Running a business? Still making million-dollar decisions based on the reports of the last quarter? Is your organization simply following the market trends instead of anticipating the changes? If so, you’re already falling behind.

In the current dynamic business environment, the key differentiators are speed and accuracy in decision-making. Companies that are still relying on conventional business intelligence tools, static dashboards, lagging indicators, and intuitive forecasting are being left behind by those who have already adopted Enterprise Predictive Analytics Services and Artificial Intelligence-Powered Decision Intelligence. The gap between reactive and predictive companies is no longer operational; it’s existential.

As McKinsey suggests, companies that leverage data and analytics at scale are 23 times more likely to acquire customers, 6 times more likely to retain them, and 19 times more likely to turn a profit.

However, the truth is that the majority of companies are struggling to move past the basics of reporting. The data exists. The technology exists. What’s missing, for most organizations, is a clear strategy to harness it.

Let’s unpack how predictive analytics and decision intelligence are rewriting the rules of business performance and what industry leaders already know that most businesses are still figuring out.

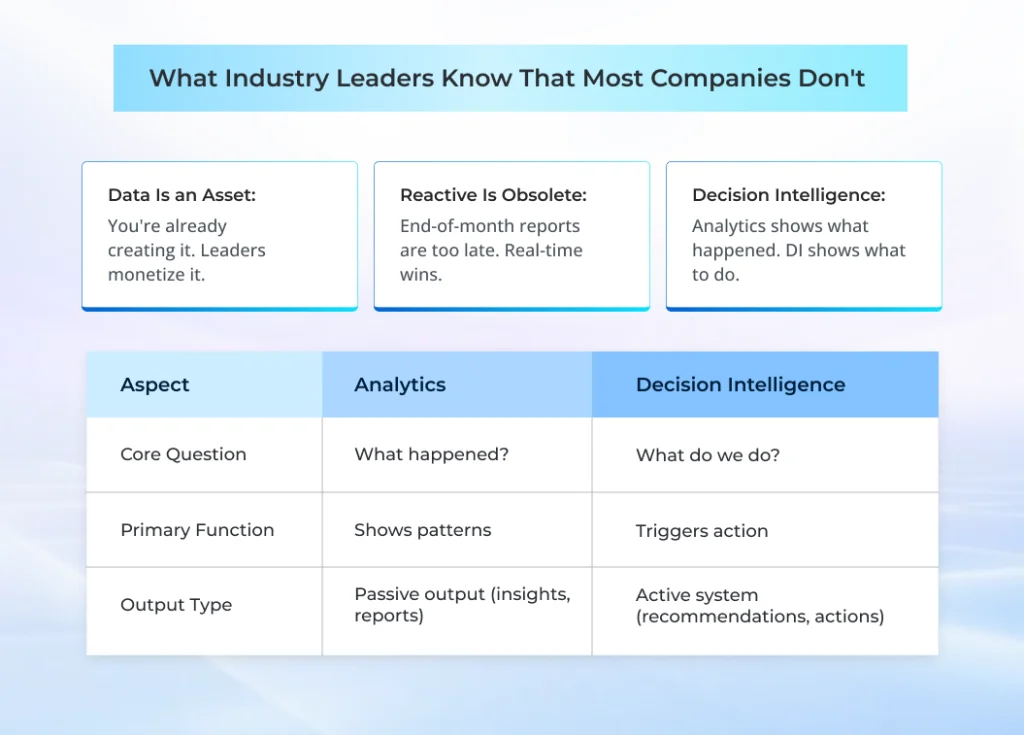

What Industry Leaders Know About Predictive Analytics That Most Businesses Don’t

The myth is that predictive analytics is a technology for business giants and Fortune 500 companies, that the cost of entry is too high, the infrastructure too complex, and the ROI too uncertain. This myth has long been debunked by industry leaders.

| Aspect | Analytics | Decision Intelligence |

|---|---|---|

| Core Question | What happened? | What do we do? |

| Primary Function | Shows patterns | Triggers action |

| Output Type | Passive output (insights, reports) | Active system (recommendations, actions) |

This is what they know that most mid-sized and growing companies don’t:

1. Data Is an Asset, Not a Byproduct

Most companies create massive amounts of data that are associated with transactions, operations, customer interactions, and supply chains. They view it as a byproduct, not as a strategic asset. Industry leaders, on the other hand, invest in Enterprise Predictive Analytics Services because they know that structured data in real-time is the raw material of competitive advantage.

