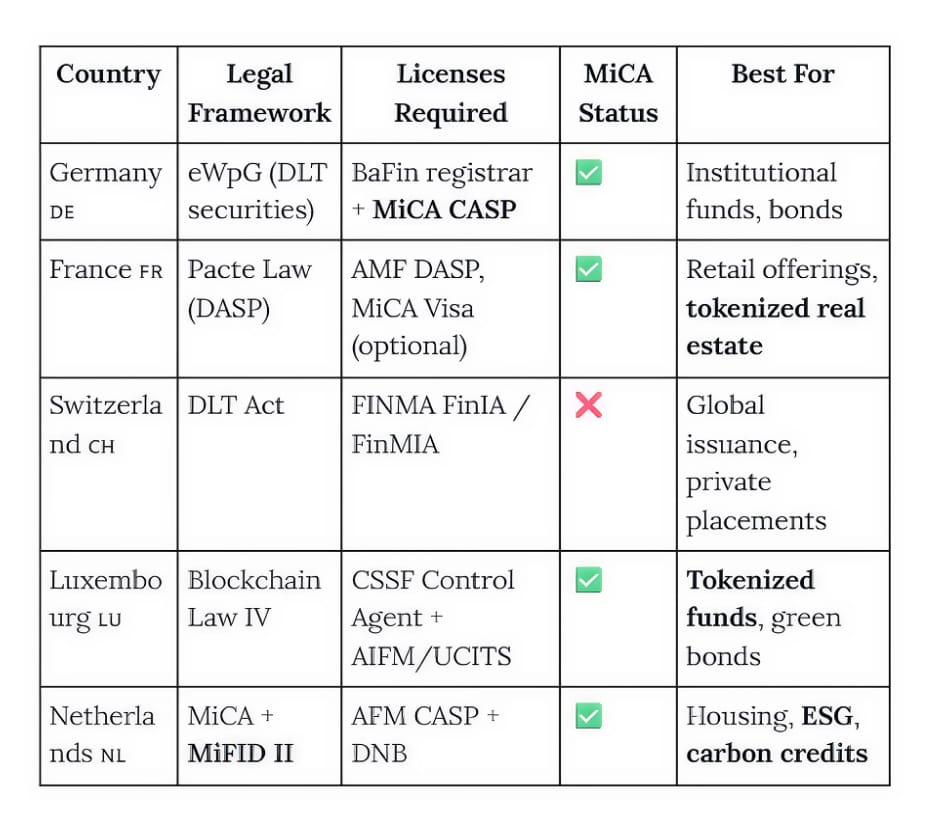

The Real-world asset Tokenization Platform Development is becoming mainstream in Europe. As businesses and investors demand clarity, five countries stand out in 2025 due to their strong legal structures, robust infrastructure, and a clear regulatory framework that fosters adoption. This guide talks about the top 5 countries well-suited for Real-World Asset Tokenization in Europe.

Each country mentioned covers essential regulatory requirements and real‑world business considerations for launching a tokenization platform or service.

Why Europe to Launch RWA Tokenization Platform?

