Providing the Real Estate Tokenization Platform Development services is not about tokenizing properties. It’s about building the infrastructure powering trillions in value. In 2025, tokenization is moving past fractional ownership to regulated, scalable ecosystems. Here’s the deep dive on trends in tokenized real estate assets that are generating leads and grabbing market share.

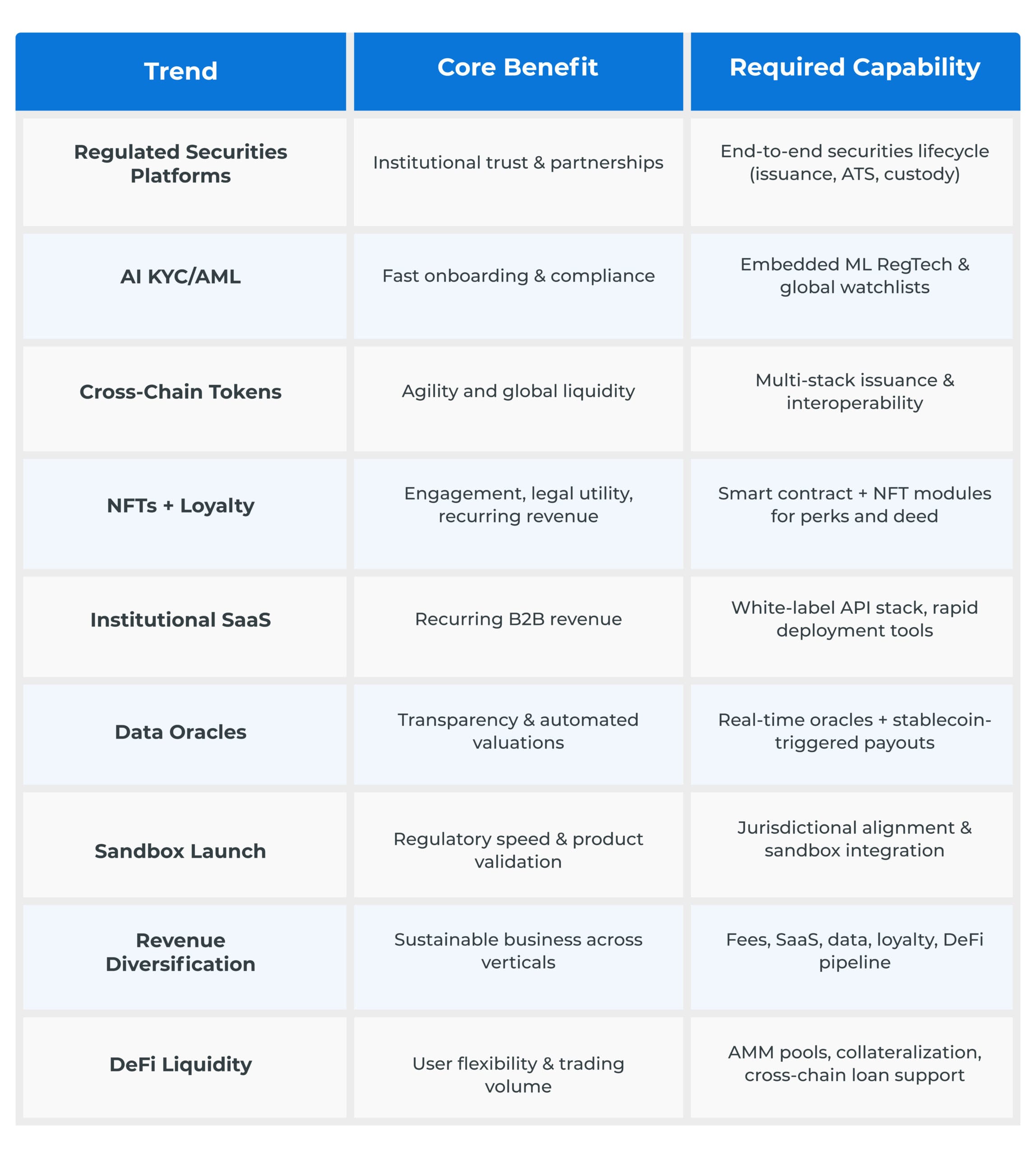

Top 10 Trends in Real Estate Tokenization in 2025

1. Regulated Digital Securities Platforms

To attract serious capital, the Real Estate Tokenization Platform Development services must treat tokens as regulated securities. Platforms must integrate:

- Licensing (VARA, SEC, MiCA)

- AML/KYC flows

- Custody and compliant secondary markets

Platforms that manage these end‑to‑end functions build institutional trust and tap into traditional networks like REITs. This instantly boosts institutional trust and opens doors with banks, funds, and traditional REIT networks.

Takeaway: Develop an infrastructure with legal licensing, custody, compliance, and trading capabilities from day one.

2. Automated Compliance

Manual compliance workflows slow onboarding and reduce conversion rates. Platforms must integrate automated KYC/AML. When onboarding becomes instant, with full audit trails, platforms become attractive to high‑net‑worth and institutional investors.

Integrating audit logging, watchlist checks, and identity verification drives higher conversion, exactly the metric that leads RFIs and discovery calls.

Takeaway: Embed automated KYC/AML to support global investors’ onboarding quickly and safely.

3. Cross‑Chain & Protocol‑Agnostic Design

Locking into a single chain limits liquidity and adoption. Leading platforms now adopt a multi‑chain strategy across:

- Ethereum‑compatible networks

- Polygon, Gnosis, Avalanche, Algorand

Multi‑chain compatibility broadens reach and positions platforms to integrate with diverse liquidity networks. This attracts both traditional and crypto‑native institutional interests and essential RFPs for token development.

