After years of anticipation, Tokenization has reached the defining moment. According to McKinsey & Co.’s report, around USD 5 trillion in Decentralized Tokenized Securities will be issued by 2030. This is an explosive time for the Blockchain Industry. The technology’s strategic future can help businesses unlock new revenue streams with benefits like operational efficiencies, increased liquidity, programmability, and composability.

Another piece of data published by Artemis clearly states that RWA will outperform the other crypto sectors in growth. Businesses looking to invest in tokenized securities—now is the moment to act. Seize this prime opportunity to unlock immense financial rewards. For expert guidance, continue reading this guide!

Understanding The Tokenized Securities

Tokenizing security is the process of materializing ownership through the issuance of a Token. These tokens are legally classified as securities and are subject to regulatory frameworks, ensuring they comply with financial laws.

Why Tokenized Securities Are the Next Big Thing in Finance?

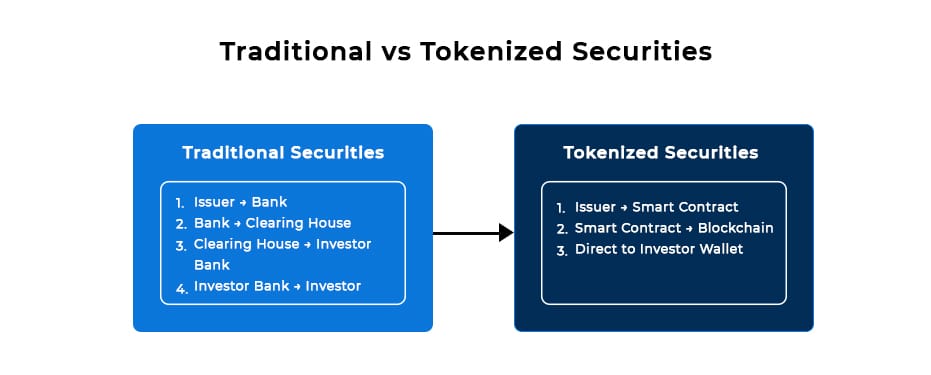

Traditional securities, such as debt, equity, and derivatives, are typically traded on stock exchanges and transferred via centralized systems that require multiple intermediaries, such as banks and Central Securities Depositories (CSDs). These intermediaries introduce inefficiencies, delays, and risks, often extending the settlement period to several months, depending on jurisdiction.

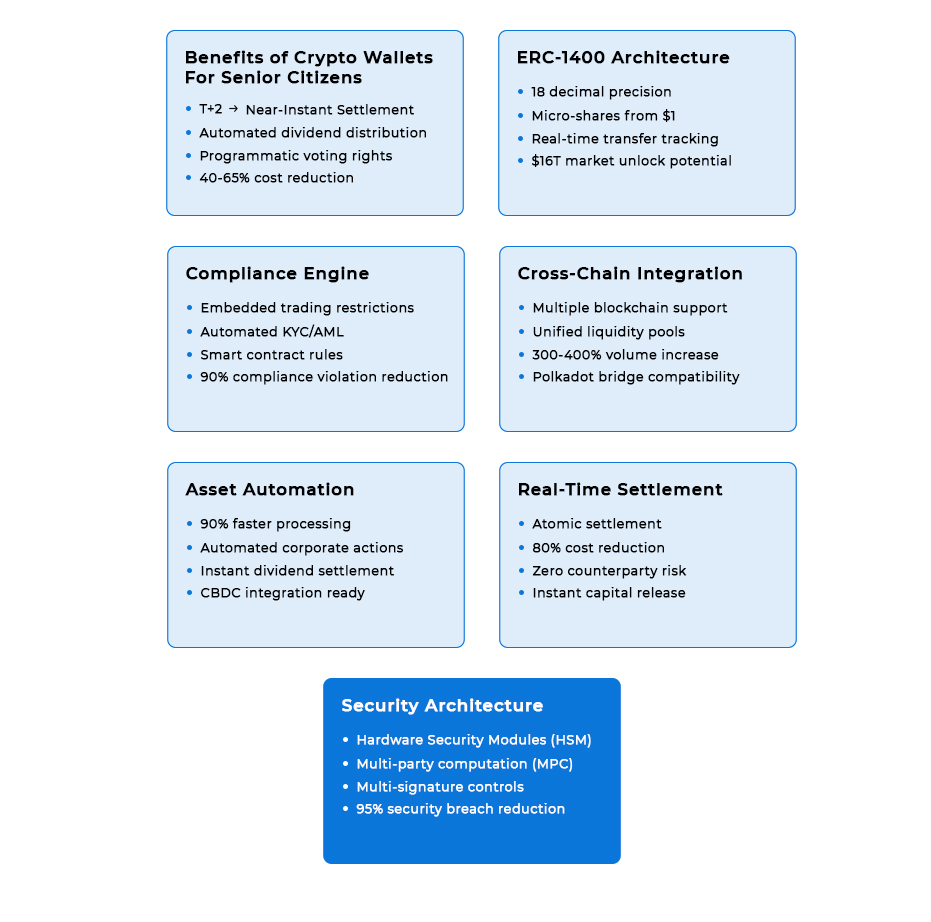

Tokenized securities eliminate these inefficiencies by utilizing blockchain technology. Instead of paper certificates, ownership is represented by digital tokens on a Distributed Ledger Technology (DLT) network, with transactions executed through smart contracts. This setup drastically reduces transaction fees and eliminates the need for intermediaries, providing faster, more secure, and transparent transfers.

