AI Summary

- Summary:

The global remittance market faces challenges like delays, fraud, and inefficiencies, impacting businesses and employees. - Visa's report highlights these issues, revealing financial stress and errors in payroll.

- To address these challenges, stablecoin remittance emerges as a modern solution offering faster, cheaper, and fraud-resistant transactions.

- By leveraging blockchain technology, stablecoins enable instant settlement, global availability, cost efficiency, transparency, and financial inclusion.

- Traditional remittance models are failing modern businesses due to high fees and inefficiencies.

The $905 billion global remittance market powers international payments, yet inefficiency, fraud, and delays continue to hold businesses back. According to Visa’s 2025 Remittances Report, enterprises and employees face growing challenges in managing fast, accurate, and compliant cross-border payroll.

The Current Reality:

- 78% of employees feel financial stress due to delayed paychecks

- 38% of B2B transactions are delayed by five or more business days

- Nearly 8 in 10 workers struggle to manage expenses when payroll is late by a week

- 1 in 5 payroll contains errors, costing companies an average of $291 per correction

- 88% of organizations have encountered some form of payment fraud

These numbers reveal a system stretched thin by legacy rails, intermediaries, and compliance bottlenecks. For global enterprises, these issues extend beyond performance metrics. They challenge governance, weaken trust, and restrict control over cross-border payments. This is where stablecoin remittance steps in as a practical, future-ready solution. Stablecoins enable faster, cheaper, and fraud-resistant payroll transactions across borders by combining blockchain’s real-time settlement and auditability with fiat-backed stability.

In this blog, we’ll explore how a stablecoin-powered payroll remittance platform can solve these long-standing challenges and help businesses modernize their global payroll infrastructure.

Why Traditional Remittance Models Are Failing Modern Businesses

Cross-border payroll has long been a challenge for global enterprises. Traditional remittance systems, rooted in legacy banking infrastructure, are ill-equipped to handle the demands of today’s fast-paced, international workforce. These systems often involve multiple intermediaries, such as correspondent banks and payment processors, each adding layers of complexity and cost. The global cross-border payments market, valued at $212.55 billion in 2025, is projected to reach $484.6 billion by 2032, growing at a12.5% CAGR.

However, according to the World Bank, average global remittance fees remain around 6.49%, significantly higher than the 3% target set by the “Sustainable Development Goals”. In certain remittance corridors, fees can climb as high as 8.78%, with Sub-Saharan Africa standing out as the costliest region, charging around 8.4% for a $200 transfer.

The inefficiency of legacy systems is why many businesses are exploring stablecoin remittance as a modern solution. By leveraging blockchain technology, enterprises can streamline payments, reduce costs, and achieve faster settlement times.