Takeaway: Design platform architecture to support cross‑chain issuance and operations.

4. Real‑Time Oracles & On‑Chain Valuation

Transparency drives trust. Platforms now integrate Oracle services (e.g., Chainlink) to deliver:

- Automated NAV updates

- Rent revenue streams on-chain

- Real-time valuation tracking

These capabilities resonate with sophisticated investors and analysts. In platform development conversations, they shift the narrative from “cool tech” to “meaningful business metrics.”

Takeaway: Incorporate on‑chain data feeds early to enable audit‑ready reporting and boost credibility.

5. NFT‑Powered Legal Automation & Loyalty Mechanics

NFTs can represent ownership, automate titles and leases, and unlock investor perks. Successful platforms use tiered NFT models that provide:

- Automated legal functions (e.g., deed transfers).

- Loyalty incentives (early access, fee discounts).

- Investor engagement mechanisms.

These features fuel stickiness: clients ask for them explicitly when seeking development partners.

Takeaway: Treat NFTs as legal and loyalty tools, not just branding gimmicks.

6. Modular Platform‑as‑a‑Service Architecture

Enterprises appreciate plug-and-play solutions. Modular, white‑label tokenization platforms offer:

- Rapid deployment (rebrandable APIs, SDKs)

- Scalable SaaS-style revenue

- Clear separation between the investor’s UI and the back-end infrastructure

Such a modular design invites B2B interest from banks, real estate firms, and fintech.

Takeaway: Architect platforms with modular APIs and white-label capabilities to tap into strategic partnerships.

7. Digital‑First Asset Servicing & Payout Automation

Traditional asset servicing is archaic. The Real Estate Tokenization Platform Development services must automate:

- Rent and revenue disbursements (via stablecoins).

- Tax document delivery.

- Investor dashboarding.

This hands-free model appeals to investors and triggers development requests based on usability.

Takeaway: Build services that automate payments, documentation, and reporting with no manual intervention required.

8. 24/7 Secondary Markets & Real‑Time Liquidity

Traditional real estate suffers from illiquidity. Tokenization platforms that enable:

- Around‑the‑clock trading.

- Built-in Automated Market Makers (AMMs).

- Regulated secondary market access.

.. attract institutional capital and instigate board-level interest in token platform deployment.

Takeaway: Ensure liquidity mechanisms are native to the platform to reassure issuers and entice investors.

9. DeFi Integrations & Collateral‑Based Lending

Combining DeFi with real estate unlocks financial flexibility:

- Collateralized lending against property tokens

- Permissionless AMM lending pools

- Derivative instruments built on tokenized assets

These integrations sound technical, but they inspire inbound leads from innovative funds and DeFi platforms.

Takeaway: Build DeFi modules for lending and borrowing—an essential revenue and engagement stream.

10. Geographic Rollouts via Regulatory Sandboxes

Choosing the right regulatory jurisdiction matters. Leading platforms launch in:

- Dubai (VARA sandbox)

- Singapore (MAS sandbox)

- Abu Dhabi Global Market (ADGM)

These markets offer regulatory clarity and fast-track deployment. Development partners get inquiries precisely because they know how to navigate these sandboxes.

Takeaway: Prioritize jurisdictions with legal frameworks supportive of tokenization and position Real Estate Tokenization Platform Development Services around sandbox readiness.

Tips For Real Estate Tokenization Platform Launch

- Start with the regulation: Launch in compliant environments—VARA, ERIR, MiCA, etc.

- Invest in embedded compliance: Choose partners like ComplyAdvantage to power AI-driven KYC/AML.

- Design cross-chain from day one: Support multiple chains and stablecoins.

- Leverage NFTs for utility & loyalty: Use property passports and token-based perks to retain investors.

- Offer plug-and-play modules: Be the go-to Real Estate Tokenization Service Provider with white-label tools.

- Integrate oracles: Automate income/tracking to enhance transparency and speed payouts.

- Pilot in sandboxes: Use jurisdictional testbeds to legitimize and accelerate growth.

- Diversify revenue: Combine transactions, SaaS, data, NFTs, and DeFi tools for a robust model.

- Layer in DeFi: Launch liquidity pools and lending instruments for token holders.

Final Thoughts

These trends in tokenized real estate assets can help platforms dominate the Real Estate Market. Providers who offer the best Real Estate Tokenization Development Services will dominate the soaring tokenization market, estimated at $500 B to $13 T in the coming years.

Want to launch a compliant, scalable, feature-rich platform optimized for lead generation and institutional trust? Our Real Estate Tokenization Platform Development Company offers tailored services, from sandbox strategy to full-stack deployment or forward-thinking fintech’s and Proptech’s.

Frequently Asked Questions

01. What is the main focus of Real Estate Tokenization Platform Development services?

The main focus is on building the infrastructure that supports tokenized real estate assets, treating tokens as regulated securities to attract serious capital and institutional trust.

02. Why is automated compliance important in real estate tokenization?

Automated compliance is crucial because it speeds up onboarding processes, enhances conversion rates, and makes platforms more attractive to high-net-worth and institutional investors by ensuring quick and safe KYC/AML procedures.

03. How does cross-chain compatibility benefit real estate tokenization platforms?

Cross-chain compatibility broadens the platform's reach, enhances liquidity, and allows integration with diverse liquidity networks, attracting both traditional and crypto-native institutional interests.