If you’ve been watching Web3 evolve, you’ll know that single-chain launches are starting to feel like flip phones in a smartphone era. Projects today don’t want to be locked into one ecosystem; they want liquidity, users, and integrations wherever they exist. That’s why multi-chain crypto coin development has moved from an “advanced feature” to a default expectation for serious launches in 2025.

One network standing out in this shift is Solana. With its ultra-low fees, high throughput, and a maturing bridge ecosystem, Solana bridges make it easier than ever to launch a token that isn’t chained to a single chain. In this guide, you’ll learn what multi-chain coins are, how Solana Bridges work, and a step-by-step plan to create your own cross-chain token in line.

What Exactly is a Multi-Chain Crypto Coin Development?

A multi-chain coin is a digital asset that can exist and move across multiple blockchains without losing its identity or value. Unlike a wrapped token that relies on a single “home” chain, a true multi-chain token can be minted or burned across different chains, with bridges and smart contracts maintaining supply synchronization.

Benefits include:

- Wider Liquidity: Tap into different DEXs and user bases.

- Resilience: Avoid relying on one chain’s uptime or fees.

- Composability: Integrate with diverse DeFi apps and wallets.

- User Convenience: Holders can transact where they already are.

This model suits projects that want to build sustainable ecosystems rather than temporary hype. It’s especially attractive for Web3 startups, DeFi protocols, and brands entering tokenization of real-world assets who need crypto coin development with serious reach.

From Tokenomics to Bridges, We Handle it All!

Solana Bridges: The Secret to Seamless Multi-Chain Crypto Coin Development

Solana already offers some of the fastest block times and lowest fees in the market — fractions of a cent per transaction. That’s critical for micro-rewards, on-chain gaming, or loyalty programs where gas costs can make crypto development economically unviable.

Bridges take this further. Solana’s emerging bridge infrastructure, from Wormhole to native Solana-Ethereum bridges, lets you:

- Mint tokens simultaneously on Solana and other chains, enabling smooth multi-chain crypto coin development.

- Lock and release assets across ecosystems without central custody, keeping supply synchronized and secure.

- Offer seamless user experiences where swaps feel native, reducing friction for holders and traders.

This means you can build a token once and have it circulated across Solana, Ethereum, BNB Chain, Polygon, and more, all while keeping supply balanced, secure, and fully integrated for real-world use cases.