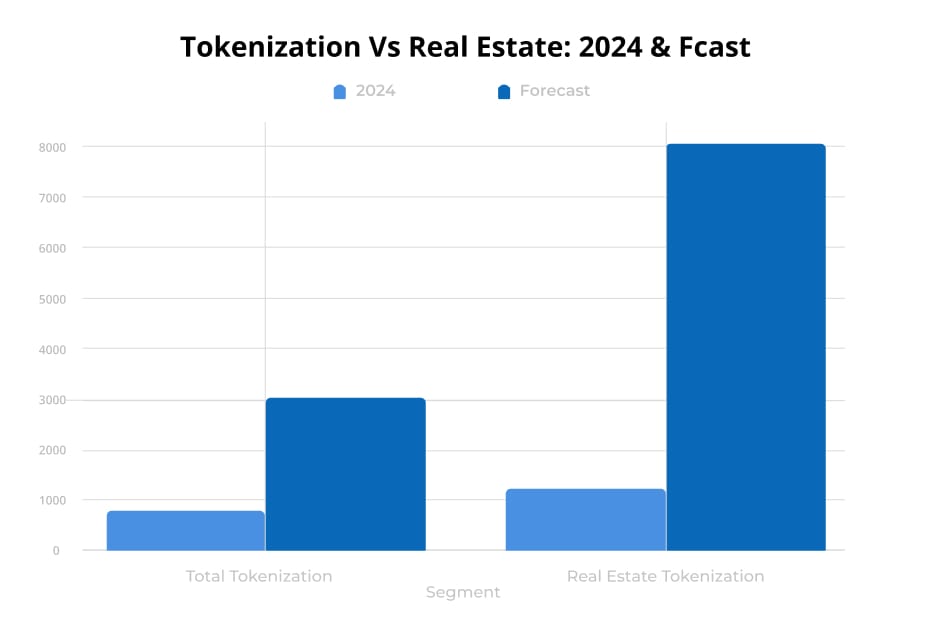

Europe owns roughly 23.6% of the global tokenization market in 2024, with a projected 25.6% CAGR, and revenues to hit USD 3.11 billion by 2030. The region already holds around USD 310 billion in tokenized assets, nearly a quarter of the global total, second only to the US. Real estate? Europe’s tokenized real estate market was worth USD 1.23 billion in 2024, and it’s heading toward USD 8.4 billion by 2034. Laws like MiCA, eWpG, and Pacte Law give real-world asset tokenization platforms the legal certainty and scale they need to go big across borders.

RWA Tokenization in Europe: Regulations Across Countries

1. 🇩🇪 Germany

Germany legally allows companies to issue financial assets (like bonds or funds) in tokenized form using blockchain. An RWA Tokenization platform requires approval from the country’s financial regulator, BaFi, to serve investors.

- Germany’s Electronic Securities Act (eWpG) legalizes securities on distributed ledgers. This gives platforms permission to issue securities digitally on DLT infrastructure.

- Crypto‑securities registrars must obtain BaFin licensing under the German Banking Act (KWG).

- Assets that qualify as financial instruments must comply with MiFID II, the EU Prospectus Regulation, and local disclosure rules.

- Full Anti‑Money Laundering (AML) compliance is required per the German Money Laundering Act.

- Germany started enforcing the MiCA framework for asset tokenization in 2024.

Platform Requirements:

- Incorporate a GmbH or AG. Apply to BaFin for a crypto‑securities registrar license if managing the token registry.

- Expect capital requirements (approx. €150,000), heavy IT security, governance frameworks, and risk controls.

- Use regulated custody services or apply for custody authorization.

- Smart contracts must be auditable and align with standards such as ERC‑1400.

Ideal for: RWA Tokenization platforms targeting institutional bond issuance, fund tokenization, or regulated securities.

2. 🇫🇷 France

France’s Pacte Law introduced the DASP (Digital Asset Service Provider) regime for RWA Tokenization services. Every platform dealing in digital assets must register with the AMF. An optional AMF visa is available for public offerings of tokenized assets.

- Security tokens fall under MiFID II and must meet EU prospectus and transparency rules.

- France strictly enforces AML rules, identity verification, and Travel Rule obligations.

- Full compliance with EU MiCA will be required from 2025, with a transition period through mid‑2026.

Platform Requirements:

- Set up a French legal entity. Register as a DASP with AMF; apply for an AMF visa if targeting retail investors.

- Develop internal controls, comprehensive documentation, risk‑management policies, and cybersecurity measures.

- Deploy AML infrastructure – KYC, customer due diligence (CDD), monitoring, and sanctions screening.

Ideal For: Real-World Asset Tokenization Platforms for real estate, equities, or public asset offerings.

3. 🇨🇭 Switzerland

Switzerland’s DLT Act formally recognises ledger‑based securities, including tokenized bond, equity, and fund offerings. FINMA categorizes tokens into payment, utility, and asset tokens; asset tokens are treated as securities.

- Platforms that offer custody, trading, or issuance must obtain licensing under FinIA or FinMIA.

- Swiss AML law mandates KYC, transaction monitoring, and Financial Intelligence Unit (FIU) reporting.

Platform Requirements:

- Form a Swiss AG or GmbH. Apply for FINMA licensing where required.

- Platform infrastructure must enable investor protection, client‑fund segregation, and full audit trails.

- Suitable for private placements and global issuance.

- Integrate with licensed centralized securities depositories, such as SIX Digital Exchange (SDX), for post‑trade settlement.

Ideal For: Institutional grade real‑world asset tokenization company offerings, private placements, international distribution.

