The next era of payments won’t be defined by slightly faster cards or marginally lower bank fees; it will be driven by programmable money that moves instantly, without friction, delays, or borders. In the casino world, where instant payouts, global deposits, and strict regulations collide, the move to programmable money is no longer a question of if, but when.

Stablecoin remittance platforms are becoming the invisible backbone of this shift, empowering casinos to settle winnings instantly, handle multi-currency transactions without costly conversions, and operate with the speed and flexibility of digital-native economies. For forward-thinking casino operators, the question is no longer if stablecoins will be part of their payment strategy, but how fast they can launch a secure, compliant, and scalable platform.

In this blog, we’ll walk you through how to build such a platform from the ground up, covering the essential components that make it robust and regulator-ready, breaking down the development process into clear steps, and revealing the factors that will determine the speed and success of your launch.

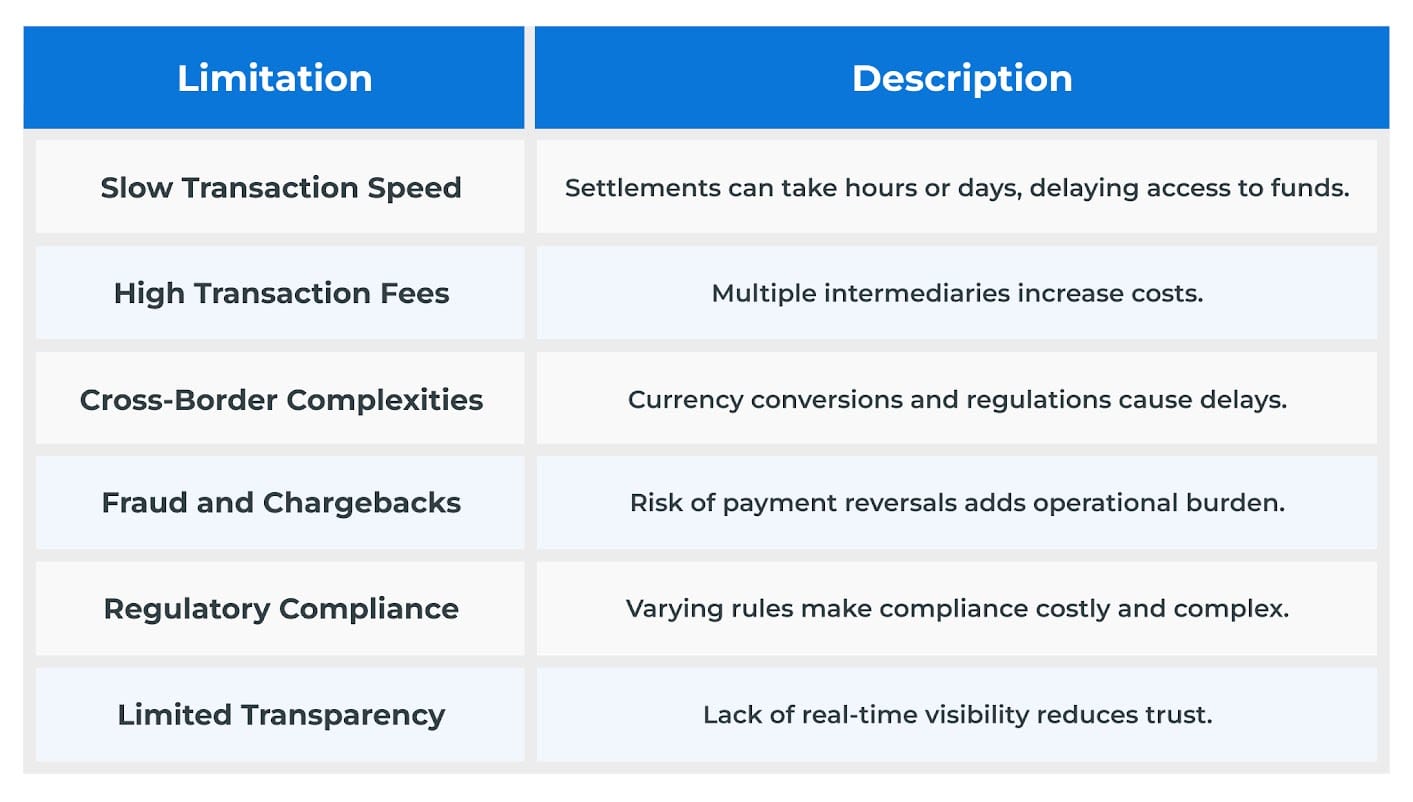

What Are the Limitations of Current Casino Payment Systems?

Traditional casino payment systems rely on slow, costly, and complex fiat-based processes that often frustrate players and operators. These systems struggle with speed, fees, cross-border issues, and regulatory hurdles. To highlight these challenges, here’s a quick overview:

Why Switch to Stablecoin Remittance?

These limitations highlight the urgent need for a payment infrastructure that can match the pace, scale, and regulatory expectations of today’s casino industry. Stablecoin remittance is not just an incremental improvement; it’s a fundamental leap forward that redefines how money moves in the casino ecosystem.

