Still think wallets are just for holding crypto? Not anymore. As the Web3 ecosystem matures, users aren’t just looking to store tokens—they’re demanding real-time, card-based utility. Today’s users want to earn yield, swap tokens, and tap their card at checkout—all from the same interface. This isn’t just convenience—it’s the new Web3 standard. The era of wallets that only store value is closing fast, and what’s emerging is a new breed of non-custodial wallets equipped with zero-fee cards that act like programmable payment tools. Whether you’re a stablecoin earner, DAO contributor, or cross-border worker, frictionless spending from self-custody is becoming essential. If your wallet can’t transact instantly in the real world, it’s not future-ready. Let’s break down why crypto card integration is redefining what wallet development truly means.

Why the Next Billion Web3 Users Won’t Use Web3 Wallets Without Cards?

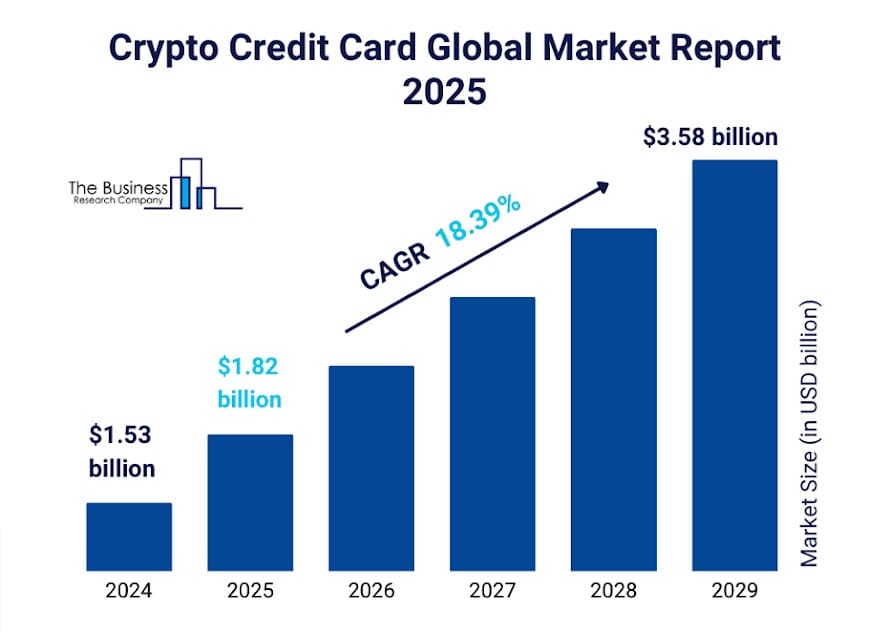

User behavior is changing from speculative interaction to seamless utility as Web3 moves closer to widespread adoption. As regulatory clarity improves and crypto-native infrastructure matures, global demand for crypto cards is soaring. The crypto credit card market is projected to grow from $1.82 billion in 2025 to over $3.58 billion by 2029 at a CAGR of 18.4%. The next billion users will be digital consumers who anticipate simple, instantaneous financial tools, not crypto-natives. Zero-fee cryptocurrency cards integrated into non-custodial wallet development solutions are now essential in this situation rather than merely a luxury. Instead of interfaces rife with conversions, wallet-to-exchange detours, or friction, these users want instant gratification.

Source link: Crypto Credit Card Global Market Report 2025

Visa reports that the volume of crypto-linked card usage exceeded billions, highlighting the demand for interoperable, spend-ready wallets around the world. By abstracting complexity and facilitating direct, gasless spending from on-chain assets, zero-fee cards satisfy this need. Cryptocurrency wallet development solutions must transform from passive storage to active, compliant, and globally spendable tools as stablecoins, tokenized payrolls, and DeFi rewards become essential components of financial behavior. In the absence of card utility. However, let us scroll through the blog to completely understand the concept of zero-fee crypto cards is, how they benefit businesses when embedded into crypto wallet development solutions, and whether their applications have brought some real-world results.

What Is a Zero-Fee Crypto Card?

A zero-fee crypto card is a payment card, typically powered by major card networks like Mastercard or Visa—that allows users to spend cryptocurrency directly from their blockchain wallet platform or exchange account without incurring standard service fees like

- Application or issuance fees

- Monthly/annual maintenance fees

- Top-up or load fees

- Conversion fees for crypto-to-fiat settlement

These cards are generally debit-style (not credit), meaning transactions are funded in real time from the user’s crypto balance—either from a custodial exchange wallet or a self-custodial wallet, depending on implementation.

Pain Points Without a Zero-Fee Crypto Card in Non-Custodial Wallets

“A great product doesn’t just work—it fits into your life without asking you to change.”

And that’s exactly where many non-custodial wallet development solutions fall short. For users who believe in self-custody, the inability to simply tap and spend their crypto isn’t just inconvenient—it’s a contradiction. As Web3 matures, users expect intuitive, fee-free access to real-world applications rather than more features. Before we explore the solutions, let’s understand what’s holding current wallets back from truly empowering their users.

- Spending Inaccessibility – Crypto stored in self-custodial wallets isn’t directly usable for daily purchases—users must manually convert to fiat through third-party platforms.

- High Transactional Friction – Fees for swaps, bridges, or off-ramps add cost layers, making small or everyday transactions inefficient and unattractive.

- Custody Compromise Risks – To use crypto for payments, users often shift funds to custodial exchanges, undermining the purpose of self-custody and exposing assets to third-party risks.

- Disjointed User Journey – Managing payments, DeFi, and wallet assets across multiple apps leads to a fragmented, complex, and non-intuitive experience.