Amazon, for instance, uses predictive analytics to predict demand and pre-position inventory before customers even click the “buy” button. It’s not just about operational efficiency; it’s a completely different philosophy about what data is for.

2. Reactive Intelligence Is Already Obsolete

The days of waiting for the end-of-month report to gain insight into business performance are now behind us. AI-Powered Decision Intelligence enables leaders to know what will happen and why, before it happens. This includes churn prediction, demand forecasting, fraud detection, and risk analysis, all in real-time.

A global logistics company that implemented an AI-Powered Decision Intelligence solution was able to reduce freight delays by 34% in one year, not by hiring more people or more trucks, but through predictive route optimization and demand analysis.

“The goal is to turn data into information, and information into insight.” — Carly Fiorina, Former CEO of Hewlett-Packard

3. Consulting Expertise Is the Bridge Between Data and Decisions

Outcomes cannot be achieved through technology alone. The leaders who have been able to unlock real value from predictive analytics always emphasize the importance of Predictive Analytics Consulting Services in their success stories. These consultants not only focus on the implementation of technology but also ensure that predictive analytics are linked with the business key performance indicators, and the outputs from algorithms are converted into decisions that are at the executive level.

Most analytics projects get stuck at the “proof of concept” stage.

4. Decision Intelligence Is a Layer Above Analytics

Here’s the key difference that most companies get wrong: Analytics shows you what has happened and what could happen. Decision Intelligence shows you what to do about it. A Decision Intelligence Platform for Business combines predictive analytics with business rules, business processes, and human expertise – building a closed-loop system that automatically acts on insights.

A financial services company with a Decision Intelligence Platform for Business can automatically identify high-risk loan applications, send them to the correct underwriters, and change credit policies in real-time.

5. The ROI Is Real But It Requires the Right Foundation

According to Gartner research, for large companies with annual revenues of $1 billion or more, the average return on investment for emerging technologies in 2023 was 20x (or 2000%) in 2023, primarily due to AI and analytics, as reported in 2024.

However, such ROI is not achieved instantly or by chance. The leadership is well aware that the underlying structure, such as clean data, strong infrastructure, scalable models, and sound interpretation of results, is of prime importance.

Those companies that perceive analytics as a one-time function, rather than an operational capability, are likely to be less successful than companies that perceive it as an operational function.

Make faster strategic decisions with AI-powered decision intelligence services from Antier

The Science Behind Better Business Outcomes: Predictive Analytics & Decision Intelligence

Understanding the mechanics that drive the predictive analytics and decision intelligence processes will help to clarify these technologies for leaders who are skeptical or overwhelmed by them.

How Enterprise Predictive Analytics Services Actually Work

The architecture is not as mysterious as the vendors claim. Enterprise Predictive Analytics Services begin with data, structured input from your CRM, ERP, and supply chain systems, as well as external data such as market data, economic data, and sometimes unstructured data such as customer feedback or web behavior. This data is cleaned and integrated into statistical and machine learning models that are trained to find patterns that would never be detected by human analysts.

What comes out the other side looks like:

- A probability score telling you which customers are most likely to churn in the next 30 days and why.

- A demand forecast accurate enough to adjust inventory by SKU and region three months out.

- A risk flag surfacing a supplier that’s showing early signs of financial distress before your procurement team has noticed.

- A scenario model showing what a 7% price increase would do to volume across your top five customer segments.

None of this is theoretical. These are outputs that enterprise teams are using to make real decisions today.

What Makes a Decision Intelligence Platform for Business Different

A lot of companies have analytics. Fewer have decision intelligence. The difference is what happens after the prediction is made.

A Decision Intelligence Platform for Business doesn’t just point to an insight, it links that insight to a particular decision, sends it to the right person or system, and tracks what happens when it’s implemented (or not). Over time, the platform learns which suggestions are being accepted, which are being overridden, and what the outcomes were. That’s the feedback loop that makes AI-Powered Decision Intelligence truly different from a dashboard with better charts.

How does it work?

A dashboard tells your supply chain manager that inventory is low. A Decision Intelligence Platform for Business tells them what to buy, from whom, at what price, based on current lead times and demand forecasts, and alerts it for approval or automatically implements it, depending on the dollar amount.

