Ever wondered what happens when DeFi’s composability meets legacy banking rails? Imagine a world where tokenization, cross-border liquidity pools, and layer-2 scalability converge under enterprise-grade DLT governance and still pass every KYC/AML and MiCA audit with flying colors. That’s the promise of white-label NEO bank platforms : modular architectures driven by smart-contract APIs, real-time compliance engines, and seamless on-chain/off-chain interoperability. In this deep dive, we will unpack the pioneers redefining Web3 banking, those with the sagacity to blend cryptographic security with regulatory finesse, and the agility to iterate in sandbox environments from Singapore to Switzerland. Ready to explore the blueprint for tomorrow’s fully regulated crypto neo-banks?

Let’s begin!

Top 7 White Label Neo Banking Service Providers Offering Regulated Platforms

1. Antier

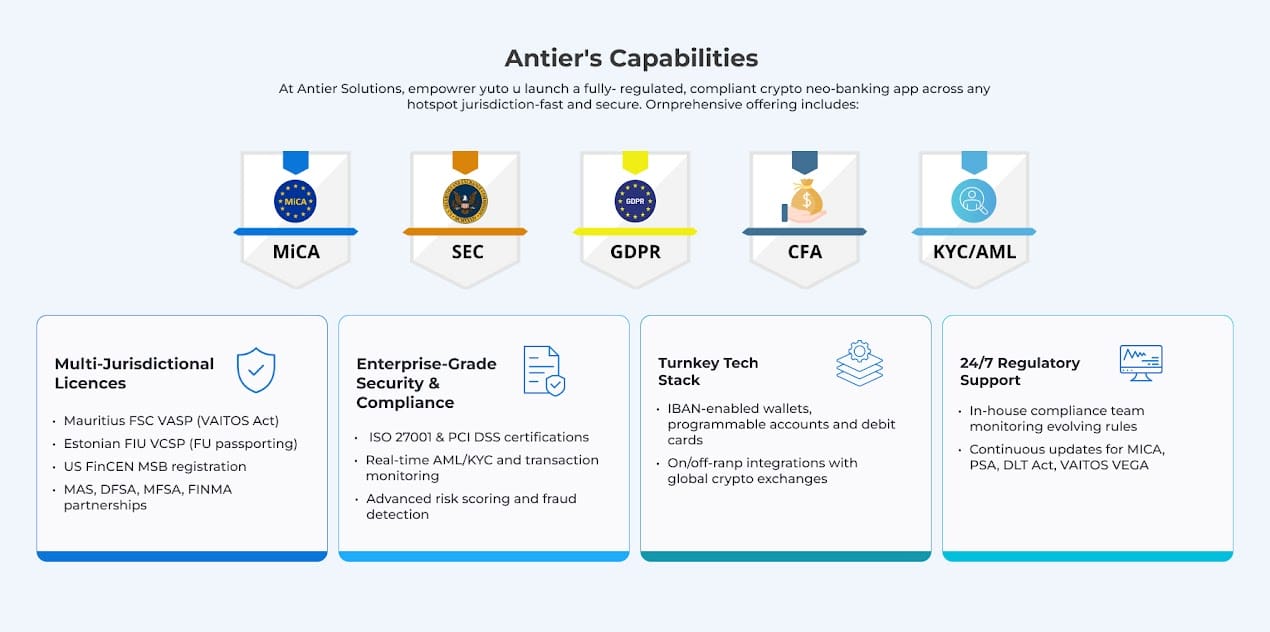

Founded in 2011 and headquartered in the US, Antier has grown into a global leader in Web3 neo‑banking. With over 700 blockchain specialists, Antier delivers end‑to‑end compliance frameworks that include real‑time AML/KYC, transaction monitoring, and ISO 27001 & PCI DSS certifications.