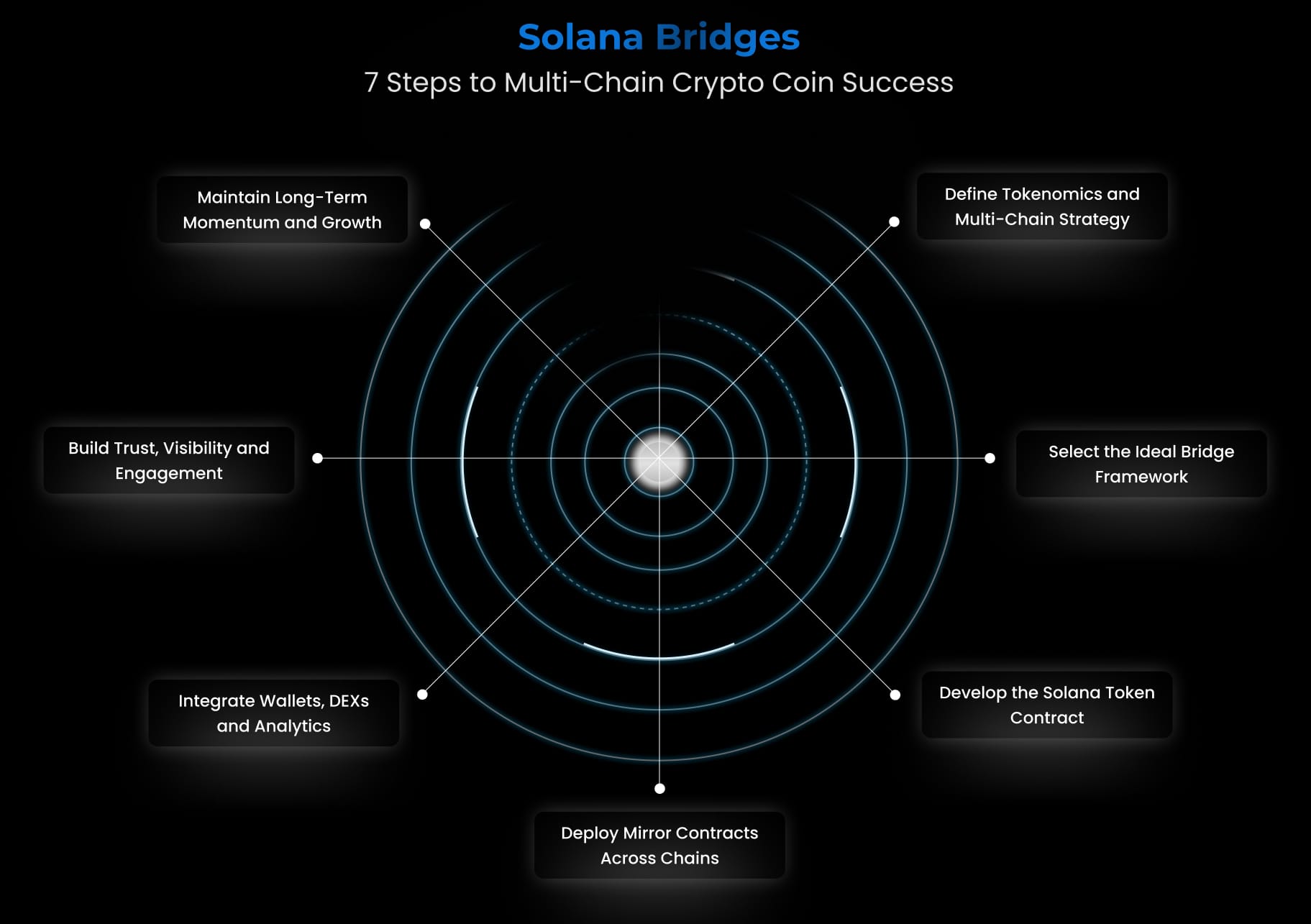

Step-by-Step: Creating a Multi-Chain Crypto Coin with Solana Bridges

Creating a multi-chain crypto coin with Solana Bridges isn’t just about launch; it’s about executing a clear plan at every stage. Below is a seven-step roadmap that provides a structured approach to design, deploy, and grow your project.

1. Define Tokenomics and Multi-Chain Strategy

- Decide how supply will be managed across chains (equal mint vs. canonical supply on Solana).

- Establish cross-chain burn/mint verification rules for crypto development.

- Map user liquidity preferences to choose which chains to bridge first.

2. Select the Ideal Bridge Framework

- Compare options such as Wormhole, Portal Bridge, native chain bridges, or a custom solution.

- Evaluate security audits, SDK/APIs, cost per transfer, and speed for multi-chain development.

3. Develop the Solana Token Contract

- Use the SPL Token Program to create your token, set decimals, freeze authority, and initial supply.

- Integrate bridging logic for locking, minting, and burning.

- Build with Rust or the Anchor Framework and document functions clearly.

4. Deploy Mirror Contracts Across Chains

- Launch ERC-20 or equivalent contracts on Ethereum, BNB Chain, Polygon, etc.

- Set permissions for bridge contracts to mint/burn in a multi-chain crypto coin development setup.

- Test cross-chain transactions on testnets first.

- Provide verified contract addresses publicly (Etherscan, Solscan).

5. Integrate Wallets, DEXs, and Analytics

- Ensure support across wallets like Phantom, MetaMask, and Trust Wallet.

- List on DEXs such as Raydium, Orca, Uniswap, PancakeSwap for crypto tokens.

- Add analytics dashboards (Solscan, Dune, or custom explorers).

- Keep bridging UX simple and jargon-free.

6. Build Trust, Visibility, and Engagement

- Publish audits, test results, team credentials, and economic models.

- Answer questions on Reddit, Quora, and developer forums.

- Release explainer videos with timestamps for your multi-chain crypto development project.

- Create evergreen FAQ and comparison pages.

- Use interactive calculators, partner landing pages, and case studies to convert interest into action.

7. Maintain Long-Term Momentum and Growth

- Plan quarterly updates to tokenomics, bridge contracts, and documentation to keep the project current.

- Monitor key metrics like bridge volume and active wallets while running AMAs and announcements on X and Telegram.

- Reserve funds for audits, partnerships, and new chain integrations to sustain growth.

Your Cross-Chain Advantage Begins with a Conversation

Common Pitfalls to Avoid

- Overcomplicating the Bridge UX – Extra steps or unclear interfaces can frustrate users and reduce adoption in your crypto development project.

- Neglecting Security Audits – Cross-chain exploits can be costly and highly visible. Always audit smart contracts and bridge integrations for safe crypto coin development.

- Ignoring Tokenomics Planning – Misaligned supply or liquidity across chains can cause instability. Define clear rules for minting, burning, and distribution in crypto coin development.

- Spreading Liquidity Too Thin – Launching on too many chains at once may dilute user activity. Start with 2–3 key chains for effective crypto coin development.

- Skipping Analytics & Monitoring – Without proper tracking, you won’t know which chains, wallets, or bridges are performing best. Set up dashboards for crypto coin development insights.

- Failing to Engage the Community – Lack of communication leads to low adoption and trust. Keep users informed through AMAs, updates, and social channels to support crypto coin development.

- Post-Launch Neglect – Launch is not the finish line. Schedule updates, refresh content, and iterate to maintain momentum in crypto coin development.

Partner with a trusted coin development company to avoid these pitfalls and ensure your multi-chain token project is secure, scalable, and successful.

Conclusion: Build Once, Launch Everywhere

In 2025, “multi-chain” is no longer optional. It is the baseline for ambitious projects. Solana’s speed, cost efficiency, and bridge ecosystem make it one of the best platforms for crypto development aimed at mainstream users.

Partnering with Antier, a leading crypto development company, ensures your multi-chain token is built with robust architecture, secure bridges, and seamless wallet integrations. Our expertise in cryptocurrency development can help you navigate the technical complexities while keeping your project scalable and future ready.