AI Summary

- Summary:

The blog post discusses why crypto exchanges continue to launch in Singapore despite stringent regulations from the Monetary Authority of Singapore (MAS). - Despite the high capital requirements and strict compliance standards, Singapore offers regulatory clarity, built-in financial infrastructure, access to the Asia-Pacific market, institutional capital, and a growing crypto-friendly environment.

- The post outlines steps to launch a compliant crypto exchange in Singapore, including setting up a local entity, obtaining the necessary licenses from MAS, building a MAS-ready tech stack, partnering with regulated service providers, and conducting internal compliance audits before going live.

- While launching in Singapore may be challenging, it provides access to institutional capital and credibility in the crypto industry.

Table of Contents

Introduction

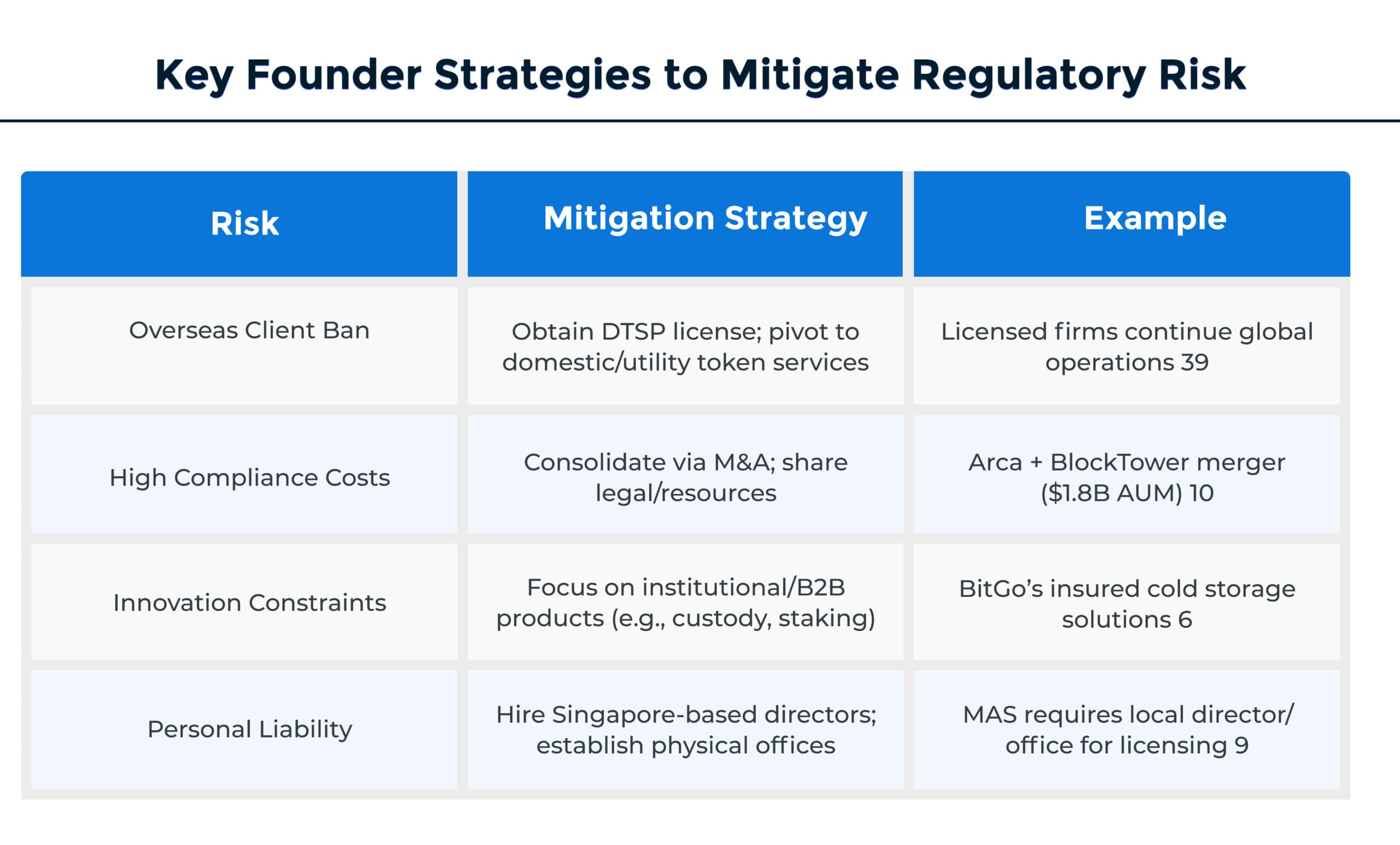

Singapore’s Monetary Authority of Singapore (MAS) just ramped up its crypto exchange regulations, separating the serious platforms from the wannabees. This was aimed at curbing money laundering following a series of high-profile scandals. The crackdown was so hard that many major exchanges operating from the mainland, offering services overseas, had to relocate operations to Panama, Hong Kong, or the UAE, given their favorable regulatory environments.

