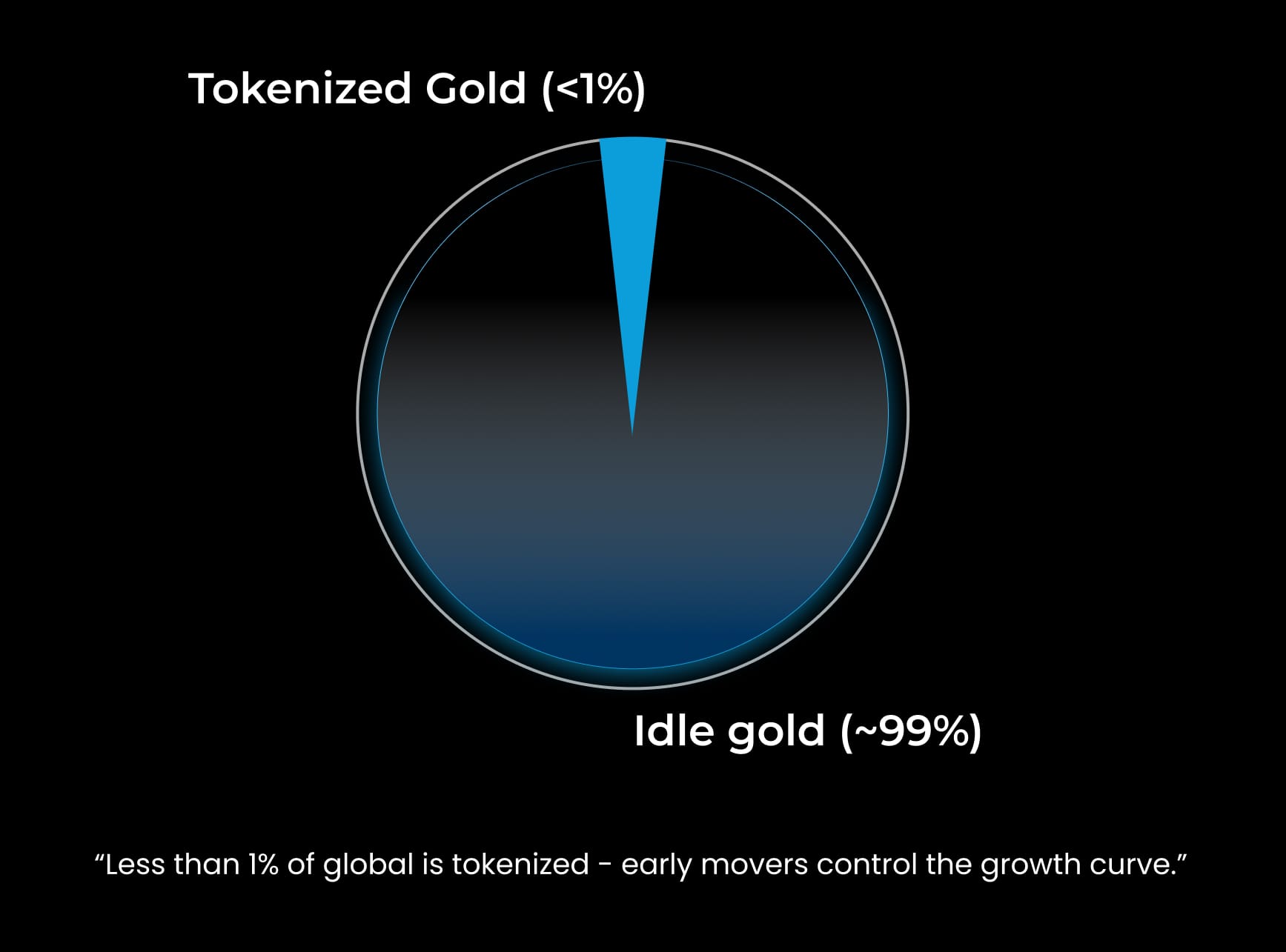

Gold tokenization platform development is modernizing access to a $15 trillion asset class that has historically remained idle in vaults, used only for storage or limited trading. In 2025, momentum accelerated: SmartGold demonstrated IRA holdings could enter DeFi while retaining tax benefits, and the World Gold Council’s PGI framework introduced a compliant path for institutional adoption. With spot prices breaking $3,600/oz, global demand for efficient, scalable, and regulated infrastructure is stronger than ever. Institutions and innovators that want to capture this market must build systems that are secure, compliant, and a scalable Gold Tokenization platform capable of handling billions in assets without compromising regulatory or technical integrity.

Gold Tokenization Across Three Pillars: IRAs, DeFi, and Wholesale Finance

Gold Tokenization for IRAs

Current Limitation: The U.S. retirement market holds trillions, and billions of that is in gold. However, IRA-held gold is a dead asset, as it generates no yield, can’t be used as collateral, and offers investors nothing beyond passive storage. Custodians know this, but they’ve had no compliant way to change it.

