Real estate represents the largest asset class on earth, valued at more than $300 trillion, larger than equities and bonds combined. Despite its enormous value, real estate is illiquid, exclusionary, and opaque. Access is often limited to ultra-wealthy investors, sovereign wealth funds, and institutional vehicles. Buying or selling property still involves stacks of paper, months of settlement time, and armies of intermediaries charging hefty fees.

This inefficiency leaves trillions in unrealized capital trapped in property markets.

Real Estate Tokenization Development changes that equation. By digitizing property rights into blockchain-based tokens, a process backed by legal structures and compliance mechanisms, tokenization promises to:

- Break down entry barriers.

- Unlock liquidity.

- Reduce reliance on intermediaries.

- Make real estate a truly global, tradeable, transparent investment class.

This guide provides a brief on Real Estate tokenization and how it works.

Illiquidity: The Billion-Dollar Roadblock Real-Estate Tokenization Finally Solves

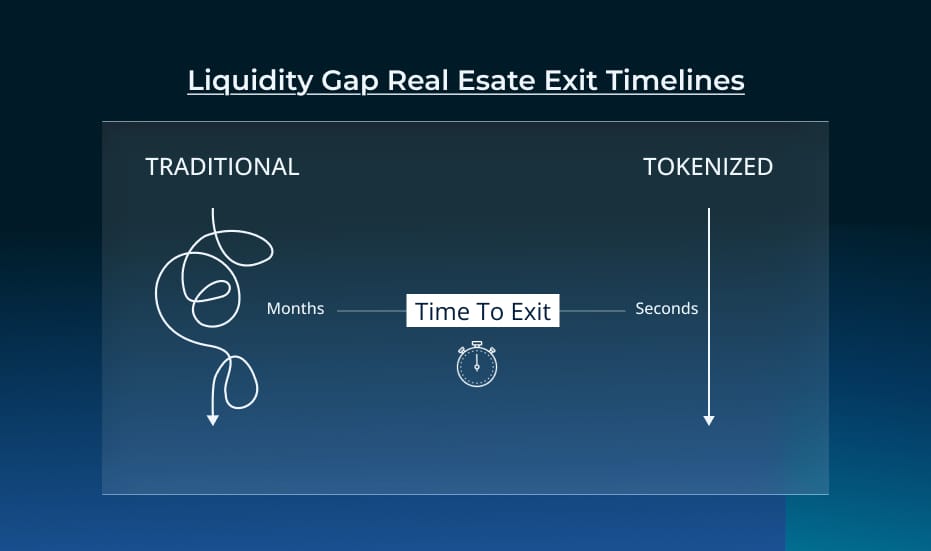

Real estate’s greatest strength is tangible, physical value, but also its greatest weakness. Unlike equities, investors cannot sell 1/1000th of an office tower in a few seconds. Transactions take weeks or months, often fall through, and incur 6–10% transaction costs.

The results are visible in market data:

- Global commercial property transaction volumes fell by 54% in 2023 due to macroeconomic headwinds.

- Private investors struggle to exit during downturns because buyers simply vanish.

- For developers, locked-up assets mean higher leverage and financing costs.

Tokenization creates secondary liquidity by fractionalizing assets into digital tokens that can be bought and sold on marketplaces, much like shares. While property remains inherently illiquid, the tokens representing ownership can trade instantly within compliant frameworks, giving investors flexibility and sponsors access to a broader pool of buyers.

Build a Scalable and Compliant Real Estate Tokenization Platform to Keep you Market-ready, globally!

From Paper to Protocol: How Real Estate Tokenization Platforms Transform Ownership