Their turnkey crypto-friendly neo-banking platform features IBAN-enabled wallets, programmable accounts, and card-issuance modules, all architected on a microservices stack for rapid deployment. Antier’s multi‑jurisdictional licenses, Mauritius FSC VASP (VAITOS Act), Estonian FIU VCSP (EU passporting), and US FinCEN MSB—combined with 24/7 regulatory support- ensure you launch a fully licensed, compliant crypto neo‑bank app anywhere in the world. This compliance‑first approach reduces regulatory friction and builds trust with end users from day one.

Established: 2011 | HQ: Mohali, Punjab, India

2. SDK.finance

Established in 2013 and based in Prague, Czech Republic, SDK.finance (TechFin UAB) offers a white‑label payments core designed for hyper‑scalable digital banking. Their modular API suite supports digital wallets, neobanks, and embedded finance, enabling rapid feature rollout without rebuilding foundational rails. SDK.finance’s platform includes built‑in compliance modules, fraud detection, and multi‑currency settlements, backed by EU trademark protection. Their scalability focus means clients can start with wallets and cards, then seamlessly add features like lending or savings vaults as user demand grows. With a decade of fintech R&D, SDK.finance empowers both startups and enterprises to scale fintech products globally under a unified, cloud‑native architecture.

Established: 2013 | HQ: Prague, Czech Republic

3. Synodus

Synodus has quickly positioned itself as a boutique white-label neobank development company. Delivering over 30 neo-banking projects in six years, this renowned white-label neo-banking service provider combines deep banking and blockchain expertise to craft highly customizable, white-label platforms. Their solutions integrate crypto custody, on/off‑ramp services, and DeFi yield engines within a single dashboard. Synodus’s USP lies in tailor-made UX flows and smart contract modules that align with each client’s brand and regulatory needs, from the ASEAN Payment Services Act to the EU’s MiCAR. By emphasizing customization, Synodus helps fintech businesses differentiate their product offerings and rapidly evolve features based on real‑time user feedback.

Established: 2019 | HQ: Cau Giay, Hanoi, Vietnam

4. DashDevs

DashDevs is a fintech software agency with 15+ years of global project delivery. This prestigious crypto neo-banking app development firm excels in integrating neo‑banking cores with third‑party services, KYC providers, payment gateways, and blockchain nodes into cohesive, compliant platforms. Their ISO‑certified development teams have delivered 100+ fintech products across the US, EU, and MENA, focusing on performance, security, and seamless user experiences. DashDevs’s comprehensive offerings range from custom mobile banking apps to full banking‑as‑a‑service (BaaS) software, all underpinned by rigorous QA, DevSecOps pipelines, and OIDC/OAuth2 authentication. This integration prowess accelerates time‑to‑market and ensures enterprise clients can plug in new services without re-architecting existing infrastructure.

Established: 2011 | HQ: Wilmington, Delaware, USA

5. Railsr

Founded in 2016 and headquartered in London, UK, Railsr pioneered the Banking-as-a-Service (BaaS) solution in Europe. Offering a unified API layer, RailsBank enables clients to issue IBANs, multi‑currency accounts, and virtual or physical cards within minutes. Their platform includes embedded crypto rails, enabling compliant on/off‑ramp integration under PSD2 and FCA e‑money licenses. RailsBank’s global footprint extends through ASIC and MAS partnerships, making it a top choice for startups eyeing the UK, EU, and APAC markets. Their BaaS solution development expertise simplifies regulatory compliance by encapsulating core banking functions, letting clients focus on front‑end innovation and customer acquisition.

Established: 2016 | HQ: London, United Kingdom

6. Crassula

Crassula delivers a core banking SaaS platform optimized for challenger banks and crypto‑enabled fintechs. Trusted by over 5 million end users, Crassula’s microservices architecture supports rapid deployment of neobanks, payment services, FX modules, and crypto‑fiat bridges. Their SaaS model includes tiered compliance templates aligned with GDPR, MiCA, and FATF standards, reducing setup complexity. This s emphasis on low‑code configuration empowers non‑technical teams to manage risk controls, ledger rules, and KYC workflows via a user‑friendly admin console. This SaaS‑first approach minimizes CAPEX and accelerates go‑live timelines, making Crassula ideal for market entrants seeking robust, out‑of‑the‑box banking and crypto functionality.