The Business Opportunity: Tokenizing IRA gold unlocks a massive client base for any business that can bridge compliance with digital finance. SmartGold and Chintai proved it’s possible: IRA gold can move into DeFi without losing tax advantages. That means businesses that build tokenization platforms for custodians can:

- Sell premium services that turn gold into a productive asset.

- Generate recurring fees from custody, minting, and reporting.

- Attract IRA custodians as long-term enterprise clients.

Recommendation for Gold Tokenization Platform Development: The winning platforms will integrate directly with IRA custodians, embed compliance rules into smart contracts, and provide IRS-aligned reporting modules. That’s how you transform idle retirement gold into an entirely new revenue stream.

Build the Rails of Tokenized Gold With Platform Development

Gold Tokenization in DeFi

Current Limitation: DeFi protocols control hundreds of billions, but their collateral base is fragile, mostly stablecoins and volatile crypto. That makes institutions nervous and limits adoption. What DeFi lacks is a truly stable, real-world, yield-generating asset.

The Business Opportunity: Tokenized gold is the missing piece. Businesses that launch tokenization platforms can:

- Charge integration fees for connecting with lending protocols like Morpho or Kamino.

- Earn spreads by seeding liquidity pools.

- Differentiate themselves by offering DeFi users’ real-world collateral instead of synthetic assets.

Recommendation for Gold Tokenization Platform Development

Any DeFi-ready platform comes with risk management modules (LTV ratios, liquidation triggers, and oracle feeds), proof-of-reserves dashboards for transparency, and whitelisted connectors so compliance-minded users can participate. That’s what gives the gold tokenization platform credibility in both DeFi and TradFi circles.

Gold Tokenization for Wholesale Finance

Current Limitation: Institutions don’t trust retail-grade token projects. For banks, clearinghouses, and institutional lenders, the absence of a legally recognized structure kept tokenized gold locked out of repo, settlement, and derivatives markets.

The Business Opportunity: The World Gold Council’s Pooled Gold Interests (PGIs) framework changed the game. Businesses that can operationalize PGIs in their platforms stand to:

- Capture integration fees from large-scale institutional adoption.

- Secure long-term partnerships with banks and custodians.

- Position themselves as infrastructure providers.

Recommendation for Gold Tokenization Platform Development

Institutional-grade platforms must support both PGI and allocated models, provide APIs that connect seamlessly with vaults and settlement systems, and offer governance frameworks with role-based permissions and full audit trails. This will tokenize gold into wholesale finance, and businesses that provide it will lead the market.

Why Should Businesses Care?

A gold tokenization platform can resolve the core problems in the financial system while opening up entirely new commercial opportunities.

The Market Demand Side:

- Illiquidity: Physical gold is slow and costly to move.

- No Yield: Gold in IRAs or vaults generates no income.

- High Barriers: Retail investors often can’t afford large bars or vault custody.

- Transparency Gaps: Trust in custody depends on opaque vault reporting.

The Supply Side:

- Capture new revenue streams by digitizing gold and monetizing transactions.

- Expand market reach by making gold accessible to retirement savers, DeFi users, and institutional desks.

- Build institutional trust through proof-of-reserves and compliance frameworks.

- Gain first-mover advantage by establishing liquidity leadership in a trillion-dollar market.

These inefficiencies of gold are the missed business opportunities waiting to be unlocked by the companies that build gold tokenization platforms.

8 Proven Ways a Gold Tokenization Platform Unlocks Growth and Revenue

Building a gold tokenization platform will enable businesses to redefine centuries-old markets into a modern, revenue-generating business model. Here’s how companies that leap can benefit.

1. Recurring Revenue from Minting, Redemption, and Custody

A gold tokenization platform transforms static gold services into continuous income. Automating minting, redemption, and custody, it generates recurring fees with every transaction. Businesses move from one-off sales to predictable revenue streams, creating long-term financial stability and compounding growth as adoption increases.

2. Transaction Fees That Scale with Liquidity

Your platform becomes the gateway for global 24/7 trading of tokenized gold. Each trade on the marketplace or integrated exchanges produces fees. As liquidity grows, revenue grows. The platform scales effortlessly, making transaction income a reliable, compounding engine that mirrors stablecoin adoption success.

3. DeFi Integration as a Profit Center

Platforms designed with DeFi connectors turn gold into yield-generating collateral. Businesses earn from protocol integrations, lending spreads, and liquidity support while positioning themselves as infrastructure providers. Rather than just servicing investors, the platform itself captures value from the DeFi economy it enables.

4. Premium Partnerships with IRA Custodians

A compliant tokenization platform enables custodians to offer yield-enabled retirement gold. For businesses, this means premium service agreements, recurring custodial revenue, and a differentiated edge in a $14 trillion market. The platform becomes indispensable to custodians seeking new ways to attract and retain retirement savers.

