Every second, blockchain networks produce massive amounts of transactional data. For customers, interpreting this data to make informed decisions is nearly impossible. Enterprises see the same problem: adoption stalls when customers can’t navigate the complexity.

Web3 AI Agents solve this by working as digital advisors, processing blockchain data, highlighting risks, and guiding smarter actions. In simple terms, AI Agents in Web3 are digital assistants designed to process blockchain data and guide customers toward smarter choices. They are:

- Autonomous: Able to act on behalf of customers, like reallocating tokens.

- Data-driven: Constantly scanning on-chain and off-chain signals.

- Interactive: Responding to natural language queries for fast insights.

- Blockchain-integrated: Directly interacting with dApps, wallets, and decentralized protocols.

For businesses building digital platforms, offering AI Agents services is not just a value-add; it’s becoming central to adoption, trust, and customer engagement.

This article explores how AI Agents in Web3 help customers make smarter decisions, why enterprises should leverage AI Agent development services, and how a well-structured strategy can create a competitive advantage for startups and established players alike.

The Customer Dilemma in Web3

Web3 promised freedom, decentralization, and empowerment. Customers could own their data, trade without intermediaries, and participate in community-driven governance. In practice, however, the user journey often looks very different.

- A DeFi investor faces hundreds of yield opportunities, each with unique risks.

- A DAO member must vote on governance proposals with limited context.

- A customer exploring NFTs struggles to separate genuine innovation from market speculation.

For businesses, this complexity translates into adoption barriers. Customers either hesitate to act, make poor decisions, or abandon platforms altogether. In a decentralized market where speed and trust are critical, decision-making becomes both a competitive advantage and a survival factor.

Let’s take the example of a first-time crypto investor. She logs into a DeFi dashboard and sees 30 liquidity pools, each offering different rewards. Some are backed by audited smart contracts, others are risky but high-yield. She doesn’t have the time to review tokenomics, on-chain activity, or community sentiment before acting. This is not an isolated case. From small retail users to enterprise teams, Web3 customers face the same dilemma: too much data, too little clarity.

Businesses feel the impact directly:

- Low adoption because customers hesitate.

- Poor retention because decisions lead to losses.

- Missed opportunities because customers can’t keep pace with rapid market changes.

Web3 AI Agents are positioned to close this gap. By embedding intelligent decision support into wallets, dApps, and enterprise workflows, businesses can empower customers to act with confidence.

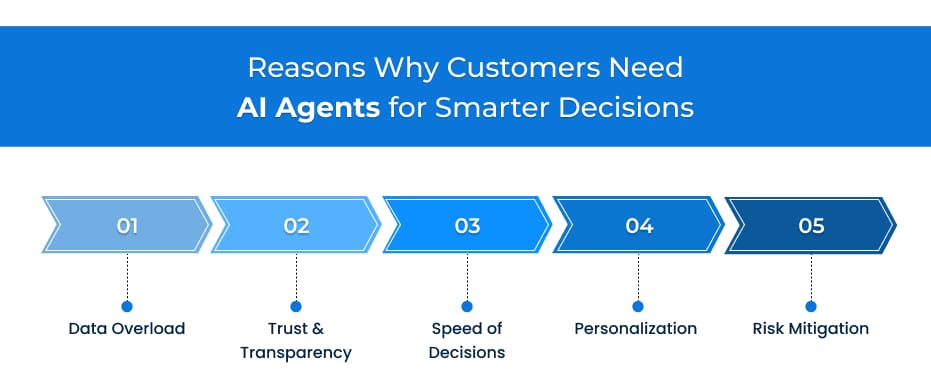

Why Customers Need AI Agents for Smarter Decisions

Data Overload

The blockchain ecosystem generates enormous volumes of data every single day, terabytes of transactions, smart contract interactions, token swaps, and behavioral activity across thousands of protocols. For customers, whether individuals or enterprises, keeping up with this constant stream is nearly impossible. Scanning dashboards, reading whitepapers, or manually analyzing charts requires time and expertise that most users don’t have.

This is where AI Agents in Web3 step in. By processing raw blockchain and market data at scale, they can identify emerging patterns, detect anomalies, and convert noise into actionable insights. Instead of overwhelming users with fragmented information, AI Agents surface clear recommendations, whether it’s reallocating liquidity, avoiding a risky protocol, or capturing a new opportunity before it peaks.

Trust & Transparency

One of the biggest adoption barriers in Web3 is the trust gap. Customers are wary of scams, rug pulls, and opaque protocols that make promises without proof. Traditional dashboards may provide numbers, but they don’t always explain what those numbers mean or how reliable they are. AI Agents address this gap by acting as independent verifiers. They cross-reference on-chain transactions, validate smart contract integrity, and offer explainable insights in simple language.

For instance, before recommending a yield strategy, an AI Agent can highlight whether the underlying protocol has a history of security breaches or whether the liquidity backing is sufficient. This transparency reassures customers, making them more confident in engaging with decentralized ecosystems. For enterprises, it also supports compliance and brand credibility.