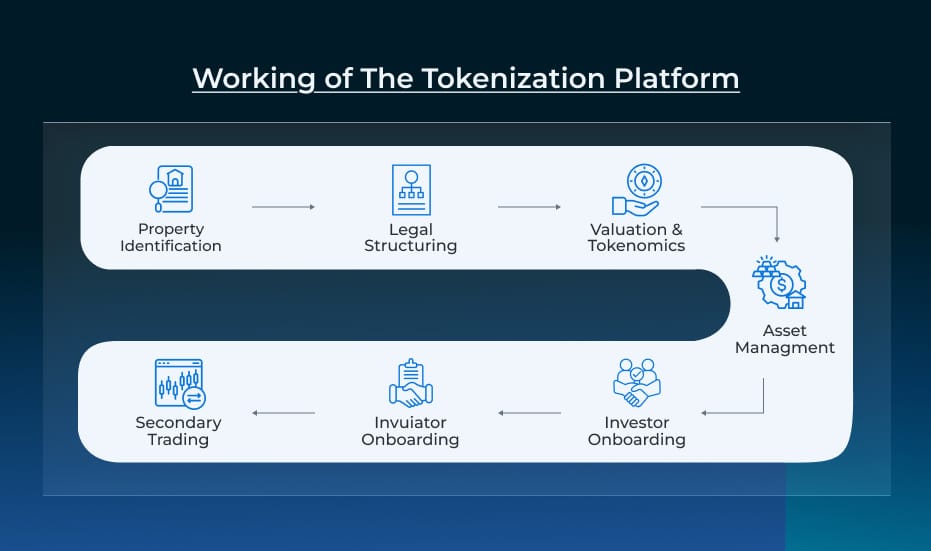

The Real Estate Tokenization Platform is a multi-layered architecture that bridges legal, financial, and technical domains. Here’s how a modern asset tokenization infrastructure works:

- Property Identification: Select suitable assets: income-generating, clear title, stable valuation.

- Legal Structuring: Create an SPV (LLC, trust, or REIT-like structure) that holds the property. Define token holder rights (equity, debt, hybrid).

- Valuation & Tokenomics: Independent valuation. Decide supply and pricing of tokens (e.g., 1M tokens at $10 each).

- Token Issuance: Smart contracts mint tokens using standards like ERC-1400 (security-compliant). Each token represents fractional ownership or cash-flow rights.

- Investor Onboarding: This involves KYC/AML checks, accreditation verification. Investors purchase tokens via fiat or stablecoins.

- Asset Management: Smart contracts automate rent distributions, dividends, or voting. Regular reports are made accessible through investor dashboards.

- Secondary Trading: Tokens listed on the platform’s built-in marketplace or integrated with ATS/exchanges. Transfer restrictions are embedded to comply with securities laws.

Governance & Redemption: Token holders can vote on key decisions. Exit options through buybacks, property sales, or token redemption.

Businesses That Can Leverage Real Estate Tokenization Platforms

Not every business is positioned to tokenize assets, but for those that are, the payoff is transformative. The strongest use cases lie at the intersection of capital-intensive industries and fragmented investor demand.

- Real Estate Developers: Instead of relying solely on bank loans or private equity, developers can raise funds through tokenized offerings. It reduces financing costs and opens projects to global investors.

- Real Estate Investment Trusts (REITs): REITs can complement their portfolios with tokenized fractions, giving retail investors a new way to access institutional-grade assets.

- Property Management Firms: Platforms automate dividend distribution, governance, and reporting, lowering admin costs and increasing client trust.

- Banks & Financial Institutions: White-label tokenization platforms allow banks to modernize custody, wealth products, and capital markets offerings.

- Family Offices & Funds: Tokenization enables cross-border diversification at speed and scale.

- Emerging Market Enterprises: In regions with underdeveloped capital markets, tokenization provides a compliant pathway to tap foreign capital.

Even non-traditional businesses can play co-working operators, student housing providers, and logistics park owners can tokenize their assets to unlock liquidity.

The unifying theme?

Any business sitting on illiquid, capital-heavy real estate can use tokenization platforms to monetize faster, raise smarter, and operate leaner.

How Real-Estate Tokenization Platforms Reward Both Users and Creators

The strength of a real estate tokenization platform is that it delivers tangible rewards to both sides of the ecosystem- investors and builders. Unlike traditional real estate structures that tilt in favor of a few, tokenization creates a balanced system where participation fuels growth for everyone involved.

For investors

- Accessibility replaces exclusivity. They no longer need deep pockets to gain exposure to premium properties. Fractional tokens allow them to participate with modest sums, while blockchain-backed ownership records eliminate the trust issues that plague traditional transactions.

- Liquidity becomes a reality. Investors are no longer locked into decade-long commitments. Tokenized shares can be traded on secondary markets, giving them the kind of exit options that real estate has historically denied.