The MAS issued a mandate, requiring all Singaporean entities offering digital asset-related services globally to secure a Digital Token Service Provider (DTSP) license under FSMA (Financial Services and Market Act 2022) or withdraw operations immediately. The directive leaves zero room for interpretation and no grace period; no extensions or transitional arrangements will be considered. Regardless of the scale of overseas operations or revenue fraction, the emerging crypto exchange software solutions have to comply.

Why Crypto Exchanges Still Launch in Singapore Despite MAS Regulations?

Despite the MAS mandate of a minimum SGD 250,000 base capital requirement (for partnerships and individuals) that exchanges must maintain as a cash deposit/capital contribution, some crypto giants are not ready to leave the crypto hub. While WazirX relocated to Panama, Bitstamp recently secured a license from MAS to offer crypto services to the Southeast Asian country. But why are crypto exchange development projects still planning their launch in Singapore while other existing exchanges are waiting for the approvals?

Here are the reasons why crypto founders are not walking away but adapting smartly:

1. Singapore’s Regulatory Clarity Offers Long-Term Competitive Advantage

Unlike fragmented or ambiguous jurisdictions, Singapore gives crypto exchange software solutions clear legal definitions and structured licensing paths under the Payment Services Act (PSA) and Financial Services and Markets Act (FSMA). This helps reduce legal uncertainty and long-term compliance risks for cryptocurrency exchange development projects.

- Well-defined token classifications: Payment tokens, security tokens, and utility tokens are separated under MAS guidance.

- Institutional trust: A MAS license enhances credibility with investors, partners, and liquidity providers worldwide.

- FATF-aligned AML rules: Strong anti-money laundering laws ensure Singapore-based crypto exchange software solutions are internationally bankable.

2. Built-in Blockchain-Ready Financial Infrastructure

Singapore’s TradFi stack is already high-performance, and most of it understands crypto mechanics.

- Real-time settlements, robust payments infrastructure, and connections to Asia’s top banking institutions

- Regulatory-grade custody and staking providers (like Onchain Custodian, BitGo)

- A deep network of market makers, OTC desks, and liquidity providers is already plugged into one of the best existing financial ecosystems.

3. Gateway to Asia-Pacific (APAC)

Singapore’s neutrality, rule of law, and trade agreements make it the perfect APAC base for cryptocurrency exchange software solutions targeting Southeast Asia, India, Australia, and even Japan and Korea.

- Stable political and economic climate, unlike other emerging Asian hubs

- An English-speaking legal system that’s friendly to cross-border transactions

- Easy access to wealth hubs like Hong Kong, Tokyo, and Sydney

4. Institutional Capital That’s Already Crypto-Curious

From Temasek to family offices and VC funds, Singapore is crawling with capital that’s actively exploring digital assets, not just watching from the sidelines. It makes Singapore the best place to launch institutional-grade cryptocurrency exchange development projects.

- Strong appetite for tokenization, custody solutions, and regulated staking models

- MAS’s Project Guardian shows local banks are preparing for on-chain asset management

- Investors prefer licensed or “MAS-in-process” projects over cowboy outfits

“Singapore is more of an institutional financial hub than a retail financial hub.”

- Casper Johansen, co-founder of Spartan Group

5. Strong Market Awareness and Growing Adoption:

The robust, crypto-ready Singaporean market is best for cryptocurrency exchange development projects.

- According to a 2025 survey, 94% of Singaporeans are familiar with at least one crypto asset

- About 29% own crypto today, and over half of current holders plan to increase exposure this year.

- Among younger investors, 40% own crypto, and many already use it for shopping (41%), paying bills (36%), or P2P transfers (43%).

- 55% stake crypto via centralized exchanges, and 54% use stablecoin.

How to Launch a Compliant Crypto Exchange in Singapore – Step by Step

And yes, you can still launch a cryptocurrency exchange in Singapore, here’s how.

