Digital asset management is at an inflection point. As Web3 adoption accelerates across Slovenia, driven by institutional interest, retail mania, and MiCA’s regulatory clarity, investors face ever more sophisticated threat vectors. In this landscape, a best crypto cold wallet becomes not just an accessory but the linchpin of any robust non-custodial architecture. This guide delivers a strategic blueprint for selecting, deploying, and securing your cold wallet in 2025. Whether you are evaluating crypto wallet development frameworks or seeking enterprise solutions, you will gain the decision-ready insights to protect long-term reserves and unlock next-generation custody.

Why Cold Crypto Wallets Are in High Demand in 2025?

Escalating Attack Surface

- Bridge exploits, phishing ASAs, and supply‑chain malware have combined to siphon billions from hot wallets.

- With private keys offline, crypto cold wallet development solutions eliminate live-network ingress points—ushering in “trust-minimized architecture” for asset guardianship.

Institutional Non‑Custodial Mandates

- Hedge funds and pension vehicles increasingly demand in-house key custody, integrating crypto cold wallet development with MPC and HSM-grade modules.

- Hybrid liquidity stacks pair on‑chain routers with air‑gapped signing: a dual‑layer approach that maximizes capital efficiency without sacrificing security.

Regulatory & Compliance Pressures

- MiCA’s stringent KYC/AML protocols have sharpened the spotlight on end-user ownership models.

- Non‑custodial “proof of possession” audits now benchmark platform integrity—fueling demand for auditable, open‑source firmware.

Slovenia’s Crypto Boom: Crypto Wallet Market Trends & Shift

Slovenia has surged to the forefront of Europe’s digital-asset revolution, with over 17% of its adult population holding cryptocurrencies, nearly double the EU average. Ljubljana, lauded as one of the world’s most crypto-friendly capitals, boasts a dense network of 24/7 ATMs, low-tax zones, and high-speed internet infrastructure that fuels retail adoption and merchant acceptance. Average wallet balances exceed €200,000, reflecting substantial HNW participation and institutional interest.

Thanks to MiCA’s full enactment in early 2025 and streamlined AML frameworks, enterprises confidently engage in cryptocurrency wallet development, launching hybrid custody models that integrate wallet platforms with hardware security. Local blockchain studios are accelerating crypto cold wallet development, offering white-label SDKs that cater to both SMBs and large-scale financial institutions. As regulatory certainty solidifies and developer communities expand, Slovenia’s market is poised for continued growth, making the selection of a best crypto cold wallet critical for any forward-looking investor. However, as we have already gone through the market conditions of Slovenia, we must go through what extraordinary things you must have in your cold crypto wallet to stand out in the market.

Primary Features of Cold Crypto Wallet Development

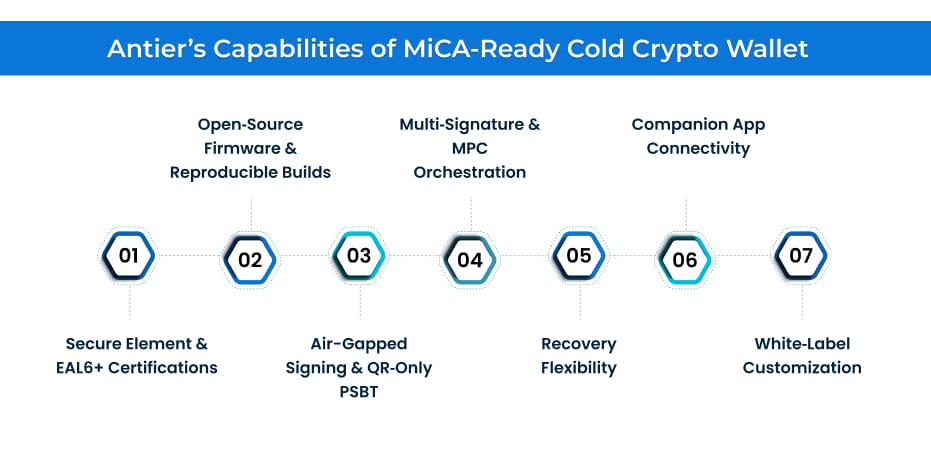

Welcome to the crossroads of engineering excellence and Web3 ambition, where your choice of cold wallet development dictates the resilience of your digital treasury. Beyond mere storage, this discipline demands hardware trust anchors, cryptographic transparency, and truly isolated transaction workflows—all woven into a cohesive, brandable solution. Here, modular architecture meets relentless auditability, empowering you with intuitive control even as threat landscapes evolve. Prepare to explore how purpose-driven design transforms your custody strategy from reactive defense into proactive assurance.

- Secure Element & EAL6+ Certification – A dedicated secure element with EAL6+ certification isolates private keys in tamper-resistant hardware. This ensures industry-leading physical protection and side-channel resistance, anchoring any cold crypto wallet development initiative.

- Open‑Source Firmware & Reproducible Builds – Publicly auditable code and bit-perfect builds prevent supply-chain tampering. You can verify that firmware binaries match the source, delivering trust-minimized security for crypto cold wallet development.

- Air-Gapped Signing & QR‑Only PSBT – Fully offline transaction approval via QR or microSD keeps private keys off any network. This “air-gapped” approach eliminates USB/Bluetooth attack vectors while retaining seamless PSBT workflows.

- Multi-Chain & Token Support – Native support for Bitcoin, Ethereum/ERC-20, Solana, and EVM-compatible chains ensures broad asset coverage. No external bridges or plugins are required, simplifying your crypto wallet app development roadmap.