Speed of Decisions

Time is a critical factor in decentralized finance. Yield opportunities, arbitrage windows, or governance proposals can change within minutes or even seconds. For a customer relying on manual research, by the time an opportunity is understood, it may already be gone. Web3 AI Agents are built to operate at machine speed.

They monitor liquidity pools, gas fees, token swaps, and governance updates around the clock, instantly flagging opportunities or risks. For example, if gas fees drop to a favorable level, an AI Agent can recommend immediate execution of a transaction or even automate it with customer approval. This speed advantage is not just about capturing profits; it’s also about avoiding losses in volatile conditions where delays can be costly.

Personalization

Web3 customers are not a monolith. A retail investor exploring DeFi wants very different insights compared to an NFT collector or a corporate treasury manager allocating millions in stablecoins. A one-size-fits-all dashboard cannot serve these distinct needs. AI Agents development enables personalization at scale. By learning from customer behavior, transaction history, and stated goals, AI Agents tailor strategies to individual profiles.

An NFT enthusiast may get alerts about rare drops, while a corporate treasury manager may receive structured risk reports and liquidity strategies. This personalization creates relevance and value for each customer, increasing engagement and long-term trust. For enterprises offering AI Agent development services, this also opens the door to differentiated products that align with diverse customer segments.

Risk Mitigation

Risk is the number one concern holding back broader Web3 adoption. From volatile token prices to insecure smart contracts, customers constantly face uncertainty. AI Agents in Web3 act as a protective layer, flagging risky transactions before they occur. They can simulate outcomes, detect abnormal patterns in liquidity pools, or warn if a counterparty shows signs of fraud.

For example, if a protocol suddenly loses liquidity or a contract shows unusual code changes, the AI Agent can immediately alert the customer. For enterprises, this risk management capability is invaluable. It ensures compliance with regulatory standards, prevents costly mistakes, and builds trust with customers who want assurance that their assets are protected.

The Impact on B2B Enterprises

Startups

For startups operating in Web3, one of the biggest hurdles is customer onboarding. New users often struggle with setting up wallets, understanding tokenomics, or navigating decentralized applications. This friction slows adoption and increases churn. By integrating AI Agent solutions, startups can offer AI-powered onboarding assistants that simplify complex steps and guide customers in real time.

Imagine a new user signing up on a DeFi lending app: instead of reading lengthy tutorials, an AI Agent explains risk levels, suggests tailored strategies, and even simulates potential outcomes. Startups that build with AI Agents in Web3 not only speed up user education but also create trust early in the journey—helping them grow faster in competitive markets.

Enterprises

For established enterprises, Web3 adoption is no longer a “wait and see” issue; it’s becoming part of treasury, investment, and customer engagement strategies. But with scale comes complexity. Large organizations need to manage risk, comply with regulations, and justify every move with data-backed reasoning. AI Agents in Web3 provide enterprises with real-time visibility into risks and opportunities.

A corporate treasury, for example, can rely on an AI Agent to monitor stablecoin reserves, track regulatory updates, and recommend adjustments to liquidity positions in seconds. This kind of intelligence strengthens decision-making, reduces exposure, and helps enterprises confidently navigate digital assets without depending solely on internal teams or fragmented data sources.

Investors

Investors in Web3 face a paradox: opportunity is abundant, but credible signals are scarce. Thousands of projects launch every year, and separating legitimate ventures from scams requires both technical due diligence and market analysis. Here, an AI Agent development company can design agents tailored for investors that scan vast amounts of market data, identify red flags in project behavior, and surface high-quality opportunities.

For example, an AI Agent can monitor wallet activity to detect whether a token is backed by organic community growth or manipulated by insiders. By prioritizing credible projects, investors gain sharper insights, reduce risk exposure, and allocate capital more effectively. Over time, this creates a stronger reputation and higher returns for professional investment firms.

Ecosystem Builders

For platforms and protocols, growth depends on active participation. Yet governance models, staking pools, and community decisions often see low turnout because users feel overwhelmed or uninformed. Embedding AI Agents services into platforms lowers entry barriers. An AI Agent can guide a new DAO member on how to vote, explain proposals in plain language, or recommend relevant governance actions based on their interests.

For DeFi protocols, agents can help users select liquidity pools aligned with their goals while clearly outlining risks. This reduces the intimidation factor, boosts participation, and nurtures stronger communities. Ecosystem builders who adopt AI Agents not only make their platforms more accessible but also strengthen loyalty and long-term sustainability.

Conclusion

Web3 customers face complexity, speed, and trust challenges that cannot be solved by user interfaces alone. AI agents are the key to helping customers cut through noise, act with confidence, and unlock the true potential of decentralized ecosystems. For businesses, they are no longer optional but essential for adoption and growth. Antier, a leading AI Agent development company, helps enterprises and startups design and deploy powerful AI Agent services that drive smarter customer decisions in Web3.