The past decade has been filled with speculation about how blockchain could “redefine finance.” But in 2025, real-world asset tokenization has converted into speculation and into practice by bringing assets on-chain. The tokenized RWA market has already crossed $26.5 billion in value (excluding stablecoins), representing enormous growth. And with over 70% market share, Ethereum has become the default institutional hub for tokenized assets. From BlackRock’s $2.8B BUIDL fund to Apollo’s private credit vehicles, the largest experiments in tokenization are already live on Ethereum or its Layer 2 networks.

This guide examines Ethereum’s dominance, the mechanics of tokenization, key asset categories, technical standards, risks, and, most importantly, the roadmap for building future-proof tokenization platforms.

Why is Ethereum Dominating RWA Tokenization in 2025?

Ethereum’s position as the most preferred blockchain for RWA Tokenization is a combination of history, technical standards, liquidity depth, and trust.

First-Mover Advantage and Institutional Experiments

Ethereum was the first blockchain to prove institutional-grade tokenization:

- 2016–2017: JPMorgan launched Quorum (a permissioned Ethereum fork) and JPM Coin.

- 2019: Société Générale issued €100M in covered bonds directly on the Ethereum mainnet.

- 2021: The European Investment Bank issued a €100M digital bond on Ethereum, settled with a CBDC trial by Banque de France.

These pilots validated Ethereum’s architecture for regulated finance. Once a few institutions were built here, network effects kicked in.

Regulatory-Ready Standards

Ethereum pioneered compliance-oriented token standards:

- ERC-20: Fungible tokens- foundation of all financial assets.

- ERC-1400: Security token standard, embedding compliance and transfer restrictions.

- ERC-3643: Permissioned token standard, enforcing KYC/AML eligibility on-chain.

These give institutions confidence that tokenized securities can be legally enforceable.

Design, Launch, and Scale your RWA Tokenization Platform on Ethereum

Liquidity Depth

Ethereum is home to the world’s largest on-chain liquidity pools:

- Stablecoins (USDC, USDT) are worth over $200B.

- DeFi lending markets (MakerDAO, Aave, Compound).

- RWA-specific pools (Ondo, Spark, Ethena).

Without liquidity, tokenization is just digital warehousing. Ethereum connects issuance to active capital.

Decentralization as Assurance

Institutions care about uptime, resilience, and transparency. Ethereum’s decentralization- thousands of validators globally, immutable records, and censorship resistance gives RWAs credibility that private chains or smaller blockchains struggle to match.

