As DeFi yield farming evolves and expands, unpredictability remains a constant struggle. Enter AI-powered yield optimizers – autonomous systems that use machine learning to minimize risk, remove human inefficiencies, and maximize returns – with algorithmic precision.

The $89 Billion Opportunity in Automated Crypto Wealth

The explosive growth of decentralized finance has opened up a vast range of wealth-generation opportunities in DeFi Yield Farming Development protocols, with $89 billion in assets now locked in.

The Mechanics of AI in DeFi Yield Farming

Traditional yield-farming strategies greatly depend on static parameters – scheduled harvests, fixed allocation ratios, and manual redeployment – thus grappling with volatility spikes, opportunity costs, gas fee surges, etc. On the other hand, an AI-Powered Yield Optimizer utilizes adaptive intelligence for every decision point, by analyzing:

- Cross-Protocol Opportunities: Scanning 50+ protocols in real-time to identify optimal yield sources based on risk-adjusted returns.

- Predictive APY Modeling: Forecasting rate fluctuations prior to market movements – using historical data and liquidity pool trends.

- Gas Fee Optimization: Estimating transaction timing to reduce Ethereum gas costs by 15-40% through batch processing.

- Risk Mitigation Engines: Identifying smart contract vulnerabilities and impermanent loss thresholds with anomaly detection.

- Personalized Strategy Matching: Aligning user risk profiles (conservative to aggressive) with optimal pool allocations.

The result? Stable, predictable APRs and fewer manual interventions in your DeFi yield farming development lifecycle.

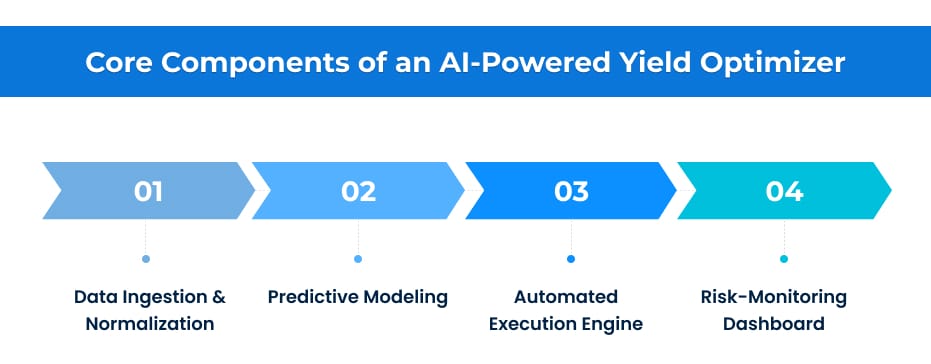

Core Components of an AI-Powered Yield Optimizer

Building an AI-driven optimizer for DeFi yield farming platform development involves the following parts:

- Data Ingestion & Normalization

To begin with, an AI optimizer initiates a unified data pipeline that pulls real-time on-chain metrics (TVL, pool depth, swap volumes) across various blockchain networks, including off-chain feeds like oracle prices and sentiment scores. All inputs are normalized into a common schema, ensuring consistent time-series and event data for reliable downstream analysis.

- Predictive Modeling

Normalized data pushes regression and time-series models to forecast APYs, liquidity shifts, and impermanent-loss risk, while reinforcement-learning agents continually improvise allocation strategies in simulated environments. Frequent retraining on new data keeps forecasts in line with changing market regimes.

- Automated Execution Engine

Modular smart-contract adapters automatically deploy, withdraw, and swap assets across multiple DeFi protocols, utilizing dynamic gas-optimization to batch or time transactions, reducing fees by up to 20%. Secure relayers monitor for failures or front-running attacks, making sure every transaction is efficient and protected.

- Risk-Monitoring Dashboard

Finally, a real-time dashboard tracks volatility spikes, liquidity crunches, protocol updates, and audit notices, with customizable thresholds to pause or cease farming activity if limits are breached. This affirms the optimizer chases high yields without compromising capital preservation.

Choosing the Right DeFi Yield Farming Development Company

Selecting a partner to develop your AI-Powered Yield Optimizer calls for rigorous due diligence and scrutiny of the following factors:

- Proven Track Record: Portfolio showcasing successful DeFi lending platform deployments across multiple blockchain networks.

- Security-Centric Approach: Thorough smart-contract audits from reputed firms and real-time on-chain monitoring systems.

- Full-Stack Proficiency: Absolute expertise from intuitive frontend interfaces to robust backend infrastructure and integration of advanced analytics.

- Flexible Customization: Options to customize lending algorithms, risk management parameters, and interface branding in accordance with business objectives.

- Continuous Support: SLA-verified maintenance services, optimization monitoring, and seamless protocol update management.

The Future is Autonomous

Incorporating an AI-Powered Yield Optimizer into your DeFi yield farming development roadmap is a must, considering it is rapidly becoming the industry standard for persistent and superior returns. The upcoming innovations will catalyse the adoption of DePIN, Generative AI advisors, Zero-Knowledge Proofs, etc.

It is worth noting that by 2027, AI agents will enhance 50% of the business decisions, highlighting their growing role in decision intelligence across organizations.

By partnering with a leading company like Antier, you gain access to end-to-end DeFi yield farming development services, from AI modelling and smart-contract engineering to custom solutions and ongoing support. Whether you are planning a new platform or upgrading an existing protocol, Antier is one of the best choices for DeFi yield farming expertise.