Advanced Analytics Services for Enterprises: Where It Works Across Industries

Advanced Analytics Services for Enterprises have a set of diverse capabilities applied differently, depending on the business. Here’s what that looks like in practice across a few verticals:

1. Financial Services

Banks using AI-Powered Decision Intelligence for credit underwriting have moved beyond static FICO scores to real-time models that factor in hundreds of behavioral and contextual signals. As a result, default rates went down 20–30% in documented cases, and credit was extended more accurately to customers who would have been declined by legacy models. Fraud detection teams are catching anomalies in milliseconds rather than reviewing flagged transactions the next morning.

2. Retail and eCommerce

Retailers applying Advanced Analytics Services for Enterprises to markdown optimization have reduced inventory carrying costs by 15–25% while improving margin recovery on aged stock. Customer lifetime value models are helping merchants stop spending acquisition budgets on customers who won’t return, and start investing in the ones who will often get back, by enabling personalized offers for each segment’s actual price sensitivity.

3. Manufacturing and Supply Chain

Predictive maintenance is probably the most well-documented manufacturing use case, with unplanned downtime reductions of up to 50% when implemented well. However, supply chain disruption modeling, which became a survival skill during the pandemic, is now a standard application of Enterprise Predictive Analytics Services in industrial environments. Knowing three weeks early that a key supplier is at risk gives procurement teams options. Finding out when the shipment doesn’t arrive gives them nothing.

4. Healthcare and Life Sciences

Healthcare systems employing predictive models to identify patients eligible for high-risk readmission have been able to focus post-discharge follow-through efforts on those who can significantly lower 30-day readmission rates. For the pharmaceutical industry, predictive models for clinical trial site selection are reducing the time and expense of getting products to market by identifying the most likely sites for on-time and successful recruitment.

What Predictive Analytics Consulting Services Actually Deliver

When companies engage Predictive Analytics Consulting Services, the deliverable isn’t a model. It’s a working capability that is part of the business. That usually means that there are a few different stages that you have to go through: understanding the current state of the data environment and where the actual gaps are, finding use cases that have the best ROI-to-effort ratio, developing and testing models that can withstand exposure to the actual production data, integrating those models into the systems that your teams are actually using, and then implementing governance to make sure that the models are correct as the world changes.

The change management component is the part that most technical vendors tend to underestimate. A model that frontline managers don’t trust or don’t know how to use . It is just an expensive science project. Getting adoption means explaining the output in plain language, giving people a way to flag when something feels off, and demonstrating over time that the model’s track record justifies the trust being asked of them.

Turn enterprise data into actionable insights with AI-powered decision intelligence today

Building a Scalable Advanced Analytics Services for Enterprises Foundation

Enterprises that get sustained value from Advanced Analytics Services for Enterprises don’t build one model and call it done. They build a platform, a unified data layer that all models draw from, a registry that tracks what’s deployed and when it was last validated, an environment where new use cases can be tested before they go live, and deployment infrastructure that makes updating a model straightforward rather than a months-long IT project.

The Decision Intelligence Platform for Business layer that sits on top of all this needs to do one thing exceptionally well, and that is to make it easy for the business to understand why a recommendation was made. In regulated industries, especially banking, insurance, and healthcare, explainability isn’t a nice-to-have. Regulators expect it. Compliance teams require it. Frankly, business leaders shouldn’t be comfortable acting on recommendations they can’t interrogate.

The ROI Conversation: What CFOs Actually Want to Hear

The global decision intelligence market is expected to climb from USD 17.7 billion in 2025 to approximately USD 72.3 billion by 2034, at a 16.9% CAGR.

The most effective AI-Powered Decision Intelligence solutions are built with measurement in mind from day one, with baseline metrics set up before deployment, decision influence tracked, and outcome data collected automatically so that the ROI discussion is always based on actual numbers, not forecasts.

Wrapping Up

The businesses that are pulling away from their competition right now aren’t necessarily smarter or better funded. Many of them simply made the decision earlier to stop operating in the dark. They invested in Enterprise Predictive Analytics Services when it felt premature. They built their Decision Intelligence Platform for Business before they fully understood how they’d use it. Now, they’re operating with a visibility and speed advantage that is genuinely difficult for later movers to close.

You don’t need to have solved your data challenges before starting this journey. You don’t need a perfect data warehouse or a team of in-house data scientists already on payroll.

That’s what Antier does. Our Advanced Analytics Services for Enterprises are built around your specific business context, not a generic platform deployed out of the box. We’ve worked across financial services, retail, healthcare, and manufacturing to help enterprise teams move from fragmented data to decisions they can trust.

If there’s a decision your business is making today that you’re not fully confident in pricing,