The RWA Tokenization Development Services are restructuring finance. As per the Industry forecast, the tokenized Real-World Assets market would be worth $4.5 billion in 2025 and $10.65 billion by 2029, at a 26.8% CAGR. This expansion hinges on robust, decentralized custody solutions. These custody systems provide the reliable infrastructure required to manage and trade secure tokenized assets at scale. As the market moves toward institutional adoption, platforms that prioritize robust custody frameworks will be best positioned to lead.

For businesses looking to develop real estate tokenization platforms, a strong understanding of the custody layers is required. This article dives into the latest technical developments, proven use cases, and implementation strategies that support secure, scalable, and compliant RWA platforms.

Tokenized Real-World Assets: Latest Advancements in Decentralized Custody Solutions

1. Enhanced Security via Multi-Signature Wallets & MPC

Platform developers are deploying multi-signature wallets and Multi-Party Computation (MPC) to decentralize private-key management. Multi-signature requires multiple approvals for transactions, eliminating single points of failure. MPC breaks private keys into cryptographic shares held across participants, so no single party ever holds the full key. Platforms like FordefiHQ, in partnership with Sonic Labs and Backed Finance, have implemented MPC-based custody alongside the Sonic blockchain, setting new standards in institutional-grade security.

2. Layer‑2 Integration for Scalability

Scalability has become mission critical as transaction volumes soar. The RWA custody blockchain solutions can integrate Layer-2 chains, including Optimistic and Zero-Knowledge (zk) Rollups, to handle off-chain transactions with main-chain security. This reduces costs and boosts throughput. Numerous banks already process RWA trades via rollups, achieving higher settlement speeds and reduced gas fees. For any firm developing decentralized custody solutions, Layer‑2 integration is essential.

3. Cross‑Chain Interoperability

Tokenized RWAs frequently span multiple blockchains. Integrating Interoperability protocols like Polkadot, Cosmos, and the Canton Network in the tokenization platform can enable seamless transfers among ecosystems. A 2024 Canton Network pilot involving 15 asset managers and 13 banks trading RWAs cross-chain is proof that custody solutions must support interoperability to build scalable platforms.

4. Decentralized Identity (DID) Capabilities

To streamline compliance, platforms must adopt Decentralized Identity (DID) systems. DID empowers holders with blockchain-based, self-sovereign identity by simplifying KYC/AML while preserving decentralization. Institutional investors favor Decentralized custody solutions that maintain legal compliance without centralized ID repositories.

5. AI + Blockchain Integration

Artificial intelligence is now accelerating custody workflows. Smart agents assess asset value, detect anomalies, and enforce compliance. For example, Antier leverages AI to optimize DeFi risk models in the Tokenization platforms and deploys AI to monitor transaction behavior and curb fraud. Integrating AI enhances platform security and appeals to tokenized RWAs for institutional investors.

Real World Asset Tokenization: Technical Upgrades Fueling Infrastructure Adoption

Real World Asset Tokenization: Technical Upgrades Fueling Infrastructure Adoption

1. Smart Contract Optimization

Smart contracts now automate governance and compliance. With Ethereum 2.0’s Proof‑of‑Stake and sharding upgrades, RWA tokenization platforms offer faster, cheaper transactions. Platforms prefer to implement contracts that automate the enforcement of rules tied to tokenized real estate debt, enabling on-chain compliance and streamlining issuance workflows.

2. Zero‑Knowledge Proof Integration

Zero-Knowledge Proofs (ZKPs) shield transaction details while maintaining auditability. Institutional investors in Europe rely on ZKPs to comply with GDPR without exposing confidential data. Secure tokenized assets platforms that embed ZKP-based privacy demonstrate both a compliance-first strategy and technical sophistication.

3. Decentralized File Storage

Off-chain legal documents, such as deeds and SPV agreements, now reside on decentralized storage networks like IPFS and Arweave. This ensures immutability, verifiability, and global access, a key to audit readiness. Execution of platform services such as tokenized real estate development requires a strong document infrastructure.

4. API‑First Architectural Approach

Modern platforms for tokenized real-world assets are adopting an API‑first design. With modular APIs, custody systems integrate legacy systems and decentralized networks. Tools like Chainlink and API3 enable real-time data feeds and smart contract synchrony. This philosophy simplifies onboarding for developers and improves long-term extensibility.

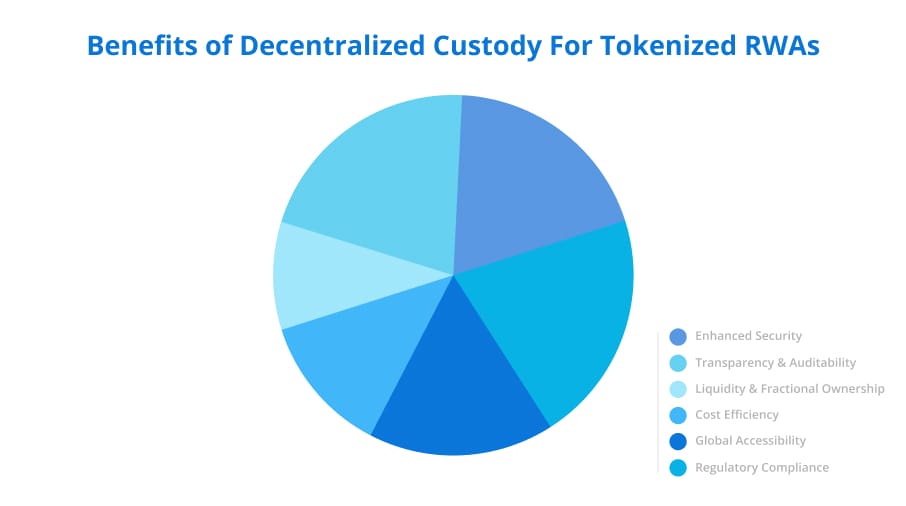

Core Benefits of Decentralized Custody to the RWA Platform Owners

- Heightened Security: The integration of MPC and multi-signature reduces vulnerabilities to wallet hacks and insider threats.