- Transparency and trust take center stage. With every transaction recorded immutably, investors have a clear line of sight into ownership, valuations, and income distributions. This reduces reliance on intermediaries and builds confidence.

For builders and platform creators

- Capital raising gains a global dimension. Instead of depending solely on local banks or a handful of investors, issuers can tap into international markets and attract capital at scale.

- Revenue becomes recurring. Beyond the initial token issuance, platforms can earn from transaction fees, custody services, compliance modules, and secondary market activity, establishing multiple income streams.

- Regulatory integration builds credibility. Platforms that weave compliance into their core design become trusted infrastructure for institutional investors, who demand rigor before committing capital.

- Automation reduces friction. Smart contracts streamline operations from investor onboarding to income distribution, freeing builders to focus on scaling portfolios and expanding into new markets.

Thus, the Real-Estate tokenization platforms create a mutual advantage loop: the more investors engage, the more liquid and attractive the system becomes for issuers; the more issuers participate, the richer the investment landscape becomes for investors. It is this rare alignment of incentives that makes real estate tokenization not just a financial innovation, but a structural reset for the industry.

Legal Foundations Shaping the Future of Real-Estate Tokenization Platform Development

For a real estate tokenization platform, compliance is the structural core. Property law, securities frameworks, AML rules, and taxation regimes define whether a platform can scale or whether it will collapse under regulatory pressure. Platforms that embed compliance into their architecture gain resilience, credibility, and investor confidence.

United States: Securities Law as the Baseline

In the U.S., tokenized real estate is generally treated as a security. Pathways include Reg D (private placements for accredited investors), Reg A+ (mini public offerings capped at $75M), and Reg CF (crowdfunding up to $5M). To enable secondary trading, platforms must secure ATS licenses, placing them under Wall Street-grade oversight. The SEC has already intervened against projects lacking compliance, proving that regulation is not optional.

Europe and Luxembourg: Establishing Legal Certainty

The EU’s MiCA regulation clarifies treatment of crypto assets but leaves security tokens under national regimes. Among member states, Luxembourg has emerged as a preferred jurisdiction through Blockchain Law IV (2024), which allows securities to be issued directly on distributed ledgers. This gives tokenization platforms a compliant pathway for pan-European expansion.

Singapore and UAE: Regulatory Hubs for Global Launches

Singapore’s MAS framework offers licensing clarity alongside sandbox innovation, attracting Asia-Pacific tokenization projects. Similarly, the UAE’s ADGM and DIFC provide digital asset licenses, tax efficiency, and sandbox environments that make them attractive for cross-border issuance and trading.

India and Hong Kong: Gradual Openings in Asia

India has yet to issue nationwide laws, but GIFT City’s IFSCA sandbox pilots (e.g., Oryx) mark the beginning of regulated tokenization. Hong Kong, in contrast, has already introduced digital asset licensing, creating a regulated gateway for international projects, while mainland China remains highly restrictive.

For Businesses is the basis of trust. Platforms that prioritize regulatory alignment position themselves for institutional adoption, cross-border scalability, and long-term market relevance.

Know About the Tokenization Jurisdictions Around the World!

Building Blocks of a Real-Estate Tokenization Platform

A real estate tokenization platform is only as strong as its engineering backbone. While the front end may display clean dashboards, it’s the invisible architecture- token standards, smart contracts, custody, and compliance layers, that determine resilience, trust, and scalability.

Token Standards: Choosing the Right Foundation

ERC-20 remains the default for fungible assets, but it lacks compliance features. ERC-721 and ERC-1155 allow NFTs and hybrid structures, suitable for unique property slices. However, ERC-1400 is fast becoming the standard for tokenized securities: compliance-ready, modular, and programmable to enforce investor rights. Platforms built by any real estate tokenization development company must treat this as a strategic choice.

Smart Contracts: Automating the Rules of Trust

From distributing rental income to enforcing transfer restrictions, smart contracts are the “silent lawyers” of tokenization. They must be audited, upgradeable, and embedded with compliance logic. A single exploit can dismantle investor trust, a risk that only rigorous audits and emergency protocols can mitigate.

Custody and Cross-Chain Infrastructure

Liquidity depends on more than issuance. Platforms must integrate cross-chain bridges and Layer-2 protocols to reduce costs and broaden reach. Custody solutions, multi-sig wallets, HSM integration, and institutional custodians to ensure tokens and funds are not lost to technical failures.