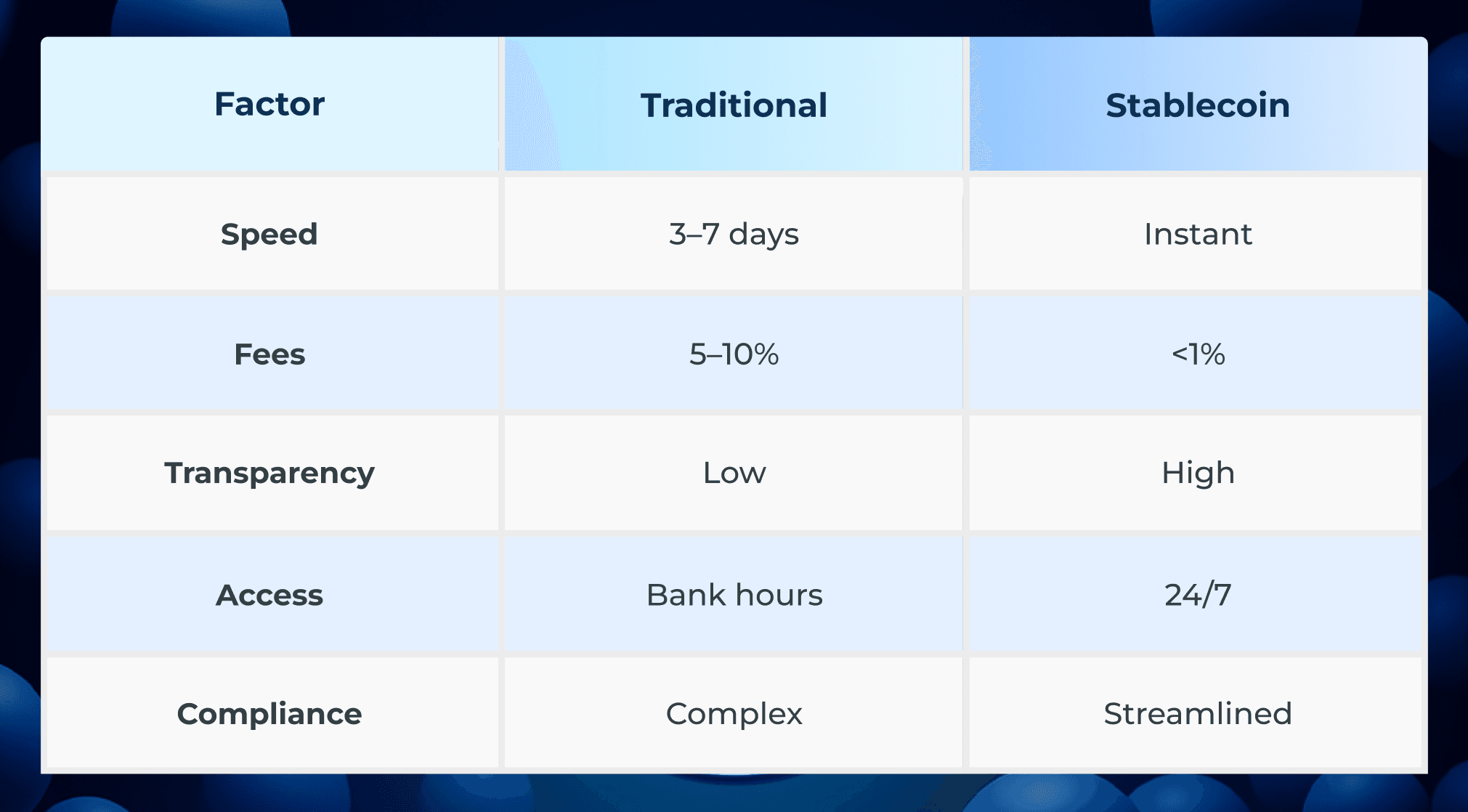

Here’s a clear comparison highlighting the gap between traditional payroll and blockchain-enabled solutions:

Modern businesses cannot afford to ignore these inefficiencies. With global teams becoming the norm, relying on traditional remittance models is not only costly but also strategically limiting. Enterprises that integrate stablecoin-based payroll systems are positioning themselves to achieve faster growth, operational efficiency, and better talent retention.

The Pain Points in Cross-Border Payroll

Global payroll is expensive, slow, and complex. Hidden fees, delays, and compliance challenges make traditional systems inefficient. This is why stablecoin remittance is gaining attention. Key pain points are summarized below.

What Makes Stablecoin Remittance a Game-Changer?

- Instant Settlement: Traditional international transfers take three to seven days. Stablecoin remittance delivers near-instant settlement. Salaries can be disbursed to employees within minutes, reducing cash flow pressure and eliminating the need to pre-fund accounts.

- 24/7 Global Availability: Banking hours limit traditional payments, but stablecoins operate continuously. Businesses can pay employees or vendors anytime, anywhere. A payment initiated in New York on Friday evening can settle instantly in Singapore, even during local weekends.

- Programmable Money: Smart contracts allow companies to embed rules and conditions into payments. A stablecoin remittance platform can automate payroll to release funds after timesheet approvals, KYC verification, or regulatory compliance checks.

- Cost Efficiency: Traditional cross-border payroll costs can reach five to ten percent per transaction. Stablecoins reduce this to under one percent. High-volume payroll operations can save millions annually while maintaining fast and reliable payments.

- Transparency and Auditability: All stablecoin transactions on a stablecoin remittance platform are recorded on blockchain, providing real-time visibility and an immutable audit trail. Finance teams can track payments instantly, reduce reconciliation errors, and minimize fraud risk.

- Financial Inclusion: Employees only need a digital wallet and internet access. Companies can pay talent globally without worrying about local banking infrastructure, making cross-border payroll accessible and efficient.

Explore how a custom stablecoin payroll solution fits your organization.

How Stablecoin-Powered Payroll Works

Global payroll no longer needs to wait on banks or intermediaries. A stablecoin remittance platform allows businesses to send payments quickly, securely, and efficiently.

- Setup & Onboarding: Employers create a corporate wallet and choose a stablecoin, usually USDC or USDT. Payroll platforms handle conversion, tax calculations, and payments. Employees set up digital wallets and consent to payment terms.

- Funding & Conversion: Fiat is converted to stablecoins via compliant exchanges. Payroll platforms calculate total salaries, including taxes.

- Smart Contract Execution: Contracts automate payroll by validating conditions, calculating deductions, and triggering payments. Transactions are immutably recorded on the blockchain.

- Payment Distribution: Transfers occur within minutes. Payments run 24/7, including weekends and holidays.

- Post-Payment & Compliance: Payroll reports and tax filings are generated from blockchain data. Employees can convert, spend, or earn yield on stablecoins. Full transparency and compliance are ensured.

