Maximize Value with Asset Tokenization Platform

Digital asset tokenization Platforms convert physical and financial assets into blockchain-based tokens, facilitating easy transfer, trading, and fractional ownership. The tokenized RWA Solutions eliminate geographical barriers, reduce costs, and enhance transparency, offering significant benefits for asset owners and investors.

WT tokenizing real-world assets boosts liquidity, accessibility, and efficiency across global markets. The platform building opens new opportunities in real estate, art, commodities, securities, etc, reshaping how we interact with assets.

Antier stands out as a leading asset tokenization development company, delivering customized platforms with meticulous attention to detail. Our experience and innovation ensure top-notch RWA tokenization services for a diverse range of investors.

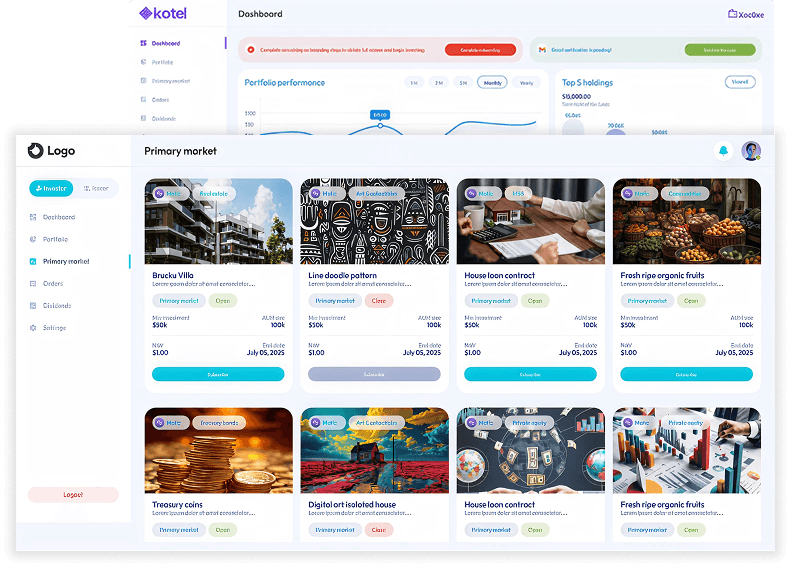

Asset Tokenization Platform Case Study

Break Down Barriers to Real-World Investment

RWA Tokenization Market Report

Digital asset tokenization market is projected to reach US$ 2709.9 million in 2029, increasing from US$ 1140.7 million in 2022, with a CAGR of 13.0% during the period of 2023 to 2029. Real estate is expected to become the largest type of tokenized asset in 2030, taking up nearly one-third of the overall market.

Smarter Asset Tokenization with AI and Blockchain

At Antier, we’re reshaping the way traditional assets enter the digital economy. By combining artificial intelligence with blockchain, we’ve taken asset tokenization far beyond simple digitization.

Our AI systems analyze data from multiple reliable sources to deliver highly accurate asset valuations. These insights power smarter tokenization models that adjust in real time, ensuring that assets—whether real estate, commodities, or equity instruments—are accurately and efficiently represented on-chain. Security and compliance are built into our process. Our AI-powered compliance engine adapts seamlessly to shifting global regulations, while decentralized identity checks provide a secure, user-friendly onboarding experience.

The result? Tokenized assets that reflect true market value, open access to previously restricted investment opportunities, and ownership models designed to evolve with changing financial landscapes. Partner with Antier to explore a smarter, safer, and more inclusive approach to digital asset ownership.

Our Real-World Asset Tokenization Platform Use Cases Include

World-class Asset Tokenization Development Company

Modules of our Asset Tokenization Ecosystem

Download eBook

Business Benefits of Our Asset Tokenization Platform

Lifecycle of a Tokenized Security

In-House Legal Experts for Real World Asset Tokenization