With tokenized securities, issuers can access a broader investor base while benefiting from lower transaction costs. Assets are stored in digital wallets, enhancing security and offering real-time ownership verification without the reliance on centralized entities.

How Tokenized Securities Enhance Market Operations?

- Issuance

Tokenized securities eliminate intermediaries and streamline the issuance process. Ownership records are stored on Blockchain and facilitate instant, low-cost transfers, resulting in real-time settlements and reduced issuance time. Paired with fiat-backed stablecoins, tokenized securities enable automatic and immediate payments. With no need for traditional clearinghouses, tokenized securities can be issued faster, cheaper, and with greater security, offering issuers access to a global investor base.

- Custody

Instead of using a centralized registrar, transactions are recorded on Blockchain which eliminates the need for a Custodian and ensures transparency and traceability. Digital wallets replace traditional vaults for asset storage with encrypted key management. This decentralized approach provides a more secure and efficient way to manage and store digital assets compared to traditional custodians.

- Settlement and Payments

Tokenized securities enable instant settlement through on-chain payments. The Delivery vs. Payment (DvP) mechanism ensures that assets and payments are exchanged simultaneously, minimizing counterparty risk. Real-time transactions using stablecoins offer instant and automatic payment for investments, coupon payouts, and bond repayments. This significantly reduces the cost and complexity of settlements and offers global access.

What Are the Benefits of Issuing Tokenized Securities?

Steps To Issue the Tokenized Securities

To issue tokenized securities, one needs to follow a structured process that ensures compliance with regulatory frameworks while leveraging blockchain technology. Below is a detailed guide on the steps involved in this process.

Step 1: Define What to Tokenize

- Assets: Identify the assets to be tokenized, which can include personal assets (cash, property) or business assets (equity, debts).

- Equity Tokens: Represent shares in a fund or company, stored digitally on a blockchain.

- Debt Tokens: Standardized financial products with clear interest rates, typically more liquid than equity tokens.

Step 2: Compliance and Regulation

- KYC and AML Compliance: Implement Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols to verify identities and ensure that only eligible participants can trade tokens.

- Permissioned Tokens: Use permissioned tokens that require validation before trades can be executed. This validation is coded into the token’s smart contract.

Step 3: Token Economics

- Valuation: Determine the value of the underlying asset and how much will be tokenized. For example, if tokenizing a €100 million real estate fund into 100 million shares, each share is valued at €1.

- Revenue Management: Clearly outline how revenues generated by the underlying asset will be shared with token holders, including potential dividends or buybacks.

Step 4: Identity Management

Utilize protocols like ERC725/735 for creating unique identities for stakeholders, allowing for secure management of permissions and transactions on the blockchain.

Step 5: Lifecycle Management with T-REX

Implement T-REX (Token for Regulated Exchanges) to ensure compliance throughout the lifecycle of the security tokens. This includes managing KYC checks, facilitating transfers, and automating corporate actions such as dividends and voting.

Step 6: Jurisdiction Considerations

Choose an appropriate jurisdiction for issuing security tokens based on its regulatory environment. Factors to consider include:

- Clarity of laws

- Regulatory bodies overseeing securities

- Compliance requirements for both issuer and investors

Step 7: Distribution Strategy

Decide on the method of revenue distribution (e.g., dividends, buybacks) and the frequency of these distributions (e.g., annually, quarterly).

Step 8: Legal Documentation

Prepare comprehensive legal documentation outlining rights associated with tokens, including shareholder rights and compliance with relevant regulations.

Step 9: Investor Jurisdiction Compliance

Ensure compliance with laws in jurisdictions where potential investors are located. This may involve adhering to specific regulations regarding private offerings or exemptions based on investor qualifications.

Futuristic Perspective

While tokenizing securities offers a promising alternative to traditional listings in specific cases, it’s not a one-size-fits-all solution. The success of tokenization depends on a company’s unique characteristics, asset types, and the regulatory landscape. Companies must conduct in-depth research to determine whether tokenization aligns with their objectives and whether the necessary investments in technology, legal frameworks, and cybersecurity are feasible. The decision to tokenize or stick with traditional listings should be rooted in a careful assessment of business needs. As technology evolves and regulations adapt, tokenization’s role in reshaping financial markets will become clearer, enabling more strategic decisions.

Build a Tokenized Securities Platform with Antier

Antier provides end-to-end Decentralized Tokenized Securities Platform solutions, enabling capital investments for the issuers. Collaborate with Blockchain experts to build a secure transparent and efficient Tokenization ecosystem that opens up new revenue opportunities through tokenized securities.

Unlock liquidity, while offering investors more accessible, fractionalized ownership opportunities. Antier’s customizable solutions are tailored to meet regulatory compliance and industry standards, ensuring a seamless experience.

Drive Innovation with Finance building Tokenized Securities Solutions.