Because everyone’s headed towards it. In July 2025, Kraken, a leading trading platform with its influence in over 190 countries, recently launched its crypto derivatives exchange in multiple US states, offering institutional investors and retail traders access to futures trading. The platform began in five jurisdictions (Vermont, West Virginia, North Dakota, Mississippi, and Washington, D.C.), with intentions to expand further. Kraken also announced plans to incorporate other TradFi futures (commodities, FX, equities) into its platform by late 2025.

Just after Kraken, Coinbase also announced the launch of “Perpetual-style” futures for US Customers with small contract sizes, 24/7 trading, and 10X leverage. D2X, an Amsterdam-based exchange, also raised $5 million to expand its MiFID II-compliant crypto derivatives exchange platform, while Marex followed the lead by partnering with GFO-X. But what is causing this shift, and why should you launch one?

Key Drivers Behind the Crypto Derivatives Surge in the US

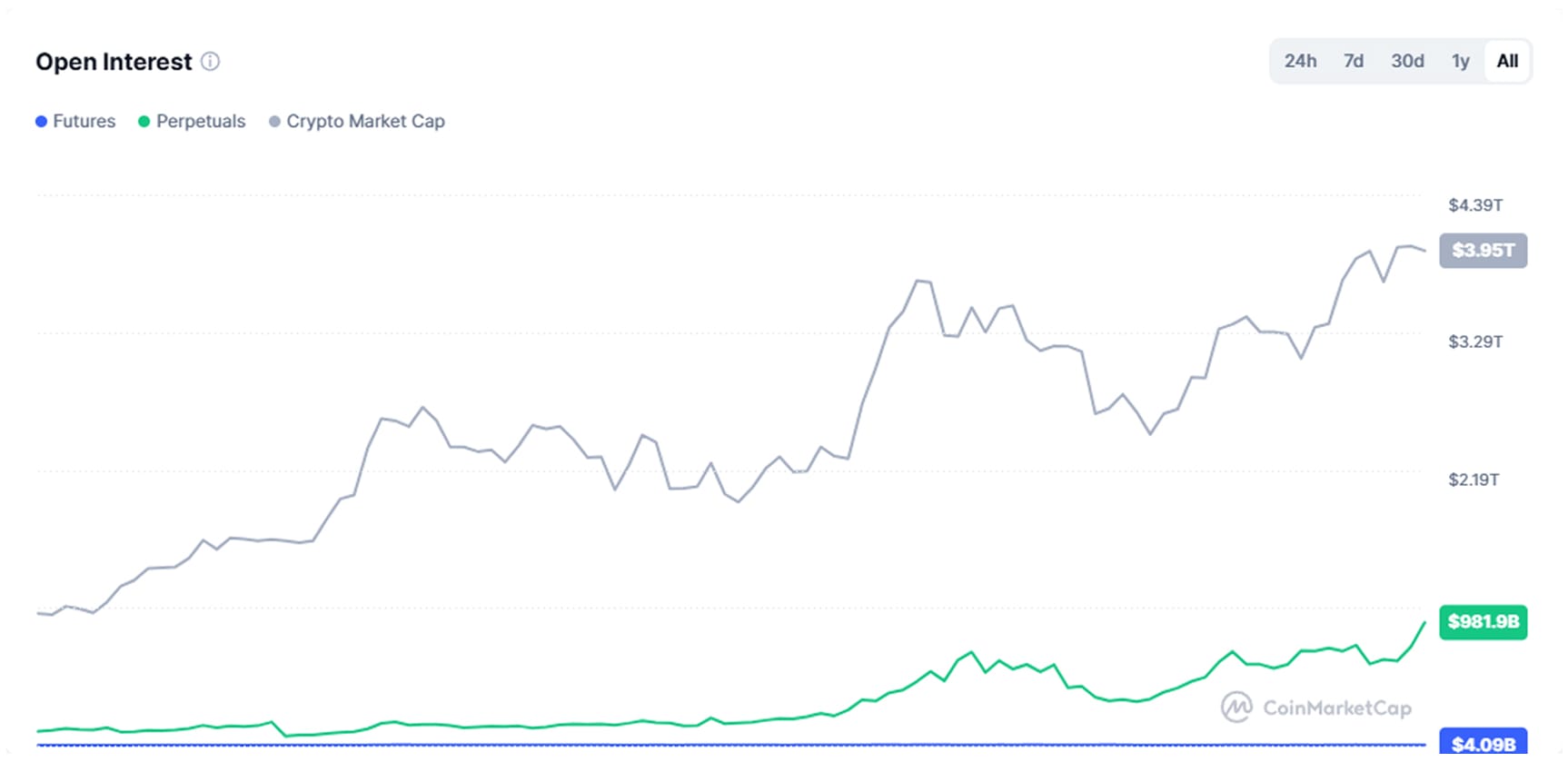

- Expanding Market Opportunity: The U.S. crypto trading market is accelerating, with derivatives volumes hitting record highs and demand rising for futures, options, and perpetual contracts. Both retail and institutional investors are driving liquidity as they seek advanced tools for speculation, hedging, and risk management. Recent product launches like futures and options for Solana and XRP on CME, and the expansion of Ethereum ETF options have further unlocked institutional capital, cementing derivatives as the growth engine of U.S. crypto markets.

