Global businesses are rethinking how they pay people. The combination of distributed workforces, the need for faster settlements, and pressure to reduce treasury costs makes payroll a prime target for innovation. Stablecoin-native on-chain payroll combines the price stability enterprises expect with the speed and programmability of blockchains. For crypto neo-banks and enterprises exploring Web3 treasury design, this is not a novelty. It is a strategic capability.

This article is written for fintech leaders, treasury heads, neo-banking product owners, and CTOs evaluating practical paths to scale payroll for global teams.

Why Does This Matter Now?

- Remote and distributed teams are the norm in Web3 and in many modern tech firms. Payroll complexity has increased accordingly.

- Stablecoins have matured as an operational instrument for treasury and payments. They offer near-instant settlement and are widely supported across blockchains and custodial rails.

- Crypto-friendly neo-banking platforms that integrate stablecoin rails can offer 24/7 settlement, predictable costs, and programmable payroll features that legacy banks cannot match.

Market Signals & Enterprise Adoption

- Growing stablecoin transaction volume shows the rails are increasingly used beyond trading.

- Payroll and remittance pilots by vendors and neo-banks show the economic case is real.

- Large enterprises and payroll platforms are experimenting with hybrid fiat and stablecoin flows to give employees conversion flexibility.

What is Stablecoin-Native On-Chain Payroll?

Stablecoin-native on-chain payroll is a payroll system where salaries, contractor fees, and benefits are issued, routed, and settled using stablecoins on blockchain networks. It combines price-stable digital currencies pegged to fiat with smart contracts that automate payment schedules, tax withholdings, conditional releases, and reconciliation. For employers, it delivers near-instant settlement across borders, lower transaction costs for micro-payments, and transparent, auditable payment trails; for employees, it offers faster access to funds and optional conversion to local fiat through integrated payment rails. Implementations vary from fully native stablecoin payroll to hybrid models that auto-convert to local currency and require robust liquidity, compliant KYC/AML flows, secure wallet custody options, and audited smart contract logic to manage risk and regulatory compliance.

Did You Know?

The stablecoin on-chain payroll integration into neo banking app reduces fees by up to 90% compared to traditional systems and enhances security with on-chain transparency.

The Pain Points in Traditional Payroll & Banking for Global Teams

- Slow settlement and long float – Traditional cross-border payroll can take days. Funds spend time in correspondent banking rails. For enterprises, this creates float issues and cash flow friction.

- High cost and FX spreads – Multiple intermediaries and conversion steps increase costs. Small payments to contractors or gig workers become uneconomical.

- Complex reconciliation – Different systems, timezone delays, and opaque fees make reconciliation manual and expensive.

- Limited access for the underbanked – In many markets, staff do not have access to reliable banking rails. Crypto-compatible approaches can expand access.

- Lack of programmability – Legacy payroll systems cannot natively implement conditional payouts, automated vesting, or micro‑payouts without custom work.

Why Integrate Stablecoin On-Chain Payroll Into Crypto Neo-Banking App?

- Predictable value- Stablecoins pegged to fiat or other assets, which preserves employee purchasing power relative to volatile cryptocurrencies.

- Near-instant settlement and 24/7 rails- On-chain transfers settle quickly and operate outside traditional banking hours. This reduces payroll friction, especially across time zones.

- Lower cost for micro- and cross-border payments- Stablecoin rails remove many intermediaries. For enterprises with many small payments, the savings add up quickly.

- Programmability and automation- Smart contracts let you automate recurring payroll, conditional releases, tax withholdings, and vesting in a reliable way.

- Improved auditability and transparency- On-chain records make it easier to reconcile payments and produce auditable trails for finance and compliance.

However, if you are willing to overcome these pain points quicker and enter the market faster, then the fastest path is launching a white-label crypto neo bank app. You can acquire the advantages and overcome the challenges in just a short span of time with less risk and investment too.

How Does the Stablecoin On-Chain Payroll Work in the Neo Banking App?

Step 1: Employer funds the payroll wallet in fiat or stablecoin via bank transfer or on-ramp.

Step 2: Treasury converts/allocates liquidity (if needed) into the chosen stablecoin and funds the payroll smart contract.

