Ready for a reality check? The Middle East and North Africa- from Morocco and Egypt across the Levant to the Gulf and Arabian Peninsula is not a single market; it’s a constellation of fast-evolving digital economies. Regulators in Abu Dhabi, Dubai, and Bahrain are building rulebooks that invite institutional capital, create fiat corridors, and accelerate tokenization. That mix is pushing crypto exchanges from boutique experiments to core financial plumbing.

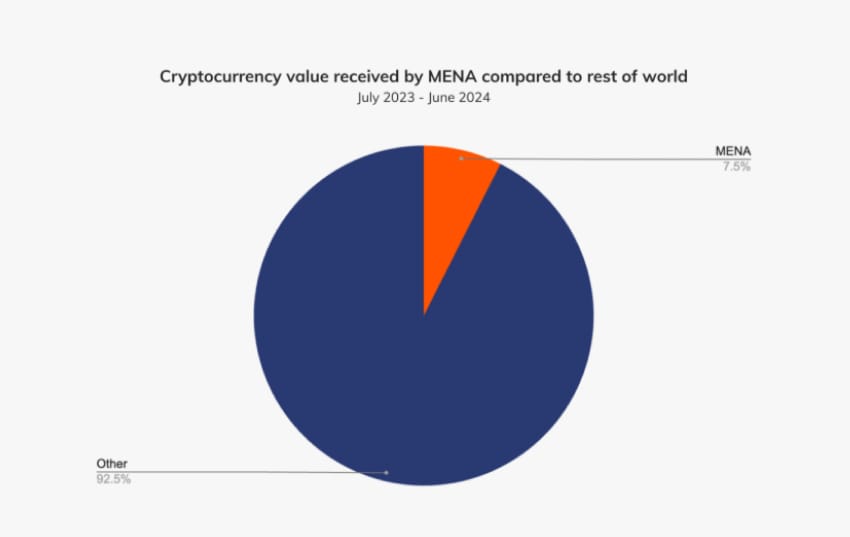

According to the latest Chainalysis data, the MENA region now represents 7.5% of global on-chain transaction volume, an estimated $338.7 billion between July 2023 and June 2024—driven overwhelmingly by institutional and professional flows. For operators and investors, white-label exchanges are the pragmatic lever: they fold compliance, custody, and liquidity tooling into a configurable stack so you can move quickly without reinventing infrastructure. In a crowded Web3 landscape, speed-with-security tradeoffs separate footnotes from firms shaping market structure. Let’s unpack how to build and launch the right platform in MENA.

Have A Close Look At The MENA Regulatory Landscape

MENA’s regulatory patchwork rewards deep compliance expertise. Key regimes include:

Why Invest in MENA-Compliant White Label Exchange Software?

✓ Market access & regulatory trust

✓ Faster time-to-market than bespoke builds

✓ Lower upfront engineering CAPEX

✓ Higher institutional credibility & depositor confidence

✓ Multiple revenue engines (custody, tokenization, staking, listing)

✓ Product localization unlocks adoption (Arabic, Sharia options)

✓ Banking and fiat on/off-ramp readiness

✓ Lower operational and compliance tail-risk

✓ Scalable multi-jurisdiction deployment from one core stack

✓ First-mover advantage in the underserved segment

Antier’s MENA-Compliant White Label Exchange Development Capabilities

When investors think of a “white-label cryptocurrency exchange” in the MENA region or elsewhere, Antier is often the first name that comes to mind: a regulatory-first partner that turns complex launches into repeatable plays. Evaluate its capabilities to make a fast and confident investment decision.

How to Develop a MENA-Compliant White Label Crypto Exchange?

Before you commit capital, know how a MENA-compliant white-label cryptocurrency exchange is built. Understanding the entire development process lets you see where your money flows, how compliance and security are enforced, and which decisions drive returns. This isn’t technical showboating; it’s due diligence. Investors who grasp the steps make smarter, faster decisions with far less surprise.

- Legal and Regulatory Infrastructure

Establishing a compliant entity in MENA often involves navigating complex jurisdictional requirements. Collaborating with local legal experts to secure necessary licenses, such as those from the Dubai Financial Services Authority (DFSA) or the Saudi Capital Market Authority (CMA), is foundational. Additionally, implementing real-time transaction monitoring and transparent reporting aligns with regional AML directives.