- Transparency & Auditability: Immutable ledgers provide complete provenance and accountability.

- Fractional Ownership & Liquidity: RWA tokenization platforms support micro-investing and real-time trading, benefiting investors and increasing the liquidity ratio.

- Cost Reduction: The RWA custody blockchain solutions remove the middlemen and eliminate the custody and transaction fees. As per the market estimations, banks have saved around $27 billion by tokenizing the financial assets.

- 24/7 Global Trading: Decentralized custody supports continuous, cross-border marketplace access, enabling real-estate firms to close deals globally without facing restrictions.

- Built‑in Compliance: Smart contracts in RWA Platforms enforce KYC/AML, investor caps, and jurisdictional rules programmatically.

These features make decentralized custody essential for real estate tokenization infrastructure and broader platform ecosystems.

Who Can Benefit from RWA Decentralized Custody Solutions: Industry-Use Cases

1. Fintech Platforms

The Fintech companies can leverage decentralized custody solutions to offer tokenized bonds, yield protocols, and investment apps. Platforms can differentiate by offering secure, compliant bridges to DeFi.

2. Banking

Leading banks can launch custody-as-a-service, targeting tokenized bonds and real estate. Banking platforms that incorporate RWA Tokenization development services for custody solutions are positioning themselves as digital asset custodians and service providers.

3. Real Estate

Real estate tokenization development services flourish with fractional ownership. Platforms like Realty and RedSwan CRE issue tokens for commercial property. With Custody systems, real estate firms secure ownership rights and use smart contracts to automate dividend payouts. Chintai’s $100 million real estate debt fund, with a $50k minimum, exemplifies how custody reinforces investor confidence.

4. Supply Chain & Trade Finance

In supply chain finance, custodians can tokenize invoices and trade documents. Platforms aligned with the supply chain are streamlining liquidity and auditability globally with decentralized solutions.

5. Art, Commodities, and ESG

Tokenized fine art and commodities rely on custody for provenance. The tokenized real-world asset platforms can issue tokenized carbon credits to track sustainability outcomes via custody-backed transparency.

Tokenized Real-World Assets Market Trends (2025)

- Institutional Entry: Firms like BlackRock, JPMorgan, and Goldman Sachs are testing custody-led tokenization pilots, proving mainstream demand.

- Regulatory Momentum: Jurisdictions including Switzerland, Singapore, and the UAE offer clear frameworks—encouraging platform development.

- Sustainable Investment Surge: ESG-focused tokenized assets, especially carbon credits, are gaining steam.

- RWA Supercycle: The trend of staking tokenized equities (e.g., AAPL, TSLA) speaks to mainstream adoption, with platforms enabling trading liquidity.

RWA Tokenization: Technical Roadmap for Platform Implementation

1. Choose the Blockchain Infrastructure

Blockchain selection will decide how your platform will function. For layer-2, you can choose or consider Solana/Hedera for performance. Ensure the platform has smart contracts and interoperability support.

2. Security Setup

For offering secure Real-World Asset tokenization development services, security is non-negotiable in infrastructure. Here is what you need:

- Deploy multi-signature wallets and MPC key management

- Integrate ZKPs for privacy protection

- Use decentralized storage (IPFS/Arweave) for legal documents

3. Enable Interoperability

Enable interoperability by embedding cross-chain protocols (e.g., Polkadot, Cosmos) and decentralized oracles (e.g., Chainlink) in the Tokenized Real-World Assets Infrastructure.

4. Embed Compliance

Integrate the DID for KYC/AML in the tokenization infrastructure for security. Code compliance into smart contracts to ensure portability across jurisdictions.

5. Scale with Layer‑2

Use side chains and roll-ups in platforms to offload RWA transactions to reduce costs and latency.

6. Add AI Modules

Incorporate AI in infrastructure for risk assessment, fraud detection, and asset valuation.

7. Prioritize UX / Admin Tools

Create professional dashboards, reporting engines, permission management, and communication modules for institutional users.

Takeaway

The decentralized custody secures tokenized real-world assets. They deliver security, transparency, cost efficiency, scalability, and are built‑in compliance. Firms aiming to build leading RWA custody platforms must incorporate decentralized custody solutions for clients and institutional capital.

Ready to build the future of tokenized asset platforms? Get in touch with Antier, a leading RWA Tokenization Platform Development Company, to discuss decentralized custody solutions and start your secure, scalable infrastructure journey today.

Real World Asset Tokenization: Technical Upgrades Fueling Infrastructure Adoption

Real World Asset Tokenization: Technical Upgrades Fueling Infrastructure Adoption