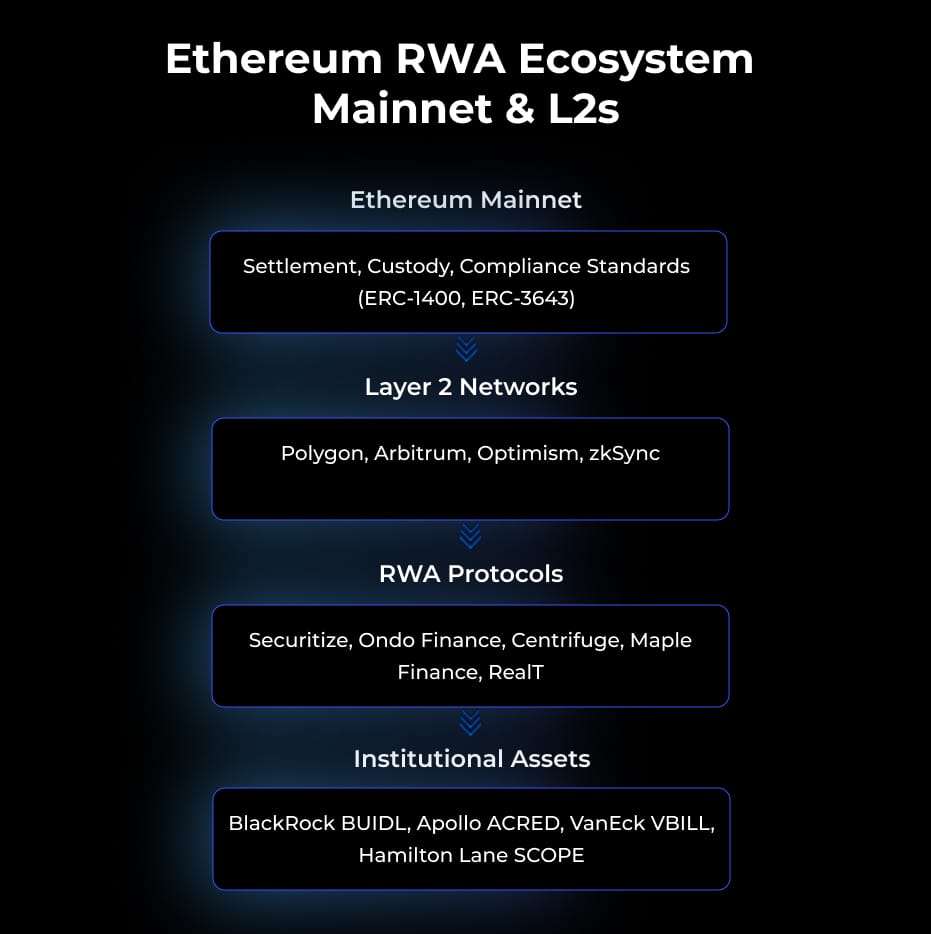

Layer 2 Expansion

Ethereum mainnet faces throughput and gas volatility. Layer 2s like Arbitrum, Polygon, Optimism, and zkSync solve this by offering lower fees and faster confirmation while anchoring to Ethereum’s security. Many platforms issue tokens on mainnet but execute trading and settlement on L2.

Tokenization Workflow: How Are Platforms Built?

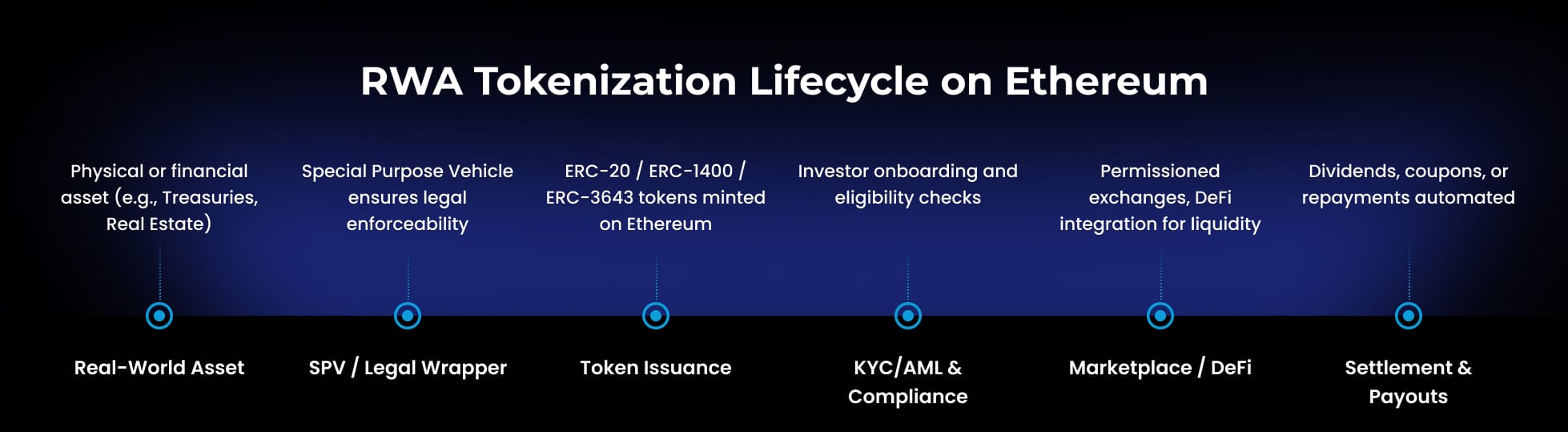

Real-World Asset Tokenization is often misunderstood as “just minting a token.” In practice, it’s a hybrid process bridging legal, financial, and technical infrastructure.