- Innovative Product Offerings: The traditional crypto derivatives exchange development won’t work because traders don’t settle for the bare minimum now. Exchanges now feature a variety of derivatives, including perpetual swaps, tokenized asset derivatives, leveraged and inverse ETFs, interest rate swaps for stablecoins, and staking derivatives.

- Whopping Trading Volumes: The derivative segment now constitutes the majority of global crypto trading, with a 74.2% share of total volumes and monthly volumes reaching $8.94 trillion. The US crypto trading market continues to grow rapidly, with derivatives volumes reaching record highs and significant interest from institutional and retail investors for futures, options, and perpetual products.

- High Leverage, Accessibility, and Profitability: Crypto derivatives exchanges combine 24/7 access with leverage as high as 125x, making them attractive to both speculative traders and those seeking advanced hedging tools. This accessibility fuels higher trading volumes and fee revenues compared to spot markets, especially during volatility. By tapping into U.S. capital markets, these platforms also gain global visibility and attract institutional participants, driving sustainable growth and profitability.

- Strategic Advantages: Establishing a presence in the US as a cryptocurrency derivatives exchange platform improves credibility and enables partnerships with regulated financial firms. Regulatory sandboxes and collaborative industry initiatives in the US further encourage technological experimentation and rapid platform evolution.

- Favorable Regulatory Landscape: In 2025, the US government has embraced a more open and innovation-driven regulatory approach, fostering clearer frameworks and support for crypto businesses and exchanges. Regulatory reform under agencies like the SEC and CFTC aims to boost American leadership in digital finance and support business innovation while maintaining compliance and risk controls.

How Much Does Cryptocurrency Derivatives Exchange Development Cost?