Compliance Oracles and Investor Experience

Compliance doesn’t end at KYC forms. Leading platforms use compliance oracles that feed accreditation results into transfer rules, making compliance continuous. On the user side, investor dashboards must be intuitive, offering NAV tracking, yield visibility, and even auto-generated tax forms.

How To Generate Recurring Revenues with Real-Estate Tokenization Platform?

For a real estate tokenization company, the challenge is building a business model that endures. Tokenization platforms cannot survive as pilots or experiments; they must evolve into sustainable financial ecosystems with recurring revenues.

Multiple Streams, One Infrastructure

Successful platforms monetize across layers:

- Issuance fees (2–5% of capital raised) for structuring tokenized deals.

- Trading fees (0.25–1% per secondary market transaction) to capture liquidity value.

Custody and servicing subscriptions, covering SPV administration and reporting. - White-label licensing, where banks, REITs, or funds rent platform infrastructure as SaaS.

- Compliance and legal services, packaged as value-added support for issuers.

- Liquidity partnerships, where spreads from market-making add another layer of income.

Why Monetization Matters

Investors and institutions won’t trust platforms that appear “project-based.” A real estate tokenization development company must show that its platform not only facilitates issuance but generates predictable income over years. This makes the difference between being viewed as a technology vendor versus becoming part of the financial market’s permanent infrastructure.

Scaling Trust and Revenues Together

When platforms scale their revenue streams, they also scale investor trust. Recurring income from custody or compliance signals maturity; successful secondary markets attract more issuers; global licensing arrangements embed the platform into traditional finance.

Real-World Tokenization Platforms Setting Benchmark

- St. Regis Aspen Resort – A Luxury Proof of Concept

The St. Regis Aspen Resort became one of the first high-profile tokenized properties when Elevated Returns raised $18 million through equity tokens. It showed the world that luxury real estate could be fractionalized successfully. Yet it also highlighted a challenge: while issuance was smooth, secondary market liquidity lagged, reminding future platforms that trading infrastructure is as critical as token creation.

- Lofty – Bringing Everyday Investors Onboard

Lofty demonstrates the power of accessibility. By converting rental properties into $50 tokens on the Algorand blockchain, it enabled investors to participate with minimal capital. With over 7,000 active monthly users and DAO-style governance, Lofty is setting a new standard for real estate tokenization companies focused on democratization.

- MetaWealth – Institutional Compliance in Action

In 2025, MetaWealth partnered with One United Properties to tokenize €17.9 million in property-backed bonds under Luxembourg law. With a 19% targeted return, this initiative shows how aligning with compliant jurisdictions like Luxembourg strengthens investor trust and attracts institutional participation.

- Oryx Project – India’s Sandbox Experiment

India’s Oryx Project, launched under the GIFT City regulatory sandbox, marks one of the first regulated tokenized offerings in South Asia. It demonstrates how emerging economies can test tokenization within controlled environments before scaling to national frameworks.

Risk Architecture: How To Develop Real Estate Tokenization Platforms That Overcome Limitations?