Step 3: Smart contract executes scheduled payments to employee wallets (or contractor addresses).

Step 4: Employees receive stablecoins instantly in their neo-bank wallets and can either hold them, convert them to local fiat inside the app, or use a linked card.

Step 5: The system generates automated accounting entries, tax reports, and on-chain and off-chain reconciliation files for finance teams.

Now, that we have understood that how does a stablecoin on-chain payroll work in neo-banking platforms, we must now scroll through the blog to clearly understand the real-world applications of the same

Talk To Our Experts To Develop a Stablecoin-Enabled Neo Banking App!

Use Cases Of Stablecoin On-Chain Payroll Into Crypto Neo Banking

- Web3 companies with global teams- Pay remote engineers and contributors instantly on stablecoin rails via your crypto neo-bank, cutting treasury overhead and eliminating cross-border bank delays.

- Marketplaces and gig platforms- Enable immediate micro-payouts to sellers and service providers through programmable stablecoin payouts, reducing fees and improving seller retention via instant liquidity.

- Subsidiaries in high-friction markets- Use stablecoins as an internal settlement layer inside the neo-bank stack to settle intercompany balances quickly, then convert to local fiat for final employee disbursement when needed.

- Cross-border remittances for payroll- Reduce transfer costs and settlement time by routing payroll through stablecoin payment rails offered by neo-banks, avoiding multiple correspondent bank hops and long hold times.

- Payroll-linked benefits and automation- Deliver automated savings, split payments, deferred vesting, and benefit disbursements as smart-contract features embedded in payroll flows, all managed through the neo-bank’s wallet and treasury tools.

- Emergency liquidity & advance pay- Offer employees instant access to earned wages or emergency advances as stablecoin transfers inside the neo-bank app, with programmable repayment schedules and minimal friction.

Neo Banking App Development Risks & How to Mitigate Them?

- Regulatory uncertainty: Maintain a clear compliance roadmap and partner with licensed custodians and compliance providers with built-in KYC/AML and automated review controls.

- Liquidity and reserve risk: Partner with a reputable blockchain development company, run reserve stress tests, and provide automated fiat fallback rails.

- Smart contract & blockchain risk: Use third-party audits, staged testing, runtime monitoring, upgradeable patterns, circuit breakers, and insurance/bug bounties.

- Employee acceptance: Offer instant fiat conversion, simple UX, step-by-step onboarding, and optional fiat payout paths with 24/7 support.

- Tax & labor law complexity: Localize payroll modules for jurisdictional withholding/reporting and embed exportable tax reports while consulting local payroll advisors.

Each of these risks is manageable but requires domain experience across compliance, treasury, smart-contract engineering, and UX. Partnering with an experienced crypto neo-bank app development company is the most effective way to mitigate development and operational risks—bringing tested architecture, regulatory know-how, liquidity relationships, and change-management practices that accelerate safe, compliant rollout.