Step 1: Asset Structuring: Off-chain assets (e.g., bonds, property, credit) are placed into a Special Purpose Vehicle or trust. This ensures investor rights are enforceable even outside the blockchain.

Step 2: Legal Wrapping: Compliance frameworks (securities exemptions, transfer agent roles) are defined. Custodians or trustees manage physical assets or legal contracts.

Step 3: Token Issuance:

- ERC-20 for fungible units (e.g., fractional bonds).

- ERC-1400 for securities with compliance logic.

- ERC-721/1155 for unique assets like art or collectibles.

Step 4: Onboarding & Compliance: Investors undergo KYC/AML. Permissioned tokens like ERC-3643 ensure only eligible wallets can hold or transfer tokens.

Step 5: Secondary Trading: Tokens trade on permissioned marketplaces or integrate into DeFi protocols for liquidity. MakerDAO, Aave, or Pendle often plug into RWA pools.

Step 6: Lifecycle Management: Dividends, coupons, and loan repayments are automated by smart contracts. Oracles provide off-chain event triggers (e.g., interest rate resets, insurance triggers).

Understanding Smart Contracts and Token Standards

For business, the contract layer plays a critical role in RWA Tokenization Platforms.

- ERC-20: Base layer for fungible assets. Used for fractionalized Treasuries, commodities, and stablecoins.

- ERC-1400: Combines ERC-20 with compliance features (partitioned transfers, whitelists).

- ERC-3643: Permissioned standard enforcing investor eligibility directly on-chain.

- Dividend Logic: Smart contracts can distribute interest or rental income daily instead of quarterly.

- Repayment Schedules: Loans tokenized as ERC-20s can have repayment coded into contract logic.

Core Asset Categories on Ethereum: How Businesses Can Build Yield-Driven Platforms

For businesses building tokenization platforms, the first and most strategic choice is deciding which asset classes to serve. Each class has its own mechanics, compliance requirements, and investor expectations. Selecting the right category shapes not only platform design but also the kind of investors and institutions the platform will attract.

Private Credit

Private credit has become the largest RWA segment (~$14B), with platforms like Centrifuge, Maple Finance, and Goldfinch leading the way. Borrowers range from SMEs and fintechs to crypto market makers, while investors are drawn by stable yields of 8–12%.

For businesses, private credit tokenization means developing strong credit evaluation systems that merge off-chain borrower data with on-chain risk signals. Platforms also need to automate loan terms and repayments via smart contracts and design capital pool structures that balance risk and return for investors.

A well-built private credit platform isn’t just digitizing loans, it’s creating a regulated, transparent, and globally accessible credit marketplace.

U.S. Treasuries and Money Market Funds

Tokenized Treasuries have surged to $6.6B, led by BlackRock’s BUIDL fund ($2.8B) and Superstate’s USTB. Institutions favor these assets because they’re low-risk, yield-bearing, and already familiar.

To operate in this space, businesses need to establish partnerships with licensed custodians who actually hold the underlying securities, while integrating with regulated transfer agents for compliance. Adding a fractionalized access layer can widen participation without undermining institutional requirements.

Platforms that get this right become natural entry points for institutional capital, as Treasuries often serve as the first step into on-chain finance.

Stablecoins

Stablecoins represent the largest RWA category ($217B+), and Ethereum is their home base. USDC, USDT, and DAI form the settlement rails for virtually every other RWA transaction.

For platform builders, integrating stablecoin rails isn’t optional. Businesses must ensure smooth on/off-ramps between fiat and stablecoins, design instant settlement flows, and consider offering yield-bearing stablecoin options to increase investor appeal.

Stablecoins are the circulatory system of tokenized finance; every successful RWA platform is built on top of them.

Commodities (Gold)

With roughly $1.5B in tokenized gold (PAXG, XAUT), commodities are an important niche. Gold appeals as an inflation hedge and diversifier, but it requires thoughtful structuring.