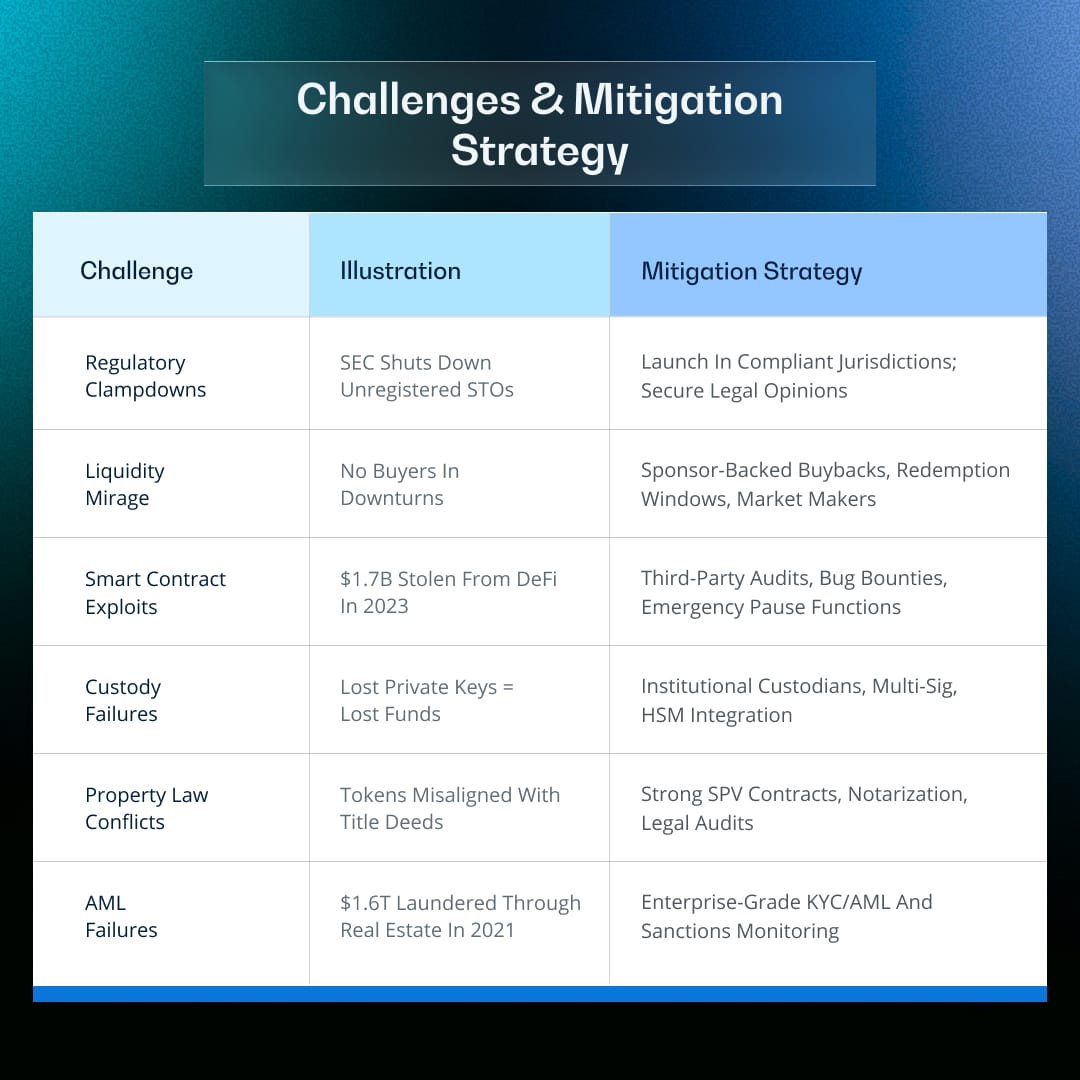

Every trillion-dollar opportunity carries its shadows. A real estate tokenization platform that ignores risk is building fragility. Success depends on anticipating and engineering safeguards into the system. Here are some common risks that platform encounter along with mitigation strategy:

Platforms that succeed are those that treat compliance, audits, and contingency planning as core features. A strong real estate tokenization development company understands that engineering resilience is its market entry.