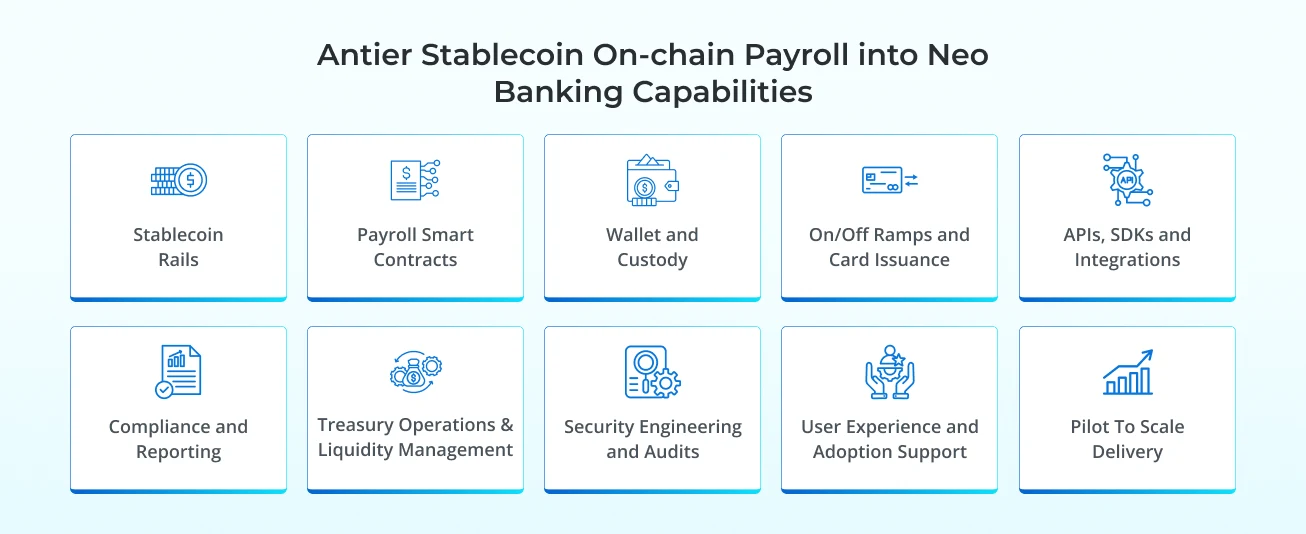

Capabilities Package: What Can Antier Do for You?

High-Level Deliverable

Antier delivers an end-to-end stablecoin on-chain payroll capability embedded into a crypto neo-banking platform. Employers can fund payroll in fiat or stablecoin, schedule programmable on-chain payouts, and give employees instant access to funds in secure wallets, with seamless fiat conversion, tax reporting, and reconciliation.

Outcome

Faster settlement, lower treasury costs, and automated payroll workflows that legacy systems cannot match.

Core Capabilities

- Stablecoin rails- Antier integrates institutional-grade stablecoins across preferred chains and layer-2 networks and manages liquidity partnerships and reserve policies.

- Payroll smart contracts- The firm designs, audits, and deploys upgradeable smart contracts for recurring pay runs, splits, withholding, conditional releases, and emergency pause controls.

- Wallet and custody- Our team implements enterprise custody using multi-sig and HSM solutions and provides both custodial and non-custodial user wallet options within the neo-bank application.

- On/off ramps and card issuance- Antier connects fiat rails and payment processors and supports card programs so employees can convert or spend locally without friction.

- APIs, SDKs and integrations- We supply developer-grade REST and webhook APIs and SDKs to integrate payroll with HRIS, ERP, accounting, and treasury systems for complete automation.

- Compliance and reporting- The team embeds KYC and AML onboarding, transaction monitoring, withholding logic, and exportable audit trails aligned with jurisdictional requirements.

- Treasury operations and liquidity management- Antier operates conversion engines, enforces reserve management, and provides failover fiat rails so payroll runs reliably under liquidity stress.

- Security engineering and audits- We enforce security best practices through third-party contract audits, runtime monitoring, circuit breakers, HSM key management, and incident response playbooks.

- User experience and adoption support- As a renowned BaaS development company, we design simple employee flows for instant conversion, card spending, and support, and we deliver onboarding materials and change management to drive adoption.

- Pilot to scale delivery- Antier runs targeted pilots for contractors or single geographies, measures key performance indicators, and iterates with finance and compliance teams to scale safely.

Why partner with Antier?

Antier combines payments, treasury, and blockchain engineering with payroll compliance and UX expertise. Partnering with Antier accelerates time to market, reduces delivery risk, and provides a production-ready stablecoin payroll stack for organizations seeking modern, programmable payroll for distributed workforces.

Conclusion

Stablecoin-native on-chain payroll into a neobanking app is not a speculative idea. It is an operational improvement that solves concrete problems in settlement speed, cost, automation, and access. For crypto fintech institutions and enterprises, offering or adopting stablecoin payroll is a strategic move that can reduce treasury friction, improve employee experience, and unlock new product capabilities.

Partnering with Antier, a pioneer in crypto neo-banking development that also holds expertise in stablecoin creation, ensures seamless integration, enterprise-grade compliance, and technical precision. Our deep Web3 expertise and proven delivery frameworks enable businesses to confidently transform payroll operations, mitigate risks, and scale globally with efficiency and trust.