Real-world asset tokenization is emerging at a fast pace. With SEBI’s regulatory nods (SM REITs, fractional ownership), and a projected market size of $100B+ by 2030, the ecosystem is primed for potential builders. This will bring more revenue, liquidity through compliance-backed infrastructure.

For fintech’s, developers, and asset managers, this is the window to build tokenization platforms in India. Whether it’s real estate, inventory, gold, or IP, tokenization will unlock the capital access model for the next decade. This guide explores how the tokenization market is growing in the Indian sector and the benefits it will bring to platform owners and investors.

The Market Opportunity: Why Tokenization Matters in India

- Fractional ownership makes real assets accessible: Tokenization transforms costly assets into fractions. Small investors can now invest in a property or art piece, broadening participation and diversifying portfolios.

- Liquidity for traditionally illiquid assets: Markets that once required months of negotiation now trust smart contracts and blockchain settlement, making assets tradeable instantly and securely.

- Global reach without border friction: Tokenized assets on compliant platforms can attract investors in Singapore, Dubai, or Europe, giving Indian issuers access to capital beyond domestic banks.

- Cost efficiency and transparency: Blockchain removes intermediaries, slashes overhead, and automates compliance, creating fewer frictions and more trust in tokenized investment opportunities.

As India is home to over 6,600 fintech startups and 26 fintech unicorns valued at $90 billion as of 2024, it gives the ecosystem talent and ambition to build platforms that scale.

Real-World Asset Tokenization: Regulatory Framework

India’s regulators are moving from observation to structural engagement.

- SEBI’s 2024 REIT Amendment: SEBI introduced Small and Medium REITs, reducing asset thresholds to ₹25 crore and mandating at least 200 investors per scheme. This opens real estate tokenization to regional developers and SME-backed assets.

- IFSCA’s GIFT City Initiative: The International Financial Services Centres Authority, regulator of GIFT City, has formed a committee to propose comprehensive frameworks for real‑asset tokenization, addressing smart contracts, custodians, risk management, and settlement protocol standards.

- Expanding institutional participation: Recently, SEBI sought public feedback on allowing foreign institutional and public funds to become “strategic investors” in REITs/InvITs, boosting capital inflows.

These developments signal growing clarity in tokenization regulations in India, enabling platforms to build with compliance and credibility.

Key Trends Shaping Asset Tokenization Platform Capabilities

From feature wars to investor demand, here’s how India’s token platforms are evolving:

- AI-Driven Valuation & Compliance: Platforms integrating machine learning to enable real-time asset pricing and rule-mapped KYC/AML workflows, critical when regulatory frameworks evolve.

- Cross-Chain Interoperability: Platforms built to support Ethereum, Polygon, BSC, and Hyperledger ecosystems. This brings cross-chain compatibility, expands liquidity, and integrates with DeFi dividend streams.

- DeFi Integration: Tokenized assets are being used as collateral in yield-generating applications, integrating the real asset finance and DeFi operations.

- Layer-2 Scalability: Platforms adopt Layer-2 networks like Polygon to tackle high transaction costs and increase throughput, which is essential for large-scale issuance.

- Institutional Adoption: Banks and fintech’s such as ICICI Bank and Paytm are piloting tokenized bonds and funds, pushing tokenized assets into mainstream finance.

These trends show how asset tokenization platform development in India is bringing the next generation evolution.