The Road to 2035: Where Real Estate Tokenization is Heading

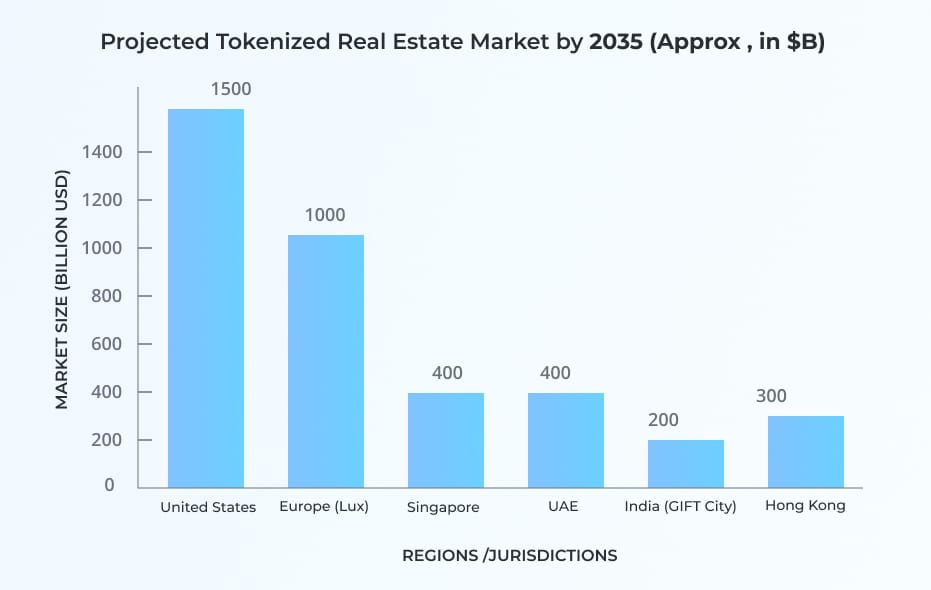

Analysts forecast $4 trillion in tokenized real estate by 2035, signaling that what is now niche infrastructure will become mainstream finance.

1. Institutional Adoption Is Accelerating

From BlackRock to Franklin Templeton, major asset managers are piloting tokenized real-world assets. For institutions, tokenization is efficient: real-time settlement, lower admin costs, and access to a broader investor base.

2. Integration with DeFi and AI

Future platforms will connect tokenized real estate to DeFi markets to enable collateralized lending, staking, and structured products. Layered with AI tools for automated valuations, predictive compliance, and fraud detection, platforms will move from being passive marketplaces to intelligent financial engines.

3. Community and Co-Ownership Models

By 2035, tokenization will also reshape ownership models. Residents could co-own local infrastructure or commercial projects, blurring the line between investor and stakeholder. Real estate will no longer be a fortress of exclusivity; it will be a networked asset class accessible at scale.

4. Not a Replacement, but a Parallel System

Tokenized real estate will not displace REITs or traditional property funds; it will sit alongside them, offering greater liquidity, inclusivity, and flexibility. The platforms that thrive will be those that balance compliance with innovation, appealing equally to regulators, institutions, and retail investors.

Launch Custom Real-Estate Tokenization Platform That Makes Property Instantly Tradeable!

Takeaway

History shows that revolutions rarely reward the asset holders; they reward the infrastructure builders. The migration of real estate into tokenized ecosystems is its inevitability. By 2035, trillions of dollars will flow through Real Estate Tokenization platforms, transforming how property is owned, traded, and financed.

Why Antier: From Development to Market Leadership

When businesses evaluate a real estate tokenization development company, need partners who can align compliance, technology, and market strategy. This is where Antier distinguishes itself.

- Compliance-First Engineering

Antier builds platforms with jurisdictional playbooks, securities-law alignment, and sandbox launch strategies. Instead of retrofitting compliance, it is embedded into the architecture, giving platforms legitimacy from day one.

- Technical Depth and Flexibility

From ERC-1400 issuance modules to institutional-grade custody and secondary marketplaces, Antier designs tokenization platforms as modular, scalable ecosystems. Clients move seamlessly from pilot projects to enterprise-scale rollouts.

- Global Partnerships and Ecosystem Access

Through its network of custodians, auditors, liquidity providers, and legal advisors, Antier ensures its platforms are not isolated technologies but part of the global capital ecosystem.

- Conversion-Oriented Delivery

For clients, success is measured not in prototypes, but in adoption. Antier delivers end-to-end real estate tokenization services that drive both capital raising and investor engagement.

With its blend of compliance-first strategy and deep technical expertise, Antier ensures its clients are builders of infrastructure.

Partner with Antier to design and launch the Real Estate Tokenization platform that will carry this transformation forward.

Frequently Asked Questions

01. What is real estate tokenization?

Real estate tokenization is the process of digitizing property rights into blockchain-based tokens, allowing for fractional ownership and increased liquidity in real estate investments.

02. How does tokenization improve liquidity in real estate?

Tokenization improves liquidity by allowing assets to be fractionalized into digital tokens that can be bought and sold on marketplaces, enabling faster transactions and access to a broader pool of investors.

03. What are the benefits of using a Real Estate Tokenization Platform?

A Real Estate Tokenization Platform streamlines ownership by bridging legal, financial, and technical domains, reducing reliance on intermediaries, lowering transaction costs, and enhancing transparency in real estate investments.