Antier - Delivering Holistic Guidance on Legal & Corporate Structuring

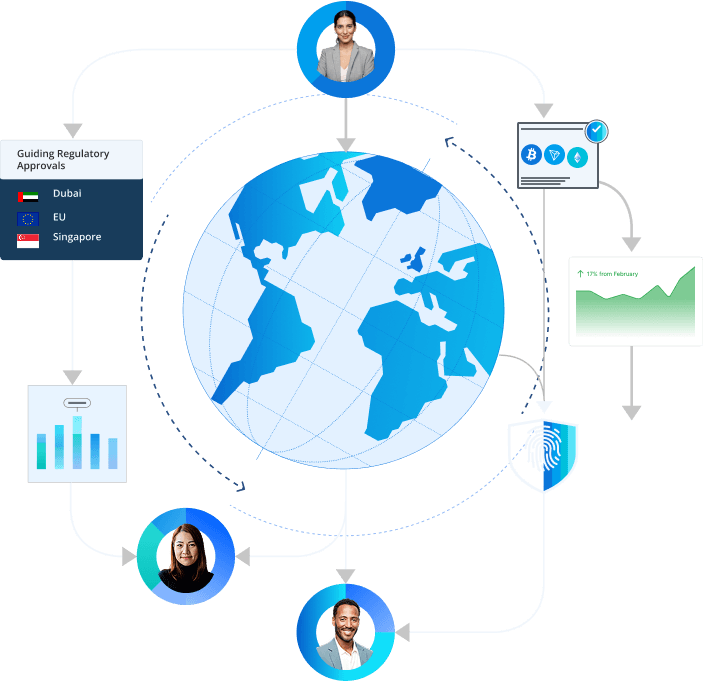

Expanding into global crypto markets exposes web3 enterprises to complex regulatory challenges across jurisdictions. Securing licenses, building compliant structures, and meeting jurisdiction-specific requirements demand more than legal expertise and require seasoned lawyers with proven expertise in both blockchain technology and regulatory strategy.

Antier is a leading web3 licensing consultancy delivering strategic advisory and compliance solutions to businesses across the globe. We bring together legal, financial, and blockchain expertise to support organizations at every stage of their web3 journey.

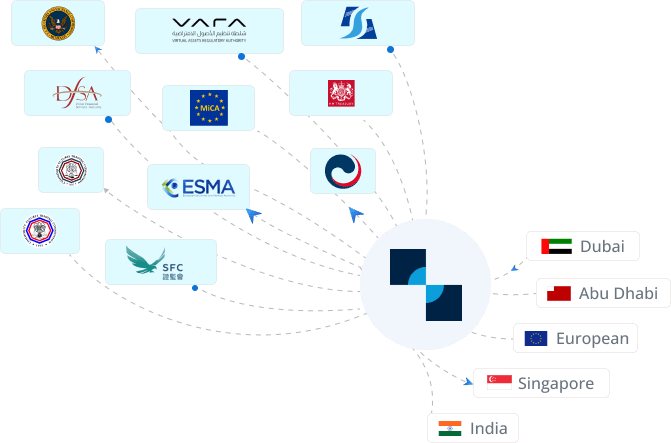

Trusted by startups, enterprises, and institutional investors, our crypto lawyers bring deep jurisdictional knowledge across VARA, ADGM, DIFC, MAS, MiCA, and more. Being a top provider of crypto consulting services, Antier works with a mission to simplify regulatory pathways and empower businesses to adopt web3 with confidence.Common Obstacles in Web3 Licensing

Turn your legal challenges into growth opportunities

Our Core Web3 Consulting & Licensing Services

Leverage our web3 licensing services tailored to your business needs

Antier’s Web3 Licensing Support Across Various Jurisdictions