Imagine deposits that clear before a player leaves the table, withdrawals processed instantly, and cross-border payouts arriving without a single bank delay. That’s the operational reality stablecoins can deliver. By removing currency barriers, casinos can reach players in any market without worrying about exchange rates, settlement delays, or intermediary restrictions.

- Instant settlements in seconds

- Global reach without currency conversion

- Lower transaction fees by removing intermediaries

- Blockchain-level transparency and fraud resistance

- Real-time auditability for regulatory compliance

By investing in purpose-built stablecoin development services, casinos can create platforms that launch quickly, scale seamlessly, and adapt to regulatory changes before they disrupt operations. In this business, speed and trust are currency, and stablecoin remittance is how you bank them. The future belongs to those who build it now.

What Are the Essential Building Blocks of a Casino-Grade Stablecoin Payment Platform?

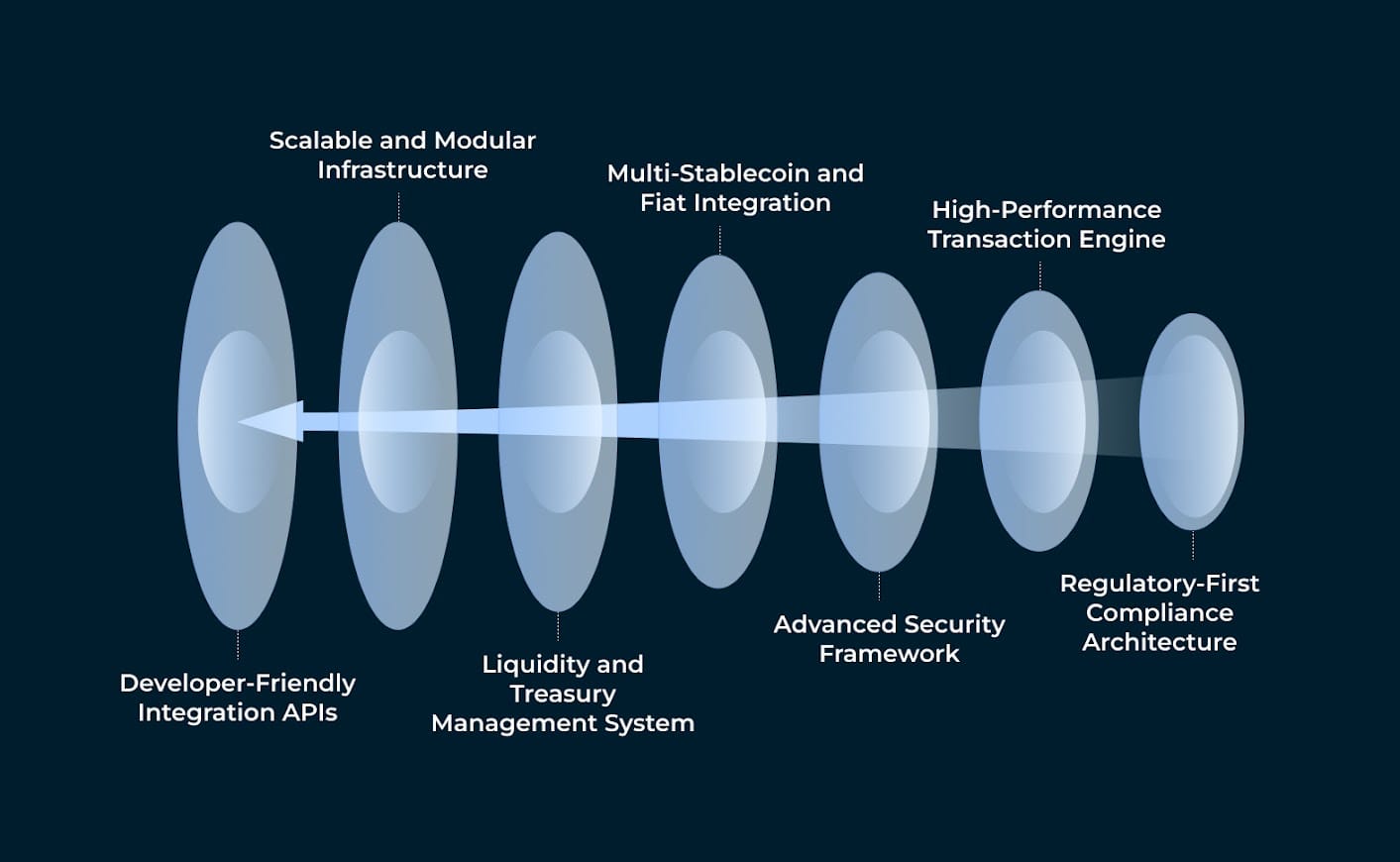

- Regulatory-First Compliance Architecture: A casino-grade stablecoin payment platform must be built with a compliance-first mindset, integrating automated KYC/AML checks, geo-restrictions, and reporting tools to meet international and local regulations. This approach ensures uninterrupted operations and protects the business from costly legal setbacks.