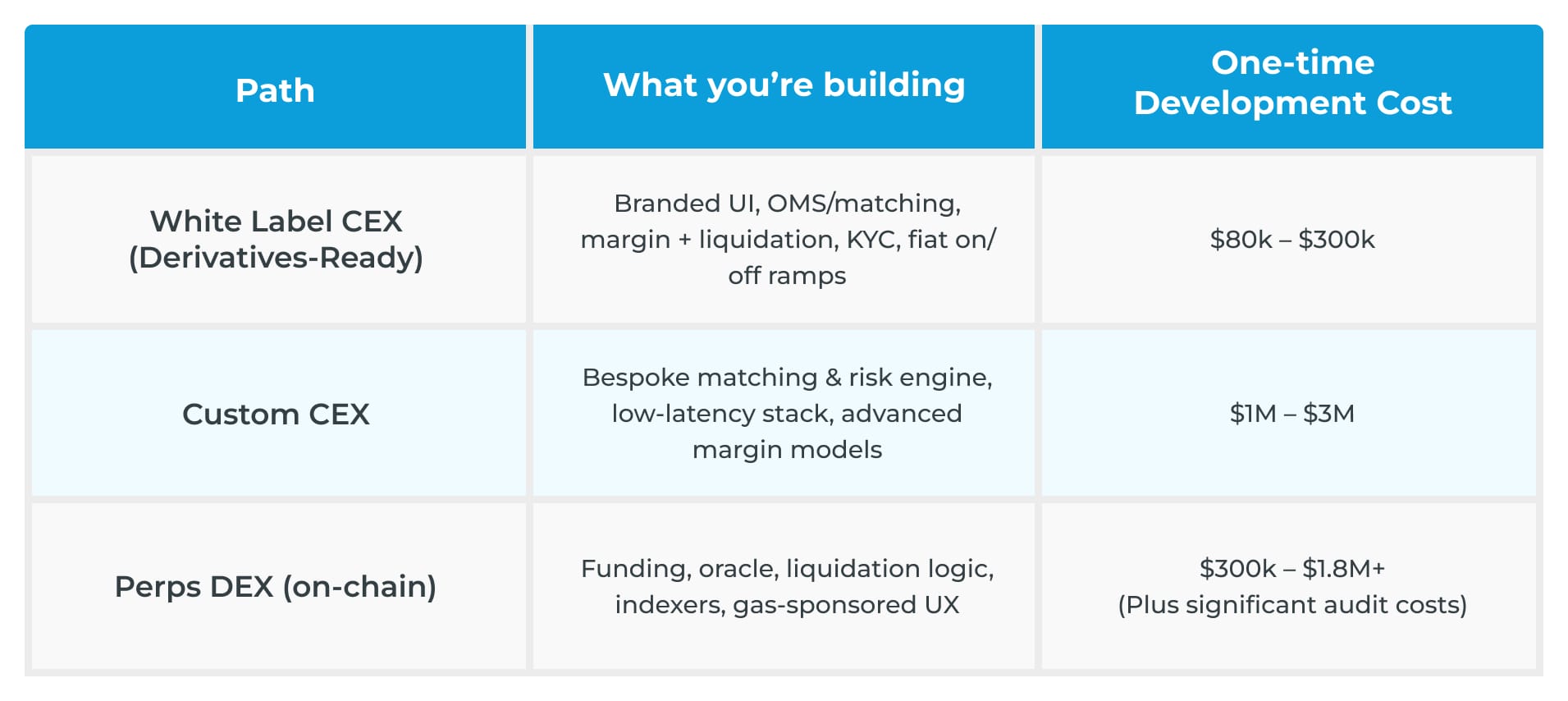

Building a crypto derivatives exchange platform may cost anywhere from $80k to $1.8M.

Core Cost Drivers: What Moves the Cryptocurrency Derivatives Exchange Price Up or Down?

- Scope: A simple exchange that only offers basic futures is cheaper. When you add portfolio margin, options trading, copy-trading, and VIP tiers, costs jump, because each of these crypto derivatives exchange features needs extra development, audits, and infrastructure.

- Speed to market: White label derivatives exchanges are faster and cheaper, as you’re rebranding an existing engine. Custom builds are slower, pricier, but you own the tech, which is more defensible and scalable long-term.

- Compliance: More KYC checks, more jurisdictions, stricter standards like SOC2/ISO translate to higher bills. If you’re only serving retail in one country, setting up your crypto derivatives exchange is cheaper. If you want institutional clients globally, compliance is a major budget item.

- Security: The more serious you are about your crypto derivatives launch, the more you’ll pay for penetration tests, custody systems (HSMs), withdrawal monitoring, and audits (if DEX).

- UI/UX Complexity: A basic UI is usually inexpensive, whereas a polished and user-friendly UI/UX and mobile-first crypto derivatives trading platform development is usually costly.

- Data: Crypto derivatives exchange users demand deep order books (Level 2), historical data, and low-latency feeds. That means higher subscription costs to data providers and robust infrastructure to serve them.

- Infrastructure: For a centralized crypto derivatives exchange, you need a matching engine and risk system that can handle thousands of trades per second. For a decentralized derivatives trading platform, you need liquidation daemons, funding-rate logic, and oracle integrations. Both require monitoring and site reliability engineering (SRE) setups to stay live, and all of this means hefty infrastructure.

- Liquidity & market-making: Traders won’t come to a dead exchange. You’ll need to pay market makers (stipends, rebates, and inventory risk coverage) to bootstrap liquidity. This is often one of the largest hidden costs.

- Distribution: Even the best crypto derivatives trading technology dies without users. Marketing, business development, listings, referral programs, etc. They are essential, and they all cost real money.

Steps to Launch Your Crypto Derivatives Exchange in the US

- Pick Your Model

- White label derivatives exchange/partner route: Fastest go-to-market; infrastructure, risk engine, and compliance are baked in.

- Custom cryptocurrency derivatives exchange development: Slower and costlier, but you own the matching/risk engine, liquidation controls, and can budget for audits (smart contracts for DEX, SOC 2 for CEX).

- Form a US Entity & Compliance Setup

- Register as a FinCEN MSB, prepare AML/KYC programs, and apply for state money transmitter licenses (BitLicense in NY if needed).

- For crypto derivatives exchange development and launch, align with CFTC/NFA (via DCM/SEF if you’re listing contracts, or FCM/IB if you’re providing access).

- Liquidity & Partnerships

- Onboard market makers, clearing partners, and data providers to ensure depth and arbitrage opportunities.

- Partnerships with regulated US firms improve credibility and open cross-market flows.

- Go Live with Compliance & Marketing

- Run pilot testing (regulatory sandboxes help).