Established: 2015 | HQ: Riga, Latvia

7. Mbanq

Mbanq is a leading crypto neo-banking app development company that offers a modular bank‑tech stack for global neo-banking ventures. Their cloud‑native platform comprises interchangeable services—core banking, cards, lending engines, and crypto vaults—that clients mix & match to fit local regulations. Mbanq’s EU e‑money license (Estonian FIU) and US MSB registration enable passporting across 30+ markets. Advanced modules for AML/KYC, consent management (GDPR), and ISO 20022 messaging ensure regulatory alignment. This modular design accelerates MVP launches while allowing incremental feature additions—ideal for fintechs evolving from single‑product offerings to full‑suite digital banks.

Established: 2016 | HQ: Naples, Florida, USA

The companies highlighted represent the pinnacle of white-label neo-banking development; they were chosen for their strict adherence to regulations, scalable architectures, and extensive domain knowledge. When you collaborate with these screened leaders, you get a compliant, future-ready backbone that can easily traverse various jurisdictions.

Emerging Regions Enabling Regulated Crypto Neo‑Banking Development

Wondering where the real action is happening in the crypto neo-banking development landscape? Below is a breakdown of top continents/regions, like Europe, the United States, Asia, etc., that are shaping the future of fully regulated white-label crypto neo-banking. Each region is discussed from a macro perspective, covering why it’s hot, which regulatory bodies matter, and how they support launching compliant crypto neo-banking platforms.

1. Europe

Why It’s Hot: Europe leads the regulatory charge with MiCA (Markets in Crypto-Assets Regulation)—the world’s most comprehensive framework for digital assets. It enables EU-wide passporting, allowing a neo-bank licensed in one member state (like Estonia or Malta) to operate across the entire EU. Europe also benefits from GDPR for strong data privacy and PSD2 for open banking integrations.

Key Regulatory Bodies :

- European Securities and Markets Authority (ESMA)

- European Banking Authority (EBA)

- MiCA framework (effective 2024–2025)

- Local regulators like BaFin (Germany), ACPR (France), MFSA (Malta), and FIU (Estonia)

Neo-Banking Angle : A crypto neo-bank in Europe can seamlessly integrate with fiat rails, issue IBAN accounts, and launch under a single country license while legally servicing all EU nations.

2. United States

Why It’s Hot : Despite regulatory fragmentation, the U.S. remains a top market for user acquisition and institutional trust. It’s home to the largest institutional capital pools, and regulations from the SEC, FinCEN, and OCC are increasingly defining the global standard. MSB registrations are straightforward, but launching a compliant white-label crypto neo-bank requires navigating federal and state laws.

To know more about>> Why It is The Right Time to Invest In Neobanking in the US?

Key Regulatory Bodies :

- SEC (Securities and Exchange Commission) – for tokenized securities

- FinCEN (Financial Crimes Enforcement Network) – for MSB registration

- OCC (Office of the Comptroller of the Currency)- for digital banking charters

- State regulators – e.g., New York BitLicense, California DFPI

Neo-Banking Angle : The U.S. offers robust regulatory legitimacy, secure banking infrastructure, and higher investor confidence, but startups must be well-capitalized to navigate state-by-state compliance.

3. Asia

Why It’s Hot : Asia is a technological powerhouse with progressive regulations in hubs like Singapore, Hong Kong, and Japan. Governments are introducing sandbox models and crypto-friendly laws to attract global fintechs. Digital payments penetration is among the highest in the world, and demand for compliant and completely regulated crypto-friendly neo banking solutions is surging.

Key Regulatory Bodies :

- MAS (Monetary Authority of Singapore) – PSA licensing

- SFC & HKMA (Hong Kong) – VASP and stablecoin licensing

- FSA (Japan) – for token and exchange regulations

- SEBI/RBI (India) – evolving stance on Web3

Neo-Banking Angle: White-label neo bank platforms in Asia can tap into high mobile adoption, API-first banking, and crypto-fiat interoperability under secure, fast-track regulatory approvals.