- Lack of Real-Time Utility – Without real-time crypto-to-fiat settlement, users face delays and can’t use their assets instantly at global merchants.

Non-custodial crypto wallets must advance beyond storage to provide smooth, practical usability in order to remain competitive in the quickly changing Web3 landscape. It is essential—not optional—to remove payment friction by integrating zero-fee crypto cards. Investing in cutting-edge cryptocurrency wallet development services that prioritize functionality and user experience, and long-term adoption first, forward-thinking companies can satisfy this demand.

Why Investing in a Non-Custodial Zero-Fee Crypto Card Wallet Is a Smarter Choice?

1. Seamless Real-World Spending with Full Asset Ownership – By integrating zero-fee crypto cards into non-custodial crypto wallets, users can finally spend their assets globally without giving up private key control. It bridges the gap between blockchain wallet development and real-world financial usability—something traditional custodial platforms can’t match.

2. Complete Self-Custody Without Compromising Utility – This innovation reflects the shift towards non-custodial wallet solutions where users demand both security and flexibility. With no third-party intervention and instant access to spendable crypto, the solution represents the future of secure yet functional crypto wallet development.

3. Micro-Transactions Without Fee Barriers – Traditional crypto cards made small purchases inefficient due to transaction fees. Zero-fee cards remove these barriers, enabling the best non-custodial crypto wallet platforms to support frictionless daily payments—a key milestone in advanced cryptocurrency wallet app development.

4. Unified Experience for DeFi, NFTs, and Payments – A zero-fee crypto card-ready non-custodial wallet creates an all-in-one hub where users can stake, swap, manage NFTs, and spend—all without leaving the wallet. This integrated model is now a top priority for any blockchain wallet development company aiming to capture Web3-native audiences.

5. Direct On-Chain Funding Across Multi-Chain Networks – Whether it’s Ethereum, Base, or Polygon, zero-fee crypto cards connected to a non-custodial wallet allow real-time, chain-agnostic funding. This efficiency is at the heart of modern non-custodial crypto wallet development, where cross-chain operability is no longer optional—it’s essential.

6. Elimination of Custodial Risk in Daily Transactions – No more transferring assets to centralized exchanges just to spend. The best non-custodial wallet platforms now enable direct spending from self-custody, significantly reducing risk. This level of decentralization is what distinguishes a top-tier cryptocurrency wallet development company in today’s market.

7. True Utility for Web3 Earnings and Rewards – As more DAOs and DeFi protocols issue payments in crypto, zero-fee card integration turns those earnings into usable value instantly. A wallet developed with this utility mindset demonstrates how advanced non-custodial crypto wallet development is unlocking next-gen financial workflows.

8. Strengthened Privacy with Regulatory Compliance – A zero-fee card inside a non-custodial wallet keeps personal data decentralized while enabling fiat payments through regulated card networks. It’s a breakthrough that wallet development companies must now engineer into their builds to stay ahead of the regulatory and Web3 privacy curve.

9. Cost-Efficient Gateway for Web3 Mass Adoption – As users increasingly seek crypto wallet app development that minimizes onboarding complexity and spending friction, this integrated model is proving to be the entry point. It’s precisely why businesses choose a trusted non-custodial wallet solution provider to launch market-ready solutions.

10. Competitive Advantage for Ecosystem Builders and Platforms – Integrating zero-fee card capabilities into a non-custodial crypto wallet product sets your platform apart in a saturated space. It shows deep understanding of user demand and technical innovation—traits expected from the best crypto wallet development company in the blockchain space.

Investing in a card-ready, non-custodial crypto wallet ensures you are not just keeping up with the market but leading it. With the right cryptocurrency development service provider, enterprises can offer users exactly what they want: freedom, flexibility, and control, without compromise.

A Success Story: Bitget Launched Non-Custodial Wallet With Zero-Fee Crypto Card

The Challenge

Users of non-custodial wallets struggled to spend crypto in real life—facing high fees, custodial risks, and complex conversions.

The Breakthrough

Bitget became the first non-custodial crypto wallet to launch a zero-fee crypto card powered by Mastercard and Immersve.

Users could now spend directly from their wallet, with real-time crypto-to-fiat conversion, no fees, and full asset control.

Results :

- 25%+ increase in wallet retention

- Thousands of activations across the UK & EU

- High micro-spend activity (under $10)

- 5% token cashback boosted engagement

The Takeaway

Bitget proved that non-custodial wallet solutions can power real-world utility—secure, fee-free, and global.

For businesses investing in crypto wallet development, this model offers a clear edge in user adoption, loyalty, and future-ready finance.

Why Build Slow? Launch Faster With Antier’s Crypto Wallet Development Services

You don’t need years of development or a massive team to launch a powerful crypto wallet with card-ready features. A non-custodial wallet with a zero-fee crypto card isn’t just a trend—it’s a user demand. If you’re building for real adoption, now’s the time to move.

Are you planning to hire the best of the team that provides cryptocurrency wallet development services? If yes, then consult the specialists at Antier. With us, you get everything under one roof:

- Custom-built non-custodial wallets

- Zero-fee crypto card integration

- Multi-chain and multi-token support

- Real-time crypto-to-fiat conversion

- Card partnerships (Visa, Mastercard, Immersive)

- Built-in DeFi, staking, and NFT modules

- Compliance-ready infrastructure (KYC/AML/MPC)

Why wait? Let your users hold, earn, and spend without friction. Book a live demo of Antier’s Web3 wallet + card solution today. Our certified team of blockchain experts will help you launch faster and smarter. If you wish to launch your brand earlier than your competitors, you can also opt for our white-label crypto wallet solutions. Our team gets it ready within 7 days!