- Robust KYC/AML Protocols

Given the stringent regulatory environment, integrating advanced KYC/AML systems is non-negotiable. Leveraging AI-powered identity verification, biometric authentication, and zero-knowledge proofs (ZKPs) can ensure compliance while preserving user privacy—a balance highly valued in MENA markets.

- Liquidity and Market Infrastructure

Access to deep liquidity pools and efficient order matching engines ensures smooth trading experiences. Partnerships with global liquidity providers and interoperability with multiple blockchains enhance market depth and trading options, which are critical for attracting institutional and retail investors alike.

- User Experience and Localization

Tailoring the platform’s UI/UX to regional languages, cultural nuances, and payment preferences fosters adoption. Features like Arabic language support, integration with popular regional payment gateways, and customer support attuned to local expectations differentiate a successful exchange.

- Security as a Cornerstone

Employing multi-signature wallets, cold storage solutions, quantum-resistant encryption, and continuous penetration testing fortifies the platform against cyber threats. Transparent disclosure of security audits and certifications further builds user trust.

A transparent white label crypto exchange software development partner guides you through every step, from licensing and compliance to liquidity seeding and security audits, so you always know how your capital is deployed. The right company explains trade-offs, timelines, and risks plainly, keeping you informed and in control. That clarity turns confidence into faster investment decisions and stronger long-term returns.

The Value of Compliance: ROI That Speaks Volumes

- Faster Licensing, lower regulatory friction, and institutional trust in one package.

- Flexible, scalable builds, configurable across UAE-Bahrain-Qatar‑Saudi compliance zones with the same core engine.

- Risk mitigation vs. fines. Think of a lesser fraction of the $7.4 billion in SEC penalties and the future Gulf enforcement magnitude.

- Revenue multipliers from tokenization, ISOs, custody, and fee‑sharing with banks and asset managers.

The MENA region’s crypto market is projected to grow exponentially, fueled by government initiatives such as Saudi Arabia’s Vision 2030 and the UAE’s Blockchain Strategy 2025. Early movers who deploy MENA-compliant white-label crypto exchange software position themselves to capture a significant market share before saturation occurs.

Moreover, regulatory clarity is improving, reducing operational risks and enabling businesses to innovate confidently. Enterprises or businesses that opt for a white-label solution with built-in compliance and scalability can focus on brand building, investor engagement, and technological innovation, all of which are critical drivers of long-term success.

Investor-FAQs Solved Related to MENA-Ready White Label Exchange

Q1. Which MENA jurisdictions can we target first?

A: Fast wins: ADGM (Abu Dhabi) and VARA (Dubai); Bahrain (CBB) and Qatar (QFC) are also viable for regulated market entry.

Q2. How quickly will we be live?

A: White-label reduces MVP time (core matching + custody + KYC) by ~40–60%; regulated launches depend on documentation and local regulator cadence.

Q3. What licenses will we need?

A: VASP/exchange license, custody permissions (if holding funds), and any local payments/PSP approvals required by the chosen regulator.

Q4. Are stablecoins and fiat rails supported?

A: Yes! Multi-stablecoin support and integrations with regional banking rails and PSPs for AED, SAR, QAR, etc., where permitted.

Q5. What are the typical MENA-ready white label exchange development costs?

A: Costs vary by scope; white-label substantially reduces engineering CAPEX—licensing, liquidity commitments, and integrations mainly drive budgets. Connecting with a renowned and experienced white label crypto exchange development company will help you have an estimated idea.

Hire a 100% Reliable White-Label Crypto Exchange Development Company!

MENA’s dynamic crypto landscape demands platforms that blend regulatory mastery, technical modularity, and security-first engineering. A MENA‑compliant white label cryptocurrency exchange isn’t just another software solution; it’s a strategic asset that accelerates market entry, minimizes risk, and amplifies institutional trust. Partner with a compliance‑centric white label cryptocurrency exchange development service provider, configure your tech stack for multi‑zone deployment, and launch in flagship markets like the UAE, Bahrain, and Qatar, while monitoring Saudi Arabia’s sandbox for early‑mover advantage. Build more than an exchange; build a trusted node in MENA’s Web3 infrastructure. Connect with certified and skilled experts at Antier for a faster and more seamless launch.