4. Middle East

Why It’s Hot: The Middle East is rapidly becoming a global crypto hub, led by the UAE’s dual frameworks (DIFC + ADGM). With tax incentives, zero-fee rails, and government-backed sandboxes, the region is aggressively attracting crypto neo-banking projects. Bahrain and Saudi Arabia are also launching VASP regulations to compete.

Key Regulatory Bodies :

- DFSA (Dubai Financial Services Authority)

- FSRA (Abu Dhabi Global Market)

- UAE Central Bank – VASP Framework

- Central Bank of Bahrain

Neo-Banking Angle : Launch-ready frameworks in free zones like DIFC and ADGM allow for compliant piloting of tokenized accounts, stablecoin wallets, and KYC-integrated fintech apps.

5. Africa

Why It’s Hot: Africa is witnessing a boom in mobile-first finance and cross-border payments. Countries like Mauritius, Nigeria, and South Africa are rolling out VASP frameworks, offering early regulatory clarity. With the rise of CBDCs and stablecoins in the region, there’s a growing demand for regulated neo-banking platforms that bridge traditional and digital finance.

Key Regulatory Bodies :

- FSC (Mauritius) – VAITOS Act

- CBN (Nigeria) – digital currency oversight

FSCA (South Africa) – crypto provider registration

Neo-Banking Angle : Africa offers massive unbanked populations and blockchain-driven financial inclusion. It’s ideal for stablecoin-powered neo-banking app development solutions that offer remittances and savings products.

6. Latin America

Why It’s Hot: Latin America is fast becoming a hotbed for crypto adoption, driven by currency volatility, inflation, and lack of trust in traditional banks. Brazil, Argentina, and Mexico are introducing crypto regulations while supporting stablecoin use and blockchain neo-banking rails. Brazil’s Central Bank is pioneering open finance APIs.

Key Regulatory Bodies:

- Brazilian Central Bank (BACEN) – Open Finance

- CNV (Argentina) – crypto oversight

- CNBV (Mexico) – Fintech Law

Neo-Banking Angle : Latin America offers real market use cases, on-chain savings, USDT-based salaries, and remittances, and businesses launching crypto-friendly neo-banking platforms are quickly becoming the financial interface of the unbanked.

Why Thinking Regionally Matters Before Investing in a White Label Neo Bank?

When building a white-label crypto neo-banking platform, it’s not just about picking a country; it’s about aligning with regional opportunity, regulatory stability, and user demand. Here’s how each region aligns:

- First, regulatory clarity varies wildly. Some regions offer sandbox environments and fast-track licenses, while others impose lengthy, costly approvals—knowing the landscape saves time and budget.

- Second, market fit is key: consumer preferences for mobile wallets, stablecoins, or DeFi features differ from Asia to Europe, so tailoring your platform to local tastes drives adoption.

- Third, operational efficiency hinges on infrastructure: payment rails, banking partnerships, and tax frameworks can make or break your launch.

Finally, competitive edge comes from partnering with jurisdictions actively courting fintech innovation—where incentives, grants, and talent pools accelerate growth. Thinking regionally ensures you build a compliant, scalable, and truly market-ready crypto-friendly neo-bank app from day one.

Choose The Best to Launch Your Fully-Compliant Crypto Neo-Bank

Looking to elevate your crypto neo-banking platform with uncompromised compliance and cutting-edge Web3 capabilities? Well, choose the best crypto neo banking development partner for your upcoming project from the above-mentioned list. Hope it helps you choose the best!

You must be wondering why Antier tops the list? At Antier, we pair multi‑jurisdictional licenses (FSC Mauritius, Estonian FIU/EU passporting, FinCEN US registration, MAS and DFSA partnerships) with ISO 27001 & PCI DSS certifications. Our in‑house real‑time AML/KYC engine, advanced risk analytics, and 24/7 monitoring enable you to launch fully‑compliant, branded crypto neo‑banking services in any hotspot—fast, secure, and future‑proof.