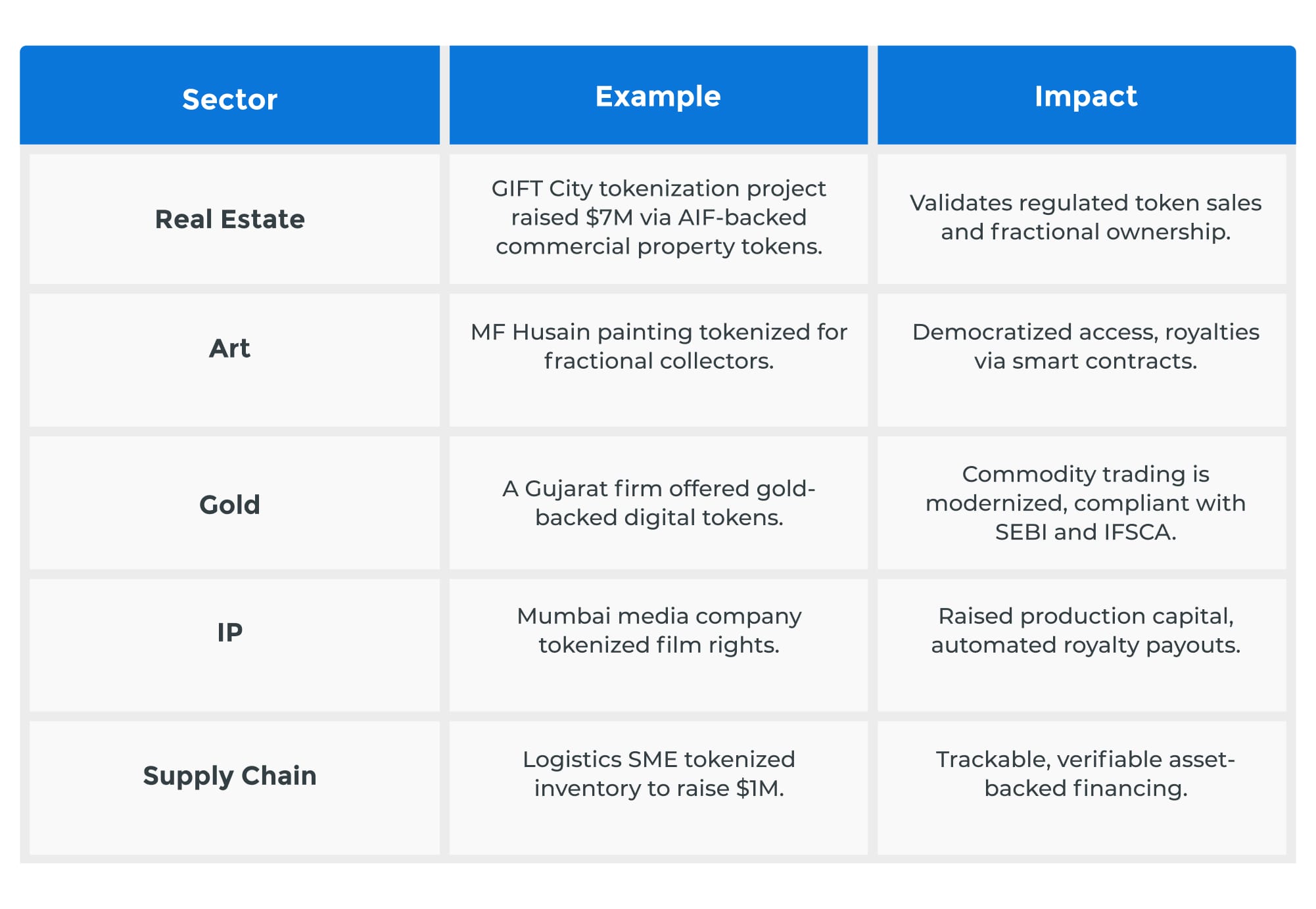

Real-World Use Cases: Where Tokenization Is Delivering

These examples prove that tokenization of real-world assets in India is generating capital, transparency, and scalability in financial infrastructure.

Building the Real World Asset Tokenization Platform? Here Is What You Need

- Custom smart contracts for ownership, payouts, and regulatory flows.

- Cross-chain integration with Ethereum, Polygon, and BSC, enabling connectivity across ecosystems.

- KYC/AML modules aligned with SEBI and IFSCA requirements.

- Secondary market support for liquidity across investor networks.

- AI-driven modules for real-time valuations, risk detection, and investor onboarding.

Platforms built integrating these features are scalable infrastructure stacks, intended for banks, fintech’s, and asset managers entering the RWA market.

Why This Is the Right Time for Indian Firms to Build Platforms

- Raise capital without debt or full asset sale: With the Asset Tokenization Platform, businesses can tokenize assets such as real estate, gold, intellectual property, or inventory, unlocking capital without needing to borrow or liquidate ownership.

- Access global investors through compliant digital infrastructure: With a well-structured asset tokenization platform in India, companies can tap international investors while reducing cross-border legal and operational friction.

- Fractional ownership of high-value assets: Through tokenized investment opportunities in India, businesses can open up premium assets to a broader investor base, including HNIs and retail investors.

- Lower operational costs through automation: Platforms integrated with smart contracts handle dividends, ownership transfers, and compliance workflows, reducing manual processes and legal overhead.

- Meet evolving regulations without rebuilding infrastructure: A modular platform ensures ongoing alignment with tokenization regulations in India and global standards like MiCA, reducing compliance risk.

- Improve liquidity for illiquid asset classes: Tokenizing real-world assets allows companies to convert otherwise static holdings into tradeable, blockchain-verified tokens.

Investor Benefits

- Access premium assets at lower entry points: Investors can buy fractions of tokenized assets in India, such as real estate or commodities, previously accessible only to institutional investors.

- Verify all transactions and holdings transparently: With blockchain tokenization in India, every transaction is recorded on an immutable ledger, providing end-to-end transparency.

- Trade tokens seamlessly on compliant platforms: Investors can enter and exit positions more efficiently through secondary markets enabled by tokenization infrastructure.

- Receive automated returns through smart contracts: Income distribution is executed automatically, removing manual delays and reducing default risk.

- Invest with confidence in regulated platforms: Trust is built into platforms that embed KYC/AML protocols and align with India’s regulatory framework for tokenized assets.

Takeaway

By 2030, India’s tokenized asset market could surpass USD 100 billion, led by real estate, green infrastructure, and SME financing. Platforms that integrate AI, are deployed on layer‑2 networks, and are built with global compliance in mind, will dominate.

If you’re a fintech, bank, real estate firm, or SME ready to lead the tokenized RWA future, Partner with an Asset Tokenization Platform Development Company in India, build a compliant, scalable platform with investor-grade features, and claim your share of the emerging tokenization economy.

FAQs

What is RWA tokenization in India?

It’s the process of converting physical assets, real estate, art, gold, and IP into digital tokens secured on blockchain, enabling fractional ownership and trade.

How do Businesses benefit from Asset Tokenization?

Businesses unlock capital, reduce costs, ensure compliance via tokenization of assets in India, and reach global investors with secure platforms.

What regulators govern this?

SEBI’s 2024 REIT amendments (including SM REIT frameworks), IFSCA’s GIFT City sandbox and tokenization guidelines, and RBI oversight for AML and systemic risk.

How can I start building?

Engage with an Asset Tokenization Platform Development Company in India offering smart contract infrastructure, modular compliance, cross-chain design, and investor UX.