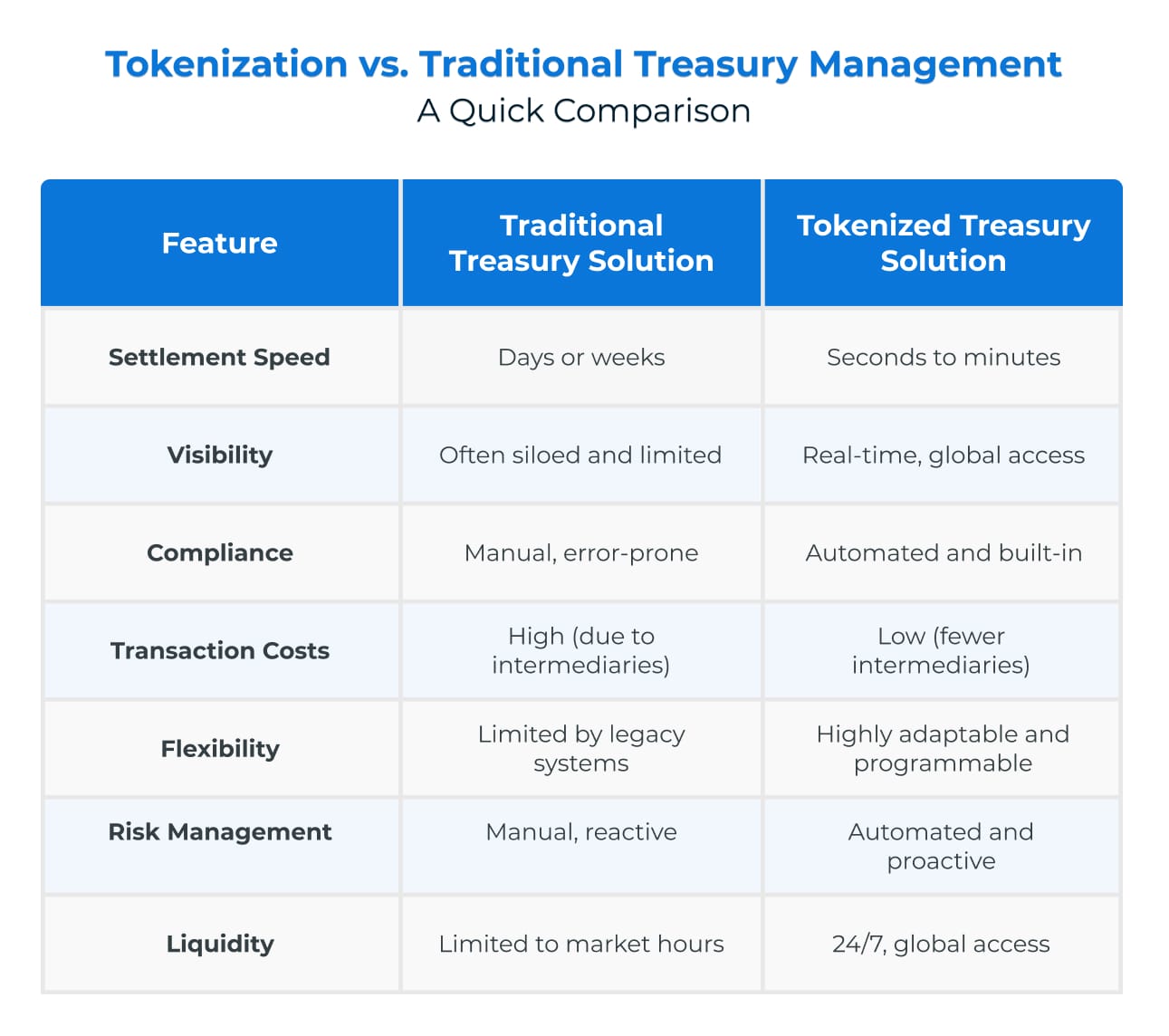

The currency treasury systems are corrupted. There are significant delays in the management processes due to inefficiencies and fragmentation in multi-currency, multi-jurisdictional operations. Tokenized treasury Platform development helps to overcome these limitations by offering an automated solution that handles the key treasury functions for better flexibility, transparency, and efficiency. With tokenization solutions, users can have real-time access to cash positions, perform easy cross-border transactions, and access automated compliance checks.

How Tokenization Platforms Are Transforming Treasury Operations?

The Custom Treasury Tokenization Solutions enable treasury teams to manage their operations more efficiently by providing:

1. Real-Time Cash and Liquidity Management

The Treasury Tokenization platform enables treasury teams to have real-time visibility into cash positions across distinct geographies. This contributes to faster decision-making during liquidity allocation and allows a quick response to market changes. Tokens that represent cash or assets can be moved almost instantly, whether between accounts, subsidiaries, or external partners. This helps to eliminate the delays that come with traditional financial processes.