Which Stablecoins Are Best Suited for Payroll?

Selecting the right stablecoin is critical for cross-border payroll and enterprise adoption.

- USDC by Circle remains the most trusted choice for global payroll. Fully backed by cash and U.S. Treasuries, audited monthly by Deloitte, MiCA-compliant, and supported across multiple blockchains, USDC dominates payroll with a 63% market share despite USDT’s higher trading volume. Its regulatory compliance, easy conversions, and broad acceptance make it ideal for enterprises.

- PYUSD by PayPal is suitable for U.S. enterprise payroll. Regulated by NY DFS and issued by Paxos, it offers monthly attestations and growing adoption, although European availability is limited due to MiCA regulations.

- EUROC (Circle Euro Coin) is the top choice for European payroll. MiCA-compliant and euro-denominated, it supports seamless payroll operations across the EU, with strong growth in adoption.

- USDG (Paxos Global Dollar) integrates with enterprise payroll platforms like Workday and ADP, making it a promising alternative for companies seeking flexibility.

For USD payroll, focus on USDC or PYUSD. For European operations, EUROC is optimal. FDUSD is not established for payroll and can be replaced with USDG where needed. Using a stablecoin remittance platform with these coins ensures cost-efficient, compliant, and fast payroll for global enterprises.

Discover how a white-label platform can streamline your cross-border payroll.

The Compliance and Regulatory Perspective

- Compliance is essential for any payroll operation, and enterprises often hesitate to adopt stablecoin remittance due to perceived regulatory risks.

- Regulatory frameworks like the EU’s MiCA, the U.S. STABLE Act, and Singapore’s Payment Services Act provide clear guidance for stablecoins in financial systems.

- Businesses can partner with licensed custodians, regulated exchanges, and compliant infrastructure providers to meet KYC, AML, and data protection standards for stablecoin remittance platforms.

- Adopting Stablecoin ensures compliance without compromise, as blockchain’s transparency offers a stronger audit trail than traditional wire systems.

The ROI of Switching to Stablecoin Payroll Systems

The benefits are tangible. On average, companies report:

- 60% reduction in transaction costs

- 3–5 days faster payroll processing

- Higher employee satisfaction in remote teams

- Full transparency in auditing and reporting

Traditional systems simply cannot match these efficiency levels. The cost savings alone justify the transition, especially for companies managing large international teams.

A well-built stablecoin remittance platform integrates with existing accounting systems, automates reporting, and provides compliance monitoring tools. The result is a modern, scalable, and financially efficient payroll ecosystem. If you are considering adopting stablecoin-powered payroll, it is essential to build a solution that suits your business needs. You can develop a custom stablecoin remittance platform for your payroll or opt for a white-label platform, which allows you to launch quickly with your branding and full functionality.

For a comprehensive guide on building, integrating, and scaling a stablecoin payroll system, here is the full detailed blog you can read.

Key Takeaways

The message is clear. The future of payroll belongs to businesses that move faster, pay smarter, and operate globally without friction. For enterprises that want to stay ahead, now is the time to act. Building a stablecoin-based payroll remittance platform helps you save costs, enhance trust, and create a seamless experience for your global workforce. If you are ready to modernize your cross-border payments, explore how a white-label stablecoin remittance platform can give you the speed, security, and compliance your business deserves.

To bring this vision to life, you need a trusted stablecoin remittance development company with deep expertise in blockchain, compliance, and enterprise-grade payment systems. Antier stands at the forefront of this innovation, helping businesses design and deploy scalable, regulation-ready remittance platforms that redefine how global payroll is managed. Partner with us to build your future-ready stablecoin remittance solution and set a new standard in payroll efficiency.

Frequently Asked Questions

01. What are the main challenges businesses face with traditional remittance systems?

Businesses face inefficiencies, fraud, and delays, with 78% of employees experiencing financial stress due to delayed paychecks and 38% of B2B transactions being delayed by five or more business days.

02. How can stablecoin remittance improve cross-border payroll?

Stablecoin remittance offers faster, cheaper, and fraud-resistant payroll transactions by utilizing blockchain technology for real-time settlement and auditability, addressing the inefficiencies of traditional systems.

03. What are the average fees for global remittances, and how do they compare to targets?

The average global remittance fees are around 6.49%, which is significantly higher than the 3% target set by the Sustainable Development Goals, with some regions charging as much as 8.78%.

04. Can Enterprises Legally Pay Salaries via Stablecoins?

Yes, many companies already use stablecoins for payroll. Typically, base salaries are paid in fiat while bonuses, commissions, and international contractor payments are made via stablecoins. This hybrid approach ensures compliance and gives employees flexibility, boosting satisfaction and retention.