Decentralized Exchange Software Development That Turns Vision Into Markets

Primitive interfaces, liquidity crunches, and an overwhelming trading experience were a thing of the past. The tangible progress of decentralized crypto exchange software solutions now positions them to challenge ancient, oak-like centralized crypto trading platforms. The new generation of AI-powered decentralized exchange software solutions is even smarter, more efficient, more secure, more liquid, and highly adaptive.

Antier delivers future-proof decentralized cryptocurrency exchange development, combining AI efficiency, bank-grade security, and full-stack flexibility to meet the evolving DeFi landscape. Let’s collaborate on an AI-enhanced decentralized crypto exchange development that your competitors will benchmark and users will trust.Don’t Just Skip the Noise-Be the Noise with a Leading Custom DEX Development Company

Feature Stack of High-performance AI Decentralized Exchange Software

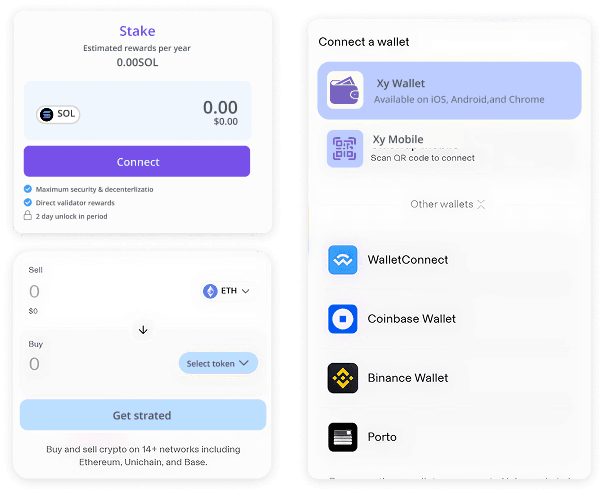

White Label Decentralized Exchange 2X Cost-Effectiveness & Faster DEX Delivery

A white label decentralized exchange development solution is a prebuilt, non-custodial trading platform that slashes costs and accelerates the development process. With over 659 million owners and the next billion on the horizon, the crypto race is on. In this high-stakes sprint, winning the next wave of users depends on how fast you move.

Being a top-notch white label decentralized exchange software development company, we build your shortcut to DeFi dominance so you can launch on time. Our fully customizable white label DEX exchanges are built to exceed market standards, so you can launch with confidence with your desired branding and customizations.- Fully Customizable & Brandable Exchange Setup

- Native Token Integration for Fees & Rewards

- Rapid Market Entry: Launch within 2-4 Weeks

- Operator-Focused Admin & Analytics Dashboard

- Compliance-Ready Modules for Institutional Adoption

Types of Decentralized Crypto Exchange Development

AMM Decentralized Exchange Development

AMMs represent autonomous mechanisms leveraged by decentralized exchanges to eliminate the reliance on centralized order books and other intermediaries. These decentralized crypto exchange software solutions rely on liquidity pools and smart contracts for pricing and trade execution. Liquidity providers earn fees, while traders get instant asset swaps in a pool-driven decentralized ecosystem.

Key Features

- Liquidity Pools

- Yield Farms

- Lottery Modules

- Token Swaps

- Slippage Tolerance

- Transaction Deadline

- Multi-Chain Capability

- Multi-Wallet Connection

Order Book DEX Development

Order book decentralized crypto exchange software emulates the traditional order book model, offering CEX-grade depth and execution. Built with centralized order matching and on-chain settlement, or a fully on-chain order book and matching engine, both can power spot trading or perpetual futures with leverage, cross-margin, and liquidation engines, enabling institutional-grade performance on-chain.

Key Features

- Limit & Market Orders

- Node-Based Matching Engine

- Leverage up to 125x

- Funding Rate & Index Price Oracles

- Advanced Order Types

- Cross & Isolated Margin

- TradingView & Depth Charts

- Real-Time Transaction History

DeFi DEX aggregator Development

DEX Aggregators, the “search engines” for DeFi trading, scour multiple platforms to find the best swap rates and route orders across liquidity sources, minimizing slippage and gas. As the best-rated decentralized exchange software development company, we build extensively efficient DeFi exchange aggregators with user-friendly interfaces, impenetrable security, and unquestionable compliance.