- Multi‑Signature & MPC Orchestration – M-of-N and MPC frameworks distribute signing authority across devices or parties. This granular control prevents single-point failures and aligns with enterprise-grade custody standards.

- Recovery Flexibility – Standard BIP‑39 seeds plus optional Shamir’s Secret Sharing and steel-plate backups guarantee resilient fund recovery. Programmable duress PINs add an extra layer of protection under duress.

- Companion App Connectivity – Encrypted BLE or QR pairing to a mobile/desktop dashboard enables portfolio management, swaps, and staking without exposing keys. This integration reflects best practices in cryptocurrency wallet app development.

- White‑Label Customization – OEM SDKs allow full UI/UX branding—from boot screens to transaction flows—while preserving the audited security core. Ideal for enterprises deploying a white-label crypto wallet solution.

To transform these ambitions into reality, engaging a seasoned partner is non-negotiable. Only through holistic crypto wallet services, spanning, can you build a truly feature-rich cold wallet. Hiring an experienced development team that offers holistic and business-catered cryptocurrency wallet development services can speed up time-to-market and ensure a secure, compliant solution. Elevate your custody framework and launch the best crypto cold wallet that stands the test of tomorrow’s challenges.

Security Best Practices: Ensuring Bulletproof Custody

“Security isn’t an add-on; it’s the architecture of trust.”

Guard against threats, preserve investor trust, and fortify your crypto holdings with ironclad custody. In an era of relentless attack vectors and regulatory mandates, a robust defense framework is no longer optional—it’s the cornerstone of asset integrity. Investors demand assurance during cold crypto wallet app development; it’s time to elevate your custodial architecture to institutional-grade reliability and unwavering confidence.

1. Trust-Minimized Procurement : Begin by sourcing your device directly from the manufacturer’s official channels. This removes supply‑chain uncertainty and ensures tamper-evident packaging. Upon receipt, inspect seals and verify serial numbers against vendor databases—no detail is too small when protecting high-value assets.

2. Offline Validation & Key Generation : Always perform firmware hash checks in an air-gapped environment before installation. Generate your seed phrase entirely offline—using an open-source, auditable tool on a clean computer—to guarantee that private keys never touch a networked machine.

3. Layered Backup Architecture : Combine a standard BIP‑39 mnemonic with advanced schemes such as Shamir’s Secret Sharing. Store metal backup plates or ceramic shards in geographically separated vaults. For high-risk scenarios, program a duress PIN that conjures a decoy wallet, preserving plausible deniability.

4. Controlled Transaction Signing : Adopt QR-only PSBT workflows or microSD-based data transfers. By forbidding USB or Bluetooth connections, you eliminate remote exploit vectors. This “air-gapped signing” model keeps your private keys completely offline throughout the entire transaction lifecycle.

5. Continuous Verification & Drills : Schedule quarterly recovery drills on a secondary device to test seed integrity and process fidelity. Maintain an internal audit log of every firmware update, backup drill, and transaction—this level of operational discipline is what separates institutional-grade custody from ad hoc setups.

Now that we know the advanced features and security capabilities that we must consider in our crypto wallet development, we must now explore how much it actually costs to develop this. Knowing saving tips and being smart is as important as evaluating the cost. Thus, let us break down the cost analysis of crypto cold wallet development and have a better understanding before investing.

An Analysis: How to Evaluate the Cost of Cold Crypto Wallet Development?

Investors, have you ever paused to consider what really drives the price tag on a best crypto cold wallet? It isn’t the sticker on a box; it’s the layers of assurance you build underneath. From sourcing tamper-evident hardware and certifying secure elements to commissioning open‑source firmware audits and architecting multi-signature workflows, each decision adds depth and diligence to your custody model.

You will account for bespoke UX/UI branding, seamless companion-app integration, and rigorous compliance reviews, all supported by ongoing firmware updates and recovery-drill programs. Factor in specialized insurance underwriting and expert training, and you’ll see that the investment reflects a holistic, end-to-end fortress, crafted to preserve both assets and confidence in perpetuity. Let us scroll down to check some strategic steps to save cost during cold crypto wallet development

Strategic Crypto Wallet App Development Cost-Saving Tips :

✔︎ Trezor and Coldcard communities drive cost-efficient, transparent cryptocurrency wallet development services.

✔︎ Negotiate volume discounts and custom OEM features through a white-label crypto wallet vendor.

✔︎ Combine a lean hardware wallet with a subscription-based MPC app to defer full HSM upgrades.

✔︎ Tap into Tangem or BitBox sales cycles—often bundled with steel backups at marginal cost.

Launch a 100% MiCA-Compliant Crypto Cold Wallet Faster Than Ever!

Only a partner with a track record of success in Web3 is adequate at this level of stakes, and Antier is that partner. As a leading cryptocurrency wallet development company, our extensive knowledge of secure elements, MPC orchestration, and open-source firmware audits is combined with a white-label SDK that is prepared for quick branding and compliance in Slovenia’s MiCA-driven market or any other booming market.

Our comprehensive strategy, which includes hardware acquisition, companion app integration, UX/UI customization, and continuous recovery drill support, guarantees that your cold wallet is not only feature-rich but also institutionally robust. We customize each module to your operational requirements and risk profile, unlike one-size-fits-all vendors, resulting in an unbeatable TCO and a quicker time to market. To turn custody from a checkbox into a tactical advantage, pick our team. Start your ultimate crypto cold wallet and confidently steer Slovenia’s cryptocurrency boom.