Investing in real estate has long required substantial capital, a geographic location, and patience. Tokenized real estate platform development is changing how real estate firms operate, monetize assets, and reach global users. By building a tokenized property platform, real estate firms can allow fractional ownership via blockchain tokens. Each token ties directly to real rental income, automates payouts, and links to auditable on-chain records. For real estate firms, this is the moment to shift from asset-heavy operations to scalable, tech-first models. With the right infrastructure, tokenized rental income services can open up new revenue streams, improve liquidity, and attract a wider pool of investors without giving up control.

Rental Income Real Estate Tokenization: Three Markets, Three Models

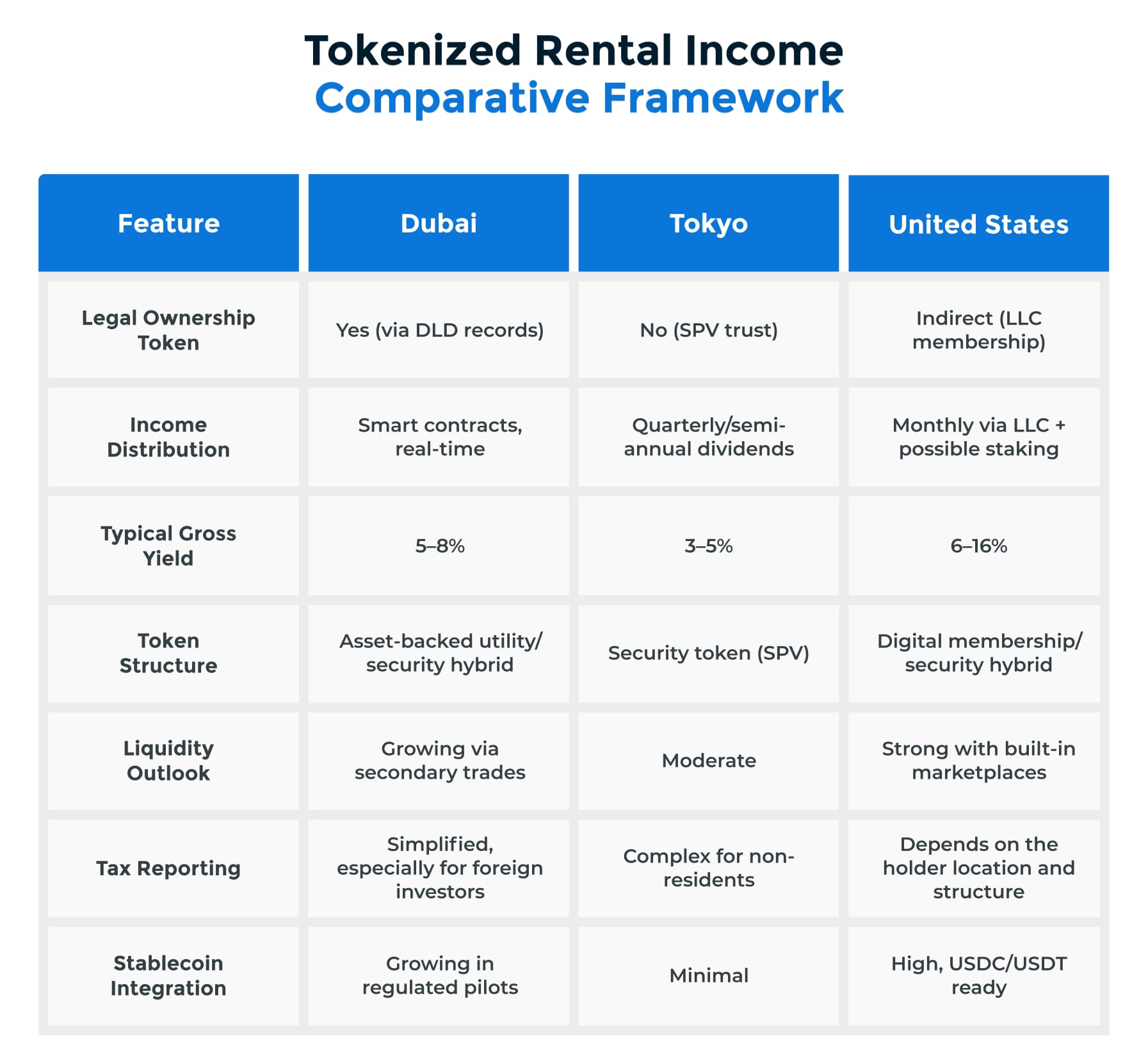

Dubai, Tokyo, and the United States each represent a unique model of how tokenized property platforms handle compliance, payouts, and ownership.

Here’s how each ecosystem gets it done, and what builders can take from their approach:

Dubai: Regulation‑Backed, Transparent, Infrastructure‑First

Dubai is government‑driven. The Dubai Land Department (DLD) and Ejari (rental contract registry) are hooked into token platforms via secure APIs. That’s gold for developers and investors aiming for transparency.

- Smart-contract real estate platforms load verified rent data from Ejari and trigger payouts instantly.

- The legal clarity removes ownership ambiguity.

- Rent flows in fiat-pegged tokens or stablecoins (like USDC or AED‑pegged coin).

- Yields of 5–8% net on mid-tier to luxury properties.

Legal & Technical Enablers

- Real titles are linked on‑chain via the DLD API—no guesswork

- Mandatory government KYC/AML cuts risk and simplifies onboarding

- Automated and legally binding payouts open the door to token-backed lending and syndicated debt products

How Rental Tokenization Benefits Real Estate Firms

- For developers and property managers, tokenizing rental income in Dubai reduces legal friction and operational overhead.