4. 🇱🇺 Luxembourg

Luxembourg legally recognizes blockchain-based tokens as financial instruments. To manage or record token transfers, the real-world asset tokenization platform must either work with or become a licensed control agent approved by the regulator (CSSF).

- Platforms processing tokenized investment funds must follow AIFM, UCITS, or ELTIF rules for structure and disclosures.

- The CSSF enforces AML/CFT compliance, including investor vetting, transactional reporting, and sanctions screening.

Business Considerations:

- Incorporate a Luxembourg SPV. Partner with or become a CSSF licensed control agent.

- Ensure AML compliance: digital onboarding, audit trails, and reporting infrastructure.

- Smart contracts must meet CSSF’s transparency and auditability standards.

- Design platforms for EU passporting to scale issuance across member states.

Ideal for: Tokenizing fund shares, green bonds, and structured debt instruments.

5. 🇳🇱 Netherlands

All Dutch platforms fall under the EU’s MiCA regime. RWA Tokenization platform offering tokenized securities or custody services, must register as a CASP (Crypto Asset Service Provider) with the AFM, and register with DNB if providing custody. If a token acts like a financial instrument, MiFID II compliance is mandatory for disclosures, investor protections, and regulatory documentation.

- The Dutch DNB regulates custodial and payment service providers, enforcing AML under the Wwft.

- AML/CFT compliance covers identity verification, transaction monitoring, and suspicious reporting obligations.

Platform Requirements:

- Form a Dutch BV or NV. Apply for AFM CASP licensing and register with DNB if custody is offered.

- Platform design must support operational resilience, cybersecurity, and maintain adequate capital.

- Build integrated KYC/CDD processes aligned with GDPR data protection rules.

- Smart contracts must comply with MiCA’s transparency and auditability mandates.

Ideal for: Launching a real-world asset tokenization platform for housing assets, carbon credits, ESG‑aligned investments, or sustainable real‑estate projects.

RWA Tokenization Across Europe – MiCA-Ready Solutions

These jurisdictions offer legal clarity, regulatory oversight, and institutional readiness that build investor confidence and platform longevity.

Tips To Launch a Successful Platform for Real-World Asset Tokenization in Europe

- Define Your Assets and Target Audience: Tokenizing bonds demands a different setup than tokenizing real estate, carbon credits, or funds. Know your audience- institutions, retail, or Cross-border buyers?

- Choose Jurisdiction Wisely: Regulatory costs, speed of licensing, legal clarity, capital needs, and passporting ability should guide your path.

- Entity Establishment: Most jurisdictions require a locally‑incorporated entity (AG, GmbH, SPV, BV). Licensing choice always varies: CASP, DASP, custodian, control agent, or securities registrar.

- AML & Compliance Architecture: KYC/CDD, sanctions screening, ongoing monitoring, all these are table stakes. Travel Rule compliance where required. Set up a unified infrastructure up front to avoid later risks.

- Tech and Smart Contracts: Smart contracts must be transparent, auditable, and aligned with local token standards (ERC‑1400, etc.). Governance, escalation procedures, and fallback options for contract failure must be in place.

- Custody & Post‑Trade Settlement: Depending on jurisdiction, use regulated custody providers, become licensed yourself, or integrate with local CSDs like SDX.

- Licensing Capital & Operational Readiness: Expect to meet capital requirements (€150k+), IT resilience standards, governance controls, and internal audit frameworks.

- Euro‑Passenger Strategy: Use cross‑border passporting (Luxembourg, Germany, Netherlands) to scale across the EU with one license. Platforms can open access to multiple markets with minimal extra licenses.

- Risk & Investor Safeguards: Mandatory segregation of client assets, audit trails, compliance reviews, and investor‑proof documentation.

- Communications & Market Positioning: Position your platform as safe, transparent, and future‑proof.

Takeaway

In 2025, tokenizing real‑world assets in Europe is becoming an enterprise reality. Germany, France, Luxembourg, the Netherlands, and Switzerland are at the top because of their clear legal structure, security, and compliance. Choosing the right jurisdiction to launch real-world asset tokenization development depends on your asset focus, investor base, and scale strategy.

Ready to build a real‑world asset tokenization platform? Partner with our Real-World Asset Tokenization Development company to build frameworks and contracts to the highest local standards.