Platforms working with commodities must integrate vault custody partners, design transparent Proof of Reserve mechanisms, and offer redemption pathways for institutional holders. Adding DeFi utility (e.g., using gold tokens as collateral for lending) further enhances adoption.

The opportunity here lies in transforming a traditionally static store of value into a programmable, collateral-ready asset for digital markets.

Real Estate

Real estate tokenization remains small (~$0.5B), but projections suggest it could exceed $1T by 2030. Platforms like RealT and RedSwan show how fractional ownership models work.

Businesses entering this sector must navigate jurisdiction-specific property laws while building mechanisms for fractional ownership, rental income distribution, and secondary trading. Integration with property managers and regulators is as critical as the blockchain layer.

Done well, real estate tokenization platforms can transform one of the world’s most illiquid asset classes into a liquid, income-generating investment stream.

Equities and Private Equity

Both public equities (via trackers like Backed Finance) and private equity (via Securitize, Polymath) are finding their way on-chain, with a combined market around $0.5B.

Businesses building in this space must integrate cap table management, governance rights, and shareholder services into token design. Reliable price oracles are essential for public equity products, while private equity platforms need seamless investor onboarding and compliance frameworks.

This category enables businesses to globalize access to traditionally restricted securities, broadening the investor base beyond traditional borders.

Some Emerging Tokenization Categories Include

Beyond mainstream categories, new frontiers are opening:

- Carbon credits (Toucan, KlimaDAO) for ESG-aligned investment.

- Insurance (Etherisc, Nayms) with parametric payout models.

- Intellectual property (Royal) with tokenized royalties.

Building platforms in these areas means connecting on-chain assets with specialized off-chain registries or data sources, such as carbon registries, weather oracles, or royalty tracking systems.

These categories remain small, but they offer businesses a way to differentiate early and capture niche but rapidly expanding markets.

Infrastructure Stack for Building Tokenization Platforms

To build at scale, platforms need more than contracts. The full stack includes:

- Smart Contracts: Financial logic for payouts, repayments, governance.

- Custody: SPVs, insured custodians, Proof of Reserve audits.

- Compliance Modules: KYC/AML, transfer restrictions, permissioned tokens.

- Oracles: Chainlink PoR, market feeds, event triggers.

- Layer 2s: Polygon, zkSync, Arbitrum for cheaper, faster operations.

- Interoperability: Chainlink CCIP or custom bridges for multi-chain liquidity.

Launch your Tokenization Platform in 7 days on the Ethereum Blockchain!

Builder Roadmap: How to Develop a Tokenization Platform

For those targeting this market, here’s the roadmap:

- Choose Asset Class → Start with Treasuries or private credit (clear demand + regulatory frameworks).

- Define Jurisdiction → Pick RWA-friendly zones (Switzerland, Singapore, UAE).

- Set Up Legal Wrapper → SPV, trustee model, audited custodians.

- Pick Token Standards → ERC-1400 or ERC-3643 for compliance, ERC-20 for liquidity.

- Integrate Compliance → On-chain KYC modules, permissioned token transfers.

- Secure Liquidity → Partnerships with DeFi protocols (MakerDAO, Aave) and institutional market makers.

- Design for multi-chain → Anchor on Ethereum, extend to L2s and specialized chains.

- Future-Proof with Programmability → Build for daily payouts, composable assets, secondary liquidity pools.

Choose Ethereum as a Benchmark, Multi-Chain as a Future

Ethereum has become the institutional benchmark for RWA tokenization for its liquidity, regulatory-ready standards, and decentralization. For businesses, it’s where capital is already flowing, and where investors are comfortable deploying funds.

But the market is still only ~1% tapped. With $200B in near-term growth and trillions expected by 2030, the opportunity is wide open. The enterprises that build tokenization platforms now will own the rails of tomorrow’s financial system.

Partner with Antier to launch in just 7 days with a compliance-first, multi-chain infrastructure, built to scale from Ethereum’s liquidity hub to the broader global RWA ecosystem.