5. Opening Gold to Retail Investors

By fractionalizing ownership, the platform lowers barriers and makes gold accessible in $10–$100 increments. Businesses expand their market from institutional clients to millions of everyday investors. The result is broader adoption, higher transaction activity, and a much larger customer base driven through the platform.

6. Institutional Adoption Through Wholesale Digital Gold

Institutions demand legal clarity and settlement-grade systems. A platform built with PGI support provides exactly that, unlocking repo, settlement, and derivatives opportunities. Businesses gain institutional clients, capture high-value fees, and elevate their role from token issuers to trusted market infrastructure providers.

7. Global Market Expansion Beyond Borders

A digital-first platform removes geographic limits, enabling instant, borderless transactions. Businesses no longer rely on regional markets; they serve investors, custodians, and institutions worldwide. This global footprint strengthens brand authority, accelerates adoption, and positions the platform as a central hub in international gold finance.

8. First-Mover Advantage in a $15 Trillion Market

Launching early secures dominance. Platforms that establish liquidity, compliance credibility, and institutional trust become the default rails others must integrate with. As stablecoins proved, first movers set standards and capture market share. A gold tokenization platform offers businesses a once-in-a-generation chance to define the industry.

A 5-Phase Roadmap to Building a Profitable Gold Tokenization Platform

Phase 1 – Legal & Regulatory Scoping

Success begins with clarity. Choose whether the platform will use allocated gold or pooled models like PGIs. Identify target jurisdictions and secure vaulting partners. Early legal alignment reduces the risk of regulatory pushback later.

Phase 2 -Platform Architecture

Once the legal model is defined, design the architecture. Develop smart contracts, compliance modules, and custody integration. At this stage, businesses set the foundation for scalability, transparency, and institutional trust.

Phase 3 -Proof-of-Reserves & Audits

Transparency is what separates serious platforms from speculative ones. Publish verifiable proof-of-reserves and partner with auditors to validate holdings. This not only builds investor trust but also gives regulators confidence to support adoption.

Phase 4 -Market Activation

Go live strategically. Launch first with IRA custodians to access retirement flows, integrate into DeFi protocols for liquidity, or onboard institutional partners for wholesale use. Each channel creates a different growth path, but together, they ensure broad adoption and revenue.

Phase 5 -Scale & Diversify

Once gold tokenization is proven, expand. Add other precious metals, integrate with CBDCs and stablecoins, and explore cross-border payment rails. This transforms the business from a single-asset platform into a multi-asset digital infrastructure provider.

Takeaway

With IRA integration, DeFi adoption, and wholesale legal frameworks, tokenized gold is becoming a central pillar of digital finance. IRAs make it compliant, DeFi makes it liquid, and wholesale frameworks make it institutional.

The companies building gold tokenization platforms today are laying the rails of tomorrow’s markets. Those rails will carry trillions, turning dormant assets into revenue engines and positioning early movers as the permanent gatekeepers of digital finance.

At Antier, we provide end-to-end gold tokenization platform development: from legal structuring and custody integration to smart contracts, proof-of-reserves, and market activation. Our solutions are built for compliance, security, and scalability, enabling you to capture revenue, expand markets, and lead in the era of tokenized finance.

Contact us today to scope your project and start building the infrastructure that transforms gold into opportunity.

Launch Your IRA-Ready Gold Tokenization Platform Today

FAQs

What is gold tokenization platform development?

It’s the process of building infrastructure that transforms physical bullion into digital tokens backed 1:1 by vaulted gold, enabling global liquidity, compliance, and integration into DeFi and institutional markets.

How do businesses profit from launching a gold tokenization platform?

Through minting/redemption fees, custody services, transaction fees, DeFi integrations, and institutional partnerships.

How does tokenized gold in IRAs remain compliant?

By integrating with IRA custodians and designing smart contracts with transfer restrictions aligned to IRS rules, we ensure that tax advantages are preserved.

Why is proof-of-reserves critical?

Because institutional adoption depends on transparent, verifiable evidence that each token is backed by vaulted gold, with no room for opacity.

What is the PGI model?

Pooled Gold Interests, introduced by the World Gold Council, are a co-ownership legal structure designed to make tokenized bullion settlement-ready and usable in wholesale markets.

Frequently Asked Questions

01. What is gold tokenization and why is it important?

Gold tokenization is the process of converting physical gold into digital tokens on a blockchain, allowing for more efficient trading and access to a $15 trillion asset class that has historically been underutilized. It modernizes access to gold, enabling it to be used in various financial applications, including IRAs and DeFi.

02. How does gold tokenization benefit IRA custodians?

Gold tokenization allows IRA custodians to transform idle gold assets into productive investments by enabling them to participate in DeFi while retaining tax advantages. This creates new revenue streams through premium services, custody fees, and long-term enterprise client relationships.

03. What are the key components for developing a successful gold tokenization platform?

A successful gold tokenization platform should integrate directly with IRA custodians, embed compliance rules into smart contracts, and provide IRS-aligned reporting modules to ensure regulatory adherence while facilitating the movement of gold into productive financial applications.