- Launch with both retail and institutional targeting

Talk to Antier’s Exchange Architects and Get Price Estimates

Top Cryptocurrency Derivatives Exchange in the US

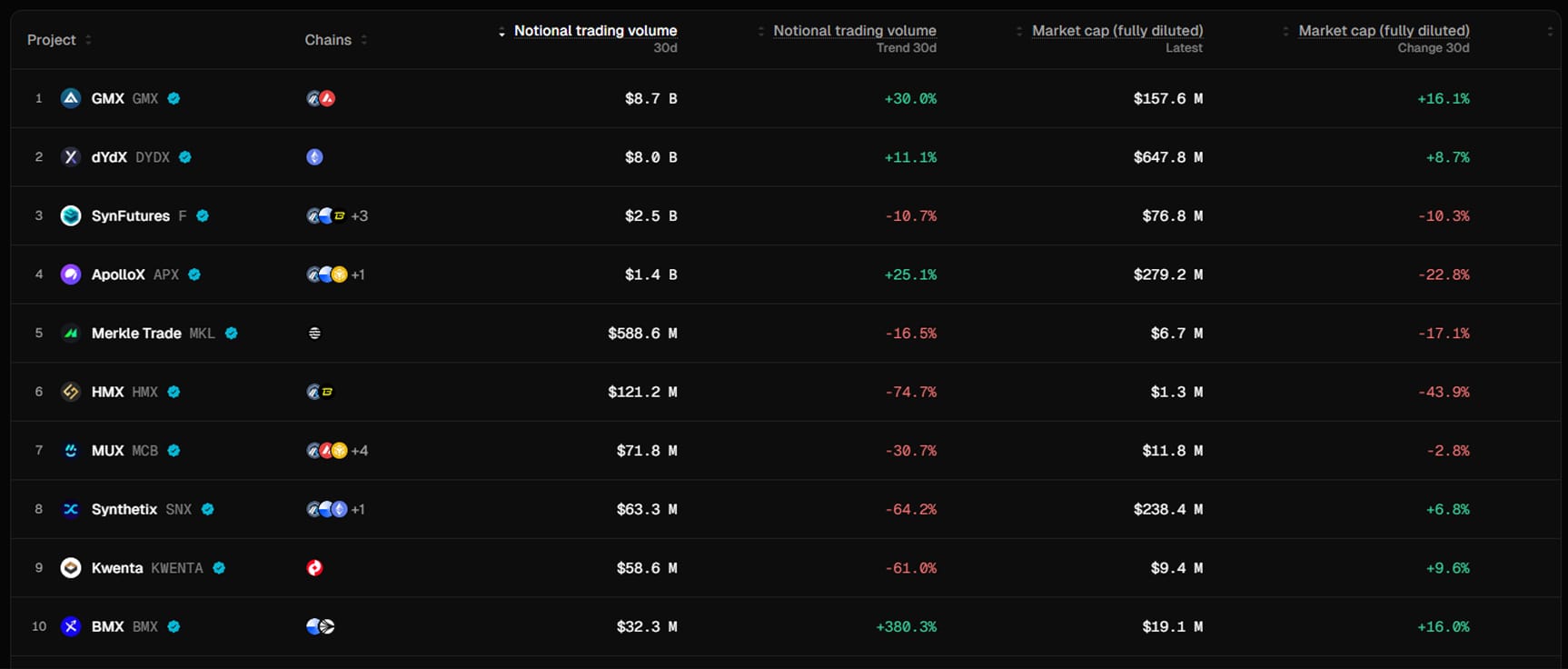

Now you know how you can launch your crypto derivatives trading platform in the US. However, to remain relevant in the market, you must consider your competition and plan your crypto derivatives exchange development accordingly.

- Coinbase Derivatives

- Products: CFTC-approved nano Bitcoin (BTC-PERP) and nano Ethereum (ETH-PERP) perpetual futures (first in the U.S.)

- Leverage: Up to 10x for retail traders

- Regulatory Status: Operates as a Designated Contract Market (DCM) under CFTC oversight

- Key Advantage: Full regulatory compliance, institutional trust, and integration with Coinbase’s ecosystem

- Kraken Futures

- Products: Perpetual and fixed-date futures for BTC and ETH

- Leverage: Up to 50x (non-U.S. users) but lower for U.S. clients due to compliance

- Regulatory Status: Complies with U.S. derivatives regulations; requires KYC

- Binance.US (Limited Derivatives)

- Products: Futures and perpetual swaps (restricted in some states)

- Leverage: Reduced to 5-10x for U.S. users

- Note: Facing ongoing regulatory scrutiny, entrepreneurs should study their adaptation to U.S. rules

- CBOE Digital

- Products: BTC and ETH futures, options, and planned perpetuals

- Key Advantage: Bridges traditional finance with crypto, leveraging CBOE’s existing infrastructure

Check out the snapshot below for the top cryptocurrency derivatives exchange platforms globally.

Final Takeaway

With derivatives volumes consistently outpacing spot markets and institutional capital flowing into regulated futures, options, and perps, the business case has never been stronger. Your actual crypto derivatives exchange development cost will depend on the model you choose. However, in any case, the non-negotiables are the same, and these are solid infrastructure, regulatory alignment, liquidity partnerships, and risk management. A seasoned crypto derivatives exchange development services provider can help you launch the next growth engine in a trillion-dollar derivatives market.

Antier’s exchange architects help you map costs, compliance, and liquidity, so you can go live with a competitive crypto derivatives exchange fastly, smartly, and profitably.

Share your requirements today!