2. Easy Cross-Border Payments and Settlements

The integration with DeFi protocols for treasury-backed assets enables the “atomic settlement,” where funds and assets can be exchanged simultaneously across borders. This reduces counterparty risk and shortens settlement times from days to just seconds. The smart contracts in treasury tokenization solutions can automatically execute multi-step transactions based on pre-defined rules, saving money and resources. The solutions bring everything on a single platform, making it easier to manage capital markets and reduce fragmentation.

3. Automated Compliance and Risk Management

The Treasury company can encode compliance requirements directly into the tokens with a White-label tokenization platform for government securities. This helps to ensure that each transaction automatically meets regional and international regulations. Every token transfer is recorded on a blockchain, creating an unchangeable audit trail. This makes compliance easier to manage and reduces operational risk.

4. Simplified Corporate Actions

The Tokenization platform automates the process of paying dividends and interest, which significantly reduces the risk of human error and cuts down on administrative work. Smart contracts make shareholder voting secure and automated, making governance processes much easier to manage.

5. Better Investment and Funding Strategies

With the Asset Tokenization Platform, Treasury Bills can be broken down into smaller shares. This opens up opportunities for more investors to participate, allowing companies to diversify their investments and manage cash flow more effectively. Unlike traditional markets, tokenized assets can be traded at any time of day, giving treasury teams more flexibility and greater access to global liquidity. As no intermediaries are involved, the transaction costs and overhead involved in investment management are reduced significantly.

Real-World Examples: Treasury Tokenization

1. Tokenized Treasury Bills

Tokenized Treasury Bills (T-Bills) are a great example of tokenization at work. By enabling fractional ownership, tokenized T-Bills democratize access to secure, government-backed assets for a wider range of investors, both big and small. Treasury teams can better manage cash flow and investments since tokenized T-Bills can be exchanged around the clock, improving liquidity. Smart contracts eliminate the possibility of error by completely automating interest payments and T-Bill redemption.

2. Tokenized Deposit Accounts

Businesses can streamline intricate financial arrangements across several jurisdictions by tokenizing deposit accounts, which enable instantaneous fund transfers and real-time updates.

3. Central Bank and Private Sector Initiatives

The use of tokenized central bank currency for cross-border settlements and securities trading is already being investigated by initiatives like the Bank for International Settlements (BIS) Agora and Helvetia. These initiatives demonstrate how tokenization could enhance security, streamline international transactions, and facilitate communication between private financial institutions and central banks.

Why Should Treasury Departments Consider Deploying a Custom Tokenization Platform?

The Treasury team can get a competitive edge in the market by using the custom tokenization solution. Here is how the tokenization platform can contribute to their growth and success.

- Future-Proof Business Operations: With a tokenized treasury Platform development solution, treasury departments can prepare their team for future innovations and regulatory changes, keeping them ahead of the curve.

- Boost Efficiency: Tokenization Platforms share real-time data and automate processes. This can enable the team to focus on strategy instead of executing manual tasks.

- Mitigate Risk: Tokenization solutions automate the compliance checks and real-time traceability, which helps to minimize traditional and regulatory risks.

- Unlock Global Liquidity: Asset Tokenization Platform provides 24/7 access to global markets and fractional asset ownership, opening new doors for liquidity management and investment opportunities.

Here Is How to Get Started with Tokenization

Keep the following points in mind to get a quick start on building an Asset Tokenization Platform for your Treasury Department:

- Assess Your Needs: Start by assessing the current treasury operations and identifying the areas where tokenization can make the biggest impact. Whether it’s speeding up payments or automating compliance, tokenization can help.

- Choose the Right Partner: Find a reputed Asset Tokenization Platform Development Company that has experience in building custom tokenization solutions for the treasury and finance sectors.

- Start Small: Begin with a pilot project. For example, tokenize part of your cash or securities and evaluate the results before scaling.

- Train Your Team: Ensure that the treasury team understands the platform’s features and the advantages of tokenization.

- Review and Optimize: Continuously monitor performance and adjust your tokenization approach to ensure you’re getting the most out of it.

Takeaway

Asset Tokenization Platforms are enhancing the Treasury operations. Treasury teams can operate more effectively, safely, and strategically with a unique tokenization platform that automates critical tasks, offers real-time visibility, and reduces expenses and risks.

Want to transform your treasury operations? Get in touch with Antier today! Our Asset Tokenization Platform Development Company can provide you with customized tokenization treasury solutions to automate, secure, and optimize your financial workflows.