- High-Performance Transaction Engine: The core of the platform should handle thousands of stablecoin transactions per second, ensuring instant deposits and withdrawals without delays or downtime. Reliable processing speed is a defining factor in delivering a premium experience.

- Advanced Security Framework: End-to-end encryption, multi-signature wallet protection, biometric authentication, and AI-driven fraud detection are essential. These security measures safeguard user funds, protect against cyberattacks, and build trust in a high-stakes casino environment.

- Multi-Stablecoin and Fiat Integration: Supporting multiple stablecoins alongside fiat on/off-ramps gives players flexibility in how they transact. This feature also allows the stablecoin remittance platform to adapt to evolving market preferences without overhauling its stablecoin development services infrastructure.

- Liquidity and Treasury Management System: A robust treasury solution ensures instant payouts, manages liquidity pools, and automates fund settlements. This keeps cash flow consistent and operations smooth, which is critical for 24/7 casino platforms.

- Scalable and Modular Infrastructure: A modular architecture allows rapid scaling during high-traffic events and quick integration of new features or compliance updates. This flexibility helps the stablecoin payment platform stay future-ready.

- Developer-Friendly Integration APIs: Well-documented APIs enable smooth integration with existing casino platforms, payment gateways, and KYC providers. This reduces deployment time and operational friction, accelerating the go-to-market process.

Step-by-Step Guide to Building a Custom Stablecoin Payment Platform for Casinos

Step 1: Define Platform Objectives and Compliance Scope

Start by mapping out the specific goals of your casino’s payment system, such as instant payouts, multi-currency support, and global accessibility. Align these goals with relevant financial regulations in each target jurisdiction. A clear compliance-first approach ensures that your stablecoin payment platform development can scale without facing costly legal setbacks.

Step 2: Choose the Right Stablecoin and Blockchain Network

Select a stablecoin that balances speed, liquidity, and low volatility, such as USDT, USDC, or a region-specific token. The choice of blockchain, whether Ethereum, Tron, or a high-performance alternative, will determine transaction throughput and fees. Partnering with an experienced stablecoin development company ensures you get expert guidance on token selection, integration, and security architecture.

Step 3: Build a Robust User Wallet System

Develop an easy-to-use, secure wallet interface for players to deposit, store, and withdraw stablecoins. Multi-device accessibility, two-factor authentication, and cold storage support are essential features. A wallet built with scalability in mind ensures seamless integration with future payment methods.

Step 4: Integrate a High-Performance Payment Gateway

Create or integrate a casino-grade payment gateway capable of processing thousands of concurrent transactions with minimal latency. Support for both on-chain and off-chain settlements boosts speed and user satisfaction. This step is critical for ensuring your stablecoin payment platform delivers a smooth user experience under peak loads.

Step 5: Implement Advanced Security and Fraud Prevention

Secure the platform with KYC/AML protocols, AI-driven transaction monitoring, and blockchain-based audit trails. Multi-signature authorization and encrypted data handling protect both operators and users from fraudulent activity, enhancing trust in your platform.

Step 6: Add Cross-Border Payment Capabilities

Enable players from multiple jurisdictions to transact without currency conversion headaches. A custom stablecoin payment solution with built-in FX rate automation and jurisdiction-based transaction routing simplifies operations while expanding your casino’s global reach.

Step 7: Test, Optimize, and Launch

Run multiple rounds of security audits, load tests, and user experience evaluations before the public launch. Partnering with a provider specializing in stablecoin payment platform development ensures the final product meets performance benchmarks and regulatory standards. Post-launch, monitor analytics to continuously improve system efficiency and user engagement.

How Much Does Stablecoin Payment Platform Development Cost?

The cost of developing a stablecoin payment platform depends on several factors, including the complexity of features, security standards, transaction capacity, regulatory compliance requirements, and integration needs with existing casino systems. A platform built with basic functionality will require fewer stablecoin payment platform development resources compared to a high-performance solution with advanced KYC automation, multi-stablecoin support, AI-powered fraud detection, and real-time liquidity management.

Partnering with a provider experienced in stablecoin development services ensures the platform is not only tailored to your operational model but also engineered for scalability, speed, and long-term compliance. Businesses can invest in a stablecoin payment platform that delivers immediate functionality and future-ready adaptability without unnecessary expenditure by focusing on the right balance of technology, security, and user experience.

Wrapping Up

The shift to stablecoin payment platforms is no longer a question of “if” but “when.” In a market where speed, transparency, and compliance can make or break a casino’s global reach, adopting a stablecoin payment platform development is the smartest move forward. Imagine offering players instant deposits, near-zero fees, and secure withdrawals while meeting evolving regulatory requirements.

By building a tailored, casino-grade stablecoin payment solution, you can attract more players, reduce operational costs, and streamline international transactions with ease. The casinos that act now will not just stay relevant; they will set the industry benchmark. The expertise you choose today will define your success tomorrow, and when it comes to delivering world-class stablecoin payment platform development, the name that leads from the front is Antier. We turn your stablecoin payment platform into the ultimate competitive edge that others can only try to match.