Key Features

- Multi-Wallet Support

- Smart Order Routing (SOR)

- Best Price Comparison

- Slippage & Deadline Controls

- Multi-Chain Support

- 10+ Liquidity Sources

- Multi-Path Swaps

- User-Friendly Interface

Hybrid DEX Development

Hybrid decentralized crypto exchange software solutions merge the liquidity pool mechanism of AMMs with advanced CEX-inspired order book-based execution. Liquidity providers supply assets to pools, ensuring instant swaps for retail users, while professional traders gain access to order book tools, such as limit orders and depth charts, balancing efficiency, flexibility, and institutional-grade performance.

Key Features

- AMM + Order Book Integration

- Aggregated Liquidity Pools

- Institutional-Grade Trading Tools

- Configurable Matching Engines

- High Scalability Across Assets

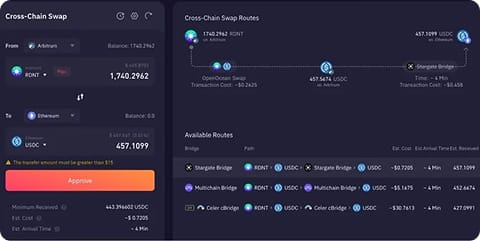

Cross-Chain / Multi-Chain DEX Development

Cross-chain decentralized exchange software enables users to swap assets across chains without depending on centralized intermediaries. The DEX development model leverages interoperability protocols, wrapped assets, or specialized relayers to execute swaps across ecosystems, thereby eliminating fragmentation and enabling traders to access broader liquidity.

Key Features

- Native Multi-Chain Swaps

- Interoperability Protocols

- Bridge-Free Trading Options

- Secure Cross-Chain Settlement

- Asset Wrapping & Unwrapping Logic

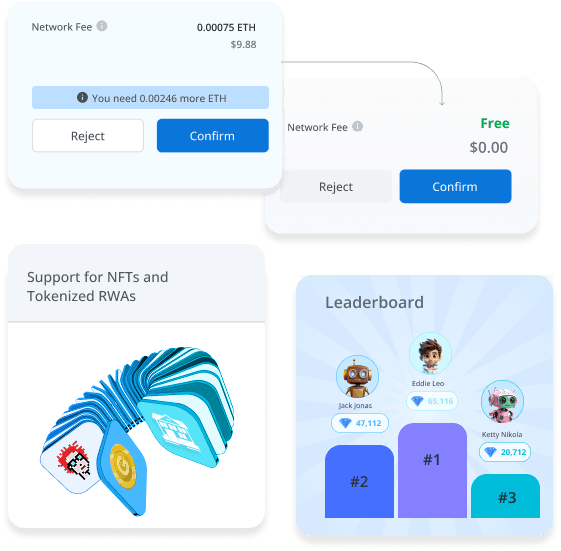

NFT & RWA DEX Development

Antier builds trading platforms tailored for NFTs (ERC-721/ERC-1155) and RWAs such as treasuries, real estate, and carbon credits. Gamified NFT decentralized exchange development enables swaps, auctions, and fractionalization of collectibles and gaming assets, while enterprise-grade RWA DEXs integrate compliance modules, fiat ramps, and institutional reporting, etc.

Key Features

- NFT Swaps, Auctions & Royalties

- Bundle & Fractional Trading

- Multi-Chain NFT Support

- RWA Token Integration (ERC-1400 / ERC-3643)

- Compliance & Regulatory Controls

- Fiat On/Off-Ramps

- Institutional-Grade Reporting

AI-Powered. DeFi-Ready. Built for What's Next.

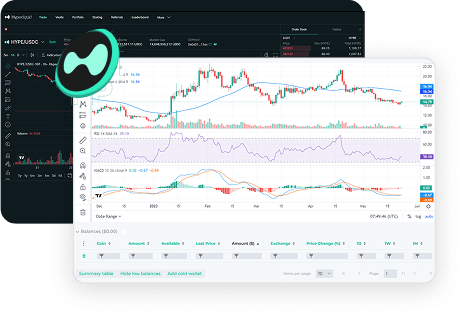

Hyperliquid-Inspired DEX Development: Live And Liquid in 30 Days

Stirred by Hyperliquid’s CEX-grade execution, zero-gas UX, and advanced, fully on-chain order book infra? Antier’s enterprise-grade white label DEX development solution, powered by Hyperliquid’s APIs and liquidity, empowers you to launch launch your exchange in 30 days. This cuts out 24-month build timelines and multi-million dollar infrastructure of custom Hyperliquid-like DEX development. Even if you envision to build a Hyperliquid-sytle exchange with custom blockchain and exceptional functionality, our team makes it possible.

Our decentralized crypto exchange software development framework also includes ready-to-deploy DEX scripts for leading models, giving you the edge to replicate proven and lead with designs.