1. Decide the Type of Crypto Exchange You Want to Launch

Before anything else, know what you’re building:

- Spot Crypto Exchange Development for simple buy/sell

- Derivatives Exchange Development for futures, options, or perpetuals

- Custodial vs Non-Custodial: Do you want to hold user funds or not?

Your exchange type determines licensing, compliance, and tech stack requirements.

2. Set Up a Local Entity in Singapore

To apply for a license, you’ll need a Singapore-registered company.

- Most go for a Private Limited Company (Pte Ltd)

- Appoint at least one local director and a company secretary

- Get a registered address and open a corporate bank account

This is standard groundwork for any business planning cryptocurrency exchange development to operate in Singapore.

3. Apply for the Right Licenses from MAS

Singapore’s MAS regulates crypto firms under the PSA.

For setting up a cryptocurrency exchange software to launch in Singapore, you’re likely applying for the following.

- Digital Payment Token (DPT) Service License

- Small or Major Payment Institution License (depending on the scale of your business)

- Digital token service providers (DTSP) license for globally operating CeFi/DeFi cryptocurrency exchange software, custodial or non-custodial wallets, token issuers, and TradFi institutions offering crypto-related services.

Want to learn more about regulatory requirements in top crypto-friendly countries including Singapore?

Your business will be assessed on:

- KYC onboarding

- AML/CFT compliance (anti-money laundering/terrorist financing)

- MAS notice PSN02 alignment

- Travel rule compliance

- Risk management processes

- Retail trading rules

- Tech infrastructure and controls

- Fit-and-proper status of founders and key team members

Pro tip: Antier’s MAS-compliant white label cryptocurrency exchange development solution is built keeping in mind Singapore’s regulatory and competitive environment.

4. Build a Tech Stack That’s MAS-Ready

MAS will review your backend just as much as your frontend. So:

- Enable KYC/AML screening from Day 1 (Sumsub, Jumio, ShuftiPro)

- Ensure transaction monitoring and audit logs are always active

- Integrate incident response workflows and data protection measures

- Secure both custodial and non-custodial wallets, if applicable

- Use Node.js, Go, or Rust-based services with a microservices architecture for a scalable backend.

- Leverage PostgreSQL for relational data, Redis for caching, and MongoDB for handling user sessions and logs

- Use C++ or Rust for low-latency order matching

- React.js or Next.js with SSR (Server Side Rendering) for SEO-friendly performance

Don’t launch with a half-baked platform. Partner with your cryptocurrency exchange development company to learn more about the tech stack and launch a full-fledged crypto trading platform with a captivating frontend and a robust backend. MAS checks security, not just UI.

5. Partner with Regulated Service Providers

Securing licenses can be challenging, but it is not enough. Your ecosystem should be MAS-aligned too.

- Choose a licensed fiat on/off-ramp

- Use MAS-compliant custodians or third-party wallets

- Work with audit-ready KYC/AML providers (e.g., Chainalysis, Sumsub, IdentityMind)

Your cryptocurrency exchange development company can help you partner with regulated service providers, enhancing the credibility of your trading platform. These partnerships reduce compliance burden and speed up license approval.

6. Run Internal Compliance Audits Before Go-Live

And when you’re done with your cryptocurrency exchange development, it’s time to test the platform comprehensively. Go for unit and stress testing. Also, before launch, you must run a full simulation of compliance checks, which includes:

- Performing a mock user onboarding

- Simulating suspicious transactions and reporting

- Running penetration tests and data breach simulations

- Having all your legal docs (T&Cs, privacy policy, user risk disclosures) ready and verified by the legal team at your cryptocurrency exchange development company.

7. Go Live Only After IPA or License Approval

Considering the current regulatory landscape, you can’t go live without approval. You must wait for your IPA or license to be granted.

Launching Your Exchange in Singapore is Tough, But It’s Worth It

Singapore isn’t the easiest place to launch a crypto exchange software after the new regulatory regime, but for founders thinking long-term, it’s still one of the most valuable jurisdictions to be regulated in. If you can clear MAS’s bar and fund a minimum base capital of SGD 250,000, you gain access to institutional capital, premium clients, and a global reputation for trust.

Launching your cryptocurrency exchange development project in Singapore may be expensive and unforgiving, but that’s exactly why Singapore is filtering out unserious players. Crypto companies with elite compliance infrastructure and a robust operational justification will crack the compliance code and launch legally in one of the most crypto-friendly countries.

Are you ready to build a trusted, institution-ready, scalable and compliant cryptocurrency exchange software? Antier is the cryptocurrency exchange development company that knows the MAS rulebook and tech stack inside out.

Share your requirements today!