- No more manual rent reconciliations, escrow delays, or trust gaps.

- Token platforms deliver real-time, verifiable income data, giving firms the tools to expand into debt products, secondary markets, or yield-based investor models, without reinventing compliance.

It’s a fully bankable model for scaling real estate with programmable cash flow.

- Anchor systems in government‑verified data.

- Treat rental income as composable yield instruments.

- Built for expansion, token-backed lending, secondary trades, and fractional asset bundles.

Dubai proves infrastructure-first tokenization creates scalable, trust-driven platforms

Japan takes a strict regulatory approach. Real estate tokens fall under securities law, meaning token = no title. Instead, properties are held by SPVs (Special Purpose Vehicles), and tokens represent economic rights only.

- Rental income is processed through the SPV and distributed as revenue-sharing dividends.

- Yields sit around 3–5%, favoring stability and auditability over aggressive returns.

Payouts are typically quarterly or semi-annually after tax and audit deductions. While slower than real-time models, the system is airtight.

Legal & Technical Enablers

- SPVs act as legal wrappers for properties—tokens never touch the title.

- Blockchain is used for audit trails and SPV bookkeeping.

- Tokens are security-compliant (e.g., ERC‑1400), making them attractive to institutions.

- Hybrid systems handle fiat payouts with growing interest in stablecoins.

How Rental Tokenization Benefits Real Estate Firms?

Real estate firms in Japan benefit from regulatory clarity and institutional-grade trust. Tokenization doesn’t replace the existing system—it strengthens it.

- Developers gain access to new capital via revenue-backed tokens while maintaining control through the SPV structure.

- It’s a clean path for firms seeking long-term investors over quick flips, especially when targeting regulated investment funds or foreign entities that demand audit-proof infrastructure.

Takeaways for Real Estate Tokenization Platform Development

- Prioritize SPV-backed economic models for institutional appeal.

- Focus on audit tracking and regulatory compliance from day one.

- Accept that slower payouts = higher legal trust in some markets.

Japan shows that tokenization works best when it reinforces, not replaces, existing legal structures.

United States: Fast-Moving, Modular, Retail-Optimized

The U.S. market is fragmented but fiercely innovative. Most platforms use an LLC or trust structure where token holders are treated as members with rights to rental income.

- Payouts are typically monthly and flow through property managers to token holders.

- Yields range from 6–16%, especially in high-rent, low-cost cities like Detroit or Cleveland. Coastal properties offer less but attract different profiles.

- Platforms like RealT, Lofty, and Arrived Homes have pushed hard into retail-friendly UX, integrated compliance, and liquidity features.

Legal & Technical Enablers

- SEC frameworks vary: Reg D, Reg A+, and Reg CF are commonly used.

- Most properties are owned via LLCs or Delaware statutory trusts.

- Internal dashboards automate tax documents, yield tracking, and wallet management.

- Many platforms integrate DeFi tools, staking, buybacks, and instant resale.

How Rental Tokenization Benefits Real Estate Firms?

- Tokenizing rental income in the U.S. allows firms to unlock value from underutilized assets and attract a global pool of micro-investors.

- With the right tech stack, real estate firms can turn properties into income-generating, tradable assets without massive upfront capital or institutional bottlenecks.

- For firms managing scattered single-family units or multifamily properties, tokenization creates predictable cash flow with liquidity baked in.

Takeaways for Real Estate Tokenization Platform Development

- Build modular: adapt structure to property type, state laws, and SEC rules

- Prioritize monthly income visibility and seamless tax tools

- Add liquidity options-internal marketplaces, token transferability, or DeFi rails

The U.S. model is a playground for fast iteration and scalable rental income logic.

What a Tokenized Rental Income Platform Benefits Real Estate Firms

1. Build Trust with Verified, Real-Time Data Feeds

Whether you’re a real estate firm or solo founder, plug into verified data like Ejari (Dubai) or licensed PM APIs (US). If rent flows are visible, the token value becomes real.

2. Enable Smart Tokens with Dynamic Yield Tracking

Property yields aren’t static. Smart tokens that track live net yield beat whitepapers every time. The Tokenized property platforms should show investors exactly what they’re earning today, not last quarter.

3. Prioritize Tax and Reporting Compliance

Platforms need built-in tax engines based on user jurisdiction. This is table stakes for trusted tokenized real estate development services.

4. Liquidity Drives Investor Growth

Features like secondary trading, P2P sales, and token buybacks are non-negotiable for investors. Especially when yield follows the token.

5. Hybrid Infrastructure

Most rent still flows through banks. Embrace hybrid models that use smart contracts for automation, but bridge to fiat rails for settlement. The best tokenized real estate platform development teams design for both on-chain and off-chain realities.

Takeaway

With tokenization rental income, Real Estate Tokenization Platforms earn trust, value, and scale. Smart tokenized real estate platform development starts with one question: how does the yield flow? If you’re building a tokenized real estate platform and want to:

- Integrate smart contract rental income.

- Design SPV and token structures that pass SEC or global securities tests.

- Enable secondary marketplaces with yield-bearing liquidity.

- Automate tax compliance across jurisdictions.

.. get in touch with Antier. Our Real Estate Tokenization Platform Development Company understands the tech, the law, and the investor mindset, and can help you launch a legally compliant and secure Real Estate Tokenization Platform for the tokenization of rental income.